Ethereum achieves staking milestone with 25% of circulating supply now staked

AdTRADERS ARE BUYING MEME KOMBAT

IS THIS NEW STAKE TO EARN MEME COIN THE NEXT PEPE?

BUY NOW AND GET 112% APY!

BUY $MK NOW!

Skip to content

crypto.news

Search

search

Close searchBitcoin (BTC)

$44,746.00

3.89%

Bitcoin priceEthereum (ETH)

$2,421.28

2%

Ethereum priceBNB (BNB)

$317.21

4.64%

BNB priceSolana (SOL)

$101.53

6.25%

Solana priceXRP (XRP)

$0.51

1.94%

XRP priceShiba Inu (SHIB)

$0.0000092

3.46%

Shiba Inu pricePepe (PEPE)

$0.0000010

3.01%

Pepe priceEl Hippo (HIPP)

$0.0000000050240

3.27%

El Hippo price Bonk (BONK)

Bonk (BONK)

$0.0000104

2.39%

Bonk priceBitcoin (BTC)

$44,746.00

3.89%

Bitcoin priceEthereum (ETH)

$2,421.28

2%

Ethereum priceBNB (BNB)

$317.21

4.64%

BNB priceSolana (SOL)

$101.53

6.25%

Solana priceXRP (XRP)

$0.51

1.94%

XRP priceShiba Inu (SHIB)

$0.0000092

3.46%

Shiba Inu pricePepe (PEPE)

$0.0000010

3.01%

Pepe priceEl Hippo (HIPP)

$0.0000000050240

3.27%

El Hippo price Bonk (BONK)

Bonk (BONK)

$0.0000104

2.39%

Bonk price

Ethereum achieves staking milestone with 25% of circulating supply now staked

By Rony Roy

By Rony Roy

February 8, 2024 at 9:31 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

Ethereum staking reaches a major milestone as 25% of the total ETH supply, around 30 million ETH, is now staked. On Feb. 8, Lido, a leading liquid staking platform, announced that over 30 million ETH, representing a quarter of Ethereum’s circulating supply, has been staked.

On Feb. 8, Lido, a leading liquid staking platform, announced that over 30 million ETH, representing a quarter of Ethereum’s circulating supply, has been staked.

According to Dune Analytics, this milestone has been reached, positioning Lido with a 31.5% market share in staked Ethereum. The total value of staked ETH stands at approximately $73 billion, with nearly a million validators contributing to the network’s security.

In the last two weeks, there has been a noticeable uptick in staking flow deposits, indicating increased activity and interest in Ethereum staking.

Nansen, another blockchain analytics firm, confirms the 30 million ETH staked figure and notes the virtually empty unstaking queue. This suggests a strong holding sentiment, with only 176,686 ETH, less than 0.6% of the total staked, waiting to be withdrawn.

You might also like:

ARK 21Shares revamps Ethereum ETF proposal with cash creation model and staking plan

Ultrasound.Money also provides a slightly lower figure of 29.8 million ETH staked but highlights an important aspect of Ethereum’s economy. Since the Merge in September 2022, Ethereum’s supply has contracted by 344,960 ETH, translating to a deflation of nearly $840 million. This deflationary trend is further evidenced by a -0.57% annual inflation rate, with 4,288 ETH, worth about $10 million, burned in the last 24 hours.

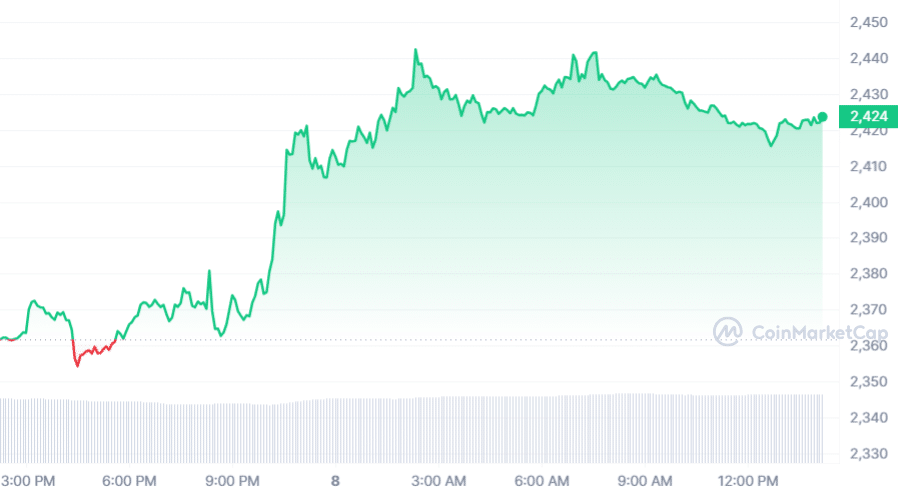

The Ethereum market has responded positively to these developments, with a 2.6% price increase over the past day. Ethereum’s price performance over the week shows a 6.8% uptick, although resistance levels loom, and the asset is still down from its January 2024 peak. ETH 24-hour price chart | Source: CoinMarketCap

ETH 24-hour price chart | Source: CoinMarketCap

Currently, Ethereum trades at half its all-time high from November 2021, but the staking and restaking narratives present potential for narrowing this gap.

