Bitcoin Bull Flag Could Predict 10% Surge To $77,000, Analyst Explains

An analyst has explained that a breakout from a bull flag pattern could lead Bitcoin to surging towards a new all-time high of $77,000.

Bitcoin Has Been Forming A Bull Flag Pattern Recently

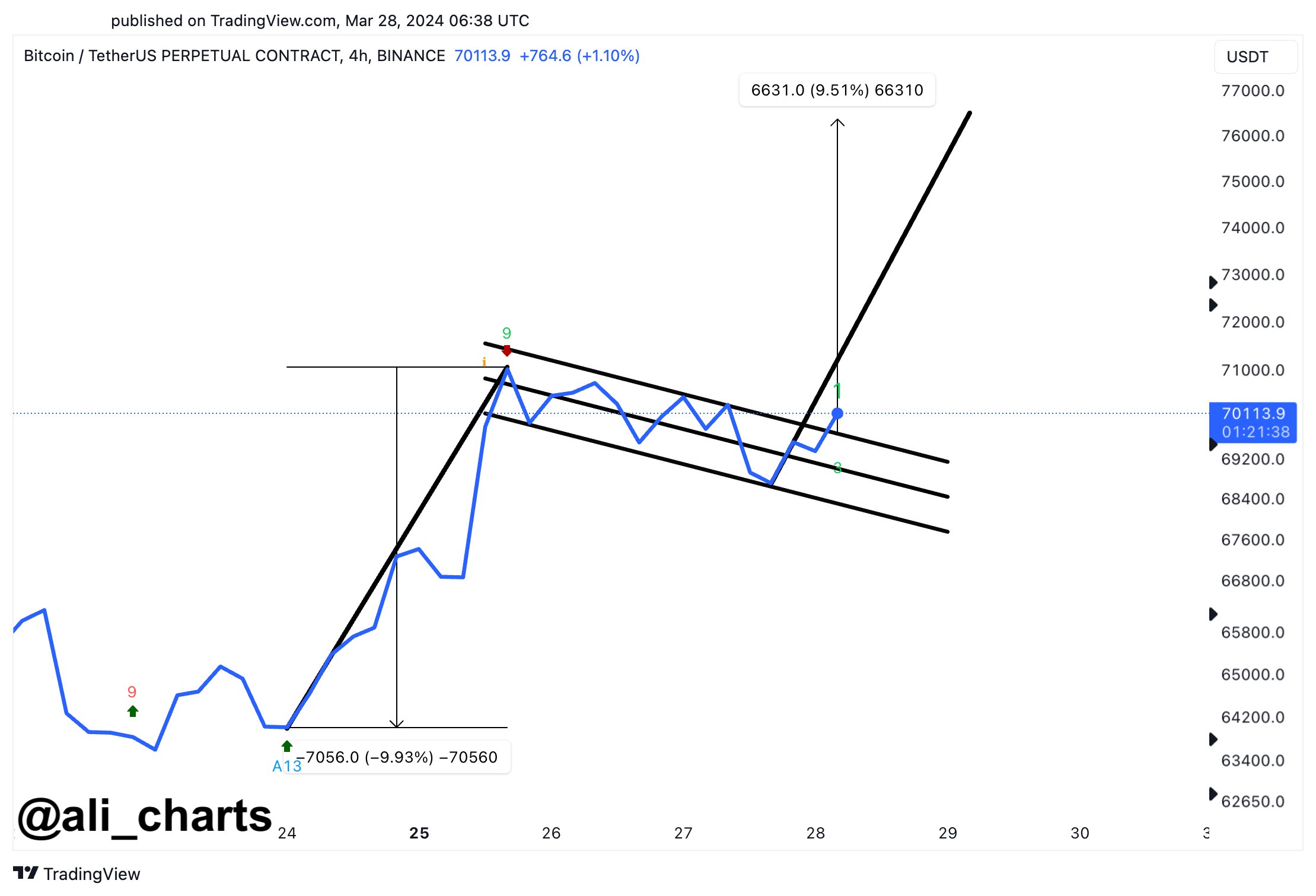

In a new post on X, analyst Ali has discussed about a bull flag recently forming in the 4-hour price of the cryptocurrency. The “bull flag” here refers to a pattern in technical analysis that, as its name implies, looks like a flag on a pole.

