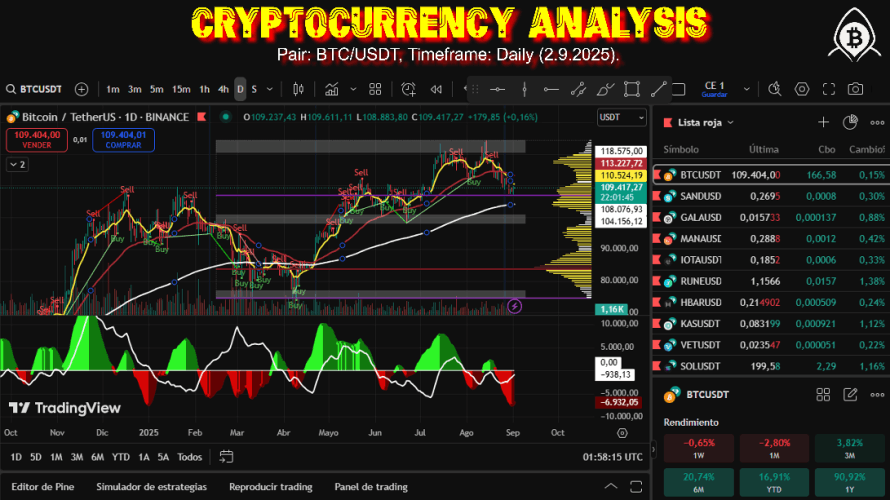

Cryptocurrency Analysis - Pair: BTC/USDT, Timeframe: Daily (2.9.2025).

The analysis in this article was generated using an advanced artificial intelligence system (which I am currently experimenting with) that coordinates four specialized agents: technical, fundamental, sentiment, and charting. Their collaboration simulates a committee of experts that cross-references data, interprets trends, and reaches a consensus, offering a unique multidimensional analysis. While AI provides speed, depth, and human-scale data processing, this content has been meticulously reviewed for accuracy and clarity, blending the best of artificial insight with human oversight for you. - The Author.

Analysis of the BTC/USDT cryptocurrency pair on a daily timeframe. This pair represents the primary benchmark for liquidity and volatility in the digital asset market, with its daily performance being a key indicator of the overall trend and prevailing price dynamics.

Technical Analysis

BTC/USDT's daily analysis shows a confluence of signals suggesting short-term caution, but with underlying long-term strength.

Short-Term Bearish Pressure: BTC/USDT has experienced a significant pullback, with declines of -0.14% in the last 24 hours, -4.76% in the last week, and -4.59% in the last month. Short-term technical indicators, such as the moving averages, the RSI (moving toward or below the 50 level), and the MACD (with potential bearish crossovers), are generating "Strong Sell" signals, reinforcing the immediate downtrend. 📉

Yearly Trend Strength: Despite the recent correction, the long-term outlook for BTC/USDT remains robust. The pair has posted an impressive +90.65% increase over the past year, implying that the long-term moving averages still support a prevailing bullish trend, suggesting that fundamental bullish sentiment persists. 📈

Post-ATH Correction: Bitcoin reached an all-time high (ATH) of 124,474.00 USDT on August 13, 2025. The current price, around 109,088.36 USDT, represents a correction from that peak, establishing the ATH as a key resistance level to watch for future movements. ⛰️

Fundamental Analysis

The BTC/USDT price has shown notable daily volatility, with an increase of 0.94% in the last 24 hours as of September 2, 2025, trading around $109,260. The 24-hour trading volume stands at approximately $42.96 billion. 📈

Institutional demand for Bitcoin remains robust; as of August 29, 2025, over 690,000 BTC had been absorbed, exceeding the new supply of 109,000 BTC. Bitcoin ETFs recorded net inflows of 1,578 BTC (approx. $174.35 million) on the same date, signaling renewed interest in digital assets. 🏦

At the corporate level, Japan's Metaplanet recently acquired an additional 1,009 BTC, bringing its total holdings to 20,000 BTC, positioning it as the sixth-largest public Bitcoin holder, demonstrating strong strategic conviction. 💼

Sentiment Analysis

BTC/USDT shows a clear short-term bearish signal, having fallen below $108,000 to trade around $107,960.01 as of September 2, 2025. Technical indicators and moving averages such as the 50-day SMA ($115,892) and the 20-day EMA ($110,195) reinforce this outlook by issuing "sell" and "strong sell" signals respectively, evidencing a lack of bullish momentum in the last 24 hours with a slight drop of 0.14%. 📉

