Explore the Top 10 Cryptocurrency Trends and Best Coins of 2024

Embark on a journey into the dynamic world of cryptocurrency as we delve into the Top 10 Cryptocurrency Trends and Best Coins of 2024. In this ever-evolving landscape, staying informed is key, and our comprehensive exploration promises valuable insights. The year 2024 unfolds with unprecedented developments, shaping the trajectory of digital currencies. From groundbreaking technological advancements to shifts in market dynamics, we navigate through the trends influencing the crypto sphere.

Uncover the latest innovations, regulatory landscapes, and emerging patterns that are set to redefine the crypto development services. Our in-depth analysis aims to guide you through the intricacies of each trend and highlight the standout coins poised for success in 2024. Whether you are a seasoned investor or a curious enthusiast, this exploration provides a roadmap for navigating the exciting and transformative journey that is the cryptocurrency market in 2024.

Top 10 Cryptocurrency Trends and Best Coins

1. Decentralized Finance (DeFi) Evolution:

➤ Innovative Advancements in DeFi:

Decentralized Finance (DeFi) emerges as a hub of creativity within the cryptocurrency landscape. In the year 2024, we foresee the transformation of current DeFi protocols, introducing enriched functionalities, scalable solutions, and enhanced user interactions. DeFi platforms might utilize layer 2 solutions and cross-chain compatibility to tackle existing issues, providing users with swifter transaction speeds and reduced fees.

➤ Growing Institutional Engagement in DeFi:

A significant trend is the escalating involvement of institutional entities in the DeFi realm. Conventional financial institutions and large enterprises may explore DeFi protocols, lending platforms, and liquidity pools, legitimizing the decentralized finance ecosystem. This influx of institutional capital could play a role in the maturation of DeFi and the evolution of more sophisticated financial tools.

2. NFTs and the Integration into the Metaverse:

➤ Expanding Horizons of NFTs:

Non-fungible tokens (NFTs) extend their impact beyond the domain of art and collectibles in 2024. Anticipate a surge in the adoption of NFTs across diverse sectors, including gaming, virtual real estate, and intellectual property. NFTs may become integral elements of the metaverse, embodying unique digital assets with seamless cross-platform connectivity.

➤ Virtual Real Estate and NFT Fusion:

The merging of NFTs with virtual real estate gains prominence, enabling users to purchase, sell, and trade virtual land using blockchain technology. This trend not only revolutionizes the virtual real estate market but also introduces innovative economic models within the metaverse. Blockchain guarantees transparent ownership and scarcity, contributing to the value proposition of virtual properties.

3. Privacy Coins and Elevated Confidentiality:

➤ Emphasis on Privacy and Robust Security:

Privacy coins, designed to provide heightened anonymity and transaction privacy, undergo a resurgence in 2024. Projects emphasizing privacy and security features, like confidential transactions and advanced cryptographic techniques, attract attention. Users increasingly recognize the significance of privacy in their financial transactions, sparking renewed interest in privacy-centric cryptocurrencies.

➤ Regulatory Hurdles for Privacy Coins:

However, this trend encounters regulatory challenges. Governments and regulatory bodies may scrutinize privacy coins due to concerns about illicit activities and anti-money laundering (AML) compliance. Striking a balance between privacy and adhering to regulatory norms becomes a critical consideration for projects in this space.

4. Central Bank Digital Currencies (CBDCs) Progress:

➤ Testing and Implementation Phases:

Central Bank Digital Currencies (CBDCs) make further strides on the global stage in 2024. Several countries may launch trials and implement CBDCs as part of their comprehensive digital currency strategies. The exploration of CBDCs by major economies speeds up, offering insights into the potential integration of digital currencies into national monetary systems.

➤ Challenges in Interoperability:

Interoperability takes center stage as countries explore CBDCs. The challenge lies in establishing seamless cross-border transactions and interoperability between different CBDCs. Initiatives to tackle these challenges may surface, facilitating international transactions with digital currencies issued by various central banks.

5. Smart Contract Platforms and Layer 2 Solutions:

➤ Rising Stars and Enhancements Beyond Ethereum:

Smart contract platforms, aiming to either compete with or enhance Ethereum, gain prominence in 2024. Projects addressing Ethereum’s scalability issues and high gas fees may witness increased adoption. Layer 2 solutions, such as rollups and sidechains, become integral components of blockchain ecosystems, offering faster and more cost-effective transactions.

