Solana Price Poised for New Bullish Cycle: How High Can SOL Go?

- Solana (SOL) is nearing a critical resistance level at $170, with indications of a potential bullish breakout.

- On the monthly chart, bullish signals include the MACD lines crossing and the RSI in overbought territory.

- As SOL approaches $170, market sentiment and technical indicators point towards a bullish breakout.

Solana (SOL) appears to be on the verge of a new bullish cycle, following in the footsteps of Bitcoin’s recent upward trend. As Solana approaches the critical golden ratio resistance level at approximately $170, with only a 10% gap to close, investors and analysts are closely monitoring the cryptocurrency’s movements.

A breakthrough at the $170 level could signal the beginning of a new bullish cycle for Solana, potentially propelling the cryptocurrency to retest its previous ATH of around $260.

The monthly chart’s Moving Average Convergence Divergence (MACD) histogram indicates an upward trend, with the MACD lines in a bullish cross and the Relative Strength Index (RSI) in overbought territory. Notably, there are currently no signs of bearish divergence or other bearish signals, further supporting the potential for a bullish breakout.

Can Solana surge higher?

Solana’s weekly chart shows predominantly bullish signals, with the MACD histogram trending higher since the previous week and the MACD lines crossing bullishly. However, the RSI’s presence in overbought territory may suggest a potential bearish divergence.

In the event of a bearish rejection at the golden ratio level, Solana may find support at approximately $99 and $60, with the 50-week Exponential Moving Average (EMA) providing additional support at around $66.3.

The daily chart presents a more mixed picture, with both bullish and bearish signals. Although the MACD lines remain crossed bullishly, the MACD histogram has been trending lower in a bearish manner, and the RSI is in overbought territory. Despite these concerns, the golden crossover of the EMA suggests a bullish trend in the short to medium term.

As Solana approaches the crucial golden ratio resistance level at $170, the cryptocurrency’s future trajectory remains uncertain. While the overall market sentiment and various technical indicators suggest a potential bullish breakout, the presence of mixed signals in shorter timeframes warrants caution.

Ethereum Is Not Done: Crypto Analyst Sets New $5,000 Target

Ethereum is currently looking to gain a strong footing above the $4,000 price level as bullish momentum continues to dominate. According to crypto analyst Ali Martinez, this bullish momentum could continue and Ethereum could as well reach $5,000 very soon.

Ali Martinez made this known while citing data from IntoTheBlock, noting that the second biggest cryptocurrency still has room to run to $5,000, albeit a small resistance around $4,522 to $4,646.

Ethereum Path To $5,000 Looks Increasingly Clear As Resistance Dwindles

Ethereum’s momentum has been building for weeks amidst a broader crypto market increase, which has seen many cryptocurrencies reach new highs. The price of Ethereum has increased by 53% in the past 30 days alone, leaving investors to wonder how high it can keep going and whether it can follow in Bitcoin’s footsteps and attain a new all-time high.

No KYC Casino and Sportsbook with up to 300% match bonus + 175 Free Spins, and Wager Free Cashback. Play now at ROLR.IO!

Related Reading: Solana Demand Soars As Institutions Buy Up SOL At A Massive 870% Premium

In a social media post on X, Martinez noted a $5,000 price point is in the books “as resistance thins.” However, a key hurdle remains at $4,522-$4,646, where 600,000 addresses hold 1.63 million ETH. Despite this resistance hurdle, Martinez believes a $5,000 price point is inevitable while noting that the only question left is when this will manifest.

#Ethereum path to $5,000 looks increasingly clear, as resistance thins. The key hurdle? A supply zone at $4,522-$4,646, where 600,000 addresses hold 1.63 million $ETH. It’s not a matter of if, but when! pic.twitter.com/LMvw3kjrEW

— Ali (@ali_charts) March 11, 2024

The analyst made this prediction using IntoTheBlock’s “In/Out of the Money Around Price” metric, which tracks the number of holders making money at the current price. Interestingly, the metric indicated that 7.64 million ETH, representing 75.95% of the volume bought between $3,428 and $4,646, are making money at the current price.

Ethereum is trading at $4,058 at the time of writing on the back of a minor correction after reaching a two-year high of $4,084. If bullish momentum continues and ETH can close the week above $4,175, that could pave the way for a quick move to $4,500 and potentially past its current all-time high of $4,891 to set a new one.

570% up to 12 BTC + 300 Free Spins for new players & 1 BTC in bonuses every day, only at Wild.io. Play Now!

