Tether gathered an additional 8,888 Bitcoins, its holdings exceeded the 5 billion USD mark

The latest purchase has helped Tether become the world's 7th largest Bitcoin holder.

Tether, the parent company of the stablecoin USDT, purchased an additional 8,888 Bitcoin (BTC), worth $627 million, in Q1/2024.

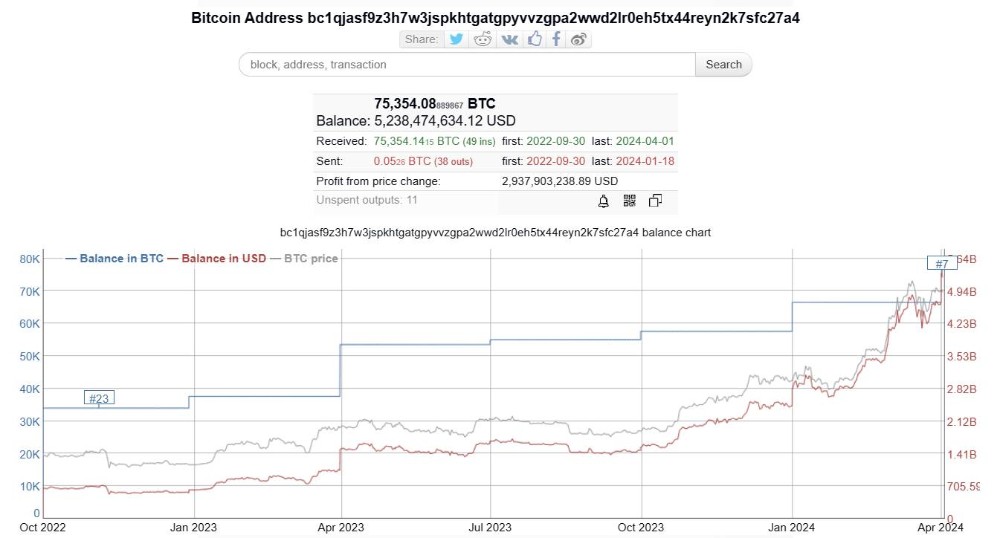

The new transaction raised Tether's Bitcoin fund to 75,354 BTC, approximately 5.24 billion USD. With an average purchase price of 30,305 USD, this portfolio is generating profits of up to 2.94 billion USD, equivalent to 130%.

Although Tether has not yet made its address public, according to research unit 21.co Reserach, this "tycoon" is the 7th highest holder of Bitcoin in the world, "jumping" 4 places compared to the position. 11 of August 2023. Owning the most Bitcoin currently is Binance, with more than 248,597 Bitcoin, approximately 17.31 billion USD.

Tether CEO Paolo Ardoino confirmed to The Block that the company just purchased an additional 8,888 Bitcoin and that the accumulation took place throughout the first quarter of this year.

In Q4/2023, Tether also bought exactly 8,888 more Bitcoins. So, it's likely that this is a trend that this giant will maintain in the coming quarters.

Tether's decision to add more Bitcoin coincides with the time when the Bitcoin spot ETF has not yet cooled down and the fourth Bitcoin halving is approaching on April 22. Furthermore, Bitcoin also just closed its highest monthly candle ever and set a new quarterly peak in the 15 years of this cryptocurrency's existence.

Tether publicly announced its Bitcoin investment for the first time in its Q1/2023 asset certification report. At that time, the company announced that it would deduct 15% of its profit surplus each month to reallocate reserve assets from government bonds to Bitcoin.

In addition, Tether has also focused on the field of Bitcoin mining and delved into the AI space in recent times. The organization aims to pioneer the development of open-source, multi-modal AI models to set new standards, promote innovation, and scale AI technology.

However, Tether's main business activities still revolve around USDT. Tether is currently the largest stablecoin issuer in the cryptocurrency market, with a total USDT supply reaching a record of more than 109 billion.

Not only Tether, many other giants such as MicroStrategy and Bitcoin nation El Salvador have also actively added this coin to their budgets since the end of last year until now.

Previously, according to The Block, the world's largest stablecoin issuer Tether at the end of 2023 purchased an additional 8,888 BTC, worth $380 million at the present time.

With this transaction, Tether's Bitcoin fund has increased to 66,465 BTC, worth $2.8 billion.

Although the company has not yet made its address public, according to research unit 21.co Reserach, Tether is the 11th holder of the most Bitcoins in the world.

Tether first bought Bitcoin in September 2022, then announced plans to allocate the company's profits to the world's largest cryptocurrency in May 2023. As of early December, Tether's Bitcoin investment had generated a profit of up to 1.1 billion USD.

USDT ended an extremely successful 2023, increasing to 21% market share and currently accounting for 2/3 of the total market capitalization of stablecoins.

In addition to Tether, many other giants like MicroStrategy also actively added more BTC to their already huge vaults, right before Bitcoin spot ETFs were approved by the SEC in mid-January.

Tether publicly announced its Bitcoin holdings for the first time in the first quarter of 2023. According to the announcement, Tether will gradually reallocate reserve assets from government bonds to Bitcoin, with recurring investments of up to 15% surplus profit every month. This decision was made at a time when the US had not yet resolved the public debt ceiling problem, when bonds were a risky investment channel. And above all, the number 1 stablecoin issuer in the market is the organization holding the 23rd highest amount of US government debt in the world.

Tether has so far kept its purchase schedule and transaction value private, but Tether pledges not to exceed 15% of its surplus assets.

Need to be cautious with Tether's Bitcoin holdings?

In fact, Bitcoin is one of the best performing assets over the past decade, but an organization holding too much of this cryptocurrency becomes a "double-edged sword" because of its volatile nature. its incalculability.

Bitcoin offers better returns than Tether, but it also has problems, Wan noted.

A less volatile asset like cash is a safer choice, Mr. Wan added:

"Tether's Bitcoin holdings account for 1.67 billion USD, accounting for 50% of its liquidity buffer. 85% of Tether's reserves are cash, cash equivalents and other short-term deposits. Therefore, if this happens Given the decline in prices for their other reserve assets, a less volatile liquidity cushion would benefit their positions.”

*Liquidity cushion refers to the high liquidity of assets with which an individual/organization can meet unexpected demands for cash.

Mikołaj Zakrzowski, researcher at CryptoQuant, made a similar point:

“In the grand scheme of things, Tether's increased Bitcoin holdings are not necessarily a major concern, as Tether also owns significant amounts of US Treasury bonds and other USD-denominated assets. However, The main issue here is that Tether contributes to double exposure, causing additional volatility to the total value of the company's reserves."

Furthermore, since Tether serves as "one of the pillars" of the cryptocurrency market, any adverse event that happens to Tether could have an adverse impact on the price of Bitcoin and the overall market. school,” quoted Zakrzowski.

Tether is like a “black box”

Because of the "vague" plan to increase Bitcoin holdings, Tether immediately received a lot of criticism. Notably, Binance CEO Changpeng Zhao called Tether's reserve report a "black box" during the AMA session on July 31.

Tether's continuous reporting of profits over many quarters has re-emphasized its leading position in the stablecoin field, but CZ still maintains the opinion that one should not place complete trust in USDT. According to the billionaire, priority should still be given to dispersion across many types of stablecoins.

Tether CTO Paolo Ardoino once said "no stablecoin has an official audit, only certification."