Despite the historical weakness in September, which has seen an average decline of 3.7% since 2013, the medium-term outlook for BTC/USDT is more optimistic. The 1-week and 1-month ratings suggest a "buy" signal, and there is expectation in the community that the price could find a bottom around $104,000, marking the possible end of the corrective phase before aiming for upside targets as high as $124,000 or even $155,000. ⚖️

Activity on social media and community forums such as Reddit and TradingView Minds remains a key driver of sentiment for BTC/USDT. There is a significant correlation between online discussions and market metrics, with the Fear & Greed Index serving as a common benchmark. However, concerns remain about the influence of trends such as "money demonstrations" that could foster unrealistic expectations and potential exchange manipulation, despite the robust trading volume of $34.46 billion. 🗣️

Chart Analysis

The BTC/USDT pair is in a crucial decision zone, with a current price near $109,088.36 USDT, having experienced a slight decline of -0.14% over the past 24 hours. The critical support zone lies between $108,000 and $110,000; if this level holds, we could see a rebound towards $116,000 and subsequently $124,000. A sustained break below $108,000 would pave the way to $99,000. ⚠️

Bitcoin's daily trading volume has seen significant growth, reaching $42,147,502,049 in the past 24 hours, a 52.00% increase from the previous day. This increase in activity suggests greater conviction or volatility in the market. 📊

Regarding reversal patterns on daily charts, the high reliability of the "Inverse Head & Shoulders" stands out, with an 84% success rate, and the "Double Bottom" with an 82% success rate in signaling bullish trend reversals. The strength of these patterns is accentuated on larger time frames. 🔄

Unified Conclusion

Currently, BTC/USDT resembles a flagship navigating through turbulent waters 🌊, facing a crucial decision zone. In the short daily term, we observe a confluence of bearish signals: the pair has retreated below $108,000, with technical indicators such as the RSI and MACD generating a "Strong Sell" and the moving averages (50-day SMA and 20-day EMA) reinforcing this outlook 📉. September's historic weakness adds a layer of caution, and a sustained breach of critical support between $108,000 and $110,000 could pave the way for a pullback toward $99,000 ⚠️. Concerns about exchange manipulation and unrealistic expectations on social media persist, despite robust trading volume.

However, beneath this choppy surface, BTC/USDT's fundamental structure remains robust. Institutional demand is unwavering, with massive BTC absorption outpacing new supply and consistent inflows into Bitcoin ETFs 🏦. Corporations like Metaplanet reinforce this strategic conviction, demonstrating strong faith in its long-term value. Despite the recent correction from its ATH, the yearly trend shows an impressive +90.65%, indicating that the long-term moving averages still sustain an underlying bullish sentiment 📈.

Opportunities emerge if current support holds, projecting a rebound toward $116,000 and potentially the ATH of $124,000. Daily reversal patterns such as the Inverse Head & Shoulders and Double Bottom, with high success rates, hint at a possible bullish trend reversal, especially with the notable increase in trading volume indicating greater conviction in the market 📊. There is expectation in the community that the price will find a bottom around $104,000, signaling the possible end of the corrective phase before aiming for new highs. Probable scenarios range from a test of $99,000 if support gives way, to a consolidation followed by a reactivation of bullish momentum toward $124,000 or even $155,000, driven by renewed institutional interest and a positive shift in medium-term sentiment ⚖️.

Disclaimer

Important: This conclusion is provided for informational and analytical purposes only and should not be construed as financial advice. Investment decisions should be based on thorough research and consultation with a qualified financial professional. The cryptocurrency market is highly volatile, and investments carry a significant risk of loss.

OTHER LINKS 👍:

🔎 Discover Cryptocurrency Trading with AI. 🤖 Robot Trader (➕💲5️⃣ FREE). 💡 LET TECHNOLOGY WORK FOR YOU 😎

- 🤖 Bot GPTrading: http://bit.ly/3IplW6G

- 📈 Zaffex Broker: http://bit.ly/468Z6tU

- ✍️ Tutorials: https://www.youtube.com/@TeamReferralFamily

💳 Get the BANCUS Cryptocurrency Debit Card 🥳 NO KYC VERIFICATION REQUIRED. Participating in their REFERRAL PROGRAM allows you to accumulate sufficient funds to purchase it WITHOUT INVESTMENT.

- 🔗 https://bit.ly/3HndJzE

- 💰 Referral Reward Levels 👉

Card Purchase:1º-10%, 2º-15%, 3º-10%;Of the Top-Up Amount:1º-0.285%, 2º-0.43%, 3º-0.285%

"If you don't find a way to earn money while you sleep, you'll work until you die" - Warren Buffett