The Backbone of Modern Corporate Crypto Adoption

The movement toward tokenized corporate treasuries is powered by an advanced crypto financial infrastructure. This ecosystem enables everything from secure custody to sophisticated onchain treasury management, allowing Digital Asset Treasury Companies (DATCOs) to thrive.

This infrastructure is what makes a digital asset balance sheet possible, allowing for secure corporate bitcoin holdings and productive Ethereum corporate holdings. It is the essential backbone supporting the entire wave of corporate crypto adoption.

The key is analyzing the treasury NAV and premium of these publicly listed crypto companies. As crypto in public markets matures, a company's approach to onchain treasury management becomes a critical indicator of its sophistication. This deep integration of blockchain corporate finance is the hallmark of a true digital asset treasury company.

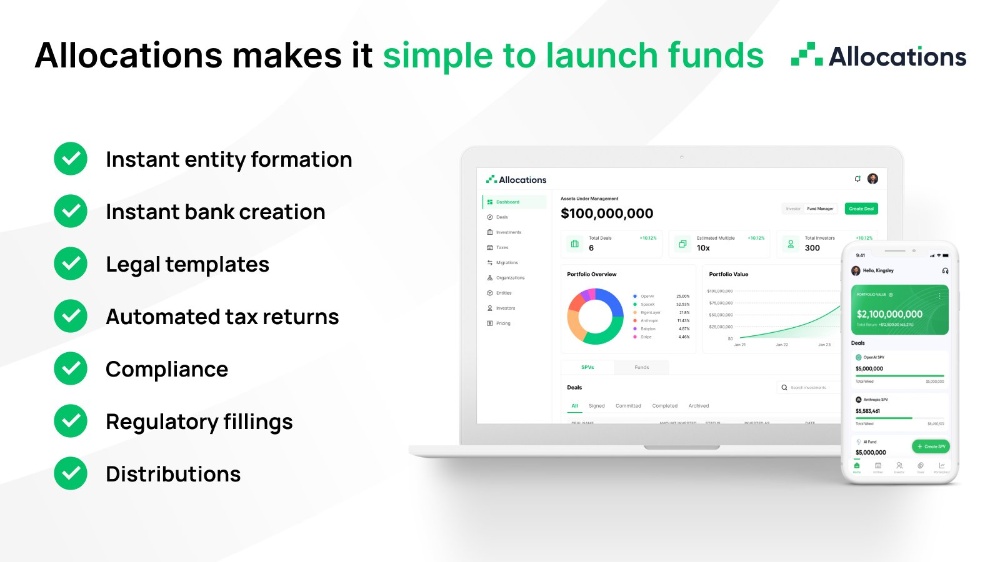

Allocations is at the forefront of this infrastructure for fund formation.

Our expert team has designed a platform with clear fees to bring efficiency to this space. Whether you're launching a startup SPV, a specialized crypto SPV, or a fully custom SPV, we provide the tools to build and manage the future of blockchain corporate finance.