The top 10 most legendary investors in history.

As an investor, one needs to have a solid investment strategy to gain exceptional returns. Such a strategy helps an ordinary investor to turn out into one of many greatest investors. The approaches the greatest adopt in their investment strategy differentiate them from ordinary investors. They are the ones who have an incredible track record of battering the market return on a time-to-time basis.

Some may prefer value investing whereas others may prefer a growth investing strategy. Further, some may leverage the circumstances surrounding them in the contemporary context. For instance, buying at a discounted price during a depression, a stock market crash, etc. exactly when ordinary investors start to panic and try to sell as soon as possible to exit the market; and holding them enough for a certain period to enjoy the exceptional return. Ultimately, it all boils down to one terminology i.e., “return”. How much return does the investor were able to generate over the course of time? Those who were able to generate exceptional returns turn out to be regarded as one of the greatest investors of all time.

The article will brief 10 of the greatest and most influential investors of all time along with their introduction, investment returns, and how much returns they were able to garner during their era. At last, the honorable mentions will be provided to those investors who couldn’t be included in the list, however, could be considered in the list of influential investors that could turn out to be the source of inspiration for many.

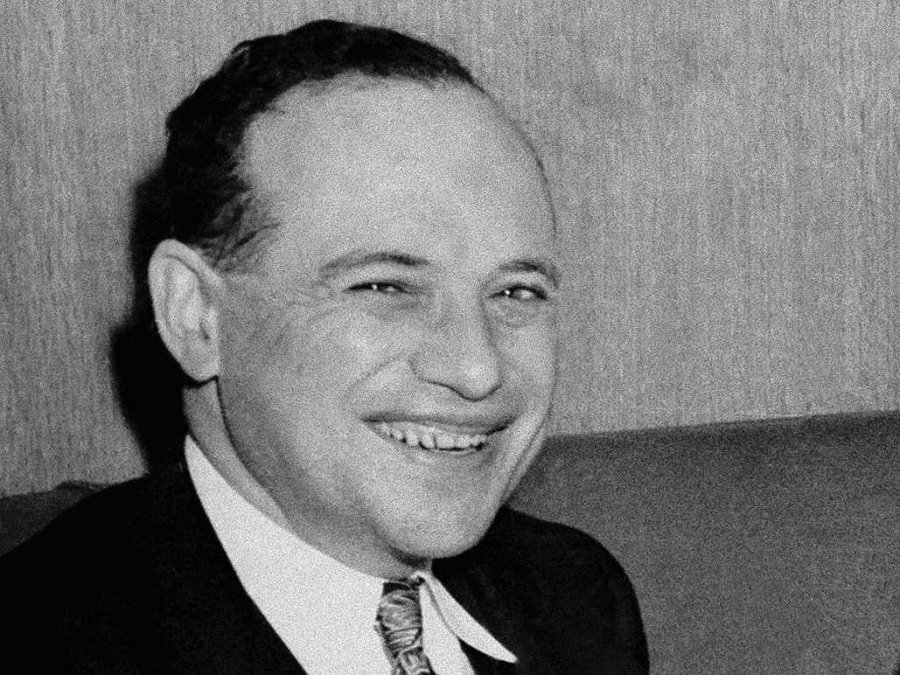

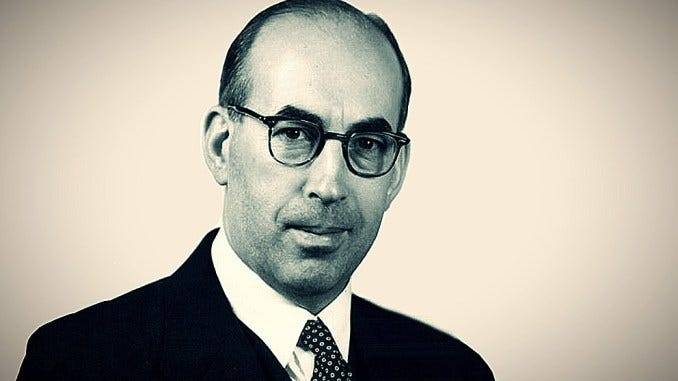

1. Benjamin Graham

Born in 1894, Benjamin Graham was an American economist, professor, and investor. Widely considered as the father of value investing, to whom Warren Buffet considered as a mentor wrote the most influential books of all time in the field of investing “The Intelligent Investor” and “Security Analysis”.

