Getting started with Amped Finance

As Amped Finance readies for it’s TGE and launch we have some pointers in this blog post about using the platform and getting started with experimenting on the Pegasus testnet.

As Amped Finance readies for it’s TGE and launch we have some pointers in this blog post about using the platform and getting started with experimenting on the Pegasus testnet.

There will be two main avenues for you to begin using the platform.

- Buying ALP or AMP and earning a passive revenue through trading fees accumulated by the exchange

- Trading the perpetual swap markets with your own assets, with leverage if you choose

Let’s get started.

1. Connecting and Bridging ETH to the LightLink Testnet (Pegasus)

Amped Finance is on theLightLink network, a chain which has the novel feature of allowing certain applications to operate in a gasless mode. Amped is utilising this feature so that trading and interacting with the protocol can be done without incurring any gas fees.

In order to get started with LightLink, visit the Chainlist page and add the network to your wallet.

You will also need some ETH on the Pegasus Testnet. The ETH that can be bridged to Pegasus is sourced from Ethereum Goerli, you can read about how to obtain some from a faucet and bridge it via our testnet bridge in this blog article.

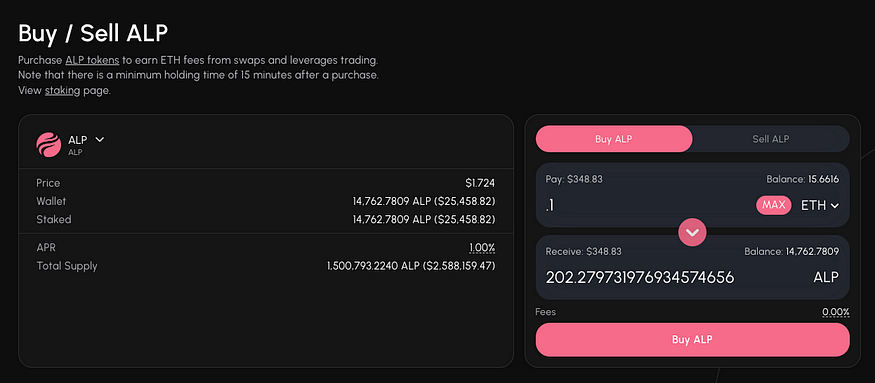

2. Buying ALP or Supplying Liquidity to the platform

Contributing your liquidity to the platform is done via the process of buying the ALP token, the ALP token represents a share of the total liquidity on Amped Finance and can be sold back in exchange for any of the pooled assets at any time.

When entering the platform you will want to visit the Buy menu option and then click Buy ALP. You will be presented with this screen: You can choose to buy ALP with ETH or with WBTC, USDT, USDC, WSOL or WBNB. Enter in the amount that you wish to swap and then press “Buy ALP”.

You can choose to buy ALP with ETH or with WBTC, USDT, USDC, WSOL or WBNB. Enter in the amount that you wish to swap and then press “Buy ALP”.

After swapping your asset for ALP you will have it automatically staked and be earning ETH as well as escrowed AMP rewards, you can check this via the Earn page.

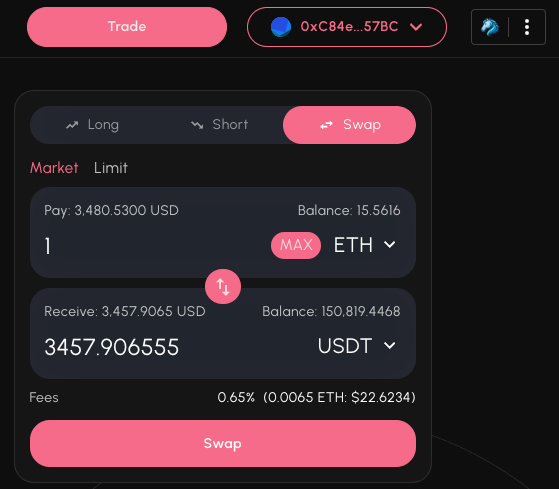

3. Swapping assets

To swap one asset for another you can visit the Trade menu and then select which assets you would like to trade.

For more detail on this process please see the documentation.

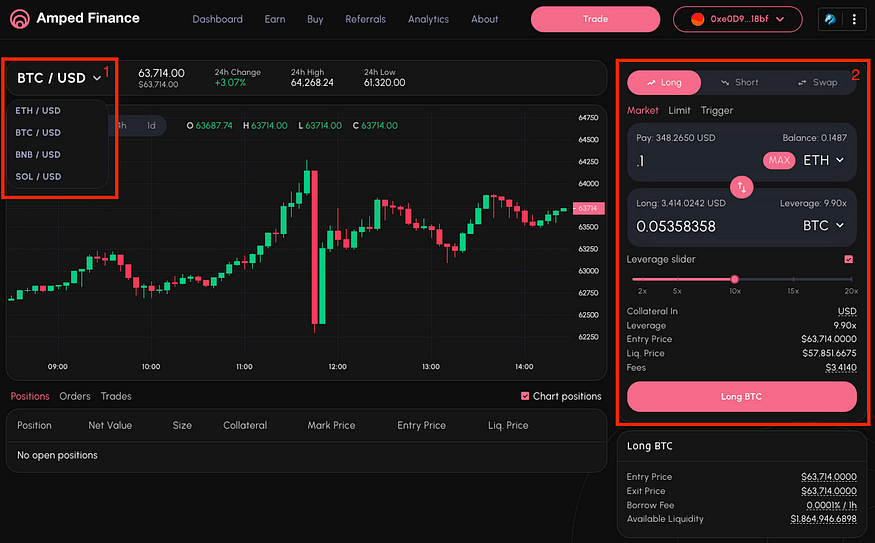

4. Trading perpetual swaps with leverage

Again, you can open perpetual swaps trades via the Trade screen.

Firstly, you will select the trading pair you’d like to open a position on. Then you can choose how much collateral you would like to put into the position, your leverage and then press “Long XXX” to open your trade.

For more details on this process, this is covered in the documentation. This should be enough information to get you acquainted with the platform, and exploring the options for trading and earning upon it. If you have further questions make sure to drop by our Discord and let the team know!

This should be enough information to get you acquainted with the platform, and exploring the options for trading and earning upon it. If you have further questions make sure to drop by our Discord and let the team know!