Bitcoin Befriends Wall St

For a recipe 10+ years in the making, the pie finally came out the oven as the much-anticipated spot Bitcoin ETF finally received SEC approval, marking a significant milestone for TradFi and Bitcoiners alike. This pivotal moment not only legitimizes Bitcoin in the eyes of boomer investors but also underscores the gap bridging between Wall Street and the burgeoning world of Bitcoin. This utility will open doors for many companies positioned in the financial sector, while also inviting guidance for Bitcoin centric counterparts to capitalize on.

For a recipe 10+ years in the making, the pie finally came out the oven as the much-anticipated spot Bitcoin ETF finally received SEC approval, marking a significant milestone for TradFi and Bitcoiners alike. This pivotal moment not only legitimizes Bitcoin in the eyes of boomer investors but also underscores the gap bridging between Wall Street and the burgeoning world of Bitcoin. This utility will open doors for many companies positioned in the financial sector, while also inviting guidance for Bitcoin centric counterparts to capitalize on.

The approval is more than just a regulatory green light; it’s a catalyst for mainstream financial adoption of Bitcoin. It represents a shift allowing traditional investors to engage with Bitcoin directly, without the ramp complexities and risks associated prior. This ETF paves the way for Bitcoin to become a staple in diversified investment portfolios and asset manager allocations, bringing a new level of exposure and liquidity to a deflationary asset.

Bitcoin is often misunderstood and underrated by traditional financial institutions, being much more than a digital asset with fluctuating value. It represents a fundamental shift in how we perceive and interact with money. Three critical areas often misunderstood by Wall Street professionals include Bitcoin’s nature as the underlying cash itself, its distinct risk profile, and its focused utility.

Unlike traditional assets valued for their cash flows, Bitcoin is the cash. It’s a new form of money undergoing a historical evolution from a collector’s item to a standard unit of account. This evolution is inherent to Bitcoin’s adoption and is characterized by inevitable volatility.

Wall Street often mistakes Bitcoin’s price volatility for high risk. However, Bitcoin’s digital bearer asset nature makes it one of the safest assets, devoid of common risks like bankruptcy or dilution. It features perfect scarcity and resilience, demonstrating a flight to quality post SVB.

Contrary to the Wall Street approach of seeking multifunctional assets, Bitcoin’s strength lies in its singular utility as a reliable store of value. Its sole focus as an efficient medium of exchange enhances its efficacy in trade, free from the influence of external use cases.

The Orange Group is an example of an advisory firm that is strategically positioned to guide and support this integration.The group specializes in investor relations, capital markets advisory, and fractional CFO services. A thorough understanding of both the traditional financial sector and the Bitcoin network and ecosystem is well suited, and Orange Group is uniquely equipped to facilitate the integration of these two worlds.

The firm’s ideology of “an inch-wide in focus and a mile-deep in impact” speaks volumes about its niched approach. By partnering with Bitcoin companies throughout their lifecycle, Orange Group offers unparalleled expertise and insights, helping these companies navigate the complex terrain of Wall Street. Its services range from assisting startups in securing capital to providing strategic advice for established companies looking to communicate effectively with Wall Street.

The Bitcoin ETF signals the dawn of a new era in financial innovation. Bitcoin, once viewed with skepticism by traditional investors, is now on the cusp of becoming an integral part of the global financial system. The ETF’s ability to offer direct exposure to Bitcoin’s price movements, coupled with the regulatory oversight and investor protections typical of traditional financial products, makes it a game-changer.

As the bridge between Wall Street and Bitcoin solidifies, the role of firms like Orange Group becomes increasingly vital for sanctioned business. Their expertise in navigating the regulatory and market dynamics of both sectors positions them as a key player in shaping the future of this relationship. Orange Group’s commitment to a Bitcoin Treasury strategy further aligns its operations with the industry it serves, showcasing a pioneering approach to corporate financial management.This is further supported by FASB adopting fair value for Bitcoin by the tail end of 2024.

January 10th, 2024 marks Bitcoin’s entry into the mainstream financial arena.While not the best marketing for self-custody and self-sovereign practices, the convergence of traditional finance and Bitcoin was inevitable. The need for expert guidance and strategic advisory has shown paramount. Orange Group champions the integration of Bitcoin into the broader financial landscape and aids in the new challenges it presents. With firms like Orange Group at the helm, the future of finance is poised for unprecedented growth and innovation atop the foundations of decentralization and freedom.

To learn more about the Orange Group, check out their website here.

Bitcoin

Finance

Economics

Etf

Investing

Follow

Follow

Written by William Boone

0 Followers

·

Writer for

Coinmonks

Bitcoin | Economics | Stewardship | Bitcoin Education == Inevitable Allocation | Proverbs 16:9

More from William Boone and Coinmonks

William Boone

William Boone

in

Coinmonks

Bitcoin Ordinals: Purposeful or Unworkable?

