Earning Income Through Cryptocurrency Exchanges and Wallets

Earning Income Through Cryptocurrency Exchanges and Wallets

Introduction

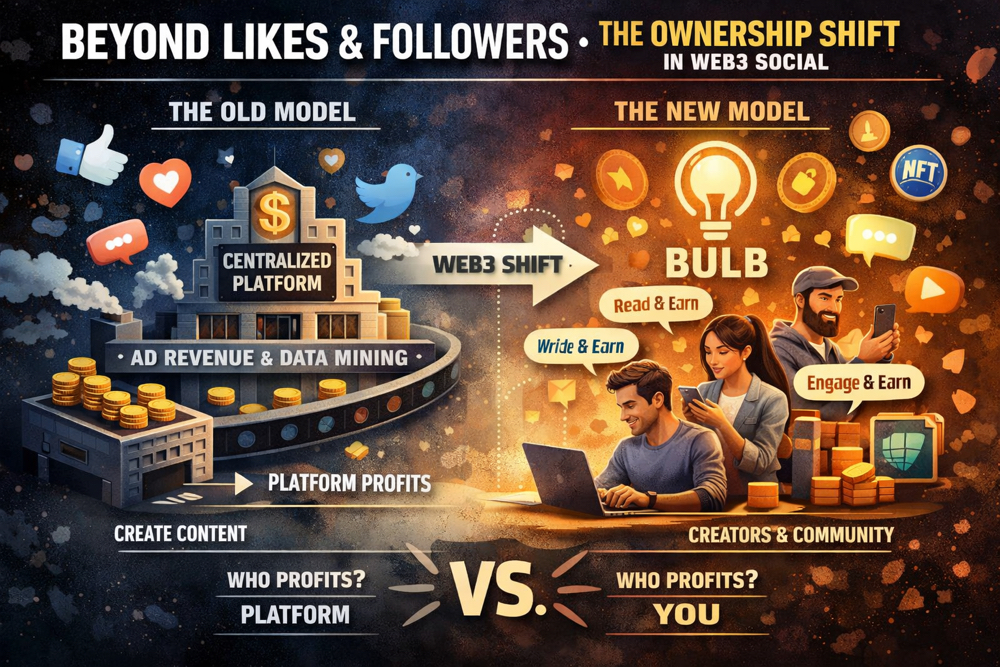

Cryptocurrency has grown far beyond a speculative trend and is now a major component of the global digital economy. Millions of users around the world rely on crypto exchanges and wallets not only for trading, but also for building sustainable and diversified income streams. Thanks to blockchain technology, individuals can participate in financial activities without relying on traditional intermediaries. Today, earning income through cryptocurrencies is no longer limited to simple buying and selling. Modern exchanges and wallets offer a wide range of opportunities such as trading, staking, long-term investing, liquidity providing, referral programs, and participation in decentralized finance (DeFi). This article explores the most effective and widely used methods for generating income through crypto exchanges and wallets, while emphasizing security and long-term strategy.

Trading on Cryptocurrency Exchanges

Spot Trading

Spot trading is one of the most straightforward ways to earn from cryptocurrency markets. In this method, users purchase digital assets at the current market price and fully own them until they decide to sell. Spot trading is commonly used for assets such as Bitcoin, Ethereum, and stablecoins. Advantages of spot trading include: - Direct ownership of assets - Lower risk compared to leveraged instruments - Suitable for beginners and long-term investors This approach allows users to benefit from market growth without exposure to liquidation risks.

Futures and Derivatives Trading

Futures trading enables users to speculate on price movements without owning the underlying asset. By using leverage, traders can increase potential profits, but at the cost of significantly higher risk. While futures markets can be profitable, they require strong analytical skills, emotional control, and disciplined risk management. For users seeking stable and consistent income, futures trading should be approached cautiously.

Passive Income Through Staking

Staking is one of the most popular passive income methods in the crypto ecosystem. It involves locking cryptocurrency to support a network or platform in return for rewards.

Staking on Centralized Exchanges

Many exchanges provide built-in staking and earning products that allow users to earn interest on assets such as ETH, USDT, and other tokens. These services often offer flexible or fixed-term options, making them accessible even to users with limited technical knowledge.

Staking via Crypto Wallets

Non-custodial wallets enable users to stake directly on blockchain networks and DeFi protocols while maintaining full control over their funds. This method provides higher transparency and decentralization and is widely used in ecosystems such as Ethereum, Solana, and Avalanche.

Long-Term Holding as an Investment Strategy

Long-term holding, often referred to as “HODLing,” is a strategy based on purchasing strong digital assets and holding them over extended periods. Investors typically store these assets in secure wallets and focus on the long-term development of blockchain technology rather than short-term price fluctuations. This method is well suited for individuals who prefer a low-maintenance approach and believe in the long-term growth of the crypto market.

