Bitcoin Sentiment Returns To Extreme Greed As BTC Breaks $71,000

Data shows the Bitcoin market sentiment has returned to the extreme greed territory as BTC has registered its rally beyond the $71,000 level.

Bitcoin Fear & Greed Index Now Points To “Extreme Greed”

The “Fear & Greed Index” is an indicator made by Alternative that tells us about the general sentiment among the investors in the Bitcoin and wider cryptocurrency market.

This index represents the sentiment as a score between zero and hundred. To calculate this value, the indicator takes into account the data of these factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

No KYC Casino and Sportsbook with up to 300% match bonus + 175 Free Spins, and Wager Free Cashback. Play now at ROLR.IO!

Related Reading: Bitcoin Top In Yet? What The Legendary MVRV Ratio Says

When the indicator has a value of 46 or less, it means that the average investor holds a sentiment of fear right now. On the other hand, a value of 54 or more implies the market shares a majority mentality of greed. Naturally, the region in-between these two (47 to 53) corresponds to the neutral sentiment.

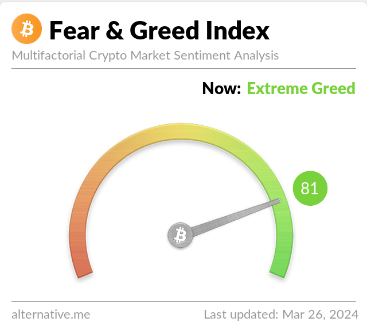

Now, here is what the latest value of the Bitcoin Fear & Greed Index looks like:

The index appears to have a value of 81 at the moment | Source: Alternative

As is visible above, the Bitcoin Fear & Greed Index is at 81 right now, meaning that it’s deep into the greed region. In fact, this value is so deep that it’s inside a territory known as “extreme greed.”

Extreme greed occurs when the index hits values higher than 75. Fear also has its own extreme region; this one occupying values under 25. Historically, these two sentiments have proven to be particularly significant for the market.

BTC and other assets in the sector have often tended to move in the opposite direction from what the majority expect. In the territory of the extreme sentiments, this expectation is naturally the strongest, and hence, the probability of a contrary move taking place is also the highest.

BitStarz Player Lands $2,459,124 Record Win! Could you be next big winner?

Because of this reason, major tops and bottoms in Bitcoin’s price have typically taken shape when the cryptocurrency has been inside the respective extreme zones.

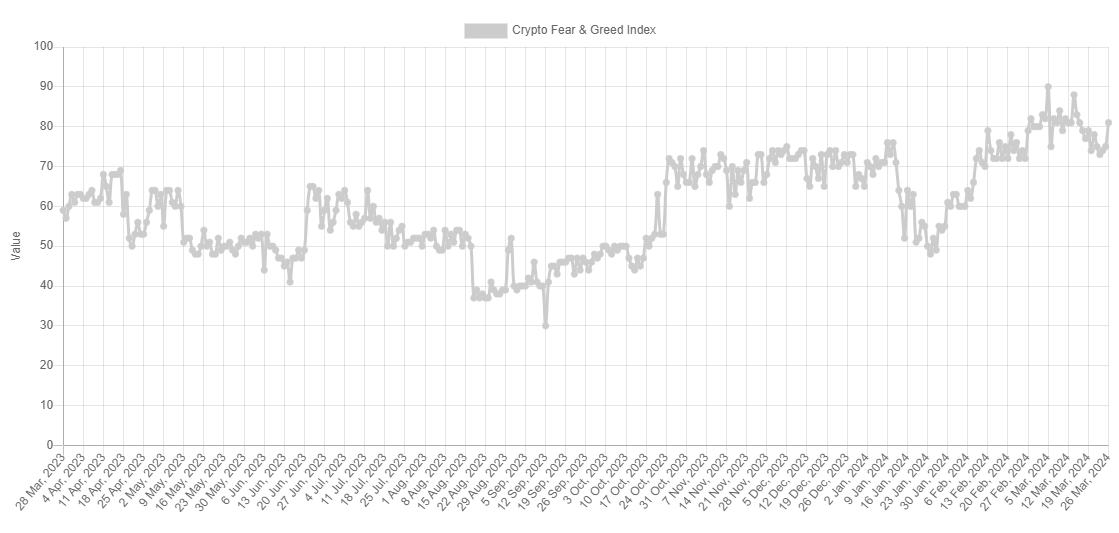

Earlier in the month, the Fear & Greed Index had assumed especially high extreme greed levels, as the asset’s rally towards new all-time highs (ATHs) had occurred.