Related Reading: Cardano Price About To Explode: Crypto Pundit Reveals Next Target

Current price action shows Ethereum has created a support around $3,950 during its move up to $4,000. As long as this price level continues to hold, the overall bullish trend remains intact. But a break below $3,920 could signal a deeper correction to $3,800.

Increased blockchain activity on layer-2 networks has pushed gas fees to new highs. As a result, developers are getting ready to roll in a Dencun upgrade, which is supposed to usher in a new era of cheaper fees. The Dencun upgrade is the first change to Ethereum’s blockchain code in over a year. BitStarz Player Lands $2,459,124 Record Win! Could you be next big winner?

ETH price trending above $4,000 | Source ETHUSD on Tradingview.com

Featured image from CNBC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Market Alert: Ethereum Faces Potential Downfall As Dencun Upgrade Looms – Here’s Why

Ethereum (ETH) is poised for a notable improvement with the impending Dencun upgrade to enhance the network’s scalability. However, amidst this anticipation, QCP Capital, a seasoned crypto asset trading firm, has shed light on an emerging trend that might influence Ethereum’s price trajectory.

The firm’s analysis reveals a shift in “risk reversals” for Ethereum, turning negative for upcoming expiries. This shift indicates growing concerns among investors about a potential decrease in ETH’s price, as a negative risk reversal often suggests a market leaning towards protective measures against a downturn.

Related Reading: These Are The Ethereum Altcoins Witnessing High Whale Interest

Market Leverage And Correction Concerns

Notably, this trend towards negative risk reversals has been attributed to an increased interest in put options, which serve as a hedge against potential losses for those speculating on price increases.

No KYC Casino and Sportsbook with up to 300% match bonus + 175 Free Spins, and Wager Free Cashback. Play now at ROLR.IO!

Moreover, the broader altcoin market participants are similarly hedging their investments in Ethereum, aiming to mitigate risks associated with their altcoin holdings.

QCP Capital’s insights into the market dynamics also highlight an underlying nervousness about Ethereum’s price stability, especially in light of the considerable leverage within the market.

The firm cautions about the potential for a market correction, albeit with an expectation of strong buying interest in the event of any price dips. QCP noted in the report:

570% up to 12 BTC + 300 Free Spins for new players & 1 BTC in bonuses every day, only at Wild.io. Play Now!

Altcoin speculators might also be buying ETH puts as a proxy to hedge altcoin downside. This makes us wary of a possible correction given the amount of leverage in the market. However, we think that the market will buy any dip aggressively.

Additionally, Ethereum’s spot-forward spreads have decreased slightly, contrasting with Bitcoin’s sustained high spreads. Commenting on the implication for investors, QCP Capital stated:

A sharp drop in spot price is likely to drag the forward spreads lower as leverage longs get taken out.

Ethereum Performance And Outlook

Despite the cautionary signals, Ethereum continues to perform “robustly” in the crypto market, closely trailing Bitcoin regarding price movements. Currently trading above $4,000, Ethereum has witnessed a modest increase of 0.6% over the past 24 hours.ETH price is moving sideways on the 2-hour chart. Source: ETH/USDT on TradingView.com

Moreover, data from IntoTheBlock (ITB) reveals an encouraging statistic: over 94% of ETH addresses are presently profitable, suggesting a strong holding pattern among investors and a reduced likelihood of selling pressure. This scenario could potentially set the stage for a price uptick.

BitStarz Player Lands $2,459,124 Record Win! Could you be next big winner?

Related Reading: Ethereum Wallets Overflow: Over 90% Addresses In Profit, Ether To Retest ATH

However, it’s important to note that Ethereum’s growth trajectory, while positive, has not mirrored the notable surge Bitcoin experienced following the approval of its spot Exchange-Traded Fund, indicating a more measured pace of appreciation for ETH.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: altcoincryptoDencun UpgradeETHethereumEthereum MarketETHUSDT

Number Of Ethereum Short-Term Holders Increasing – Is A Bull Rally Next?

Ethereum (ETH) has been showing a solid performance lately, leaving investors both ecstatic and wary. The world’s second-largest cryptocurrency, boasting a market capitalization of nearly $480 billion, recently surpassed the coveted $4,000 mark for the first time since December 2021, igniting a flurry of bullish predictions. But is this a genuine resurgence, or are we witnessing a temporary blip before a potential correction?

