GENIUS Act Ignites RWA Tokenization Boom — Aptos Leads 260% Growth in 2025

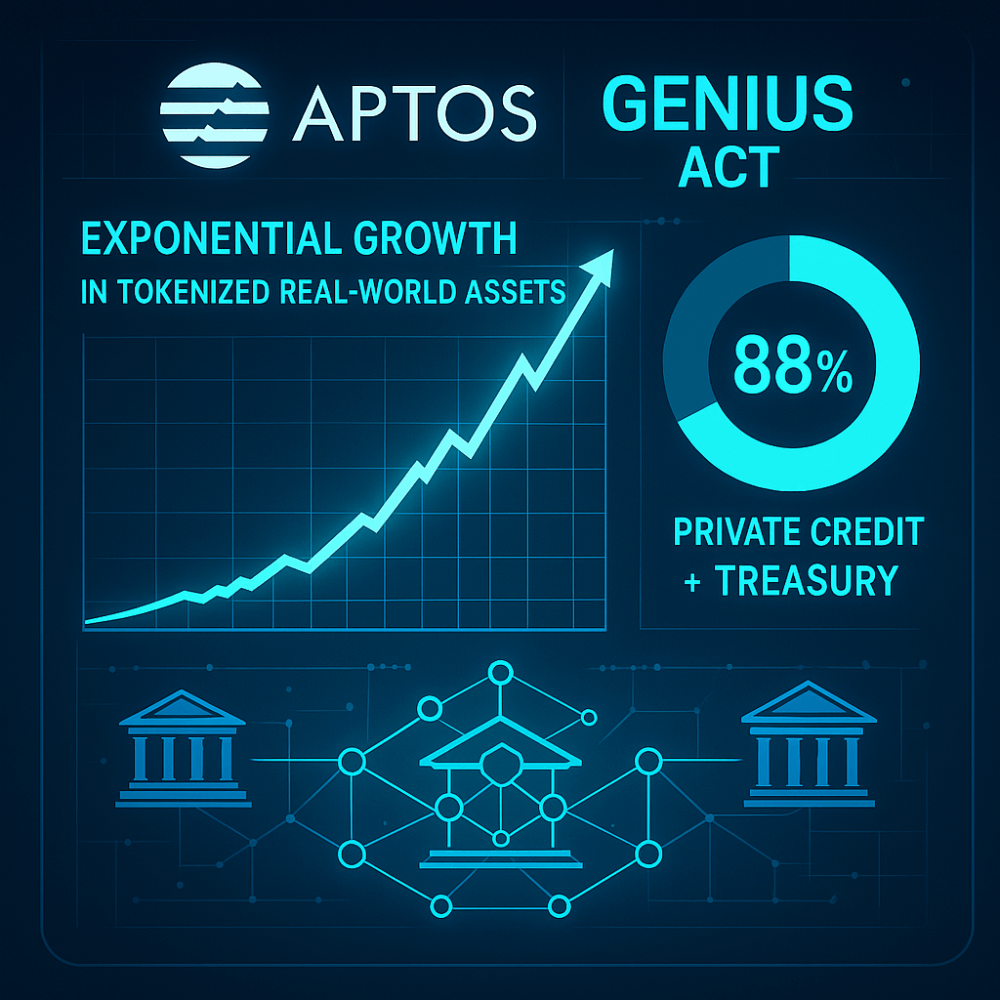

The real-world asset (RWA) tokenization market has exploded in the first half of 2025, growing over 260% from $8.6 billion to more than $23 billion. A major catalyst behind this boom has been the passage of the U.S. GENIUS Act, which brought much-needed regulatory clarity for stablecoins and asset tokenization — significantly boosting institutional confidence.

Aptos Labs is riding this wave as a key platform for RWA issuance. Its blockchain now hosts over $540 million in tokenized assets, supported by high-profile issuance from entities like Berkeley Square’s PACT Consortium and BlackRock’s BUIDL initiative.

Currently, tokenized private credit and U.S. Treasury debt make up about 88% of the RWA market, thanks to their fractionalizability, faster settlement, and lower transactional friction. According to Solomon Tesfaye of Aptos Labs, while these "low-hanging fruit" are already seeing adoption, the next phase will involve tokenizing more complex assets—like derivatives, intellectual property, specialty finance, and potentially money market assets.

This shift signals a broader transformation: RWA tokenization is moving from niche innovation to mainstream financial infrastructure. With regulatory headwinds now clarified and institutional rails laid by GENIUS, platforms like Aptos are emerging as major rails driving web-level integration between traditional finance and DeFi.