Investment Strategy

- Value Investing: Sorted out the company whose market price is less than its true worth.

- Neglected the market sentiment and focused on firms with good dividend returns.

- Bought the shares of the company with strong fundamentals and great prospects.

- Sorted out companies with healthy cash flow, above-average profit margins, low debt, strong balance sheets, and financial ratios.

Return

Benjamin Graham enjoyed the return of about 20% for 20 years of time frame from the year 1936 to 1956, generally beating the market return.

2. Warren Buffett

Born in 1930, Warren Buffett is an American investor and philanthropist. Considered the greatest investor in the modern era, Buffett can be considered the greatest in the contemporary context as well. As of October 2021, he is the 6th richest person on the planet with a net worth of $96 billion. Since 1970, he has been the largest shareholder of Berkshire Hathaway in which he holds the post of chairman as well.

Investment Strategy

- Follows Graham’s philosophy of value investing, to whom he considers a mentor.

- Hunts for the stocks whose price is below their intrinsic value.

- Focuses on three major aspects of investing: consistency, duration, and magnitude of the returns expected.

- Ability to consistently beat the market return through his traits of investing: patience, discipline, and value investing inspired through Benjamin Graham.

Return

Buffett has been successful in providing a return of around 21% annually for the shareholders which is double the return of the S&P 500 index of only 9.7% per annum.

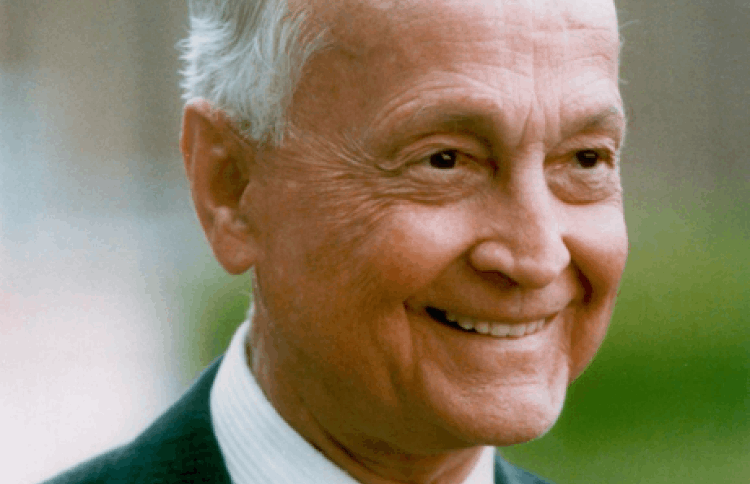

3. John Templeton

John Templeton born in 1912 was an American-born British banker, investor, philanthropist, and fund manager. In 1999, Money magazine named him as the greatest global stock picker of the century. He is the one who created the concept of mutual funds that can be seen in the present era. This idea of creating the mutual fund came from his own experience.

During the Great Depression, Templeton bought 100 shares of every company listed in the New York Stock Exchange (NYSE) that traded below $1 per share in the year 1939. He diversified by picking 104 companies in total and his total investment was $10,400. Till the time frame of the next four years, 34 in total 104 companies went bankrupt. Despite this, he was able to sell the remaining entire portfolio for the sum of $40,000. This is how he came to know about the power of diversification. If some fail, others prosper and this is how you could increase your return of investment through minimizing the risk. This is how he gained experience and started his mutual fund ‘Templeton Growth Fund’ in 1954.

Investment Strategy

- Was the ultimate bargain hunter. Would search out those companies which nobody else were searching and came up with the best value stocks that were neglected by other investors.