Related Reading: Cardano (ADA) Price Alert: Analyst Predicts 60% Rally In Next 7 Days

Let’s dissect the forces at play. Proponents of a sustained uptrend point to a confluence of positive factors. The long-awaited approval of a US-based Ethereum ETF is a hot topic, with speculation swirling that a green light could trigger a significant influx of institutional capital, potentially injecting billions into the Ethereum ecosystem.

Additionally, the upcoming Bitcoin halving, an event that cuts Bitcoin’s mining reward in half, is expected to have a positive spillover effect on the entire cryptocurrency market, potentially propelling Ethereum further.

Surge In Short-Term Ethereum Holders Signals Optimism

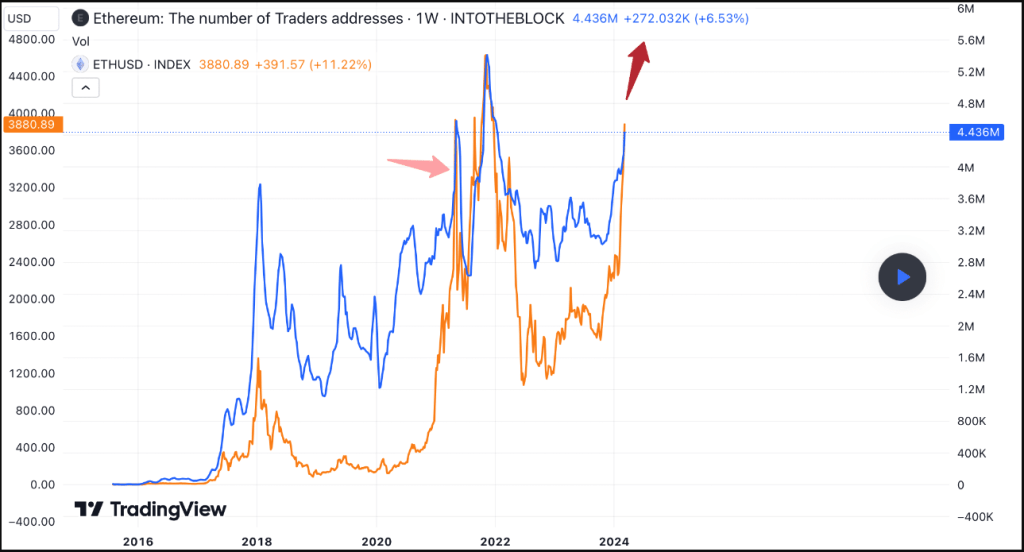

This optimistic outlook is bolstered by a surge in on-chain activity. Data from IntoTheBlock reveals a significant increase in the number of short-term Ethereum holders.

Source: TradingView/IntoTheBlock

Historically, this trend, with its 60% monthly price surge for ETH, aligns with bull markets, signifying an influx of new users entering the crypto space and actively participating in the network. Think of it as a crowded party – the more people show up (currently approaching the highs of the last bull cycle), the livelier the atmosphere becomes (and potentially the higher the price goes).

But, there’s more to the story. A closer inspection of technical indicators paints a slightly different picture. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are currently hovering in overbought territory, with RSI specifically nearing the 70 mark.

Total crypto market cap is currently at $2.677 trillion. Chart: TradingView

In simpler terms, this suggests that Ethereum’s price at slightly above $4,000 might be stretched a bit thin and due for a potential pullback. Imagine a jump rope competition – if you’re swinging too hard and fast (like an RSI over 70), eventually you’ll trip yourself up.

Source: Coingecko

Ethereum’s Future: Balancing Act

Adding a layer of intrigue, the sentiment among investors seems geographically divided. While the “Coinbase Premium,” a metric reflecting buying pressure, is thriving in the US, its Korean counterpart indicates ongoing selling activity.

Related Reading: Bitcoin Hodlers Eye Long Term: $520 Million BTC Go To Cold Storage

This regional disparity could be attributed to diverse market dynamics and investor preferences. Perhaps American investors, with a green Coinbase Premium, are more optimistic about the regulatory landscape surrounding crypto, while their Korean counterparts, with a red Korea Premium, are taking a more cautious approach.

So, what does this all mean for Ethereum’s future? The answer, unfortunately, isn’t as clear-cut as we’d like. The confluence of positive factors like potential ETF approval, increased network activity with a surge in short-term holders, and a potential Bitcoin halving boost paint a bullish picture.

However, technical indicators hinting at an overbought market and contrasting investor sentiment across regions introduce a note of caution. Ethereum is currently walking a tightrope – will it maintain its momentum or face a reality check in the form of a price correction? It’s anybody’s guess.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: blockchainethereummarket analysisPrice action