Tokenized Stocks vs Traditional Stocks — Why Allo Leads the Way

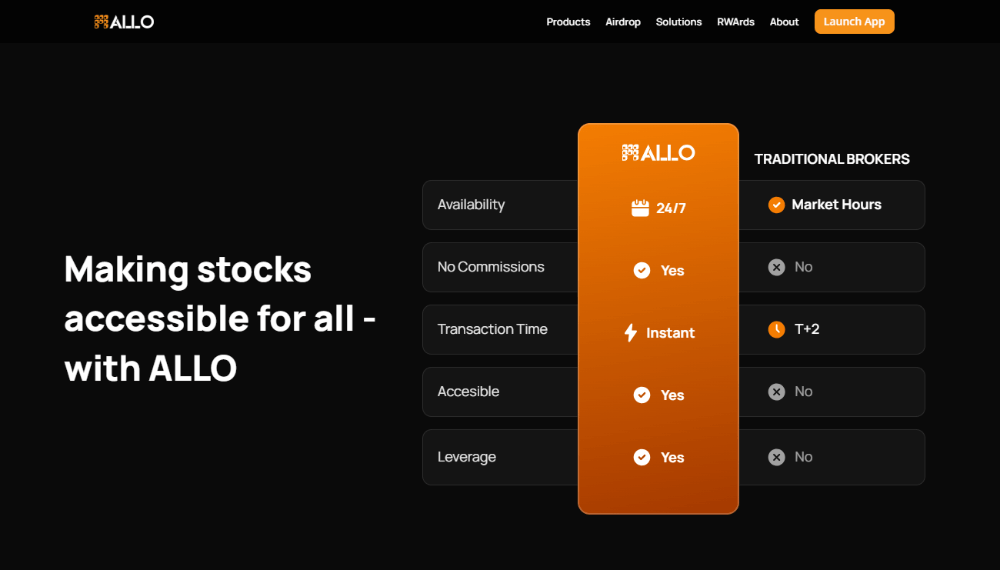

Investors often ask: tokenized stocks vs traditional stocks, which is better? The answer is clear when you see what it means to trade tokenized stock with Allo.

Traditional stocks are limited to specific hours and involve slow settlement times. Tokenized stocks, however, give investors 24/7 access, cross-border stock investing, and instant transactions via blockchain.

On Allo, you can:

- Invest in tokenized US stocks.

- Explore tokenized bonds and real estate.

- Learn from a beginner’s guide to tokenized stocks.

- Discover Allo staking opportunities for extra yield.

With Allo RWA token explained, users also gain clarity on governance and liquidity. By 2025, the best RWA platforms for investors will combine education, compliance, and global access. Allo already delivers all three.

With features like Allo multi-asset portfolio management and the Allo decentralized stock exchange, the platform simplifies tokenized investing for everyone.

Whether you’re a beginner or a fund manager, the benefits of RWA tokens for investors are now clear—liquidity, speed, and access. In short, if you want to be part of the tokenized stock exchange 2025, the time to start with Allo is now.