In this pattern, a sharp uptrend is succeeded by a period of consolidation towards the downside. The uptrend makes up for the pole, while the consolidation period acts as the flag.

Related Reading: Dogecoin Soars 17% To Break $0.21 As Volume Explodes

When the price is trapped inside the flag, it tends to find resistance at its upper line, so tops may be probable to form there. Similarly, the lower line may act as support, thus facilitating for bottoms to take shape.

The bull flag is usually considered to be a continuation pattern, meaning that the prevailing trend (that is, the trend of the flag) would continue once the consolidation period is over.

This happens when a break above the resistance line takes place. The uptrend emerging out of such a break may be of the same height as the pole. If the asset falls under the support line, though, the pattern could be considered invalidated.

Like the bull flag, there is also the bear flag pattern, which works similarly except for the fact that the pole in this case corresponds to a downtrend while the flag is generally a consolidation channel angled upwards. Just like the bull flag, a continuation of the prevailing bearish trend may follow this formation.

Now, here is the chart shared by Ali that shows the bull flag that BTC’s 4-hour price has recently been consolidating inside:

Looks like the price of the asset has been breaking out of this pattern recently | Source: @ali_charts on X

From the graph, it’s visible that the 4-hour Bitcoin price has appeared to have been consolidating inside this bull flag over the last few days. It’s also apparent that, in the past day, BTC has been climbing above the resistance line of the pattern.

This could mean that the cryptocurrency is preparing a break out of this formation. Naturally, the asset would have to show more momentum before the breakout can be confirmed.

Related Reading: Bitcoin “Liquid Inventory Ratio” Hits All-Time Low, What It Means

“If BTC holds above $70,000, we could see a surge of nearly 10% to a new all-time high of $77,000!” says Ali. The analyst has chosen this target as such a swing would be of the same length as the pole that had preceded this flag.

BTC Price

Bitcoin has so far been heading in a direction that would add more credence to the breakout, as its price has now broken past the $71,300 level. With this surge, BTC investors would be enjoying profits of more than 7% over the past week.

The price of the asset appears to have surged over the past 24 hours | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Are Old Bitcoin Whales Selling Or Mitigating Risks Using Spot BTC ETFs?