Restaking, which enables users to stake the same ETH across multiple protocols, is gaining traction. CoinGecko’s introduction of a restaking token category, now valued at around $300 million, reflects this trend. Significant price increases in restaking tokens like Pendle Finance and Picasso, alongside the success of platforms such as EigenLayer, highlight the expanding interest in Ethereum’s staking ecosystem.

Read more:

Angel Drainer targets restaking platforms with new attack vector, Blokcaid warns READ MORE ABOUT

READ MORE ABOUT

cryptocurrency

ethereum

ethereum staking service

Analysts backing Cardano, PepeFork, and KangaMoon in 2024

February 8, 2024 at 9:30 am

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Investors are actively seeking potent cryptocurrencies for high returns in the upcoming bull market. Some analysts have suggested Cardano (ADA), KangaMoon (KANG), and PepeFork (PORK) as possible options.

Cardano price prediction

Cardano is down 6.1% and 4.2% in the past month and week.

ADA is currently ranging between $0.4753 and $0.5237.

You might also like: Cardano forecasted to hit $5, will other altcoins follow?

The short-term outlook seems negative, but the long-term outlook is bullish due to increased on-chain activity.

Some analysts say ADA will float to $0.557012 in the coming weeks.

PepeFork slows down

PepeFork is inspired by Pepe-The-Frog and is listed on Uniswap and MEXC.

Its market cap rose above $200 million shortly after launch, making it the ninth biggest meme coin.

The total supply of PORK is 420 trillion, and the top 10 owners hold more than 15% of the supply.

You might also like: PEPE meme coin fork PORK above $200m market cap in 48 hours

Currently, PORK is trading between $0.0000003238 and $0.000000837.

Despite a 36% drop from its all-time high of $0.0000009132, the coin is up 122.7% in the last week.

Analysts say the token can rally to $0.000001232 in the coming months.

KangaMoon price forecast

KangaMoon aims to merge socialFi and play-to-earn gaming with meme coins.

Their goal is to create a community steeped in meme culture.

You might also like: Investors closely tracking Injective, Mirror Protocol, and KangaMoon in Q1 2024

Before the official game launch, KANG holders can participate in various challenges and events to earn additional tokens and rewards.

Presently, KANG is trading at $0.005 in the ongoing presale.

Conclusion

Some financial analysts are bullish on Cardano, KangaMoon, and PepeFork in 2024. Although Cardano and PepeFork are down, prices might recover in the future. KangaMoon plans to launch a new platform based on meme coins later this year, possibly supporting KANG prices.

Read more: Study examines USDT and DAI stability, Kangamoon draws investors in presale

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Memecoin craze sees one trader reap over 100k in profits on newly listed DEFROG

By Anna Kharton

By Anna Kharton

February 8, 2024 at 9:28 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

An unknown trader earned $166,000 from the growth of the DEFROGS cryptocurrency in just two days.

Lookonchain analysts say the trader spent 0.26 Ethereum (ETH) to buy 100 DeFrogs coins (DEFROGS), with the user paying 0.178 ETH —about $423 — in gas fees, before selling 60 DEFROGS for 27.8 ETH, approximately $67,000.

The user still has 40 DEFROG coins left at their disposal, leaving a total profit of $166,000 for the trader.

Some speculate that insiders could be responsible for the profits, with one comment on X suggesting that it is often developers of a project who reap the rewards early when a new coin increases in value.

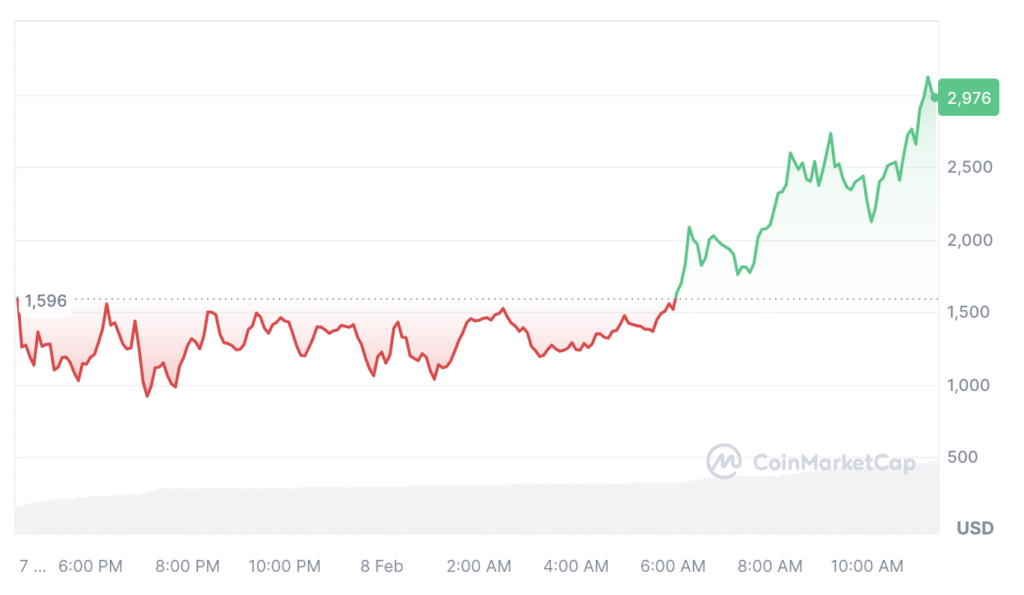

According to CoinMarketCap, over the past 24 hours, the token has risen by more than 85%, increasing in price to $2,930 at the time of writing.