Two of the major tops in this period, including the current ATH, coincided with peaks in the indicator, implying that the overheated sentiment may have once again played a role.

Looks like the value of the metric has turned around in the past day | Source: Alternative

With the recent drawdown in the asset, though, the sentiment also cooled off and exited out of the extreme greed territory, as is visible in the above chart. In bullish periods, the sentiment retreading back to the normal greed region can be a positive sign for fresh upward moves to start.

And indeed, this has followed for the cryptocurrency this time as well, as its price has made notable recovery over the past couple of days. With the coin making a return back towards $71,000, the sentiment has also heated up again, hence why the index’s latest value is pointing at extreme greed.

Related Reading: Bitcoin Retests Resistance: Here’s The Level A Break Could Lead To

The aforementioned tops from earlier in the month occurred at Fear & Greed Index values of 90 and 88, respectively, suggesting that the current extreme greed value of 81 may not be too high for another peak to be probable.

BTC Price

Bitcoin had broken above the $71,000 level earlier in the day, but the digital asset has since registered a bit of a pullback towards $70,700.

The price of the coin seems to have sharply risen over the past two days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, Alternative.me, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: bitcoinBitcoin BreakBitcoin extreme greedBitcoin Fear & Greed Indexbitcoin rallybitcoin sentimentbtcbtcusd

Solana’s (SOL) ‘Black Account’ Cryptocurrency Rival Announces Exchange Sneak Peak Pushing Token Up 400%

In a thrilling development that has taken the cryptocurrency market by storm, Option2Trade (O2T), widely regarded as Solana’s (SOL) ‘Black Account’ cryptocurrency rival, has unveiled an exchange sneak peek that has catapulted its token value by an astonishing 400%. This significant milestone has captured the attention of investors and traders alike and positioned Option2Trade (O2T) as a formidable contender in the rapidly evolving crypto landscape, directly challenging the likes of Solana (SOL).

In a thrilling development that has taken the cryptocurrency market by storm, Option2Trade (O2T), widely regarded as Solana’s (SOL) ‘Black Account’ cryptocurrency rival, has unveiled an exchange sneak peek that has catapulted its token value by an astonishing 400%. This significant milestone has captured the attention of investors and traders alike and positioned Option2Trade (O2T) as a formidable contender in the rapidly evolving crypto landscape, directly challenging the likes of Solana (SOL).

Option2Trade (O2T) Emerges from the Shadows

Option2Trade (O2T) has been quietly building its platform, aiming to revolutionize the crypto exchange space with unique features and benefits not currently offered by Solana (SOL) or other established cryptocurrencies. With the announcement of their exchange sneak peek, O2T has demonstrated its potential to disrupt the market, offering users advanced trading capabilities and unparalleled access to high-growth investment opportunities.

Solana (SOL) Investors Take Notice

As Option2Trade (O2T) continues to gain traction, investors who have traditionally backed Solana (SOL) are beginning to take notice. The remarkable 400% increase in O2T’s token value following the sneak peek announcement has made it abundantly clear that this new entrant is not to be underestimated. Solana (SOL), with its own set of innovative features and strong community backing, now finds itself in a position where it must acknowledge the rising competition from Option2Trade (O2T).

The Allure of Option2Trade (O2T)’s ‘Black Account’

The concept of a ‘Black Account’ has been central to the appeal of Option2Trade (O2T), offering users exclusive benefits and privileges beyond traditional crypto trading accounts. This has been a significant draw for users looking for more from their cryptocurrency experience, something that Solana (SOL) and other platforms may not currently provide. As a result, O2T’s innovative approach to user engagement and satisfaction is reshaping expectations within the crypto community.

