If a Bitcoin ETF Is Approved, Here's What May Happen: Hype or Historic Turning Point?

In brief:

- The SEC is on the brink of approving a first spot bitcoin ETF in the U.S. after 10 years of failed applications.

- Opinions on what will happen in the crypto market if the SEC approves a spot bitcoin ETF are mixed.

- Some analysts say predictions of a huge influx of investment are overdone.

(Image Source: bloomberg)

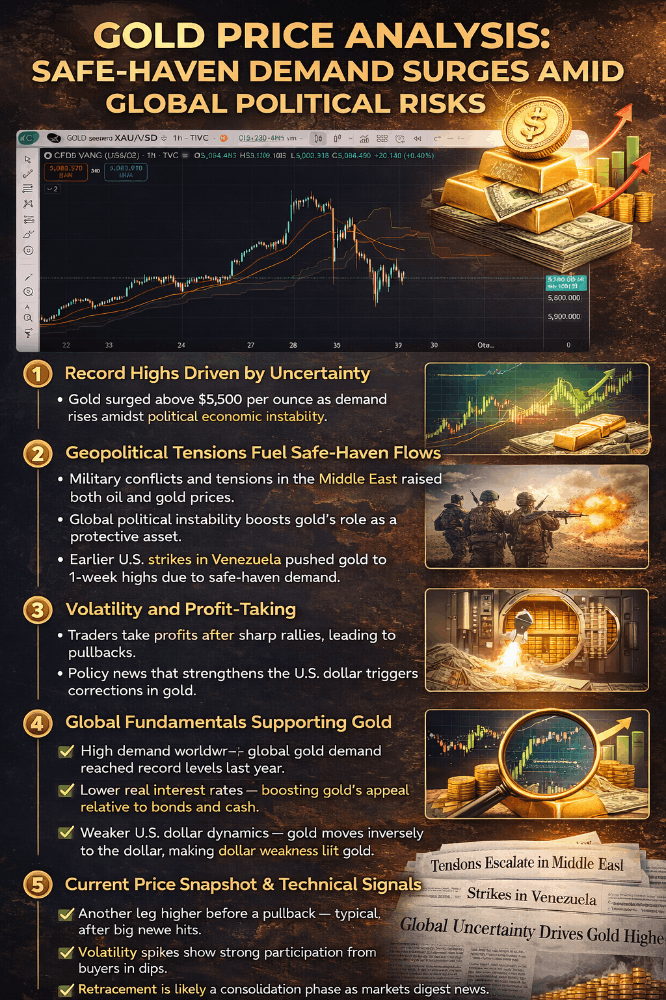

After a decade of applications, rejections, and revisions, the U.S. Securities and Exchange Commission (SEC) could finally be on the verge of approving the first-ever spot Bitcoin ETF. This landmark decision has sent shockwaves through the financial world, with investors and analysts alike scrambling to predict the potential consequences for the cryptocurrency market. While the exact impact remains shrouded in uncertainty, one thing is clear: a green light for a Bitcoin ETF would mark a pivotal moment in the evolution of digital assets.

A Long-Awaited Green Light

(Image Source: blockworks)

For years, the SEC has expressed concerns about the volatility, lack of regulation, and potential for manipulation inherent in the cryptocurrency market. These concerns led to the rejection of numerous Bitcoin ETF proposals, leaving many institutional investors hesitant to enter the space. However, with Bitcoin's price stabilizing and regulatory frameworks maturing, the SEC's stance appears to be softening. In October 2023, SEC Chair Gary Gensler hinted at a potential shift, stating that the commission was "open" to approving Bitcoin ETFs that met its standards. This newfound openness has fueled speculation that a green light could come as early as 2024.

- Solana Plunges 9%: Is the Ethereum Killer Losing its Edge? Read more

- Bali's Crypto Revolution: Tokocrypto's T-Hub Ignites Innovation Read more

- Celsius's ETH Unstaking: Impact on Market Price... Read more

- 100 Days to the Halving: 5 Things to Know in Bitcoin This Week Read more

Potential Impact: A Spectrum of Opinions

(Image Source: decrypt)

The potential consequences of a Bitcoin ETF approval are hotly debated. Some analysts predict a surge in institutional investment, as traditional financial players gain easier access to the cryptocurrency. This influx of capital could drive up Bitcoin's price, potentially leading to a bull run similar to those witnessed in 2017 and 2021 (CoinDesk, 2024). Proponents of this view point to the success of Bitcoin futures ETFs, which have already attracted billions of dollars in investment despite their limited scope (Forbes, 2023).

However, others argue that the impact may be more muted. They point out that many institutional investors are already indirectly exposed to Bitcoin through Grayscale Bitcoin Trust (GBTC), a popular crypto investment vehicle that trades at a premium to its underlying Bitcoin holdings (The Block, 2023). Additionally, concerns persist about the potential for market manipulation and regulatory hurdles, which could dampen investor enthusiasm.

- Grayscale Shakes Up GBTC & Charges Towards... Read more

- The Future of Finance: DeFi or TradFi? Read more

- Taiko: A Based Rollup Bringing Ethereum to Warp Speed Read more

- Optimistic Rollups vs Zero-Knowledge Rollups... Read more

Beyond Bitcoin: A Broader Market Shift

(Image Source: seekingalpha)

A Bitcoin ETF approval would likely have ripple effects beyond the leading cryptocurrency. Increased investor confidence in the broader crypto space could lead to increased demand for other digital assets, potentially boosting the entire market. Additionally, the SEC's decision could pave the way for the approval of other cryptocurrency-related ETFs, further legitimizing the asset class and attracting more mainstream attention (CNBC, 2023).

Tempering Expectations: A Measured Approach

(Image Source: bitcoinnews)

It's important to remember that even with a Bitcoin ETF approval, the cryptocurrency market remains inherently volatile and unpredictable. Investors should approach any potential price increases with caution and avoid getting caught up in the hype. A measured, long-term investment strategy remains crucial for navigating the dynamic world of digital assets.

- SEC's Bitcoin ETF Decision: Matrixport Analysis & Market Impact Read more

- Exploring Solana's Rise: From Search Interest to Market Success Read more

- Genesis Rolldrop Dymension's Season 1: Claim Your Airdrop! Read more

- The Scoop on Layer 1 and Layer 2 in 2024 Read more

Conclusion: A New Chapter for Crypto

The potential approval of a Bitcoin ETF marks a significant turning point for the cryptocurrency market. While the exact impact remains uncertain, it's clear that this decision would represent a major step forward in the mainstream adoption and legitimization of digital assets. As the regulatory landscape evolves and institutional interest grows, the future of crypto looks brighter than ever.

- Bali: Paradise Lost or Paradise Regained? Read more

- Exploring Bali's Pawukon Calendar: A Harmonious Balance with Nature Read more

- Aftermath Finance: Pioneering DeFi Solutions... Read more

- Exploring the Best Coworking Spaces in Canggu... Read more

- EigenLayer Sets Record with $900 Million in Deposits! Read more