Forex Trading: A Gamble or Calculated Investment?

Forex Trading: A Gamble or Calculated Investment?

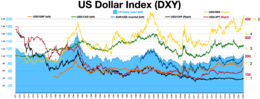

The foreign exchange market (forex, FX (pronounced "fix"), or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.[1] US Dollar Index DXY

US Dollar Index DXY

US Dollar Index (DXY)

USD/GBP exchange rate

USD/Canadian dollar exchange rate

EUR/USD (inverted) exchange rate

USD/JPY exchange rate

USD/SEK exchange rate

USD/CHF exchange rate

Understanding Forex Trading

Forex trading involves buying and selling currencies with the aim of profiting from fluctuations in exchange rates. Unlike traditional stock markets, forex operates 24 hours a day, five days a week, across different time zones, making it the largest financial market globally. Its liquidity and accessibility attract a diverse range of participants, from individual retail traders to multinational corporations and financial institutions.

The Gambler's Perspective

From a certain standpoint, forex trading can resemble gambling. Traders often rely on intuition, speculation, and luck when making decisions, akin to placing bets in a casino. The allure of quick profits and adrenaline-fueled trading sessions can blur the lines between calculated risk-taking and impulsive gambling behavior. Additionally, the unpredictable nature of currency markets, influenced by geopolitical events and economic indicators, contributes to the perception of forex trading as a gamble.

The Investor's Approach

Mitigating Risks

While forex trading inherently involves risk, prudent risk management practices can mitigate potential losses and preserve capital. Techniques such as setting stop-loss orders, diversifying portfolios, and using leverage judiciously help traders navigate the volatile nature of currency markets. Additionally, continuous learning, staying updated on market developments, and adhering to a well-defined trading plan contribute to long-term success in forex trading. Conclusion

In conclusion, the debate over whether forex trading is a gamble or a strategic investment is multifaceted and subjective. While some may view it through the lens of chance and uncertainty, others recognize it as a legitimate investment opportunity requiring skill, knowledge, and discipline. Ultimately, how one perceives forex trading depends on their mindset, approach, and willingness to embrace both the risks and rewards inherent in the dynamic world of currency trading.

References

- ^ Record, Neil, Currency Overlay (Wiley Finance Series)

- ^ Global imbalances and destabilizing speculation Archived 17 October 2016 at the Wayback Machine (2007), UNCTAD Trade and development report 2007 (Chapter 1B).

- ^ Jump up to:

- a b c "Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2022". 27 October 2022.

- ^ CR Geisst – Encyclopedia of American Business History Infobase Publishing, 1 January 2009 Retrieved 14 July 2012 ISBN 1438109873

- ^ GW Bromiley – International Standard Bible Encyclopedia: A–D William B. Eerdmans Publishing Company, 13 February 1995 Retrieved 14 July 2012 ISBN 0802837816