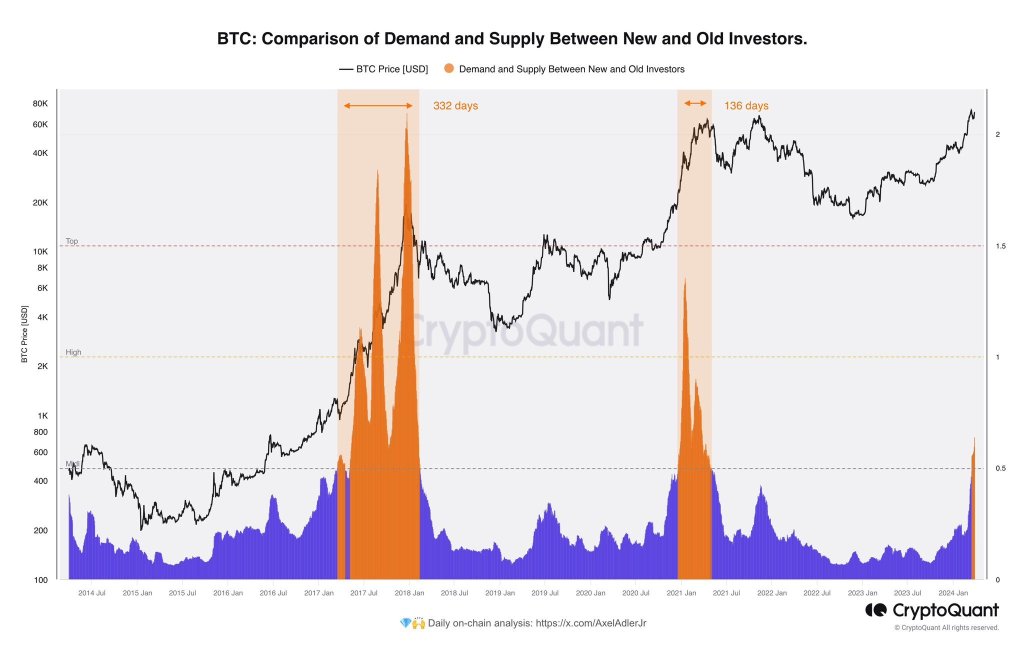

Ki Young Ju, the founder of CryptoQuant, a blockchain analytics firm, has noticed a curious trend. In a post on X, the founder shared a snapshot suggesting that Bitcoin “old whales” might be shifting their holdings to “new whales,” mainly traditional finance heavyweights like Fidelity and BlackRock.

The United States Securities and Exchange Commission (SEC) recently approved these new whales to list spot Bitcoin exchange-traded funds (ETFs) for all investors.  Bitcoin old Whales moving holdings | Source: Analyst on X

Bitcoin old Whales moving holdings | Source: Analyst on X

“Old Whales” Moving Coins: Selling Or Risk Mitigation?

While a definitive sell-off isn’t confirmed, commentators replying to the founder’s post believe these “old whales” could be mitigating risk. In their assessment, moving their Bitcoin stash from self-custody to a regulated investment vehicle like spot Bitcoin ETFs is a better measure of covering unexpected eventualities.

Related Reading: Crypto Exec Reveals Why Meme Coins Are The Next ‘Trojan Horse’ For Crypto Adoption

If this is the approach, then it could prove strategic. Bitcoin holders can transact without depending on a third party. Notably, this development coincides with a significant drop in BTC inventory on major exchanges like Coinbase and Binance, as well as at GBTC.

The decline has accelerated since the introduction of spot Bitcoin ETFs, hinting at a potential departure from exchanges. Meanwhile, the operators of GBTC are unwinding the product and converting it to a spot Bitcoin ETF following a court decision.

Will Spot BTC ETFs Gain Traction?

Even so, that “old whales” are moving their coins to centralized products like ETFs contradicts the core philosophy of BTC as a tool for financial self-sovereignty. Whether more users, mainly retailers, will choose to own spot Bitcoin ETF shares rather than the underlying coins directly remains to be seen.

Related Reading: Fantom: Market Slowdown Chops Off 10% From Gains – Here’s Why

Institutions might be obliged by law to use a regulated product if they need to be exposed to BTC. However, retailers can choose to buy directly from exchanges or mine. This freedom might lead to more retailers opting to buy BTC.Bitcoin price trending upwards on the daily chart | Source: BTCUSDT on Binance, TradingView

This trend emerges ahead of the highly anticipated Bitcoin halving. This event is set for mid-April 2024 and will further reduce BTC’s circulating supply, potentially driving higher prices. Before then, BTC prices are firm, steady above $70,000 at the time of writing.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: bitcoinbitcoin pricebtcBTCUSDTspot Bitcoin ETFs

Shiba Inu Going To $0.0001: Crypto Analyst Reveals What Will Drive The Rally

Shiba Inu has gone on various price spikes in the past few months amidst a surge in activity and interest in the meme coin. This price movement has prompted traders and analysts to ponder on when SHIB can reach the much coveted $0.0001 mark, a price level which it has largely failed to reach despite the impressive price action.

Micheal_EWPro, a crypto analyst, posted an analysis on when SHIB could potentially reach the $0.0001 price level. According to him, the current dynamics could push SHIB above $0.0001 in June. Interestingly, his price prediction is based on the Elliott Wave Theory.

Analyst Reveals SHIB Is Going To $0.0001

According to the SHIB chart shared by Michael on the 3-day candlestick formation, the meme coin’s price formation since 2022 has largely followed the Elliott Wave count. The Elliot Wave Theory is basically a technical analysis method that analyses price movement traditionally in terms of a 5-wave move in the direction of the larger trend and a 3-wave correction in the opposite trend.

