Wyckoff Redistribution

Identifying Market Distribution Patterns

Wyckoff Redistribution, also referred to as secondary distribution, is a critical concept within the Wyckoff Trading Method. This pattern occurs within the context of an established downtrend or after a prolonged distribution phase, signaling a temporary pause or correction before the resumption of bearish momentum. Traders who grasp the principles of Wyckoff Redistribution can gain valuable insights into market dynamics and potential trading opportunities during market downturns.

Wyckoff Redistribution, also referred to as secondary distribution, is a critical concept within the Wyckoff Trading Method. This pattern occurs within the context of an established downtrend or after a prolonged distribution phase, signaling a temporary pause or correction before the resumption of bearish momentum. Traders who grasp the principles of Wyckoff Redistribution can gain valuable insights into market dynamics and potential trading opportunities during market downturns.

Definition of Redistribution

Redistribution occurs when smart money (informed investors) continues to distribute assets, while less informed market participants (the public) may perceive the market as oversold or anticipate a reversal. During the redistribution phase, prices consolidate within a trading range or exhibit lower volatility movements, indicating a temporary pause or correction within the ongoing downtrend. Redistribution patterns often resemble a series of smaller consolidations within a larger distribution structure, signaling a period of renewed distribution by smart money before the next leg down in the downtrend.

Key Characteristics of Wyckoff Redistribution

- Consolidation Within a Downtrend: Redistribution occurs within the context of an established downtrend, serving as a temporary pause or correction within the ongoing bearish momentum. Traders may observe a series of lower volatility movements, trading ranges, or smaller consolidations within the redistribution structure.

- Persistent Selling Pressure: During the redistribution phase, selling pressure typically persists as smart money continues to distribute assets at higher price levels. Traders may identify signs of distribution, such as price stabilization, failure to sustain upward momentum, and bearish price action, as indications of potential future price depreciation.

- Distribution by Smart Money: Smart money uses the redistribution phase to offload additional positions or reinforce existing short positions at favorable prices before the resumption of the downtrend. Traders may interpret signs of distribution, such as price rejection at resistance levels, increase in selling volume, and bearish chart patterns, as indications of potential further downside in the market.

- Confirmation of Downward Momentum: The breakdown from the redistribution structure confirms the continuation of the underlying downtrend, as prices breach key support levels or exhibit strong bearish momentum. Traders may enter short positions or add to existing short positions upon confirmation of the breakdown, anticipating further downside potential in the market.

Thank you!

_________________________________

Your most valuable asset is your time. Invest him properly!

DYOR

Not your keys, Not your crypto!

Find useful articles to read: HERE

My referal links:

Disclaimer:

The articles provided about Technical Analysis (TA), various cryptocurrency projects, including their features, technologies, and potential considerations, are intended for informational purposes only. While efforts have been made to ensure the accuracy and reliability of the information presented, they should not be construed as financial or investment advice. Cryptocurrency markets are highly volatile and speculative, and investing in cryptocurrencies carries inherent risks. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Additionally, the liability of the author for any losses or damages incurred as a result of reliance on the information provided is hereby disclaimed.

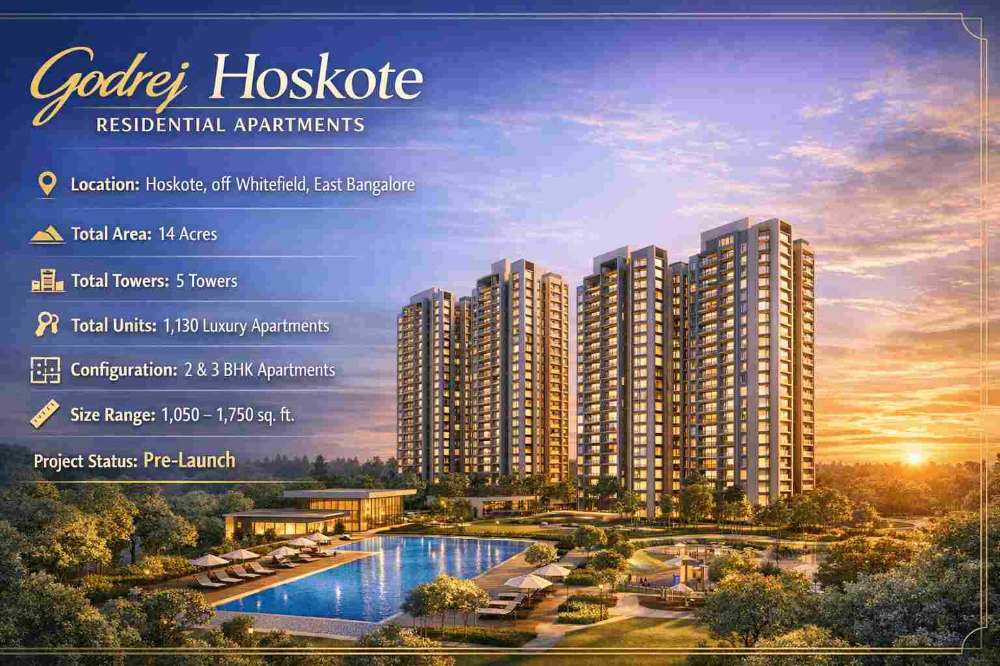

The head Image from: market-bulls.com