How Blockchain Is Used in Finance

Introduction

Finance is one of the industries most transformed by blockchain technology.

From payments to lending, investing, and banking, blockchain is changing how money moves around the world.

But how exactly is blockchain used in finance?

Why are banks, startups, and investors paying so much attention to it?

In this article, you’ll discover how blockchain is used in finance, its main applications, benefits, and why it represents a major shift in the global financial system.

1. The Problems With Traditional Finance

Traditional finance relies heavily on:

- Banks

- Intermediaries

- Centralized systems

These systems often cause:

- Slow transactions

- High fees

- Limited access

- Lack of transparency

Cross-border payments can take days, and millions of people remain unbanked.

Blockchain was created to solve these problems.

2. Blockchain as a Payment System

One of the first financial uses of blockchain was digital payments.

With blockchain:

- Payments are peer-to-peer

- No bank approval is required

- Transactions work 24/7

- Transfers are faster and cheaper

Cryptocurrencies like Bitcoin and stablecoins allow people to send money globally within minutes.

This is especially powerful in countries with limited banking access.

3. Decentralized Finance (DeFi)

DeFi is one of the biggest innovations in finance.

It allows users to access financial services without banks, using blockchain and smart contracts.

With DeFi, people can:

- Lend crypto and earn interest

- Borrow assets without credit checks

- Trade tokens directly

- Earn passive income

Everything is automated and transparent.

4. Smart Contracts in Finance

Smart contracts are self-executing programs on the blockchain.

In finance, they are used to:

- Automate payments

- Execute loans

- Distribute interest

- Manage insurance claims

Once conditions are met, the contract runs automatically.

This reduces:

- Human error

- Fraud

- Administrative costs

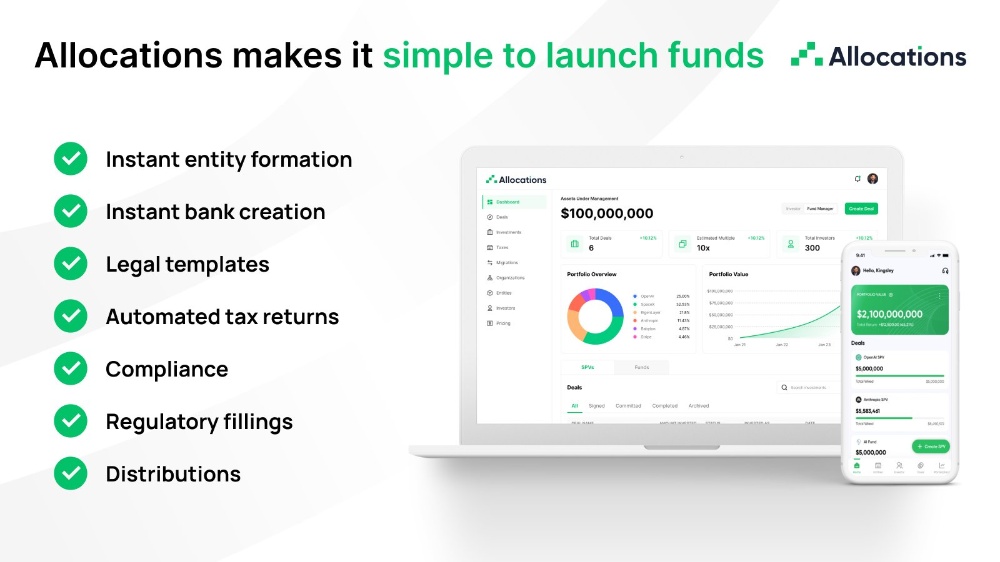

5. Blockchain in Banking

Banks are exploring blockchain to improve efficiency.

Blockchain helps banks:

- Process settlements faster

- Reduce operational costs

- Improve security

- Increase transparency

Some banks use private blockchains, while others integrate public networks.

Blockchain doesn’t replace banks — it upgrades them.

6. Cross-Border Payments and Remittances

Sending money across borders is expensive and slow.

Blockchain solves this by:

- Removing intermediaries

- Reducing fees

- Speeding up transfers

- Operating globally

Millions of people use blockchain-based solutions for remittances to support families abroad.

7. Asset Tokenization

Blockchain allows real-world assets to be digitized.

This includes:

- Real estate

- Stocks

- Bonds

- Commodities

Tokenization makes assets:

- Easier to trade

- More accessible

- More liquid

It opens investment opportunities to more people.

8. Blockchain and Financial Transparency

Blockchain records every transaction permanently.