Previously there was Segwit, Lightning, and Taproot; producing a consensus of being productive for the Bitcoin network. The Bitcoin…

5 min read

·

Dec 20, 2023

5

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

38K

1016

William Boone

William Boone

How and Why You Should Be Using RSS in 2024

In 2024, amidst the tech landscape dominated by surveillance and algorithm-driven content, RSS (Really Simple Syndication) emerges as a…

2 min read

·

5 days ago

Recommended from Medium

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.7K

119 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

423

10

Lists

Leadership41 stories

Leadership41 stories

·

199

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1217

saves

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

Staff Picks558 stories

Staff Picks558 stories

·

642

saves

Johnwege

Johnwege

in

Coinmonks

The Greatest Crypto Bull Market You’ve Ever Seen

Throughout your life there will be a handful of decisions that you make that will change your life financially forever. For the better, or…

·

5 min read

·

5 days ago

247

2

Shawn Forno

Shawn Forno

in

The Startup

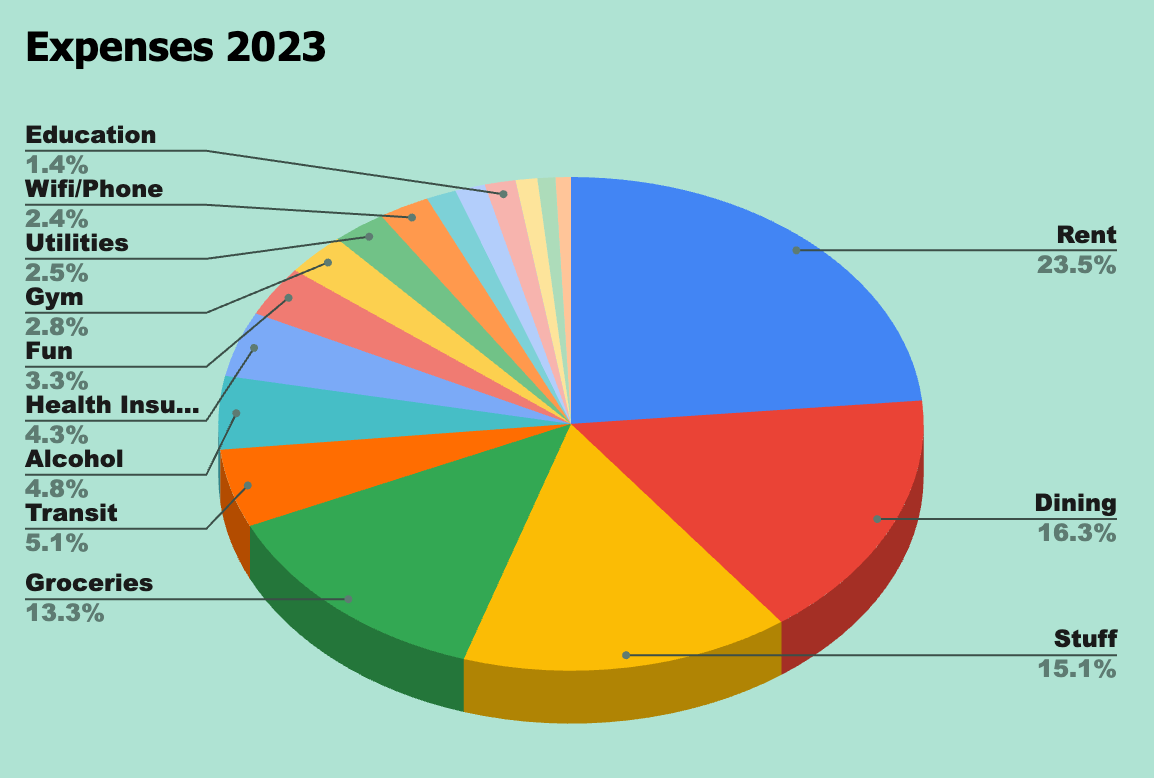

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.6K

49

Wes O'Donnell

Wes O'Donnell

This is Why the US Won’t Be Sending the A-10 Warthog to Ukraine

On paper, the Fairchild Republic A-10 Thunderbolt II was built for exactly the type of warfare happening right now in Eastern Ukraine…

·

5 min read

·

4 days ago

3.2K

25

Barry Gander

Barry Gander

Putin Faces Nightmare Insurgents: The Mothers of Russian Soldiers

Russians mothers have warned that an insurrection is brewing over the Kremlin’s treatment of mobilized soldiers who were sent to Ukraine.

·

14 min read

·

5 days ago

3.3K

24