- Considered to be the contrarian investor because he would pick the stocks irrespective of market trends and what other investors were doing in the market.

- He was an early investor who followed the principle of value investing.

- Preferred fundamental analysis rather than technical analysis when picking the stock.

- Bought the stocks at the peak point of pessimism rather than optimism.

Return

John Templeton was able to generate an annual return of more than 15% over the course of 38 years.

4. Peter Lynch

Born in 1944, Peter Lynch is an American investor, mutual fund manager, and philanthropist. He made his name as one of the greatest investors through the management of ‘Magellan Fund’ at Fidelity Investments between the time frame of 1977 and 1990. During his tenure, he managed to provide an annual return of about 29%, making it the best performing mutual fund in the world. This is the return that was double that of the S&P 500 market index. Hence, it can be seen that Lynch was able to consistently beat the market. Further, the assets grew from $20 million to over $14 billion over the course of 13 years.

Lynch has written some great books on the field of investing like ‘Beating the Street’, ‘One Up on Wall Street’, ‘Learn to Earn’ etc.

Investment Strategy

- Pick up those companies that can be bought at a reasonable price. Those companies might be small but reflect the traits of fast-growing companies.

- Considered to be the one who practically reflected growth investing to its perfection in his investment strategy.

- When picking up the stocks, he only stuck to what he knew about. A stock on which he possessed very little knowledge, he generally ignored it.

Return

Lynch, as already stated above provided annualized return of about 29% over the course of 13 years.

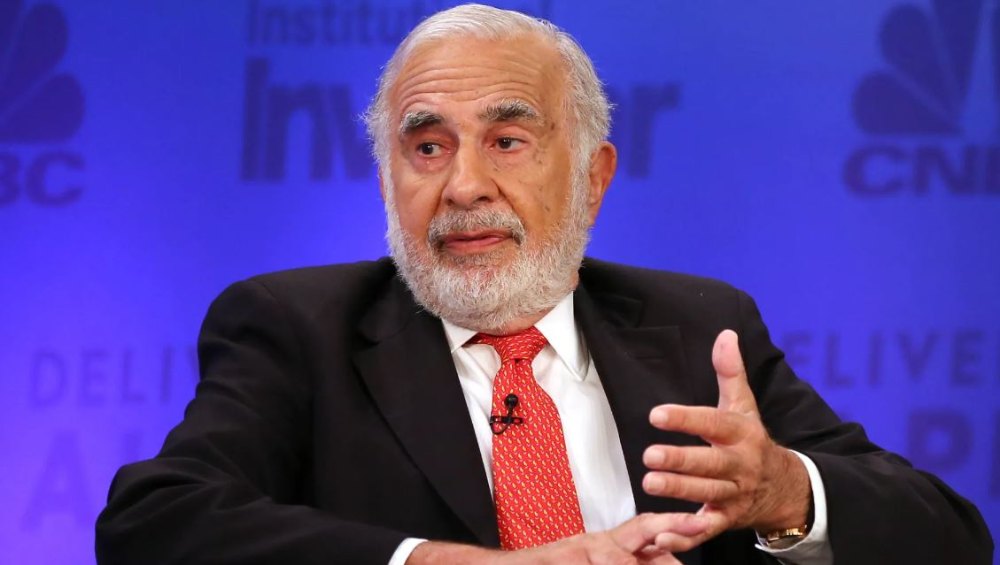

5. Carl Icahn

Carl Icahn born in 1936 can be taken as a quite different type of investor if compared to others in this list. It is because he tends to take quite a different approach during his investment journey. Icahn has developed himself as a ‘corporate raider’ during the late 1970s and early 1980s. It is because he tends to analyze the company that had a poor management system and he tends to acquire enough shares of the company in order to vote himself in order to get on the Board of Directors. Then, he changes the senior management to achieve what is favorable for the company to deliver solid results. He experienced a lot of success along with controversies over the past 30 years. He is the founder of ‘Icahn Enterprises’.

Investment Strategy

- Buying the stocks of the company is poorly managed, which is easier to change once you are in charge of the company through the accumulation of a large portion of shares of that particular company.