This helps:

- Reduce fraud

- Improve audits

- Track money flows

- Increase trust

In finance, transparency is critical.

Blockchain provides it by design.

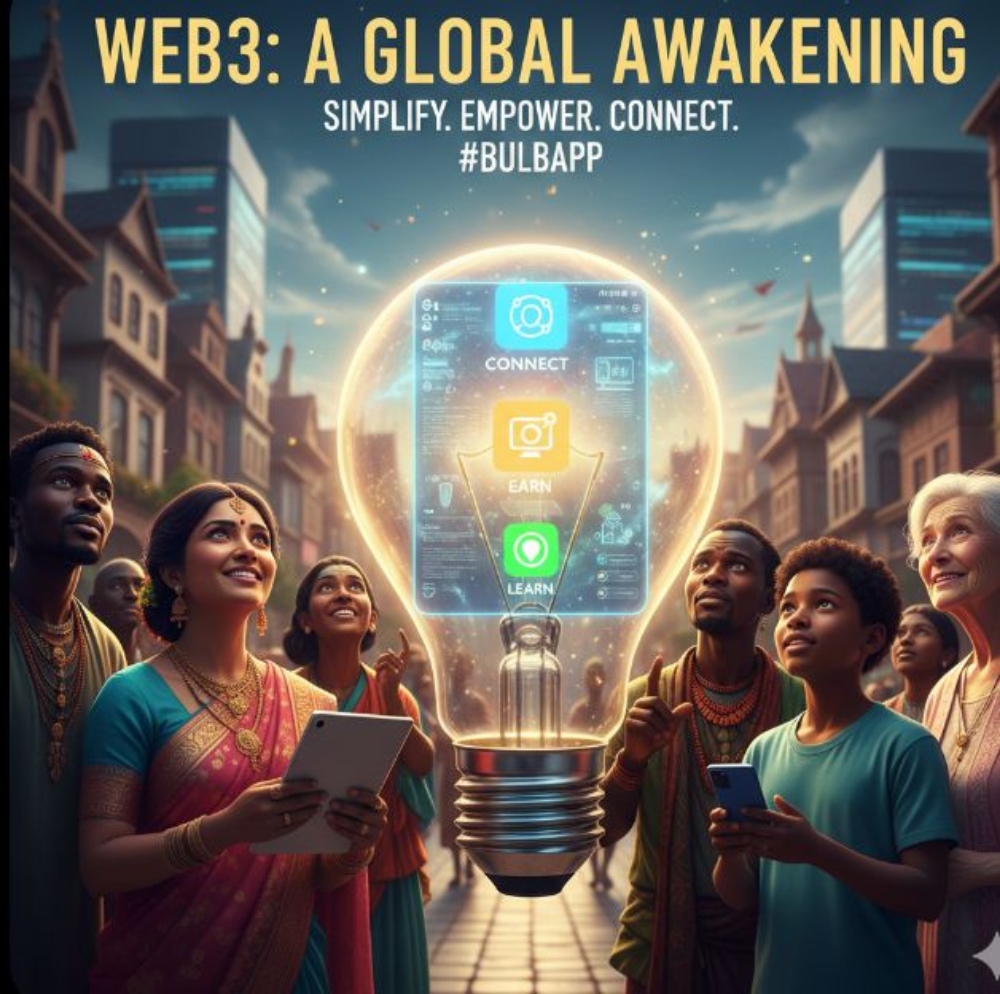

9. Financial Inclusion Through Blockchain

Millions of people lack access to traditional banking.

Blockchain only requires:

- A smartphone

- Internet access

- A crypto wallet

This gives people access to:

- Payments

- Savings

- Loans

- Global markets

Blockchain empowers the unbanked.

10. Risks and Challenges

Despite its benefits, blockchain in finance has challenges:

- Volatility

- Scams and hacks

- Regulation uncertainty

- Technical complexity

Education, regulation, and better security tools are improving the ecosystem.

11. The Future of Blockchain in Finance

As adoption grows:

- DeFi will become more user-friendly

- Banks will integrate blockchain systems

- Tokenized assets will expand

- Payments will become faster and cheaper

Blockchain is not a trend.

It is a financial revolution.

Conclusion

Blockchain is reshaping finance by making it:

- Faster

- More transparent

- More accessible

- More efficient

From payments to DeFi and banking, blockchain is building a new financial system.

The future of finance is decentralized, digital, and global.

💬 Which blockchain finance use case interests you the most?

Payments, DeFi, or banking? Share your thoughts in the comments!

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)