Five Risk Management Strategies

What is risk management?

Risk management is the process of identifying, assessing, and taking steps to reduce or eliminate the potential for negative events to impact an organization, project, or individual. It's a proactive approach to dealing with uncertainty.

Why is Risk Management Important?

- Protects Assets: Prevents damage to an organization's resources, both tangible (buildings, equipment) and intangible (reputation, data).

- Enhances Decision-Making: Helps make informed choices by weighing the potential risks and rewards of different courses of action.

- Improves Stability: Makes operations and finances more predictable, minimizing surprises.

- Increases Business Confidence: Shows stakeholders (investors, employees, and customers) that the organization is prepared and responsible.

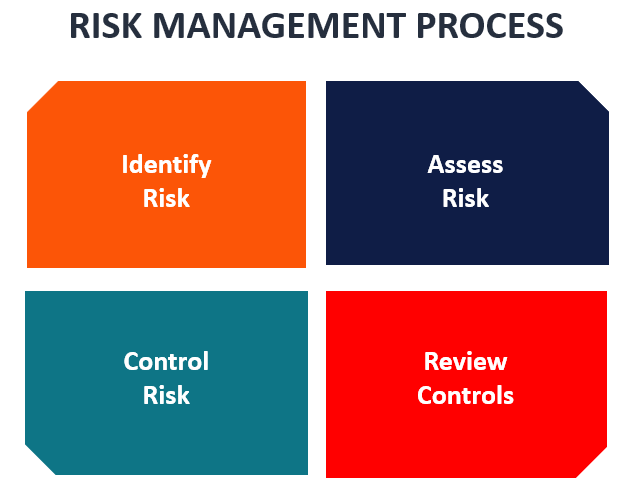

The Risk Management Process

The risk management process typically involves these steps:

- Identification: Brainstorming potential risks that could affect the project, organization,

- Assessment: Analyzing the likelihood and the potential impact of each identified risk.

- Prioritization: Ranking risks from most serious to least serious.

- Response Planning: Developing strategies for dealing with each risk. Typical responses include:Avoidance: Eliminating the possibility of the risk occurring.

- Mitigation: Taking steps to reduce the likelihood or impact of the risk.

- Transference: Shifting the risk to a third party (e.g., insurance).

- Acceptance: Recognizing a risk may occur and planning how to handle it.

5.Monitoring and Control: Ongoing review of the effectiveness of the risk management plan and making adjustments as needed.

Example

Let's say a construction company is building a bridge. Here's how risk management might be applied:

- Identification: Potential risks could include weather delays, worker injuries, supply chain problems, and design flaws.

- Assessment: The company would assess how likely each of these risks is to happen and their potential damage if they did happen.

- Prioritization: Worker injuries might be prioritized as the highest risk based on severity.

- Response Planning: Safety training, backup suppliers, and insurance policies could all form a risk management response.

- Monitoring and Control: Ongoing site inspections and updates to the plan would keep the process on track.

Four key risk management planning methods

1. SWOT Analysis

- What it is: SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. This method analyzes both internal and external factors that could influence a project or organization.

- How it helps with risk:Strengths and opportunities can point to areas where proactive risk management can maximize advantages.

- Weaknesses and threats highlight areas of vulnerability and the types of risks you might need to plan for.

2. Root Cause Analysis

- What it is: A problem-solving method aimed at identifying the underlying cause of a problem or risk, rather than just addressing the symptoms. Tools like the "5 Whys" or fishbone diagrams are often used.

- How it helps with risk: Identifies hidden contributing factors to risks allowing you to plan mitigations that address the root of the issue, often preventing potential issues entirely.

3. FMEA (Failure Mode and Effects Analysis)

- What it is: A structured approach to identifying ways a product, process, or system might fail. Analyzes failure points, their likelihood, effect, and how they may be detected.

- How it helps with risk:Proactive identification of potential problems

- Prioritizes risks based on severity and helps establish safeguards

- Often used in engineering and manufacturing

4. Scenario Planning

- What it is: Imagining different possible futures and what the implications would be for the organization or project. Usually a few specific 'scenarios' are developed (e.g., best case, worst case, most likely).

- How it helps with risk:Forces consideration of unexpected potential risks by thinking beyond “business as usual.”

- Allows for the development of contingency plans for a range of outcomes

Important Notes:

- Methods overlap: These methods can be used in combination for even better results. For example, root cause analysis could be used within scenario planning to dig into worst-case events.

- Choice depends on your situation: There's no single "best" method. Factors like the nature of the project and the specific risks will determine which approach is most suitable.

Why is a risk management strategy important in crypto?

1. High Volatility: The crypto market is famous for its extreme price swings. Coins can gain or lose significant value in a matter of hours or days. Without risk management, these fluctuations can lead to devastating losses.

2. Emerging Market: Cryptocurrency is still a relatively new and developing market. Regulations are evolving, and there's less established infrastructure compared to traditional financial markets. This can increase uncertainty and create unanticipated risks.

3. Security Risks: Crypto exchanges and wallets are frequent targets for hackers. Theft or loss of assets due to security breaches is a major risk that requires focused mitigation strategies.

4. Complexity: The technical and economic aspects of cryptocurrency can be difficult to understand for many. This makes it easy to make uninformed investments that carry a high level of risk.

How a Risk Management Strategy Helps

- Controlled Exposure: Setting limits on how much you invest in different cryptocurrencies ensures your portfolio isn't overly vulnerable to any single asset's volatility.

- Preservation of Capital: Techniques like stop-loss orders can help to automatically sell and salvage some capital if an asset's price drops sharply.

- Informed Decision Making: Taking the time to assess risk forces you to research a project in more depth and look beyond hype, fostering better choices.

- Psychological Preparation: Having a plan in place for how you'll respond to losses helps reduce the likelihood of panic selling or emotional trading during downturns.

- Protection against Vulnerabilities: Robust security practices and diversification across exchanges can reduce the impact of hacks or sudden exchange closures.

Important Note: Crypto risk management is NOT about eliminating risk completely; that's impossible in this space. It's about understanding the risks involved and minimizing their impact on your investments.

Check Out My Latest Blogs:

1- Don't Get Hooked:Crypto Phishing Scams (Great)

2- Demystifying the Portal to Web3: Your Guide to Web3 Wallets (Great)

3- A beginner-friendly guide to sidechains: Everything you need to know about it (Brilliant)

4- How to Grow Your Savings (Brilliant)

5- Trump's CBDC Blockade (Brilliant)

6- Tips to Secure Your Cryptocurrency Holdings (Brilliant)

7- Demystifying NFT Loans: Risks, Rewards, and How They Work (Brilliant)

8- What Is a Hardware Wallet and Why You Should Use It (Brilliant)

9- Trading Psychology: How to Trade Without Emotions (Brilliant)

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)