➤ Integration of Layer 2 Scaling:

As blockchain projects incorporate layer 2 scaling solutions, users witness enhanced transaction throughput and reduced congestion. This trend not only elevates the user experience but also contributes to the broader scalability of blockchain networks. Competing smart contract platforms aim to establish themselves as viable alternatives, fostering a more competitive and diversified ecosystem.

6. Blockchain Interoperability:

➤ Facilitating Cross-Chain Communication:

In the year 2024, blockchain interoperability takes the spotlight, nurturing cross-chain communication and cooperation. Projects emphasizing interoperability solutions gain momentum, allowing assets and data to flow seamlessly between different blockchain networks. This trend aligns with the industry’s vision for a more interconnected and interoperable blockchain ecosystem.

➤ Decentralized Bridges and Oracles Development:

The creation of decentralized bridges and oracles becomes pivotal in facilitating interoperability. These solutions act as connectors between diverse blockchains, ensuring secure and trustless asset transfers. The movement towards blockchain interoperability resonates with the industry’s pursuit of a unified and interconnected blockchain infrastructure.

7. Sustainability and Green Initiatives:

➤ Adoption of Eco-Friendly Consensus Mechanisms:

In response to environmental concerns, sustainability and green initiatives become integral to the crypto exchange development company trends space in 2024. Projects adopting eco-friendly consensus mechanisms, such as Proof-of-Stake (PoS), gain favor. The industry acknowledges the importance of mitigating the carbon footprint associated with energy-intensive mining operations.

➤ Embracing Carbon-Neutral Blockchain Initiatives:

Blockchain projects actively participate in carbon-neutral initiatives, exploring ways to offset their environmental impact. Carbon-neutral blockchain networks and projects contributing to environmental sustainability garner recognition and support from environmentally conscious users and investors.

8. Decentralized Autonomous Organizations (DAOs) in Governance:

➤ DAOs Shaping Project Governance Landscape:

Decentralized Autonomous Organizations (DAOs) assume a crucial role in shaping the governance of blockchain projects. In 2024, an increasing number of projects embrace DAO structures to involve the community in decision-making processes. Token-based voting systems within DAOs become standard, fostering a more democratic and decentralized approach to project governance.

➤ Fostering Community-Driven Development:

DAOs not only influence governance decisions but also contribute to community-driven development. Projects leveraging DAOs may allocate funds, make strategic decisions, and prioritize development based on the consensus of token-holding community members. This evolution signifies a shift towards more inclusive and transparent project management.

9. Cross-Industry Blockchain Adoption:

➤ Integration Across Diverse Sectors:

Blockchain adoption transcends the financial sector, expanding into various industries in 2024. Sectors such as healthcare, supply chain, logistics, and entertainment witness increased blockchain integration. The technology’s ability to enhance transparency, traceability, and security attracts interest from diverse industries seeking innovative solutions.

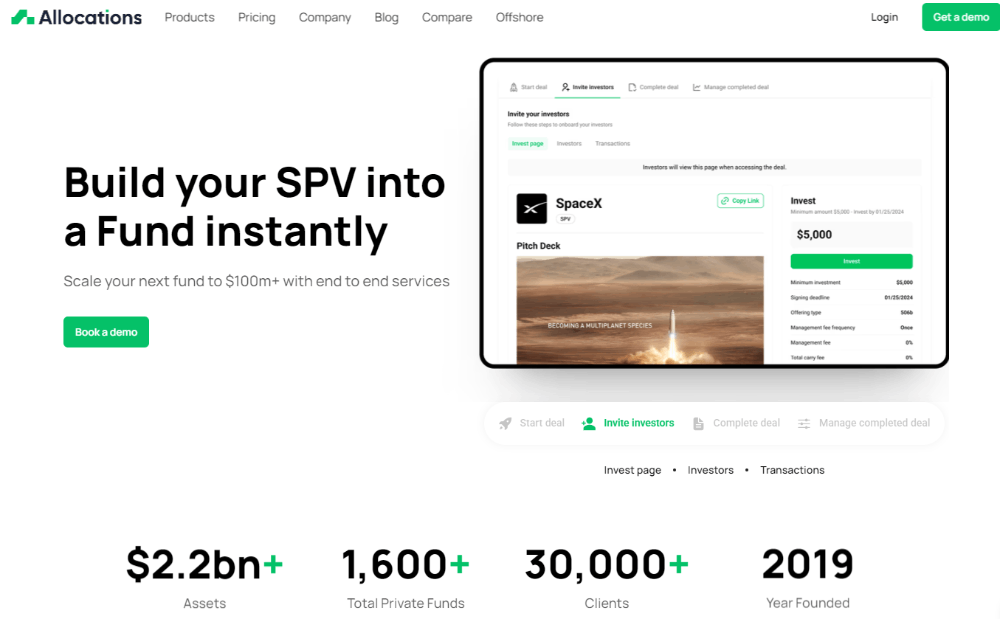

➤ Rise of Tokenization for Assets:

