Stable Coins

🪙 StableCoins

What Are Stablecoins?

Stablecoins are cryptocurrencies that are designed to always stay at a fixed value — usually $1.00.

They give you the speed and flexibility of crypto, without the crazy price swings.

In short:

→ Crypto that doesn’t act like crypto.

→ Digital cash that stays stable.

🧠 Real-World Analogy:

Think of stablecoins like U.S. dollars on the blockchain —

fast to send, easy to use, and always worth a dollar.

You can send $10,000 worth of stablecoins to someone in Japan, and they’ll receive it in seconds — no banks, no conversions, no delays.

🤔 Why Use a Stablecoin Instead of USD?

- Borderless: No need for a bank or country approval

- 24/7 transfers: Send anytime, settle instantly

- Low fees: Cheaper than wire transfers or remittance apps

- Crypto-friendly: Use them in DeFi, trading, savings, and more

- No volatility: Unlike ETH or BTC, the price doesn’t swing

🔧 How Are Stablecoins Pegged?

Most stablecoins are pegged to the U.S. dollar in one of these 3 ways:

1. 💼 Fiat-backed (Centralized)

- Backed by real dollars in a bank account

- Example: USDT (Tether), USDC (Circle)

- You trust a company to hold the real money

2. 🤖 Crypto-backed (Decentralized)

- Backed by crypto assets (like ETH)

- Example: DAI (by MakerDAO)

- Maintains the $1 peg using smart contracts + overcollateralization

3. 🧪 Algorithmic (High-risk)

- Not backed by real assets

- Use supply/demand algorithms to stay stable

- Example: UST (RIP) — many have failed or crashed

⚙️ Where Are Stablecoins Used?

- 🔁 Trading pairs on crypto exchanges (BTC/USDC)

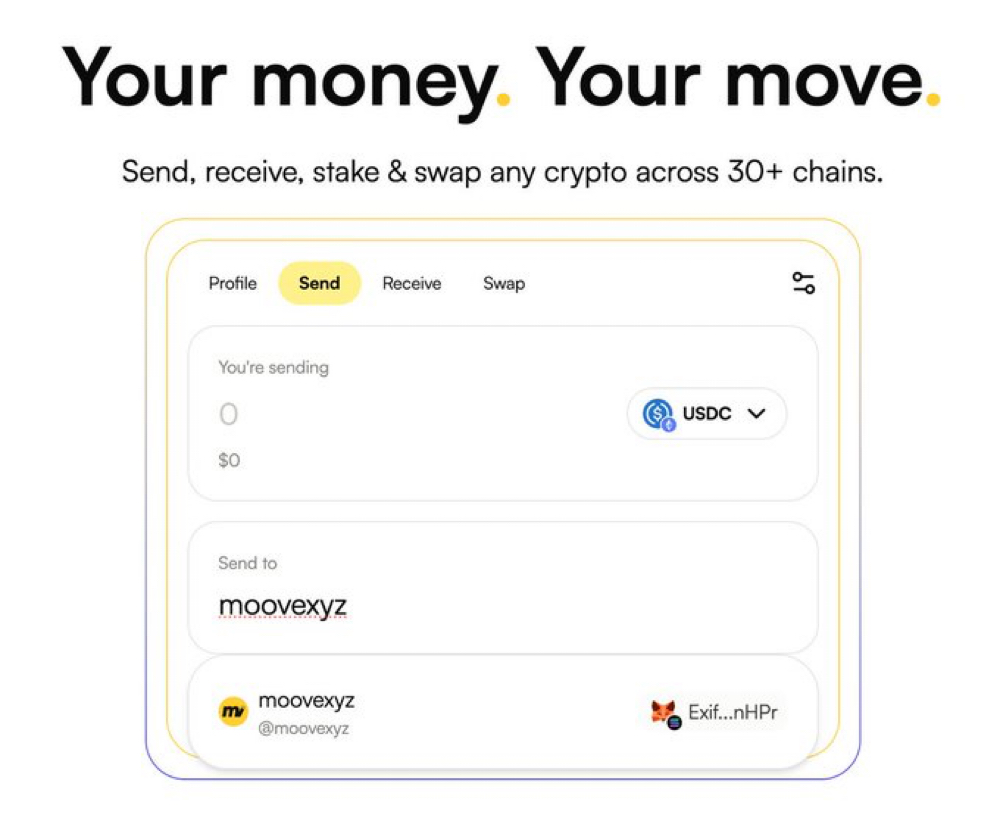

- 💸 Sending/receiving money cross-border

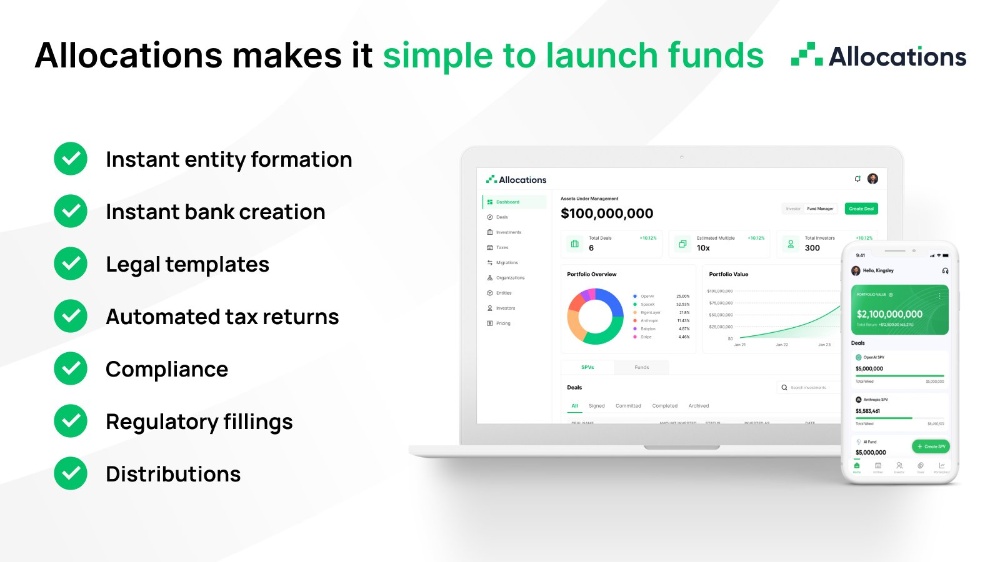

- 🏦 DeFi lending, borrowing, staking

- 🛍️ Payments (some merchants accept USDT/USDC)

- 💰 Storing value during market dips (exit volatile coins)

Stablecoins are like the cash of the crypto economy.

⚠️ Risks to Know

- Fiat-backed = trust in the issuing company

- Algorithmic = unstable and often collapse

- Regulation is catching up — some stablecoins might face legal pressure

- Not all are fully backed or audited — always DYOR

TL;DR:

Stablecoins = crypto dollars.

They’re designed to stay stable, fast, borderless, and easy to use.

They’re essential for trading, saving, DeFi, and real-world payments.

But not all stablecoins are created equal — choose wisely.