Solana Plunges 9%: Is the Ethereum Killer Losing its Edge?

(Image Source: cointelegraph)

Solana, the high-speed blockchain touted as the "Ethereum Killer," has recently stumbled, experiencing a 9% price drop for its native token SOL. This plummet has sent shockwaves through the crypto community, leaving investors scrambling for answers. But what exactly triggered this descent, and what does it mean for the future of Solana?

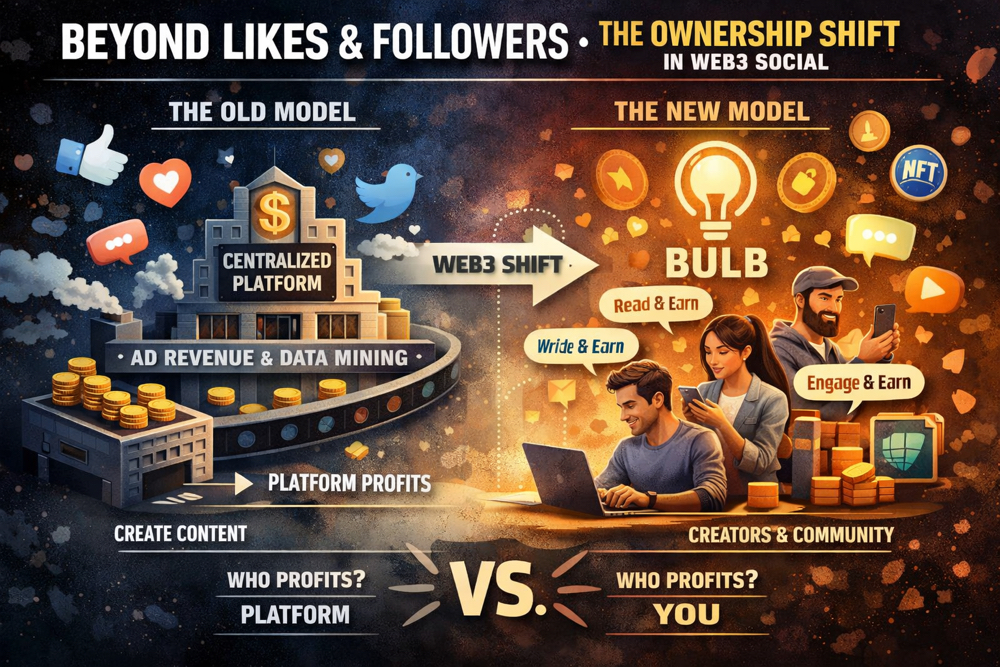

dApp Ecosystem Enters Phase of Sustainable Growth

(Image Source: cointelegraph)

One major factor behind Solana's recent woes is the declining demand for decentralized applications (DApps). While Solana boasts impressive transaction speeds and low fees, its DApp ecosystem must catch up with its technical prowess. Popular DeFi and NFT projects must be faster than Solana, leaving users with fewer options than Ethereum and other established blockchains. This lack of user engagement has led to a decline in Solana's total value locked (TVL), further dampening investor sentiment.

Bali's Crypto Revolution: Tokocrypto's T-Hub Ignites Innovation

Genesis Rolldrop Dymension's Season 1: Claim Your Airdrop!

Galxe's New Year Festival: Igniting Crypto Excitement with Big Wins and Galactic Rewards

Solana's Token Standard Facing Growing Pains

(Image Source: binance)

Solana's native ecosystem also faces challenges within its token ecosystem. SPL, the standard for tokens on the Solana network, has seen several high-profile projects struggle in recent weeks. Jito, DogWifHat, and BONK, once considered rising stars, have experienced significant price drops, raising concerns about the overall health of the Solana ecosystem (Bitget News, 2024). This lackluster performance has eroded investor confidence in SPL tokens, further adding downward pressure on SOL.

Solana's Rocket Fizzles as Leverage Deflates

(Image Source: analyticsinsight)

The speculative frenzy surrounding Solana that fueled its late 2023 rally has run its course. Leverage, a tool used to amplify gains (or losses), was rampant during Solana's bull run. Still, as the market cools down, investors are unwinding their leveraged positions, increasing selling pressure on SOL. The decline in leverage demand further underscores a shift in investor sentiment away from Solana and towards a more cautious approach.

Unveiling the tea Protocol's Incentivized Testnet: A Gateway to Rewards for Open-Source Developers

The Scoop on Layer 1 and Layer 2 in 2024

Optimistic Rollups vs Zero-Knowledge Rollups: A Comprehensive Comparison

Beyond Blockchain Blues: Macroeconomic Headwinds Fuel Solana's Dip

(Image Source: decrypt)

Beyond the blockchain-specific factors, broader macroeconomic conditions also play a role in Solana's recent price decline. Rising interest rates and concerns about a recession have dampened investor appetite for riskier assets, including cryptocurrencies. This risk-off sentiment has impacted the entire crypto market, with Solana no exception.

Solana's Silver Lining: Beyond the Clouds

Despite the recent setbacks, Solana still possesses inherent strengths that could see it bounce back. Its high transaction speeds and low fees remain attractive to developers and users, and its continued focus on scalability puts it in an excellent position to benefit from future blockchain adoption. Additionally, the Solana Foundation has a strong track record of supporting ecosystem development, which could foster the growth of innovative DApps and attract new users.

EigenLayer Sets Record with $900 Million in Deposits!

Exploring Solana's Rise: From Search Interest to Market Success

Aftermath Finance: Pioneering DeFi Solutions, Staking, and LST on Sui Blockchain

Solana Weathers Storm: Can it Shine Again?

While the recent price drop raises concerns, writing Solana's obituary is too early. The blockchain's technical advantages and ongoing development efforts offer a promising foundation for future growth. However, the success of Solana hinges on its ability to attract developers and users, build a vibrant DApp ecosystem, and navigate the volatile macroeconomic landscape.

Only time will tell if Solana can reignite its flame and reclaim its "Ethereum Killer" moniker. But one thing is sure: the recent price dip is a stark reminder of the inherent risks associated with investing in cryptocurrencies and the importance of conducting thorough research before venturing into this dynamic and often unpredictable market.

Celsius's ETH Unstaking: Impact on Market Price and Restructuring Process

Grayscale Shakes Up GBTC & Charges Towards Spot Bitcoin ETF: A Major Move for Crypto

The Future of Finance: DeFi or TradFi?

SEC's Bitcoin ETF Decision: Matrixport Analysis & Market Impact

Exploring the Best Coworking Spaces in Canggu: A Digital Nomad's Oasis

Exploring Bali's Pawukon Calendar: A Harmonious Balance with Nature

Exploring the Future of Intelligent and Secure Messaging with Dmail: Insights from Galxe Radio Eps 4

References:

- Cointelegraph. (2024, January 5). Why is Solana (SOL) price down 9% this week?

- Bitget News. (2024, January 5). Why is Solana (SOL) price down 9% this week?

- CoinDesk. (2024, January 6). Crypto Market Cap Tumbles as Fed Signals Hawkish Tilt.

- Solana Foundation. (2024, January 1). Ecosystem Update: December 2023.