Related Reading: XRP Price Enters Pre-Bull Rally Phase: Crypto Analyst Reveals Next Target

Each of these Elliott Wave can be further subdivided into various patterns of smaller degree impulses based on their formations. However, all the subdivisions add up to one larger wave impulse.

Using this knowledge of Elliot Wave Theory, the analyst noted that SHIB has started the formation of the third of five larger degree waves since October 2023 albeit with smaller degree impulses which he labelled as i, ii, iii, iv, and v. Traditionally, the third Elliot Wave is usually the largest and most powerful wave in a trend where most of the price action takes place. As a result, his analysis points to the third wave ending at a price just above $0.0001 in the first week of June.

The analyst did implore a take-profit at $0.00008854 and a final price target of $0.00010191, while also noting that the bulls still have some work to do before this price point can come to a reality.

$SHIB bulls got a little work to do here on 3D but after that I think it sends to my sub 5 TP pic.twitter.com/YQLQqw8bxH

— BigMike7335 (@Michael_EWpro) March 24, 2024

What’s Next For Shiba Inu?

Shiba Inu has reversed since reaching $0.00004456 and has majorly traded between $0.000030 and $0.0000275 since the beginning of the week. However, analysts and SHIB enthusiasts remain positive, especially with SHIB securing a listing on an Australian-based crypto exchange.

Related Reading: The Road To $100,000: Bitcoin Whale Accumulation Explodes

This positive sentiment recently pushed SHIB to second place in crypto searches. At the same time, Shiba Inu’s layer-2 platform, Shibarium, has seen its TVL surging to a new high of $3.9 million.

At the time of writing, SHIB is trading at $0.00003097, up by 14% in the past seven days.

SHIB price at $0.000031 | Source: SHIBUSDT on Tradingview.com

Featured image from TronWeekly, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: analystcryptocrypto analystcrypto newsSHIBSHIB newsSHIB priceShiba InuShiba Inu newsShiba Inu PriceSHIBUSDSHIBUSDT

Shiba Inu Climbs To Second Spot In Crypto Searches As SHIB Rallies

The ever-vibrant Shiba Inu community is thriving once more as SHIB gains widespread recognition surpassing top cryptocurrency assets in the market to become the second most sought-after digital asset in the entire European continent, securing its stance in the crypto landscape.

Shiba Inu Takes Europe By Storm

XRP enthusiast and market expert Marcel Knobloch, also known as Collin Brown, reported the coin’s latest milestone on X. According to Brown, Shiba Inu has seen significant growth in its long-term investor base, taking Europe by storm by becoming the second most search crypto in the continent.

Brown noted that the milestone is reminiscent of the peak of 2021, having rallied a startling 300% in just 8 days. SHIB’s interest is not limited to Europe, and it has taken the top spot on search charts all the way from Italy to Nigeria.

Related Reading: Shiba Inu Takes Over The Internet: Google Searches Climb As Global Interest Surges

As a result of the development, WazirX’s poll has crowned SHIB the king of meme cryptos. Thus, Collin Brown has urged the cryptocurrency space to watch out for Shiba Inu, noting that the Shiba pack is at the forefront of the race.

The rankings were determined following a comprehensive analysis of Google Trends data in the past 1 year in order to ascertain the cryptocurrency that, based on searches, each nation in Europe desires to invest in. After gathering collective data, the findings showed a noteworthy pattern that indicated changes in people’s interest in the crypto market.

Shiba Inu went past notable coins like Ethereum (ETH) – the second largest crypto asset, Cardano (ADA), and Dogecoin (DOGE) – the largest meme coin, securing the top pick in about 7 European countries. These include Russia, France, Italy, the United Kingdom, and among others.

Meanwhile, Bitcoin (BTC) – the largest crypto asset remains the most searched coin in the continent acquiring top choice in about 21 European nations, such as Poland, Germany, Belgium, Romania, etc.

