What is Sell in Garment? Is the Sell in May strategy correct in Crypto?

Every time May approaches, the saying "Sell in May" is spread among investors, referring to the trend that financial markets often operate less efficiently and investors should withdraw money to avoid risks. So what is Sell in May?

What is Sell in Garment?

Sell in May is an investment strategy in the financial and business world, with the purpose of advising investors to sell all stocks, bonds, etc. in early May and buy them back in November. Sell in May is often commonly applied in stocks around the world, based on the concept that the market tends to increase stronger from November to April compared to the remaining months.

There are many theories about the origin of the Sell in May strategy. However, the most common origin of Sell in May comes from the 17th century English proverb, with the full version: "Sell in May and go away, and come on back on St. Leger's Day" (Sold out in May and took a break, then came back on St. Leger's day).

In addition, the US economy during the above period was also significantly influenced by Britain (because it was a colonial country). Therefore, some American investors also apply the Sell in May strategy from Memorial Day in May to Labor Day at the end of September.

Why has Sell in May become popular?

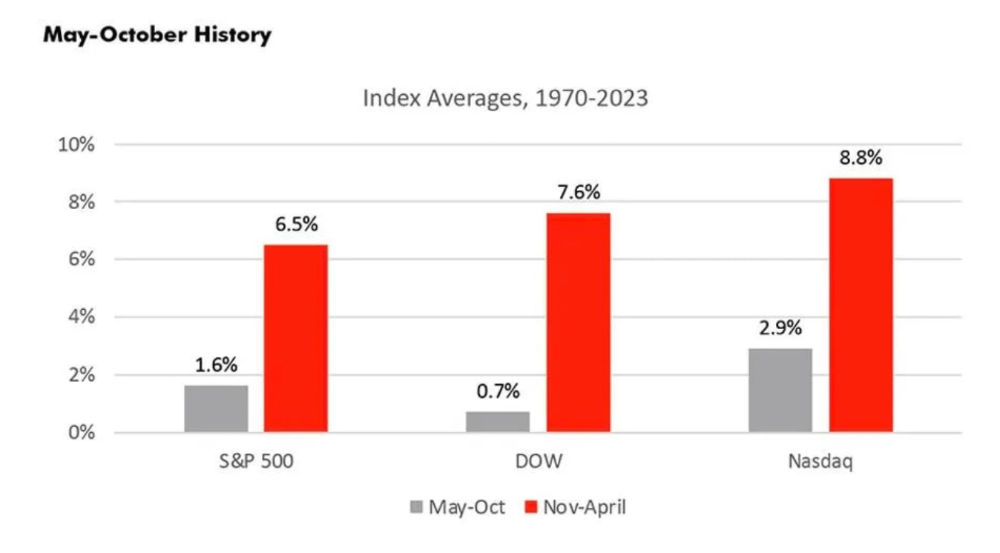

Since the mid-20th century, the Sell in May strategy has become increasingly popular around the world, especially in the UK and US stock markets. According to statistics, the stock market tends to increase strongly from November to April compared to the period from May to October.

The chart below illustrates the difference in returns between two periods (from May to October and from November to April) of three important indexes: S&P 500, Dow Jones and Nasdaq, measured from year to year. 1970 to 2023.

For the Vietnamese stock market, the saying Sell in May is also quite clear. Specifically, if investors buy and hold stocks from May to October, the average return rate is only 0.87%. Meanwhile, the rate of the remaining period (from November to April) reached 12.2%, with an increase equivalent to 12 times.

Is Sell in May effective in crypto?

In the stock market, the Sell in May strategy has been proven effective based on past growth data. However, when applied to crypto, Sell in May is still controversial advice.

First, compared to stocks, the crypto market is still relatively new with rapid development. In addition, the fluctuation amplitude of crypto is quite large and unpredictable.

Second, crypto trading time is 24/7, so investors need to monitor the market closely to seize opportunities instead of limiting investment by applying the Sell in May strategy.

Finally, not only crypto, whether the financial market increases or decreases depends on many factors, from macro to micro.

Therefore, investors should not make hasty decisions based solely on the above strategy. Instead, investors should combine different methods such as fundamental analysis, technical analysis, market monitoring... to come up with the most suitable strategy.