At the same time, DEFROGS, a meme coin created based on the PEPE crypto project, launched only on Feb. 7. The developers claim that DEFROGS is a token of the new ERC-404 standard, which combines the properties of cryptocurrency and non-fungible tokens. As part of the project, the team has initially issued 10,000 tokens. Source: CoinMarketCap

Source: CoinMarketCap

Earlier, an unknown trader purchased 5 ETH ($11,715) worth of PORK tokens seven minutes after trading opened and earned $3.3 million in three days. Of the 9.5 trillion PORK purchased, the trader sold 6.3 trillion PORK for 329 ETH (about $765,000). The remaining 3.2 trillion PORK the trader is holding is worth approximately $2.55 million in unrealized gains.

You might also like: Trader turns 4.3 ETH into $1m after Elon Musk became CTO

READ MORE ABOUT

meme coin

pepe

trading

Solana, Meme Moguls, and Bitcoin lead ahead of bull run

February 8, 2024 at 8:06 am

SPONSORED

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Experts believe that Solana (SOL), Meme Moguls (MGLS), and Bitcoin (BTC) will be leading the next market upswing. While Bitcoin and Solana fell in January, Meme Moguls reached a new all-time high.

Solana’s trading volume drops

Solana’s daily trading volume has decreased by $2.5 billion after a recent correction. Its daily trading volume is now $1.48 billion, making it the 6th most traded cryptocurrency globally.

Although its trading volume has dropped, SOL has been stable in the past week amid a general drawdown in altcoins.

You might also like: Analysts: Solana might soar to 2021 highs of $260

Solana is one of the top-performing altcoins over the last 12 months.

Experts predict that SOL could push towards $150 in Q1 as the ecosystem grows.

Bitcoin price fell in January

In January, 11 spot Bitcoin ETF products were approved and launched.

Even though BTC rose to $49,102, prices are under pressure, falling to $43,115.

You might also like: Crypto assets saw $708m inflows last week; Bitcoin and Solana lead

According to Julio Monero, head of research at CryptoQuant, the price decrease could be because short-term holders took profits.

Many investors question whether this trend will continue before the upcoming Bitcoin halving in April.

Meme Moguls geared for gains

Meme Moguls is a new play-to-earn (P2E) ecosystem that is gaining popularity.

They will showcase their first game preview soon, displaying new features. Investors can test them after the game launches on March 11.

You might also like: Arbitrum and Celestia recovering, Meme Moguls up 42% in presale

The game has raised over $2 million.

MGLS prices are expected to rise from $0.0036 to $0.0042 afterward. However, analysts are overly bullish on the token.

Read more: Litecoin trending higher, Tron traders shift focus to Meme Moguls presale

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

ARK 21Shares revamps Ethereum ETF proposal with cash creation model and staking plan

By Rony Roy

By Rony Roy

February 8, 2024 at 8:06 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

ARK 21Shares has recently adjusted its application for a spot Ethereum exchange-traded fund (ETF), shifting towards a cash-creation model akin to its previously approved spot Bitcoin ETF.

The strategic amendment filed on Feb. 7 also includes plans to stake a portion of the ETF’s Ether (ETH) holdings potentially, aiming to generate additional income through staking rewards.

This move follows the firm’s successful transition of its Bitcoin ETFs to a cash creation and redemption model in December after engaging in discussions with the United States securities regulator.

The transition from an in-kind redemption model, where non-monetary payments such as BTC were used, to a cash-creation model marks a significant strategic pivot. Under the new model, ARK 21Shares will buy Ether corresponding to the order amount and deposit this Ether with the custodian, leading to the creation of ETF shares.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, highlighted this change, stating, “Looks like they updated to be only cash creations and some other things that bring it in line with the recently approved spot BTC ETF prospectus.”

The adaptation is seen as a move to align the Ether ETF closely with the regulatory preferences demonstrated in the approval of Bitcoin ETFs.

You might also like: Standard Chartered foresees Ethereum ETF approval by May 23

However, the adoption of the cash creation model may impact arbitrage transactions conducted by Authorized Participants, which are crucial for maintaining the ETF’s share price in close correlation with Ether’s market price. This complexity underscores the nuanced balance ETF issuers must strike between regulatory compliance and market functionality.

Moreover, ARK 21Shares’ latest S-1 filing introduces the concept of staking a portion of the ETF’s Ether holdings through “one or more trusted third-party staking providers.” While this proposal aims to leverage the income-generating potential of staking, it is accompanied by notable risks, such as the potential for Ether losses through slashing and the requirement for staked Ether to be locked up for extended periods.

The proposal to include staking in the ETF structure has stirred debate among industry observers. Finance lawyer Scott Johnsson pointed out that the staking-related paragraphs being in brackets suggests that the proposal is tentative and subject to regulatory dialogue.

Echoing this cautious stance, James Seyffart, another ETF analyst at Bloomberg, expressed skepticism about the SEC’s willingness to permit staking within spot Ether ETFs, stating, “But time will tell.”

The SEC’s decision on various applications for spot Ether ETFs, including those from ARK 21Shares, VanEck, Hashdex, Grayscale, and Invesco, is eagerly awaited, with a series of deadlines stretching from May to August 2024. However, Seyffart anticipates a collective decision by May 23, mirroring the SEC’s approach to Bitcoin ETFs earlier on Jan. 10.

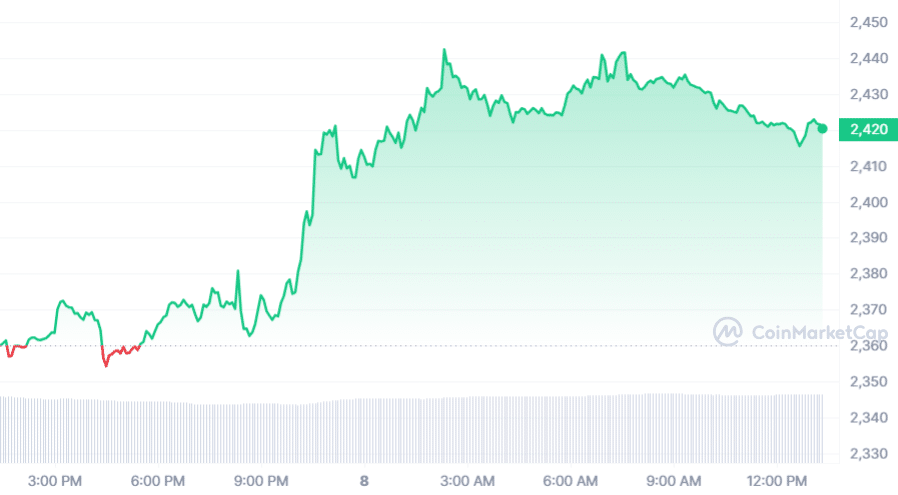

The amendment to ARK 21Shares’ ETF application has not only sparked discussions around regulatory compliance and innovation in the ETF space but also influenced market dynamics. Following the announcement of the updated filing, Ether’s price experienced a notable surge, breaking above $2,400 and marking a two-week high. ETH 24-hour price chart | Source: CoinMarketCap

ETH 24-hour price chart | Source: CoinMarketCap

Read more: Europe leads Ethereum ETF market with $4.6b AUM

READ MORE ABOUT

cryptocurrency

ethereum

ethereum etf

Wormhole to airdrop 1.7b tokens to community members

![]() By Denis Omelchenko

By Denis Omelchenko

February 8, 2024 at 8:04 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

The cross-chain protocol Wormhole has revealed plans to distribute billions of W tokens among community members in a bid to decentralize its governance.

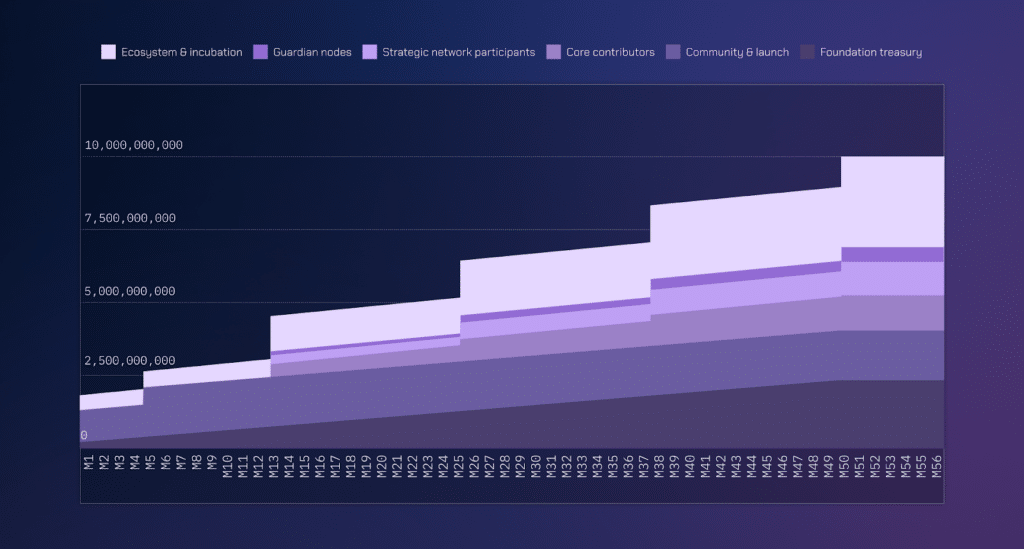

As per a blog post, the Wormhole team allocated 1.7 billion (17% of the total supply) of its native token called W for community airdrop and launch, while the initial circulating supply will be set at 1.8 billion W tokens. The remaining 82% of W tokens will be initially locked, with plans for gradual unlocking over four years.

The protocol will roll out its native token, W, on both Ethereum‘s ERC-20 standard and Solana‘s SPL. Under the token distribution plan, the largest allocation, accounting for 31%, is allocated for ecosystem and incubation, followed by foundation treasury at 23.3%, and core contributors at 12%. Wormhole’s token distribution plan | Source: Wormhole

Wormhole’s token distribution plan | Source: Wormhole

While the snapshot for the community airdrop has already been taken, specific details regarding the distribution criteria remain unclear.

Eventually, Wormhole plans to “progressively decentralize the protocol’s governance to W holders,” the developers said in the blog post, adding that W holders could guide community programs and treasury-related activities.

“The goal of this governance launch is to empower and enable the Wormhole community to address these critical areas with the necessary resources and support.”

Wormhole

Founded in 2021, Wormhole is a cross-chain protocol designed to facilitate interoperability and communication between different blockchain networks.

In November 2023, the protocol raised $225 million at a $2.5 billion valuation from investors Coinbase Ventures, Multicoin Capital, and Jump Trading, which initially incubated the protocol under its digital asset division Jump Crypto. Rather than equity, Wormhole issued token warrants to investors. These warrants guarantee that investors will receive an allocated supply of a crypto token launched by the protocol.

Read more: Wormhole attacker transfers $155m to DEX

READ MORE ABOUT

ethereum

solana

wormhole

Crypto custodian Bakkt discloses to the SEC it is facing liquidity issues

By Anna Kharton

By Anna Kharton

February 8, 2024 at 8:02 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

gains.

Summary

Bitcoin and Cardano are firm and may lift the broader crypto markets. Investors have been watching Everlodge and exploring its growth potential.

Read more: Real-world assets tokenization is new frontier in crypto; Everlodge and Hedera may profit

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Bitmain-backed Bitcoin mining firm BitFuFu eyes going public via SPAC deal

![]() By Denis Omelchenko

By Denis Omelchenko

February 8, 2024 at 7:50 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

Crypto mining company BitFuFu plans to go public on the Nasdaq stock exchange via a SPAC deal with Arisz Acquisition Corp.

According to documents filed with the U.S. Securities and Exchange Commission (SEC), BitFuFu plans to go public under the ticker symbol “FUFU” once the merger with Arisz Acquisition Corp is finalized. The merger is anticipated to receive approval from Arisz’s board by Feb. 24, the document reads.

Following the merger, BitFuFu will issue a total of 150,000,000 ordinary shares to Arisz shareholders at $10 per share.

According to the filing, BitFuFu mined 2,253 BTC in the first half of 2023, valued at over $100.2 million based on current market prices. At that time, BitFuFu managed approximately 131,000 miners, comprising 105,800 leased miners, 20,600 self-owned miners, and 4,600 customer-hosted Bitcoin miners. This equates to a combined mining capacity of 15.2 EH/s, the filing says.

You might also like: Phoenix Group expands mining fleet with $187m Bitmain deal post-IPO

BitFuFu’s operations are understood to be closely linked with Bitmain, a prominent player in Bitcoin mining. In 2021, BitFuFu announced a strategic partnership with Bitmain, saying the latest will use its resources, including operating and maintenance management systems and a stable power supply from its mining farm, to ensure a “premium user experience to BitFuFu clients.”

Founded in 2020, BitFuFu is a cloud mining platform that enables users to participate in crypto mining without needing to set up and manage their own mining hardware. In a press release in early 2022, BitFuFu said in a press release that the merger with Arisz Acquisition represents a pro forma enterprise value of approximately $1.5 billion.

Read more: Bitmain fired employees after salary data leak

READ MORE ABOUT

bitcoin

bitmain

sec

US lawmakers get ‘very, very close’ to agreement on stablecoin bill

By Anna Kharton

By Anna Kharton

February 8, 2024 at 7:42 am Edited by Dorian Batycka

Edited by Dorian Batycka

NEWS

Collect the article

share

Rep. Maxine Waters said U.S. lawmakers are inching closer to reaching an agreement on stablecoin legislation.

In an interview with Politico Pro, Waters said on Feb. 7 that negotiators are “very, very close” to reaching an agreement on stablecoin legislation.

The House Financial Services ranking member spent months trying to reach a compromise with Committee Chairman Patrick McHenry (R-N.C.) on how to regulate stablecoins, cryptocurrencies pegged to assets such as the U.S. dollar. Her comments in the interview are the first real sign that these conversations have moved forward, the publication notes.

“That’s what’s important to me: Our central bank should have the power of oversight and the ability to be at the head of this.”

Maxine Waters, member of the House of Representatives

Last April, the U.S. House Financial Services Committee released a bill regulating stablecoin issuers. A note on the Committee’s website stated that adopting a law on stablecoins at the federal level will reduce companies’ costs involved in their issue. According to the authors, these tools can improve the efficiency of electronic payments but are associated with significant risks.

Considering the rapid development of the cryptocurrency market, its risks, and opportunities, the U.S. authorities see the need for legislative regulation citing the collapse of Terraform Labs and FTX.

You might also like: Congressman pushes for limits on SEC crypto enforcement funds

READ MORE ABOUT

lawmakers

regulation

stablecoin

u.s. house of representatives

Flare and Polkadot bullish, Pullix lists on CoinGecko ahead of launch

February 8, 2024 at 7:16 am

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto markets are volatile and notoriously unpredictable. However, recent developments suggest that Polkadot (DOT) and Flare (FLR) may rally. Meanwhile, Pullix (PLX) is set to launch in less than 70 days, having been listed on CoinGecko.

Polkadot is steady but bullish

DOT lost roughly 7% in the past month, falling from its year-to-date peak of over $9 in December to an average of $6.7 in February.

You might also like: BitCountry’s InnoVoy Event aims to transform Polkadot’s identity landscape

Meanwhile, DOT is up 3% in the past week, with experts expecting a recovery in the months ahead.

Flare rallying

Flare lost about 16% in 2023 but the token is up 90% in the past 30 days.

The expansion is behind rising trading volume and market cap.

According to Digitalcoinprice, FLR may rally to $0.07 by the end of 2024.

Pullix is rising, listed on CoinGecko

Investors are exploring Pullix in Q1 2024.

PLX has been pre-listed on CoinGecko and has over 15,000 investors. The token is listing in less than 70 days.

The presale has raised almost $5 million.

You might also like: Avalanche and Cardano volatile, Pullix launching in 30 days

Pullix is a hybrid exchange that aims to synergize the best features of centralized and decentralized platforms.

The platform is a trade-to-earn platform where members can trade multiple cryptocurrencies.

Pullix will also implement a token burn feature to keep the token scarce. There is a profit share model, where token holders earn a percentage of revenue.

The presale is in its last two stages, where PLX is selling for $0.10.

There is a 10% bonus for presale investors.

Read more: Analysts endorse Helium and Pullix, back to all-time highs?

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Investors sue NBA over ties with Voyager following $4.2b loss

By Mohammad Shahidullah

By Mohammad Shahidullah

February 7, 2024 at 9:54 pm Edited by Brian Stone

Edited by Brian Stone

NEWS

Collect the article

share

The NBA faces a lawsuit due to its promotional associations with the now-defunct cryptocurrency exchange Voyager Digital Holdings Inc.

According to investors, the partnership is responsible for financial damages amounting to $4.2 billion. According to Bloomberg reports, accusations of severe negligence have been leveled against the NBA for its promotional agreement involving Voyager and Mark Cuban, the previous Dallas Mavericks’ majority owner.

The legal action follows a prior lawsuit against Cuban for his endorsement of what is now deemed a fraudulent and unregulated venture. In 2022, investors charged Mark Cuban with deceit over Voyager’s security assurances, alleging that his representations contributed to their financial losses. Cuban has dismissed these accusations as completely unfounded.

You might also like: Former bank CEO Charged in $47m crypto embezzlement case

Additionally, the Commodity Futures Trading Commission has pursued legal action against Voyager’s co-founder Stephen Ehrlich, accusing him of deceptive practices in managing a digital asset trading and custody platform. Ehrlich has countered these allegations, claiming his designation as a “scapegoat” for others’ misconduct.

The lawsuit highlights a broader trend of NBA teams engaging in promotional activities with cryptocurrency entities, including the beleaguered FTX exchange. FTX’s collapse led to fraud convictions for its founder, Sam Bankman-Fried.

Read more: Dymension sees 55% surge within hours of mainnet debut

READ MORE ABOUT

lawsuit

nba

voyager

Hedera price spikes 15% as Saudi Arabia government invests $250m

By Ibrahim Ajibade

By Ibrahim Ajibade

February 7, 2024 at 9:39 pm Edited by Brian Stone

Edited by Brian Stone

MARKETS

Collect the article

share

HBAR price rose 15% on Feb. 6 to reach a 20-day peak of $0.78, hours after the Hedera team confirmed a $250 million agreement with the Saudi Arabian Ministry of Investment.

Hedera’s recent five-year partnership agreement with the Saudi Arabian government has initiated positive price action. But notably, a vital market metric suggests derivatives traders could scuttle the HBAR price rally.

Hedera price soared 15% as investors reacted to Saudi partnership

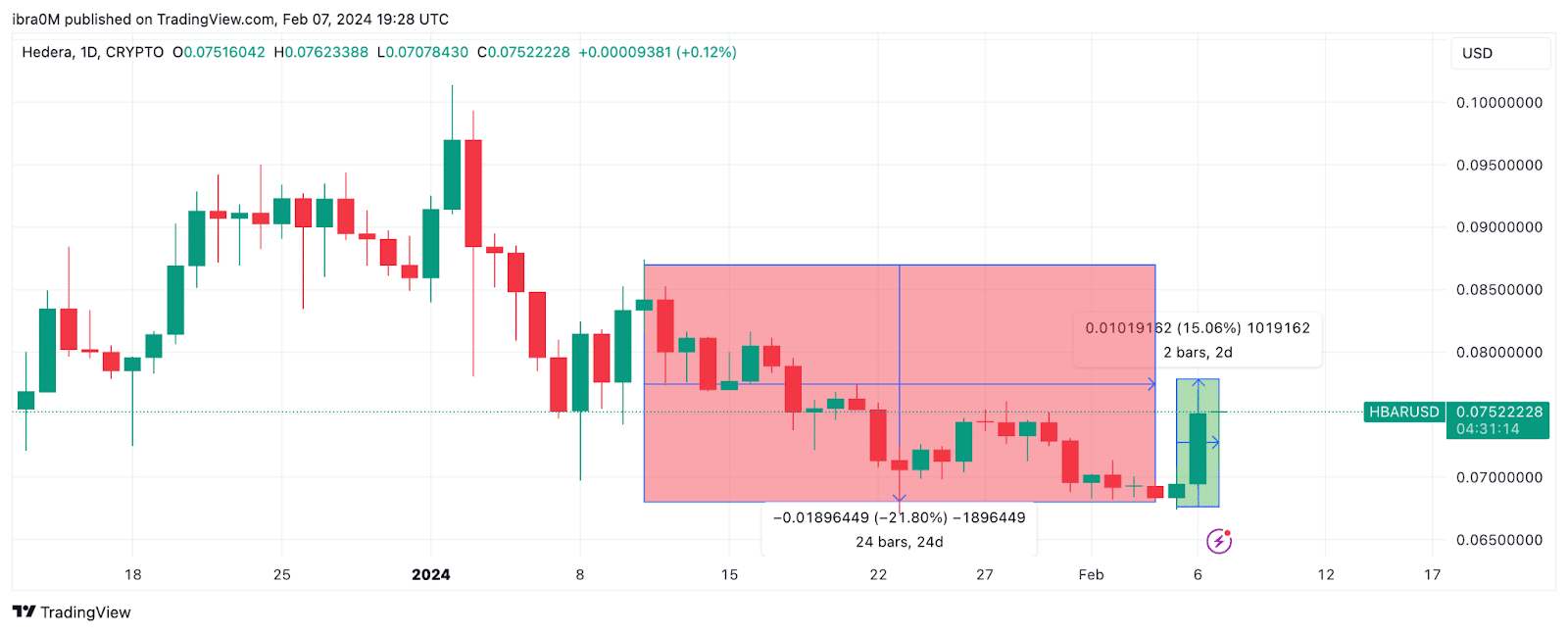

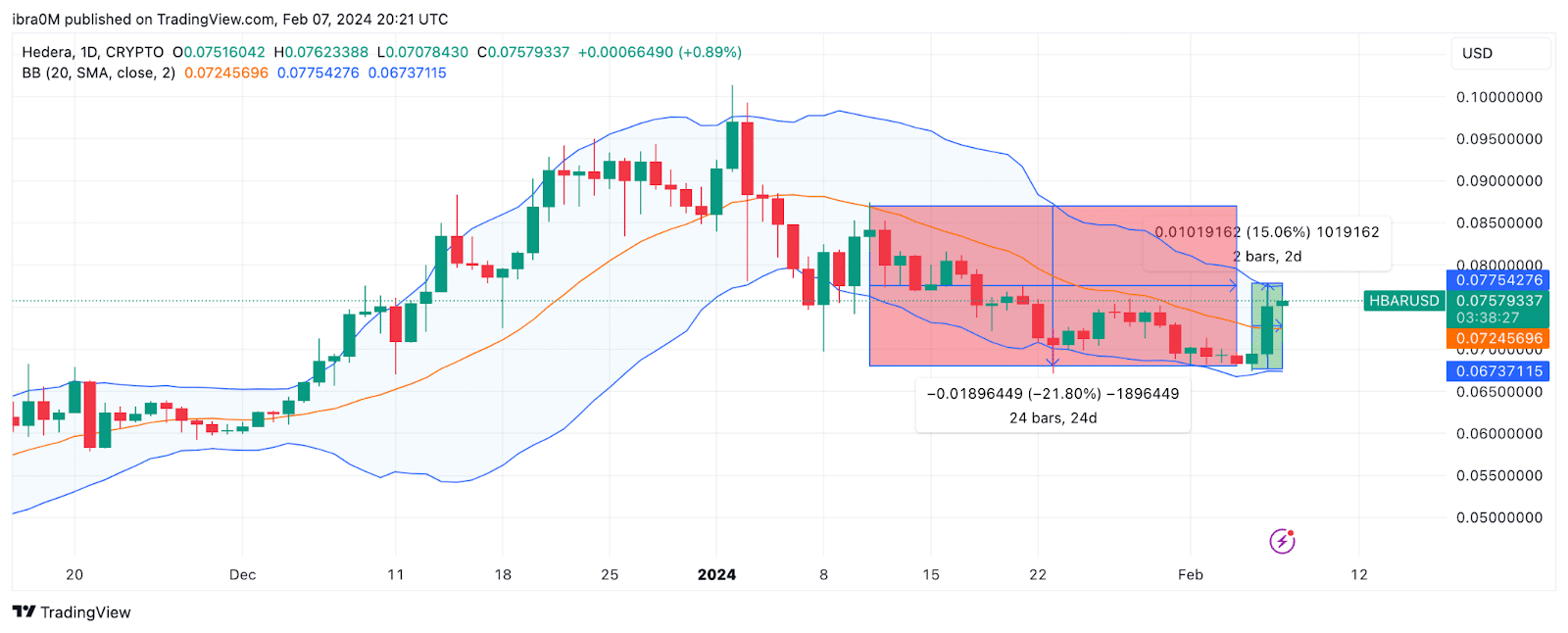

HBAR price has been trending down since the crypto market correction that heralded the Bitcoin ETF approval in mid-January.

The Hedera blockchain native coin had tanked 22% between Jan. 11 and Feb. 5, But the momentum flipped bullish following the announcement of Hedera’s partnership with the Saudi Arabian government on Feb. 6. Hedera (HBAR) Price Action Jan. 11 to Feb. 7, 2024. Source: TradingView

Hedera (HBAR) Price Action Jan. 11 to Feb. 7, 2024. Source: TradingView

Details of the partnership outlined an investment plan enabling companies to create advanced technological solutions at the newly launched DeepTech Venture Studio in Riyadh.

In a dramatic turn of events, HBAR price gained 15%, rising from $0.69 to $0.77 within 24 hours of the announcement, as depicted in the chart above.

Speculative traders placing large bets on retracement

The rare rally sent Hedera to a 20-day peak after three consecutive weeks on the back foot. However, a vital market metric shows that speculative traders may scuttle the recovery phase.

Coinglass’ funding rate metric tracks real-time swings in fees paid by long and short trades in the derivatives markets to keep their contract positions open.

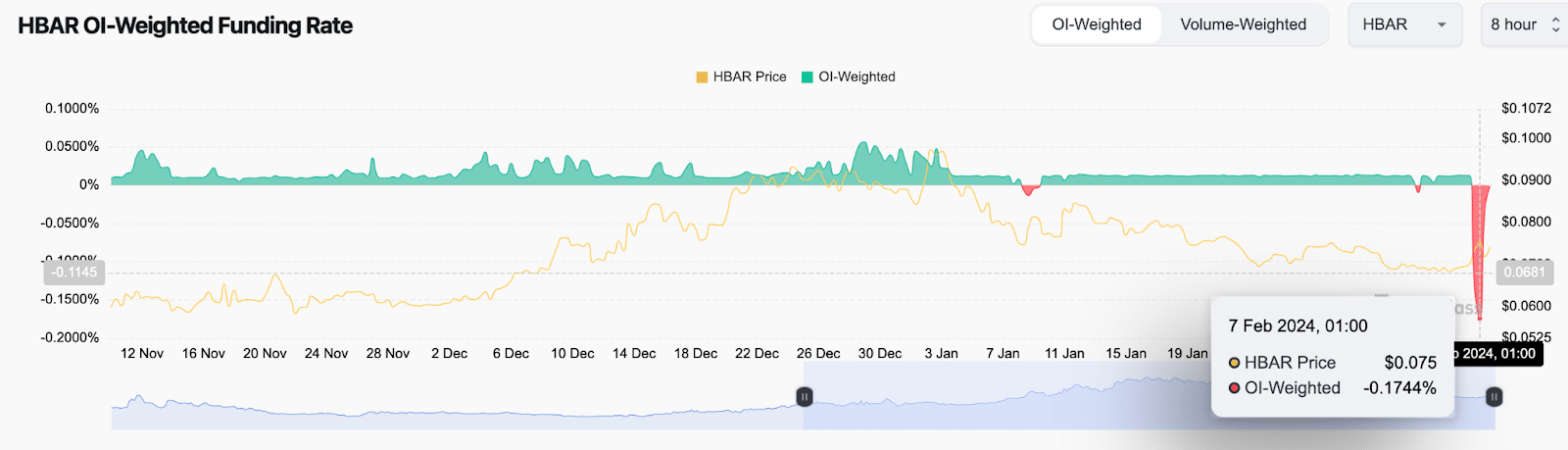

The HBAR funding rate has recorded a noticeable decline in the negative zones as market activities swung bullishly in the spot markets. A close look at the chart below shows that the funding rate sank to a 90-day low of -0.02% on Feb. 7.

When the funding rate rapidly swings negative during a rally, most speculative short traders pay record fees to keep their futures position open in hopes of booking profits when prices fall.  Hedera (HBAR) Funding Rate vs. Price | Source: CoinGlass

Hedera (HBAR) Funding Rate vs. Price | Source: CoinGlass

Essentially, the negative trend in HBAR funding rates implies that the prevailing sentiment in the derivatives markets is skeptical about the sustainability of the price rally. If the bulls fail to counteract these positions and establish a stronger upward momentum, HBAR spot prices could soon be at risk of a sharp downturn.

HBAR price forecast: Bears could target $0.65

Drawing inferences from the market data trend analyzed above, the bullish impact of the $250 million Saudi Arabia partnership on Hedera price could be shortlived.

And having recently traded as low as $0.67 on Feb. 5, before the recent rally, the bears could set their sights on a more audacious downswing below $0.65 during the next attempt.

However, the Bollinger band’s technical indicator shows that the bulls could mount a formidable support line around the $0.67 area. But if that support level cannot hold steady, a bearish reversal toward $0.60 could be on the cards.  Hedera (HBAR) Price Forecast following Saudi Arabian partnership, Feb. 2024. | Source: TradingView

Hedera (HBAR) Price Forecast following Saudi Arabian partnership, Feb. 2024. | Source: TradingView

On the upside, if the bulls can build on the momentum from the Saudi partnership, they could invalidate this negative Hedera price prediction by staging a $0.80 retest.

However, as depicted by the upper Bollinger band in the chart, a looming sell-wall at $0.78 could scuttle the rally.

You might also like: Hedera, Saudi Ministry ink $250m deal to drive web3 development

READ MORE ABOUT

hedera

price analysis

saudi arabia

Craig Wright trial day 3: Wright presents 2008 documents citing Bitcoin Cash

By Mohammad Shahidullah

By Mohammad Shahidullah

February 7, 2024 at 9:31 pm Edited by Brian Stone

Edited by Brian Stone

NEWS

Collect the article

share