Latest Milestone Buttresses SHIB’s Price

SHIB’s recent achievement displays a constant rise in its interest, reflecting the trust of its community members around the world. In addition to bolstering SHIB’s standing, this ranking indicates that European investors are considering adopting the token even more.

Related Reading: Shiba Inu Ecosystem Blooms: BONE Jumps 44% With $3 Target In Sight

Following the project’s landmark, the Ethereum-based memecoin has managed to secure gains of over 18% in the past week. SHIB has experienced a rebound to the $0.000030 threshold, after falling as low as $0.000025 during the start of the week. With the memecoin market demonstrating momentum presently, SHIB might be poised for more significant gains in the coming months.

Consequently, SHIB’s rise to the aforementioned price has taken advantage of the market’s general recovery and its seven-day upswing. As of the time of writing, Shiba Inu was trading at $0.0000305, indicating a decline of 1% in the past day. Meanwhile, its trading volume and market cap have decreased by over 1% and 16%, respectively. SHIB trading at $0.00003055 on the 1D chart | Source: SHIBUSDT on Tradingview.com

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Why BlackRock Could Bet On This RWA Token: Crypto Analyst

In an era where the boundaries between traditional finance (TradFi) and crypto continue to blur, the tokenization of real-world assets (RWAs) stands out as one of the hottest trends. This trend, which allows tangible assets like vehicles and real estate to be bought and sold as tokens on a blockchain, promises to revolutionize the efficiency and speed of asset transactions.

Just last week, BlackRock, the world’s largest asset manager, has positioned itself at the forefront of this movement with the launch of a $100 million tokenization fund, which has already attracted over $240 million in investment within its first week.

Larry Fink, CEO of BlackRock, has been vocal about the potential of tokenization, stating that RWAs “could revolutionize, again, finance.” This comment has contributed to a notable surge in the valuation of several RWA crypto tokens in recent weeks. In light of these developments, crypto analysts from Layergg have identified a specific crypto project that they believe could garner significant interest from BlackRock.

Why BlackRock Could Choose Aptos

The project in question is Aptos, which has been earmarked for its potential in the RWA space. According to Layergg’s analysis shared on X (formerly Twitter), the narrative surrounding RWA and tokenization, bolstered by BlackRock’s involvement, suggests a nascent yet rapidly growing interest in this sector.

They highlight that mid to low cap RWA projects listed on Binance have performed exceptionally well, indicating a broader market interest spurred by narrative-driven investment strategies. However, the favorite crypto project for BlackRock could be Aptos.

Related Reading: Crypto Exec Reveals Why Meme Coins Are The Next ‘Trojan Horse’ For Crypto Adoption

A closer look at Aptos reveals several factors that might make it an attractive partner for BlackRock. Firstly, Aptos is poised to make a significant announcement related to RWA in April, coinciding with the Aptos DeFi DAYS event from April 2 to 5. Aptos DeFi Days | Source: X @layerggofficial

Aptos DeFi Days | Source: X @layerggofficial

This announcement is speculated to involve a partnership with a global asset management firm, potentially BlackRock. “A partnership with a global asset management firm is expected to be announced. It is speculated that this may include BlackRock,” the analysts remarked.

The basis for this speculation includes Aptos CEO Mo Shaikh’s previous tenure at BlackRock, suggesting pre-existing industry connections that could facilitate such a partnership. Aptos founder Mo Shaikh | Source: X