- Focus on companies that are undervalued specifically with low P/E ratios.

Return

Able to deliver a return of 14.6% over the time frame of 15 years (2000-2015) through ‘Icahn Enterprises’. It might seem less compared to the return provided by others on the list. However, this is not true. If you look at the return of S&P 500 returns in the same period, it has only provided a return of 5.6%. When compared both, the return provided is massive and almost triple.

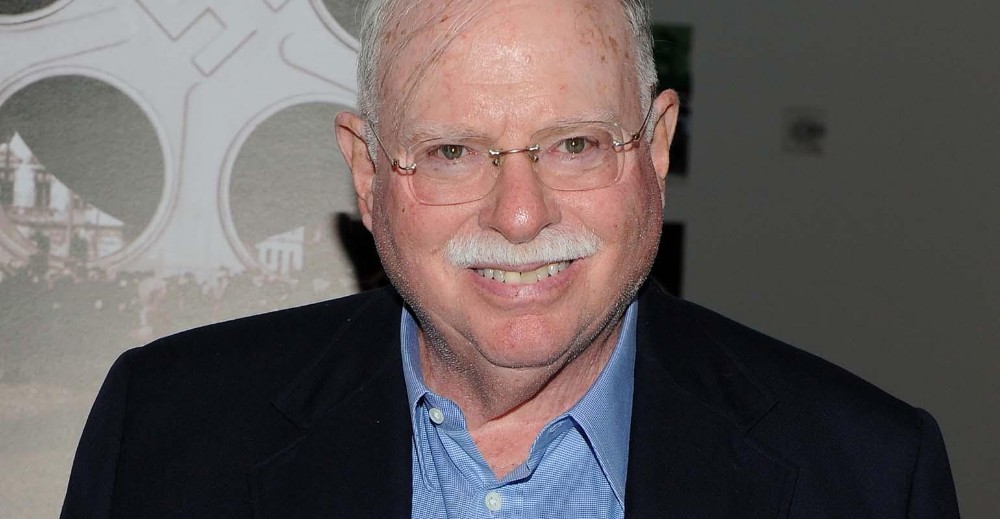

6. Michael Steinhardt

Born in 1940, Michael Steinhardt is an American hedge fund manager, investor, and philanthropist. He was named as “Wall Street’s greatest trader” in an article by Bloomberg in 2014. His investment strategy constitutes of various aspects of investment i.e., through stocks, bonds, options, currencies, etc. He used to strategize as a long-term trader but used to take insights and learn from short-term strategic trades as well. His astounding return doubles that of the S&P 500 is more than enough to consider him as one of the greatest.

Investment Strategy

- Adopted both long-term and short-term trading strategies.

- Not only stocks, but he also focused on bonds, options along with currency.

Return

From the year 1967 to 1975, he was able to deliver an average annualized return of about 24% through his fund “Steinhardt Partners” over the course of 28 years. This is more than double of S&P 500 return if compared to the same period of time.

7. George Soros

Born in 1930, George Soros is considered to be the most generous investor as he has donated more than $32 billion to ‘Open Society Foundations’. Considered as a genius in hedge fund investments, George Soros is very well known for his speculative investment strategy. His benchmark of shorting is very popular in the world of investing. He made $1 billion through shorting on a single day in 1992, which is hard to believe to date. For this, he risked his $10 billion on a single deal.

Investment Strategy

- Followed a very odd strategy if compared to others because he tends to showcase a very speculative investment strategy.

- Very instinctive strategy that heavily relied on instinct and gut in his investment’s decision.

- He was very well-informed about both worldwide and regional economic trends which he used to apply during his investment.

Return

Provided the average annual return of 30% from 1970 to 2000 through the management of “Quantum Fund”.

8. John (Jack) Bogle

John C Bogle is a founder of Vanguard Group, one of the largest mutual funds with more than $7 trillion assets under management [As of 2021]. He is considered the most influential mutual fund manager and the creator of index funds. He managed Vanguard Group until 1996 when its inception in 1974.