Affiliate and Referral Programs

Cryptocurrency exchanges frequently offer referral programs that allow users to earn commissions by inviting others to the platform. This income model does not require active trading or capital investment. Common characteristics of referral programs: - Commission-based earnings from trading fees - Long-term passive income potential - Ideal for content creators, bloggers, and community managers Affiliate marketing has become an important revenue stream for many individuals active in the crypto space.

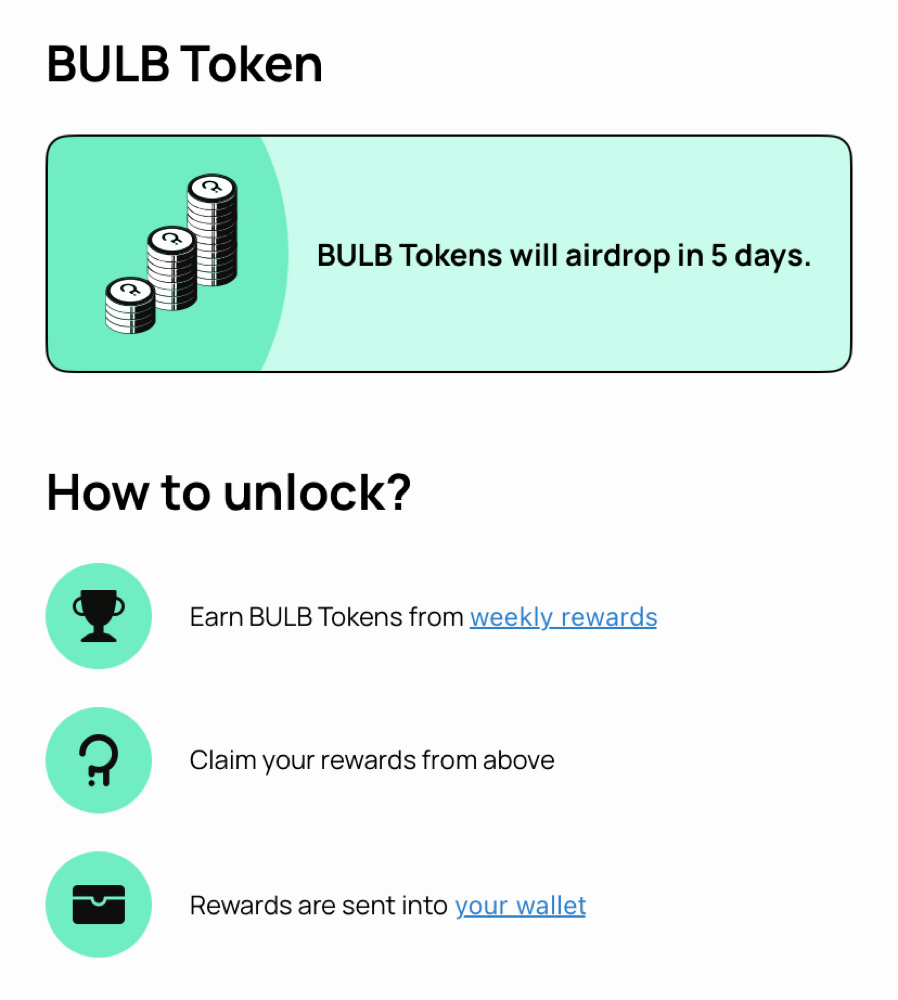

Wallet-Based Opportunities and Airdrops

Crypto wallets play a central role in participating in decentralized ecosystems. Many blockchain projects distribute free tokens through airdrops to early adopters and active users. Typical activities that qualify users for airdrops include: - Using decentralized exchanges - Performing token swaps - Providing liquidity - Interacting with smart contracts Although airdrops are not guaranteed, they can be highly rewarding and are considered a strategic opportunity by experienced users.

Earning Through Liquidity Providing

Decentralized exchanges allow users to earn income by supplying liquidity to trading pools. In return, liquidity providers receive a share of transaction fees generated by the platform. While this method can generate consistent returns, it also carries risks such as impermanent loss, especially during high market volatility. A solid understanding of DeFi mechanics is essential before engaging in liquidity provision.

Security and Risk Management

Regardless of the chosen income strategy, security remains a critical factor in crypto activities. Best practices include: - Enabling two-factor authentication (2FA) - Using non-custodial or hardware wallets for storage - Keeping private keys and seed phrases offline - Avoiding unverified links and platforms - Regularly reviewing permissions granted to DeFi applications Strong security habits are essential for protecting assets and ensuring long-term success.

Conclusion

Cryptocurrency exchanges and wallets provide multiple pathways for earning income in the digital economy. From active trading to passive staking and decentralized finance, users can choose strategies based on their experience, risk tolerance, and financial goals. A balanced approach—combined with continuous learning, proper risk management, and security awareness—can turn crypto platforms into reliable tools for long-term income generation.

Exchange Link:

https://omni.apex.exchange/referral?referralCode=HOZFYY9N