SPV Fund Administration: The Backbone of Modern Private Market Investing

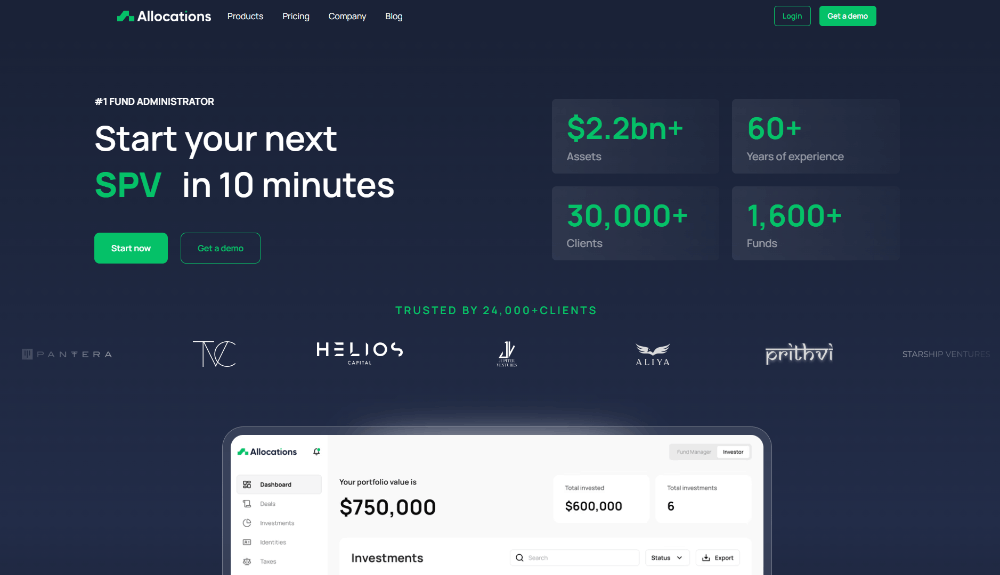

SPV fund administration plays a vital role in the world of private market investing, helping investors efficiently manage deal-specific entities while staying compliant with legal and tax regulations. Platforms like Allocations make it simple to start an SPV, manage investors, and maintain compliance with Form D and Blue Sky laws.

Learn how to set up your first SPV: https://www.allocations.com/startup-spv

What is SPV Fund Administration?

At its core, SPV fund administration covers accounting, compliance, investor management, and reporting. It ensures SPV structure transparency and seamless fund flow between Delaware SPVs and investors. Allocations automates every step — from formation to distribution.

Understand fee structures here: https://www.allocations.com/fees

Why Delaware SPVs Lead

A Delaware LLC remains the preferred structure due to strong investor protection and clear legal frameworks through the Delaware Court of Chancery. Allocations offers an expedited filing process and a Delaware SPV setup checklist 2025 for fund managers.

Meet the Allocations experts behind the process: https://www.allocations.com/team

Allocations also supports tokenized SPVs for digital assets and Web3 ventures.

Learn more here: https://www.allocations.com/crypto-spv

For tailored solutions, explore: https://www.allocations.com/custom-spv