new aristokrat

From the desk of Steve Strazza @Sstrazza

Dividend Aristocrats are easily some of the most desirable investments on Wall Street. These are the names that have increased dividends for at least 25 years, providing steadily increasing income to long-term-minded shareholders.

As you can imagine, the companies making up this prestigious list are some of the most recognizable brands in the world. Coca-Cola, Walmart, and Johnson & Johnson are just a few of the household names making the cut.

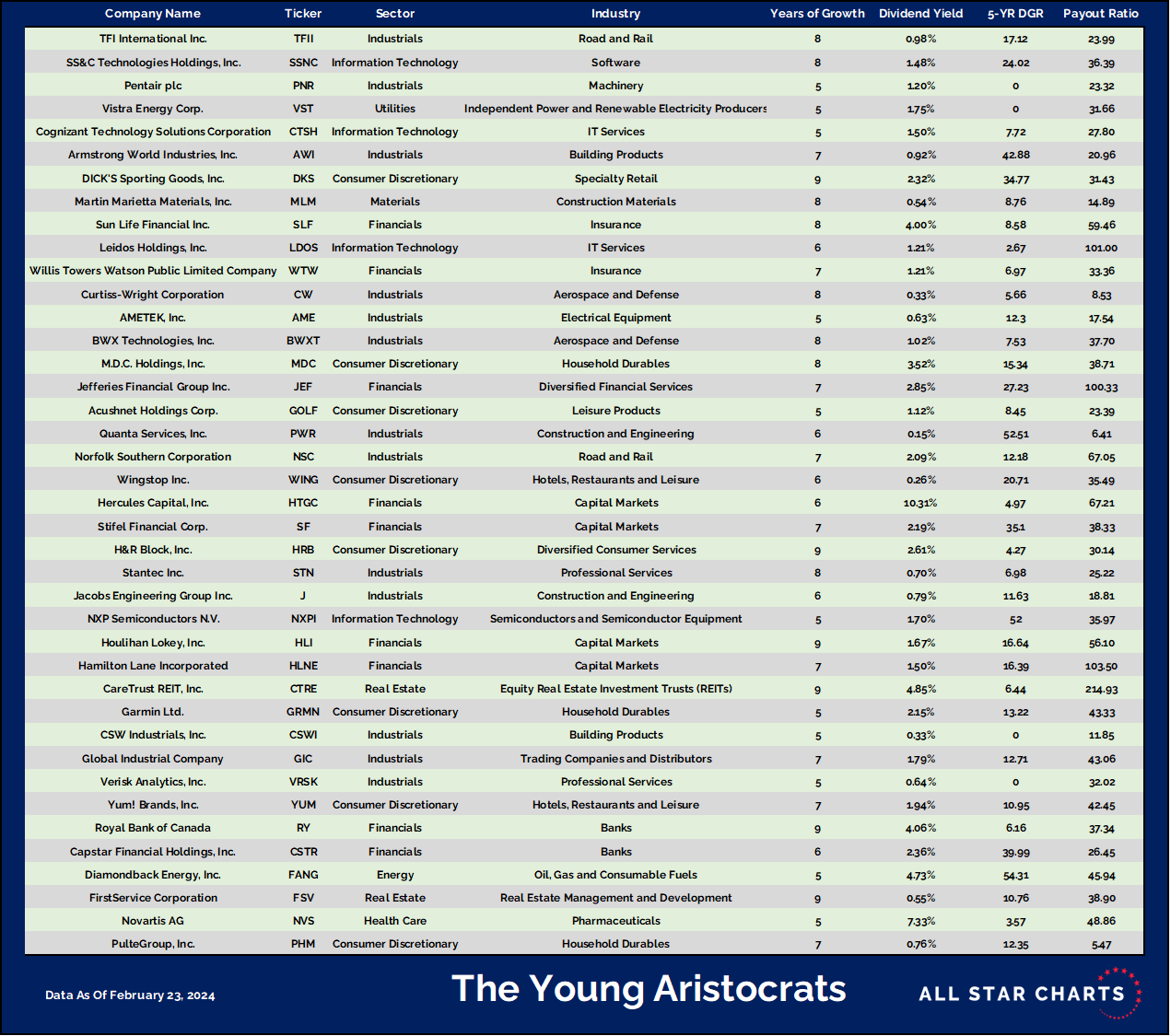

Here at All Star Charts, we like to stay ahead of the curve. That’s why we’re turning our attention to the future aristocrats. In an effort to seek out the next generation of the cream-of-the-crop dividend plays, we’re curating a list of stocks that have raised their payouts every year for five to nine years.

We call them the Young Aristocrats, and the idea is that these are “stocks that pay you to make money.” Imagine if years of consistent dividend growth and high momentum and relative strength had a baby, leaving you with the best of the emerging dividend giants that are outperforming the averages.

By adding our technical analysis to the mix, the Young Aristocrat setups give you the opportunity to own the best of the market’s future blue-chip winners before they become must-own household names.

Oftentimes, the strongest performers in this universe and even the Aristocrats themselves pay relatively small dividends. This is usually because the stock appreciation makes it tough to keep up with the payout — even for companies that consistently grow their yield in the double-digits! For this reason, we don’t have a minimum threshold for the dividend. What we’re really doing here is creating a list of quality stocks based on their ability to persistently grow their shareholder return.

And maybe the best part? This list is not just designed for long-term investors. Any kind of investor or trader can use this list as it helps generate ideas across all timeframes, even the short term. Remember, some of the most important filters we use for this list are momentum, relative strength, and proximity to new highs.

Here’s our latest list of dividend growth stocks. As always, we’ve sorted the table by proximity to new 52-week highs: