Make Your $JUP Airdrop More Valuable

The statistics shown in the image below show that Jupiter is number one among the dexes used.That’s why the airdrop will be valuable. Okey lets go  Our strategy is to earn $USDC and $JUP by using DYMM to claim the airdrop and $Met tokens because you are using Meteora (@MeteoraAG).

Our strategy is to earn $USDC and $JUP by using DYMM to claim the airdrop and $Met tokens because you are using Meteora (@MeteoraAG).

To get started, you can read this post.to recap how DLMM works

Add liquidity to a single-sided DLMM pool for JUP

Let's select the liquidity pool in which you want to open a position.

- JUP/USDC (Bin steps: 125, Fee tier: 0.25%): https://app.meteora.ag/dlmm/6N1nUDCC9gkbRaA2X2G2feuoZJk3KWFpGzHgqvSMAusq SGDFG

- JUP/SOL (Bin steps: 125, Fee tier: 0.25%): https://app.meteora.ag/dlmm/9DFwVTwFYYvQFmr9iSV6tQ5TW2CgXU82pgAU7B4Cd6LF

Take a look at the JUP/USDT pool as an example

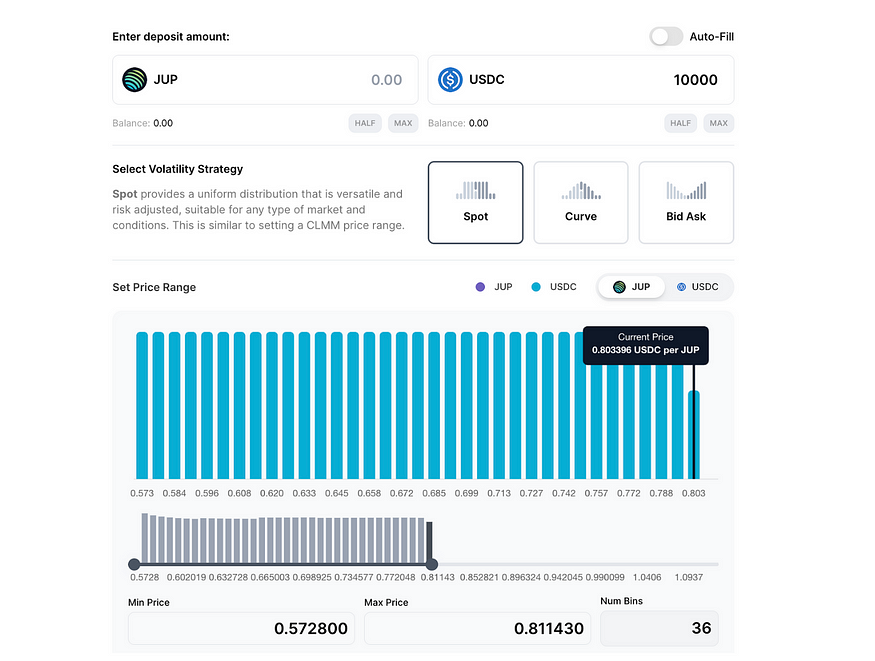

Spot

In this pool example, the active price is preset at 0.811430 USDC per JUP, so you can add USDC and can set a range of minimum 0.572800 USDC per JUP and maximum 0.811430 USDC per JUP. After launch, if JUP continues to fall further within your range and trades occur, the active price would move to the left and your initial USDC waiting there will be swapped out for JUP. If JUP price reaches all the way down to 0.572800 USDC, your position would only have JUP as all your USDC would have been used. If the JUP price is out of your range, your position is inactive and your liquidity gets untouched.

After launch, if JUP continues to fall further within your range and trades occur, the active price would move to the left and your initial USDC waiting there will be swapped out for JUP. If JUP price reaches all the way down to 0.572800 USDC, your position would only have JUP as all your USDC would have been used. If the JUP price is out of your range, your position is inactive and your liquidity gets untouched.

As this is a Spot strategy, your USDC liquidity is uniformly distributed and you would be acquiring JUP at the same rate at every bin and price point.

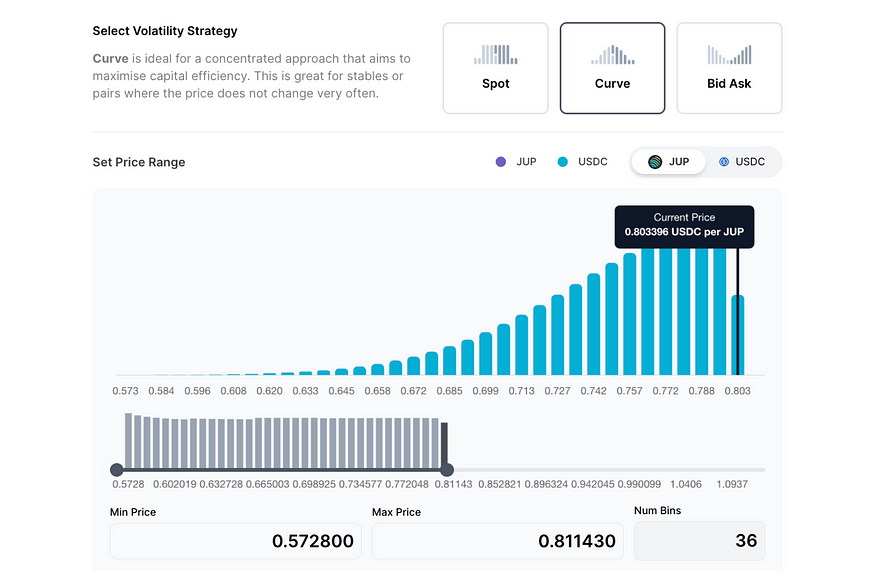

Curve

Using the same pool example above but with the Curve strategy, your liquidity is more concentrated when it is closer towards the current preset active price of 0.811430 USDC per JUP. This means that if JUP price hits 0.811430 USDC and continues dropping, more of your USDC is being swapped out for JUP near the 0.811430 USDC price point. As the price falls further, a decreasing amount of USDC in each price point is used. This strategy may be useful if you feel that JUP is more likely to be traded closer to 0.811430 USDC.

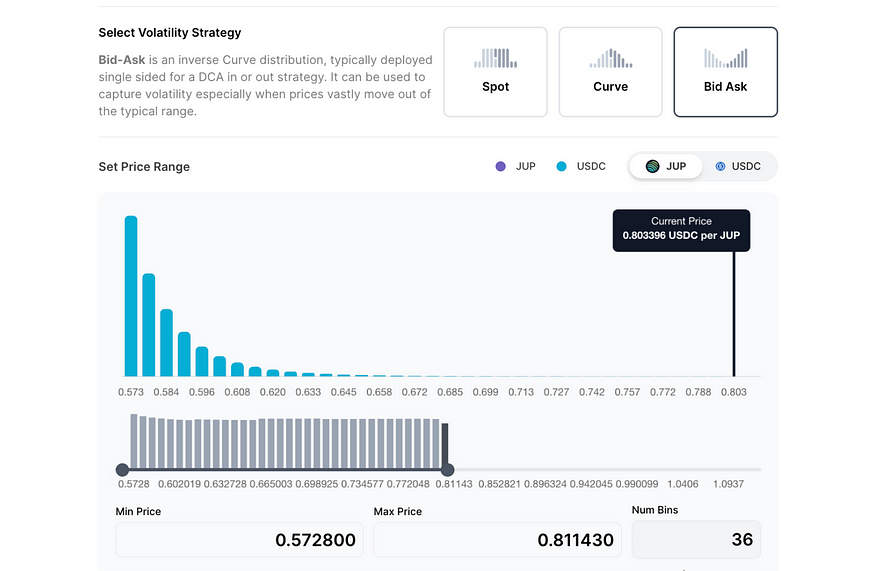

Bid-Ask

Conversely, when compared to the Curve strategy, the Bid-Ask strategy makes your liquidity more concentrated further away from the current preset price of 0.811430 USDC per JUP. When JUP price falls below 0.811430 USDC and moves towards the left, your USDC is being swapped out for JUP at an increasing rate. More of your USDC is used as the price falls further left and towards the minimum of 0.572800 USDC. This strategy may be useful if you feel that JUP is more likely to be traded closer to 0.572800 USDC. 🤩🤩Congratulations!

🤩🤩Congratulations!

• You earned $JUP and $USDC or $SOL by farming with the DLMM pool.

• You have accumulated points for the Meteora $MET Airdrop.

Thanks for read 😊