Comparing Option2Trade (O2T) with Solana (SOL)

The comparison between Option2Trade (O2T) and Solana (SOL) extends beyond their technological offerings. While Solana (SOL) has established itself as a leader in providing fast, decentralized blockchain solutions, Option2Trade (O2T) is carving out a niche focusing on trading efficiency and investor rewards. The market’s response to O2T’s exchange sneak peek suggests a growing demand for platforms that can offer both innovation and value to their users.

The Impact on Solana (SOL) and the Broader Market

The success of Option2Trade (O2T) and its recent 400% token value increase following the exchange sneak peek have sent ripples through the cryptocurrency market. Solana (SOL), known for its resilience and rapid transaction capabilities, may need to revisit its strategy to maintain its competitive edge. The emergence of O2T highlights the dynamic nature of the crypto market and the constant innovation that drives it forward.

Solana’s (SOL) Response to the Challenge

As Option2Trade (O2T) continues to rise, all eyes are on Solana (SOL) to see how it will respond to this new challenge. Solana (SOL) has a history of innovation and community engagement, which it will likely leverage to counter the growing popularity of O2T. The competition between Solana (SOL) and Option2Trade (O2T) exemplifies the vibrant and competitive spirit that defines the cryptocurrency industry.

Conclusion: A New Era of Cryptocurrency Competition

The announcement of the Option2Trade (O2T) exchange sneak peek and the subsequent 400% increase in token value mark a significant moment in cryptocurrency history. As Solana (SOL) faces this new ‘Black Account’ cryptocurrency rival, the market is reminded of the importance of continuous innovation and adaptation. For investors and users, the competition between Solana (SOL) and Option2Trade (O2T) promises more choices, better features, and potentially higher returns, signaling the start of a new era in the digital currency space.

For more information on the Option2Trade (O2T) Presale:

Use promo code O2TLaunch to get a 15% bonus.

Visit Website: Option2Trade (O2T)

Join and become a community member:

https://t.me/O2TOfficial

https://twitter.com/Option2Trade

Disclaimer: This article is sponsored content and is not financial advice. CryptoNewsZ does not endorse or guarantee the accuracy of the content. Readers should verify information independently and exercise caution when dealing with any mentioned company. Investing in cryptocurrencies is risky, and seeking advice from a qualified professional is recommended.

Bitcoin Held On Coinbase Exchange Reach 9-Year Low, Can Bitcoin Reach $75,000?

In a recent development, data from crypto analytics firm Glassnode shows that the amount of Bitcoin held on Coinbase has reached a 9-year low. This has raised the possibility of the flagship crypto rising to a new all-time high (ATH) of $75,000 soon enough.

BTC Held On Coinbase Drops Significantly

According to Glassnode, the Bitcoin balance on Coinbase dropped to a nine-year low of 344,856 on March 18. This suggests that Bitcoin investors are choosing to move their holdings off exchanges and hold for the long term rather than sell anytime soon. A move like this reduces the short-term pressure on Bitcoin and could spark an upward trend in BTC’s price.

Related Reading: Why Is The Price Of LUNC And USTC Up Today?

Meanwhile, the drop in BTC held on Coinbase looks to be a trend, with data from market intelligence platform Santiment showing a drop in the total amount of Bitcoin held on centralized exchanges (CEXs). This data is also supported by the fact that these exchanges have recorded more outflows than inflows lately.

Further data from Santiment also shows that the supply on exchanges as of March 22 stood at just over 836,000 BTC compared to the 18.82 million BTC that resides out of these CEXs. The decline in the number of BTC held on exchanges is undoubtedly a welcome development, considering how the flagship crypto token has recently been plagued with a wave of profit-taking.

Before now, the bearish sentiment surrounding BTC was further strengthened by JPMorgan’s theory that Bitcoin was overbought and that the crypto token could experience further price declines soon enough. However, with BTC back over $70,000, there is the belief that this is just the beginning of an upward trend that could see it reach new highs.