Investment Strategy

- Low-Cost Index Investing

9. Bill Gross

Born in 1944, Bill Gross is considered the greatest bond fund manager. He is the founder and manager of Pacific Investment Management Company (PIMCO). For his contributions in the field of bond and portfolio analysis, he was enlisted on the Fixed Income Analyst Society’s Hall of Fame, and he was the very first portfolio manager to achieve it in the year 1996.

Investment Strategy

- The main emphasis is on buying individual bonds.

- Adopts long-term investment strategy and considers a time frame of 3-5 years.

Fund Management

As of Sept 30, 2020, PIMCO possesses $2.2 Trillion fixed-income assets under management.

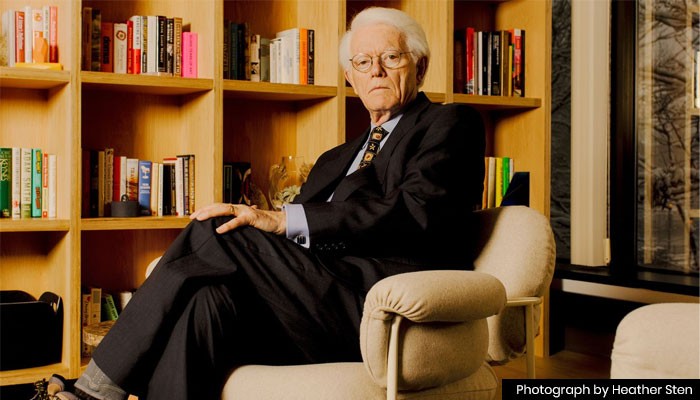

10. Bill Miller

Bill Miller is one of those investors that has achieved that majority of investors dream of. He is considered to be one of the greatest because he was able to beat the S & P 500 consistently over a 15-year period from 1991 to 2005. In 1999, he was named “Fund Manager of the Decade” through Morningstar.com.

Investment Strategy

- Value Investing Strategy.

- He believes if growth stocks can be traded for the right price, they can act as value stocks, hence considered an unconventional investor.

- Some of his investments: Early investors of Amazon, invested heavily in Bitcoin.

Fund Management

Between the time frame of 1990 to 2006, Miller was able to turn the hefty amount of $750 million to an exceptional $20 billion in assets under management.

Honorable Mentions

The investors were categorized into the top 10 list on the basis of their investment strategy and the exceptional returns they were able to generate over the period of years. However, some investors could not accommodate the list. They too possess some remarkable achievements during their investment journey. Hence, they are mentioned in this section.

John Neff

John Neff was an American mutual fund manager who handled the Windsor Fund for about 31 years (1964 – 1995), in which he delivered a return of 13.7% which was higher than the S&P 500 (10.6%) if compared at the same time span.

- Neff was a value investor, the common trait found in the majority of greatest investors.

- Selected the companies with strong dividend yields which would show the power of compounding in the long

- Focused on the companies with lower P/E ratios.

Cathie Wood

- Founder and CEO of ARK Invest.

- ARK Innovation ETF has been able to generate an annualized return of 39% from 2014 till early 2021, which is triple the return of the S&P 500 if compared on the basis of the same time frame.

Thomas Rowe Price Jr.

- Is Considered the father of growth investing.

- Investment in good companies for the long term, basically the stock-holding

- Suggested fundamental research as the vital one when it comes to stock picking.

Philip Fisher

- Wrote one of the most influential books on growth investing ‘Common Stocks and Uncommon Profit’.

- Even Warren Buffet considers his investment style to constitute 15% Philip Fisher and 85% Benjamin Graham.

- One of his famous stocks was Motorola which he bought in 1955 and held till 2004.

- Filtered out companies based on high-profit margin, high return on capital, leading industry position, products, and services, etc.

Peter Thiel

- Turned $2000 to $5 billion through Roth IRA.

- Being the founder of PayPal and having early access to PayPal shares before it went public, of course, played a vital role in this gigantic achievement.