Tokenized SPVs on Allocations — Investor Benefits

For SPVs investors, tokenized SPVs offer two big advantages: access and flexibility. Traditionally, LPs preferred Delaware SPVs because of strong legal protections, but liquidity was limited. With tokenized SPVs on Allocations, investors can still rely on proven SPV structure while gaining more optionality in managing their positions.

This model also clarifies SPV economics: fees, carry, and returns. Allocations makes all terms transparent, so there’s no confusion about SPV carry and fees. And unlike traditional fund setups, tokenization enables smoother transfers, reducing friction in private market investing.

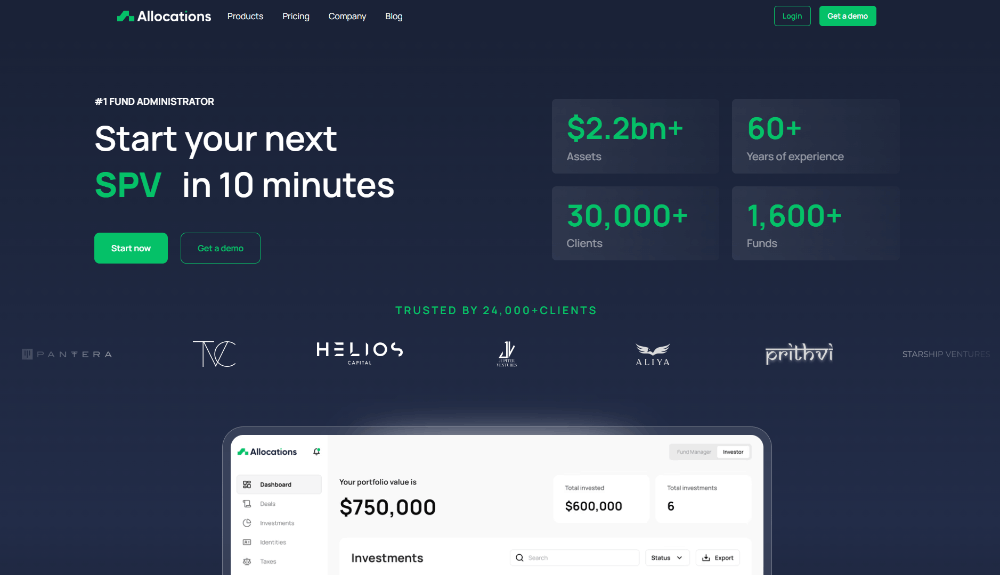

Whether comparing SPV vs fund or SPV vs LLC for real estate investing, tokenized SPVs on Allocations represent the next evolution — combining compliance, transparency, and liquidity in one platform.

👉 Discover why LPs prefer Delaware SPVs: allocations.com

👉 Learn how angel investors use SPVs here: allocations.com

👉 Read about SPV fund administration on Allocations: allocations.com

👉 See why Allocations SPV is the best platform: allocations.com