Aptos founder Mo Shaikh | Source: X

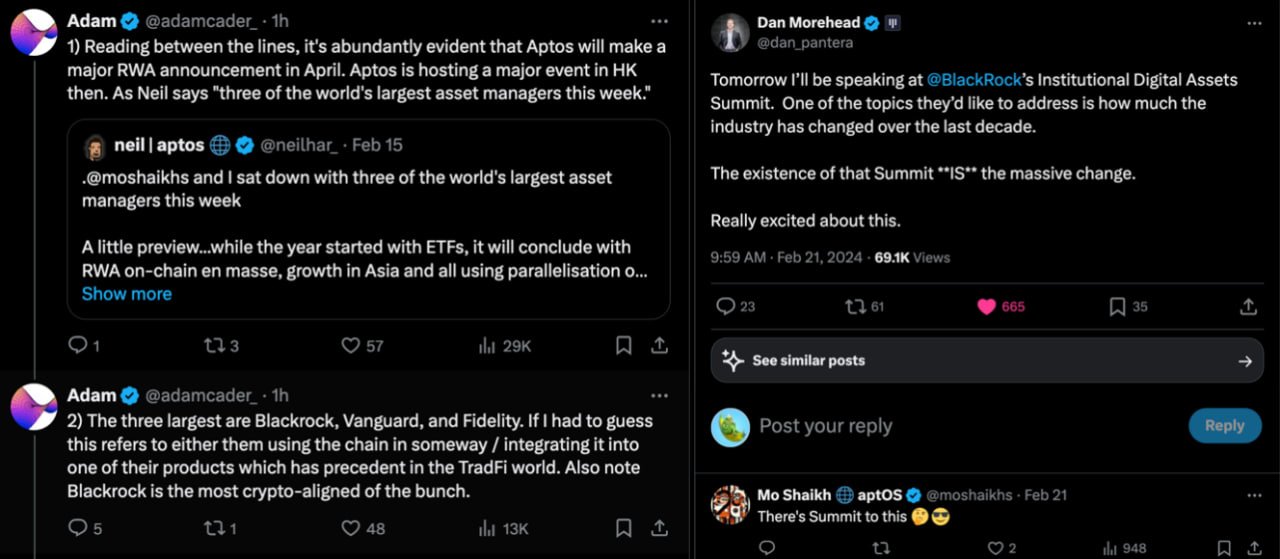

Moreover, Aptos founder Mo Shaikh & head of ecosystem at Aptos Labs Neil H hinted at this early on. In mid-February Shaikh revealed via X: “I sat down with three of the world’s largest asset managers this week A little preview…while the year started with ETFs, it will conclude with RWA on-chain en masse, growth in Asia and all using parallelisation on Aptos See you in Hong Kong.”

Related Reading: Bitcoin Next Stop $80,000? Crypto Analyst Sees BTC Soaring Ahead Of 2024 Halving

On February 21, Shaikh also commented on a post on X by Dan Morehead, founder and managing partner at Pantera Capital. Morehead stated, “Tomorrow I’ll be speaking at BlackRock’s Institutional Digital Assets Summit. […] The existence of that Summit **IS** the massive change. Really excited about this.” Mo Shaikh mysteriously commented, “There’s Summit to this.” Clues from the Aptos founder | Source: X @layerggofficial

Clues from the Aptos founder | Source: X @layerggofficial

Besides that, Adam Cader, founder of Thala Labs recently stated via X that “something is cooking for Aptos. I’m a co-founder of the largest application on the network, and here’s my list of upcoming significant ecosystem wide catalysts.” Cader referenced Shaikh’s statement and added that Blackrock, Vanguard, and Fidelity are the three largest asset managers in the world.

“If I had to guess this refers to either them using the chain in some way / integrating it into one of their products which has precedent in the TradFi world. Also note Blackrock is the most crypto-aligned of the bunch,” he said via X.

Crypto Revolution: Will APT Follow AVAX?

But that’s not all. Aptos has been hinted to explore partnerships with other major asset management firms, including Franklin Templeton, which has previously invested in Aptos (tier 3) and planned to utilize its blockchain for money market funds.

Such strategic alliances could position Aptos similarly to how Avalanche benefited from its partnerships in the Project Guardian initiative (JPMorgan and Wisdomtree), experiencing a substantial price increase post-announcement. “Avalanche saw a price increase of more than 4x following the ‘Project Guardian’ news,” Layergg noted.

They concluded, “If a partnership with BlackRock proceeds, more ‘Big partnerships’ will naturally follow.”

At press time, APT traded at $17.59, up 87% over the past five weeks. APT price eyes its ATH, 1-week chart | Source: APTUSD on TradingView.com

APT price eyes its ATH, 1-week chart | Source: APTUSD on TradingView.com

Featured image from Pensions & Investments, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

7