Where is BTC going next?

Bitcoin Just Filled the July CME Gap to the Dollar — What’s Next? $104K or ATH?

Bitcoin just hit a textbook move — one that seasoned traders have been watching closely.

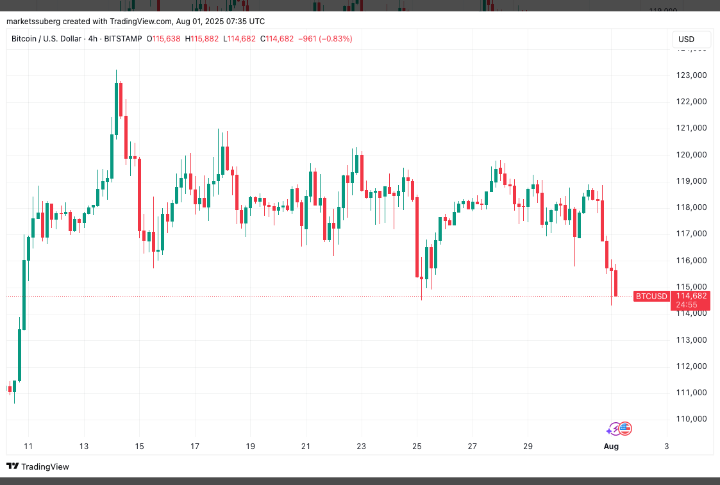

On Friday, BTC fell to a multi-week low of $114,322, perfectly filling the CME Futures gap from July. For those unfamiliar, CME gaps are price levels left behind when Bitcoin futures on the Chicago Mercantile Exchange close for the weekend and reopen at a different price. Historically, BTC tends to come back to “fill” these gaps — and that’s exactly what just happened. To the dollar.

But here's where things get interesting...

While some traders like Ted Pillows are bullish, seeing this as the perfect setup for an upward move, others are treading with caution. Cipher X warned that if Bitcoin doesn't reclaim $116,000, we could be staring down a potential drop to $104,000. Another trader, Crypto Candy, noted that BTC must hold above the $115K–$116.7K range to avoid dipping toward $111.8K before any new rally begins.

The timing of this move coincides with new US trade tariffs — a macro event that’s shaken Bitcoin harder than traditional markets. While the S&P 500 only slipped 0.4%, Bitcoin saw a much steeper correction, underlining how sensitive the crypto market still is to geopolitical developments.

And it's not just tariffs. The recent PCE inflation data came in hotter than expected, and Fed Chair Jerome Powell's hawkish stance has dampened hopes of any rate cuts in 2025. For risk assets like BTC, that’s a heavy cloud overhead.

Still, there’s a silver lining.

The S&P 500 touched all-time highs just a day prior, thanks to strong tech earnings. Bitcoin, despite its volatility, is still in macro bullish territory, and some analysts are already eyeing $141K to $150K as the next big levels — especially if the “tick tock” fractal playing out continues to mirror past bull cycles.

So what now?

Bull case: Gap filled, fear is high, and historical trends favor upside post-fill. We may see a sharp bounce.

Bear case: If we don’t reclaim $116K soon, the next stop could be $111K or even $104K.

Macro wildcard: US economic policy and inflation data will likely guide the next major move.

The CME gap has done its job. Now the charts — and the traders — write the next chapter.

Are you preparing for another leg up, or bracing for deeper correction?

Drop your BTC short-term and long-term targets below.

Let’s chart this journey together.