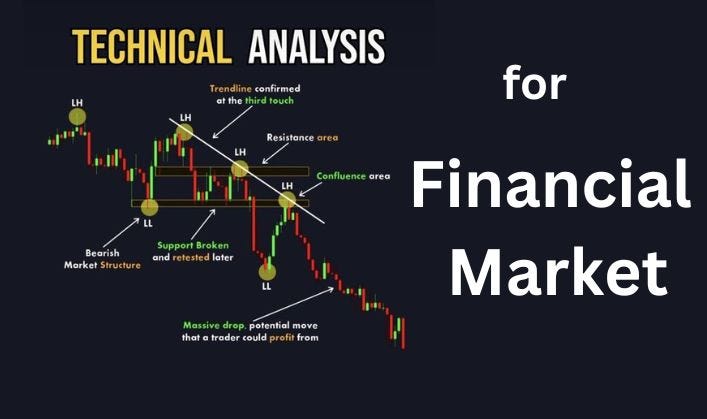

An In-Depth Exploration of Technical Analysis for Financial Markets

Technical analysis, a potent tool wielded by market participants, meticulously assesses historical price data, trading volume, and diverse technical indicators to project and evaluate price movements in financial markets. This systematic approach empowers investors to make informed decisions, navigating the complexities of trading with confidence. In this comprehensive exploration, we delve into the intricate details of technical analysis, highlighting its pivotal role, and significance in financial markets, and its instrumental assistance in deciphering the dynamic landscape of trading.

Technical analysis, a potent tool wielded by market participants, meticulously assesses historical price data, trading volume, and diverse technical indicators to project and evaluate price movements in financial markets. This systematic approach empowers investors to make informed decisions, navigating the complexities of trading with confidence. In this comprehensive exploration, we delve into the intricate details of technical analysis, highlighting its pivotal role, and significance in financial markets, and its instrumental assistance in deciphering the dynamic landscape of trading.

Bybit offer: Deposit $50, and GET 10 USDT (withdrawable)!

Understanding Technical Analysis

Fundamentally, technical analysis hinges on the belief that scrutinizing past price shifts and trading volumes yields invaluable glimpses into forthcoming market trends. Analysts leverage an array of charts, patterns, and indicators to pinpoint potential entry and exit points, while also gauging the overall robustness of a trend. This methodical examination of historical data forms the basis for strategic decision-making, enabling investors to navigate the intricacies of the market with a nuanced understanding of trend dynamics and crucial turning points.

Also read: Navigating Cryptocurrency Tax Implications: Insights For Investors In The US, UK, And Canada

Key Components of Technical Analysis

Price Charts

In the realm of technical analysis, various types of price charts play a pivotal role in visually encapsulating market dynamics. Candlestick charts, line charts, and bar charts emerge as prevalent choices, employed to depict price movements across distinct time frames. Serving as the cornerstone of technical analysis, these charts provide a graphical representation of historical price data. Candlestick charts offer nuanced insights into price fluctuations, line charts simplify trends over time, and bar charts present a comprehensive view of open, high, low, and closing prices. Together, they furnish analysts with essential tools to decipher and interpret market behavior.

Chart Patterns

Proficient recognition of chart patterns constitutes a critical facet within the realm of technical analysis. Among the prevalent patterns are head and shoulders, double tops and bottoms, triangles, and flags. These patterns serve as invaluable indicators, potentially signaling imminent trend reversals or continuations. The head and shoulders pattern, for instance, suggests a potential trend reversal, while double tops and bottoms indicate a shift in market sentiment. Triangles and flags, on the other hand, often signify a consolidation phase before the resumption of a prevailing trend. Attuned analysts leverage these patterns to anticipate market movements, enhancing their ability to make strategic and well-informed decisions.

Technical Indicators

Key indicators such as Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) play a pivotal role in furnishing quantitative insights into market dynamics. Moving Averages offer a smoothed trend line, aiding in the identification of overall market direction. RSI quantifies the magnitude of recent price changes, signaling potential overbought or oversold conditions, while MACD gauges the convergence or divergence of two moving averages, indicating changes in momentum. These indicators collectively provide analysts with objective metrics for assessing market strength, momentum trends, and potential points of overextension, facilitating more informed and data-driven investment decisions.

Support and Resistance

In the application of technical analysis, the identification of crucial support and resistance levels stands as a fundamental strategy for traders. These levels serve as strategic markers, allowing traders to anticipate potential reversals or breakout points in the price movement. Typically derived from historical price data, support levels denote where prices have historically found a floor, while resistance levels indicate where they have faced barriers.

Trend Analysis

Technical analysis plays a pivotal role in discerning the prevailing trends within financial markets. The identification of these trends is instrumental for traders as it allows them to strategically align their investment strategies with the broader market sentiment. Whether choosing to ride the existing trend or preparing for a potential reversal, understanding the direction of the market trend is essential for making informed and timely decisions.