Spot Bitcoin ETFs Record Net Inflows

BitMEX Research revealed in an X (formerly Twitter) post that the Spot Bitcoin ETFs recorded a combined net inflow of $15.7 million on March 25. This represents a positive turn of events after these funds recorded negative flows throughout last week. The wave of profit-taking by these Bitcoin ETF investors contributed to the BTC dip that occurred during that period.

Related Reading: 7 Days Of Crypto: Key Events That You Should Keep An Eye On This Week

The crypto community will no doubt keep their eyes on the flows recorded by these Spot Bitcoin ETFs this week as they could give an idea of whether or not the outlook towards BTC has become bullish again. These Bitcoin ETFs now play a prominent role in the Bitcoin ecosystem, considering how much BTC these fund issuers accumulate whenever there is a high demand for them.

At the time of writing, Bitcoin is trading at around $70,700, up over 5% in the last 24 hours according to data from CoinMarketCap.

BTC price trending north of $70,000 | Source: BTCUSD on Tradingview.com

Featured image from BBC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: bitcoinbitcoin coinbasebitcoin exchangesBitcoin newsbitcoin pricebtcBTC newsbtc pricebtcusdBTCUSDTcoinbasecoinbase news

Ripple CEO Responds To SEC’s Shocking $2 Billion Demand

In a rather shocking development, the United States Securities and Exchange Commission (SEC) has demanded a $2 billion sanction against Ripple. Responding to the startling demands, Ripple’s Chief Executive Officer (CEO), Brad Garlinghouse has taken a firm stance against the agency’s demands, determined to expose the true nature of the SEC.

Ripple CEO Criticizes SEC’s Demands

Stuart Alderoty, the Chief Legal Officer (CLO) of Ripple recently disclosed in a post on X (formerly Twitter) that the US SEC has petitioned a Judge for $2 billion in fines and penalties against Ripple. According to the Ripple CLO, the SEC is in a relentless pursuit to “punish and intimidate Ripple,” rather than faithfully applying the law.

Related Reading: Bitcoin To $50,000 Or $80,000? Crypto Expert Predicts Where Price Is Headed Next

Challenging the SEC’s $2 billion penalty, Garlinghouse emphasized that the agency has consistently operated beyond the bounds of law in various enforcement actions. He disclosed that Judges have also taken note of the SEC’s actions, previously admonishing the agency for its extensive abuse of power entrusted to it by Congress.

The Ripple CEO also criticized the SEC’s penalty demand, arguing that it lacks precedent and justification, particularly given the absence of any allegations, findings of fraud or recklessness in the case. As a result, Garlinghouse has vowed to expose the SEC for its conduct, emphasizing that Ripple will vigorously respond to the SEC’s action.

Notably, Alderoty has disclosed that the company’s legal team will be addressing the SEC’s demands in a filing scheduled for next month. Offering his perspective on the SEC, the Ripple CLO characterized the agency as one “that trades in statements that are false, mischaracterized and designed to mislead.”

SEC Actions Hurt XRP Holders The Most

In its lawsuit against Ripple, the US SEC accused the payment company of violating securities laws by selling XRP in unregistered securities offering to investors in the US. According to the agency, the company and its executives had allegedly failed to protect its investors, depriving them of adequate disclosures of XRP.

However, members of the Ripple community argue that the SEC’s enforcement actions against Ripple have not protected investors but caused even deeper challenges and financial losses for XRP holders.

Related Reading: Bitcoin Whales Remove A Staggering $2.3 Billion From Exchanges, Is It Time To Buy?

A popular XRP enthusiast, identified as XRPCryptoWolf has asserted that it should be the SEC, not Ripple, paying billions to XRP holders.

“The SEC asking for $2 billion in fines and penalties is ridiculous when they’re the ones who financially hurt XRP holders the most. The SEC owes XRP holders tens of billions of dollars,” he stated.

The XRP community member disclosed that after the SEC announced its lawsuit against Ripple, approximately $15 billion was wiped out from XRP’s market capitalization, and the token was also delisted from major exchanges. As a result of the lawsuit’s significant impact on XRP’s value, millions of XRP holders experienced financial losses.

XRP price at $0.644 | Source: XRPUSDT on Tradingview.com

Featured image from Inside Bitcoins, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.