Tokenization becomes a prevalent trend as real-world assets are represented as digital tokens on blockchain networks. This includes tokenized securities, real estate, and even intellectual property. The tokenization of assets contributes to increased liquidity, fractional ownership, and a more accessible investment landscape.

10. Regulatory Clarity and Framework Development:

➤ Maturation of Regulatory Frameworks:

Regulatory clarity continues to evolve, with governments worldwide working to establish comprehensive frameworks for the cryptocurrency industry. As the sector matures, regulatory authorities may provide clearer guidelines on issues such as taxation, compliance, and the classification of digital assets. This trend contributes to a more stable and predictable regulatory environment.

➤ Collaborative Efforts Between Regulators and Industry:

A notable shift occurs as regulatory bodies collaborate with industry participants to develop effective and balanced regulatory frameworks. Dialogue between regulators, businesses, and advocacy groups becomes crucial in fostering an environment where innovation can coexist with regulatory compliance. This collaborative approach contributes to the industry’s long-term sustainability.

Why Cryptocurrency is Currently Trending?

Cryptocurrency markets exhibit high volatility, with trends evolving swiftly. Here’s a detailed analysis based on research:

1. Market Capitalization:

- Bitcoin (BTC) and Ethereum (ETH) are commonly regarded as market benchmarks due to their leading market capitalization.

- Observe altcoins showing substantial increases in market cap, as it may signal growing investor interest.

2. Social Media Trends:

- Keep an eye on social media platforms such as Twitter, Reddit, and crypto-related forums for discussions and sentiments about specific coins.

- Increased mentions, positive sentiment, and community engagement can serve as indicators of a coin gaining traction.

3. News and Developments:

- Stay informed about recent news and developments in the cryptocurrency space, as positive news, partnerships, and technological advancements can impact a coin’s popularity.

- Explore the roadmap and upcoming releases of cryptocurrency trends to assess their potential for future growth.

4. DeFi and NFT Projects:

- Decentralized Finance (DeFi) and Non-Fungible Token (NFT) projects are capturing attention. Investigate projects in these sectors, as they often introduce innovative concepts and attract interest.

5. Community Support:

- A robust and active community plays a vital role in a cryptocurrency’s success. Evaluate community forums, social media groups, and developer engagement to gauge the level of support and collaboration.

6. Exchange Listings:

- The listing of a cryptocurrency on reputable exchanges can enhance its visibility and liquidity, potentially leading to increased trading activity.

7. Tokenomics and Use Cases:

- Examine the tokenomics of a cryptocurrency, including its supply, distribution, and utility within its ecosystem.

- Cryptocurrencies with clear and practical use cases tend to attract more attention.

8. Technical Analysis:

- Utilize technical analysis charts to identify potential entry or exit points. Common indicators include moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence).

Remember, the cryptocurrency market is speculative, and trends can change rapidly based on various factors. Conduct thorough research and, if necessary, consult with financial professionals before making investment decisions. Always exercise caution and remain aware of the risks associated with cryptocurrency investments.

Conclusion

As we conclude our exploration into the Top 10 Cryptocurrency coin development Trends and Best Coins of 2024, it is evident that the landscape of digital assets is evolving at an unprecedented pace. The trends identified offer a glimpse into the future of blockchain technology, emphasizing themes such as sustainability, decentralization, and increased adoption. The standout coins highlighted in our analysis showcase innovation and resilience, positioning themselves as potential leaders in the market.

As the crypto ecosystem continues to mature, investors, enthusiasts, and industry participants are encouraged to stay vigilant and adapt to the ever-changing dynamics. The year 2024 holds promise for continued growth and transformation, emphasizing the importance of staying informed and agile in the face of emerging opportunities and challenges. With a diverse range of trends and coins shaping the narrative, the cryptocurrency landscape of 2024 is both dynamic and full of potential for those willing to navigate its complexities.