Risk Management

Utilizing technical analysis empowers investors to implement effective risk management strategies. By scrutinizing historical price movements, investors can strategically set stop-loss orders and define risk levels. This proactive approach serves as a protective shield, mitigating potential losses in volatile market conditions. The identification of key support and resistance levels, trend patterns, and indicators facilitates a nuanced understanding of potential risks. This, in turn, allows investors to establish well-informed and tailored risk management plans, enhancing the likelihood of preserving capital. In the ever-fluctuating landscape of financial markets, the integration of technical analysis not only guides investment decisions but also acts as a crucial tool for safeguarding portfolios against adverse market movements.

Entry and Exit Points

Technical analysis serves as a valuable tool for traders by facilitating the identification of optimal entry and exit points in their trades. This precision is attained through a nuanced interpretation of chart patterns and technical indicators, coupled with a keen awareness of market trends.

Confirmation of Fundamental Analysis

The fusion of technical analysis with fundamental analysis is a common practice among investors, offering a holistic perspective on market dynamics. This dual approach is instrumental in confirming or challenging investment decisions, providing a more comprehensive and nuanced understanding of the financial landscape.

The Psychological Aspect

In addition to charts and indicators, technical analysis places significant emphasis on understanding the psychological factors that influence market participants. Market sentiment, fear, and greed are pivotal drivers of price movements, and a deep comprehension of these emotional dynamics empowers traders to anticipate potential market reactions and make informed adjustments to their strategies.

Limitations of Technical Analysis

While technical analysis is a valuable tool, it is not without its limitations. Market anomalies, unexpected events, and sudden shifts in sentiment can defy traditional technical indicators. Additionally, overreliance on historical data may lead to missed opportunities or inaccurate predictions.

Conclusion

Technical analysis, a vital tool in finance, analyzes historical price data, charts, and indicators to predict market movements. It helps traders identify trends, and entry/exit points, and manage risks. Key components include price charts, chart patterns, and technical indicators. The integration of technical and fundamental analyses offers a comprehensive view. Understanding psychological factors such as market sentiment enhances decision-making. Despite its benefits, technical analysis has limitations, including susceptibility to unexpected events. In the ever-changing financial landscape, it guides investors but requires a balanced approach.

Disclaimer: The author’s thoughts and comments are solely for educational reasons and informative purposes only. They do not represent financial, investment, or other advice.

Financial Market News

Crypto

Blog

Analysis Follow

Follow

Written by Coinscapture

1.7K Followers

Coinscapture is the best, real-time, high-quality cryptocurrency market data provider, by listing 2000+ cryptocurrency globally. https://coinscapture.com/

More from Coinscapture

Coinscapture

Coinscapture

in

CoinsCapture

10 Known Decentralized Email Service Providers

The nature of blockchain technology has brought an evolution in the space of innovation and technology. One of the key features of…

4 min read

·

Aug 31, 2020

84

1

Coinscapture

Coinscapture

Top 10 Telegram Channels for Crypto Signals in 2023

5 min read

·

Sep 21, 2023

10

Coinscapture

Coinscapture

in

CoinsCapture

5 Most Popular Web3 Books To Read

Internet development will progress to Web3 in the future. This new platform will revolutionize our online interactions because of its…

5 min read

·

Sep 13, 2022

8

Coinscapture

Coinscapture

Strategies for Hash Rate Enhancement in Cryptocurrency Mining

Cryptocurrency mining, a fundamental process in blockchain technology, involves validating and securing transactions on a network. Miners…

4 min read

·

Oct 2, 2023

3

Recommended from Medium

0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

580

11 Geoffrey Robichaux

Geoffrey Robichaux

Behind the Story: Navigating the Art of Prompt Engineering in Generative AI

There is more to a story than the final destination. The journey along the way captures all the small lessons, tangents, and bumps in the…

8 min read

·

4 days ago

389

Lists

Modern Marketing54 stories

·

376

saves

Staff Picks559 stories

Staff Picks559 stories

·

649

saves The Pareto Investor

The Pareto Investor

The Beautiful Mathematics Behind Bitcoin

The One and Only Formula You Need to Know to Understand the Genius Behind Satoshi’s Masterpiece.

·

3 min read

·

6 days ago

291

3

SlowMist

SlowMist

Comprehensive Report on North Korean Hackers, Phishing Groups, and Money Laundering in 2023

The preceding article offered an in-depth analysis of the blockchain security landscape in 2023. This article shifts the focus to the…

9 min read

·

Jan 11

20 Arthur Hayes

Arthur Hayes

ETF Wif Hat

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor…

17 min read

·

3 days ago

657

8

Anthony Nguyen

Anthony Nguyen

How to buy Bitcoin (#BTC) Guide

The Bitcoin ETF has been approved, opening the door to more investors to access this asset.

4 min read

·

Jan 12

71