Navigating Cryptocurrency Regulation: Key Trends and Implications

Introduction

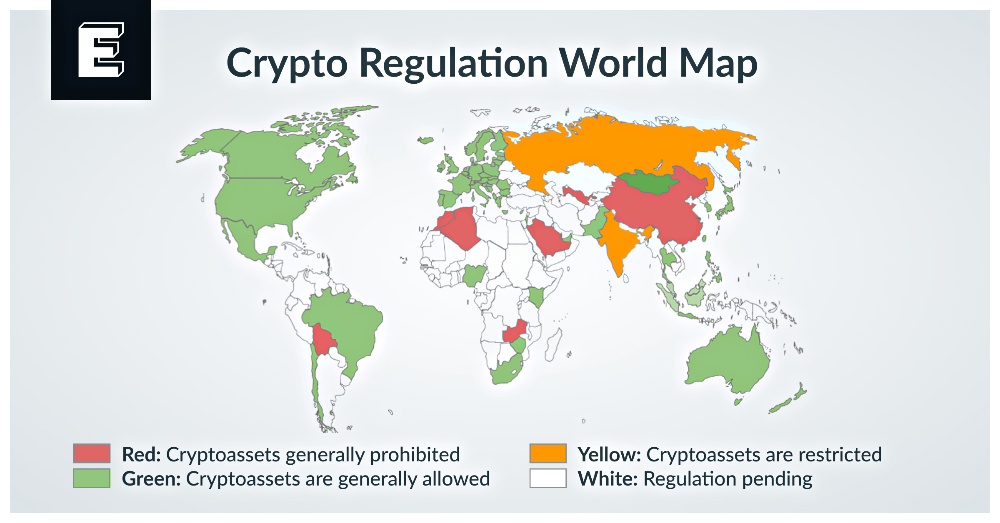

In the fast-paced world of cryptocurrency, regulatory developments play a crucial role in shaping market dynamics and investor sentiment. As governments worldwide grapple with how to regulate this burgeoning industry, understanding the latest trends and implications of cryptocurrency regulation is essential for all stakeholders.

1. Stablecoin Scrutiny

- Regulators are increasingly scrutinizing stablecoins due to concerns about financial stability and systemic risks. - Questions have been raised about the reserves backing stablecoins, issuance, redemption mechanisms, and potential impact on the broader economy.

2. DeFi Regulation

- The rapid growth of decentralized finance (DeFi) platforms has caught the attention of regulators. - Concerns revolve around investor protection, financial stability, and compliance with existing regulations. - Regulators are grappling with how to apply traditional financial regulations to decentralized platforms offering lending, borrowing, and trading services without intermediaries.

3. Central Bank Digital Currencies (CBDCs)

- Many countries are exploring the development and issuance of central bank digital currencies (CBDCs). - CBDCs aim to modernize payment systems, enhance financial inclusion, and address potential risks posed by private cryptocurrencies. - Questions arise regarding their coexistence with existing cryptocurrencies and their impact on the broader cryptocurrency market.

4. Taxation of Cryptocurrency Transactions

- Taxation of cryptocurrency transactions is a topic of regulatory focus in many jurisdictions. - Clear guidance is sought on how to tax various cryptocurrency activities, including trading, mining, staking, and earning interest. - Addressing tax evasion concerns and ensuring compliance are key priorities for regulators.

5. Environmental Concerns

- Environmental impact, particularly related to cryptocurrency mining, is under scrutiny. - Proof-of-work (PoW) cryptocurrencies like Bitcoin face criticism for their energy consumption. - Discussions center around promoting sustainable mining practices and exploring alternative consensus mechanisms like proof-of-stake (PoS).

Read Also : https://www.bulbapp.io/p/b4c9d482-8ab3-45d1-9199-bf338ac981b0/navigating-regulatory-waters-the-impact-of-regulations-on-decentralized-finance-defi?s_id=39f47288-3ec2-4cdc-80e9-53923c18b992

Conclusion:

Navigating the complex regulatory landscape of cryptocurrency requires vigilance and adaptability. As regulators continue to refine their approach to overseeing this evolving industry, stakeholders must stay informed about the latest trends and compliance requirements. By understanding the implications of cryptocurrency regulation, investors, businesses, and policymakers can navigate the regulatory environment with confidence and contribute to the long-term sustainability and legitimacy of the cryptocurrency ecosystem.

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)