Solana and Avalanche recovers, meme coin targeting to raise $5m

In January, Spot Bitcoin ETFs added 151,000 BTC. Solana (SOL) and Avalanche (AVAX) are firm, while Galaxy Fox (GFOX) investors are targeting $5 million in presale.

Jerome Powell’s decision to keep rates stagnant confirms the end of the hiking cycle. Over-leveraged traders are struggling, but investors buying at spot are comfortable.

Solana and Avalanche recover

Solana and Avalanche offer fast and affordable transaction capabilities.

Solana is popular for trading meme coins.

You might also like:

Polygon and Solana slide, new crypto raises $10m

Similarly, Avalanche’s Subnet program allows institutions to create customized blockchains easily, which may support growth in the future.

Both cryptocurrencies have shown synergy in the past, with Solana leading a rally and Avalanche following afterward. As they grow, small-cap altcoins could benefit.

Galaxy Fox presale targets $5 million

Galaxy Fox has a unique feature of a play-to-earn component.

This memecoin has deflationary tokenomics, a taxation system that funds the Treasury, Stargate, and the liquidity pool, and an NFT collection that grants special in-game privileges.

You might also like:

Synthetix in bullish zone, Galaxy Fox presale eyes $500K

Galaxy Fox uses taxes to pay stakers and has an automated value accrual system.

Its runner game also has a broad market appeal amongst GameFi supporters. It allows anyone to turn their gaming skills into cash.

Closing thoughts

Markets tend to repeat patterns. SOL can be an option for those who want to invest in smart contract platforms. However, aggressive traders looking for higher returns can explore GFOX.

Read more:

Bitwise poll on spot Bitcoin ETF shows doubt; investors consider Galaxy Fox presale

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Bitcoin falls, XRP and NuggetRush may post sharp gains

February 4, 2024 at 2:00 pm

SPONSORED PARTNER CONTENT

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bitcoin fell after the Federal Reserve announced that it would keep rates steady. Meanwhile, analysts say XRP can rally in 2024. On the other hand, more investors are exploring NuggetRush (NUGX).

Bitcoin drops

Bitcoin recently fell to $42,000 following the Fed’s decision to delay interest rate cuts due to, among other macro factors, falling inflation and a robust labor market.

You might also like: Coinbase officially ends Bitcoin SV support

Despite this, many analysts remain optimistic, citing the upcoming Bitcoin halving as a possible trigger for bulls.

NuggetRush set for gains in 2024

NuggetRush may benefit from the upcoming Bitcoin halving event.

The platform has a play-to-earn (P2E) game for gamers to earn rewards. Its mining virtual world is based on the gold rush.

You might also like: Investopedia ranks XRP highly; Injective and NuggetRush bullish

Players can also stake NFTs and NUGX to earn rewards. They can also access a wide range of NFT collections, including RUSHGEM NFTs, integrated directly into the game and staked for up to 20% returns.

In the ongoing presale, over 168 million NUGX have been sold.

At the present stage, each NUGX is available for $0.018.

XRP is firm

XRP is solid, recently breaking above a historic bearish pattern. Even so, XRP remains in a bearish formation, staying around the $0.50 support. Some analysts believe XRP may rally and break above $1 in 2024.

Conclusion

The Fed’s decision negatively impacted crypto assets, including Bitcoin. However, other data suggests that XRP and NuggetRush might continue to trend higher in the long term.

Read more: NuggetRush presale gains traction as Dogecoin and XRP face headwinds

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Top cryptocurrencies to watch this week: XRP, PYTH, SUI

By Wahid Pessarlay

By Wahid Pessarlay

February 4, 2024 at 1:05 pm Edited by Anthony Patrick

Edited by Anthony Patrick

MARKETS

NEWS

Collect the article

share

Among the top cryptocurrencies to watch this week are XRP (XRP), the native token of the Ripple network, as well as Pyth Network (PYTH) and Sui (SUI).

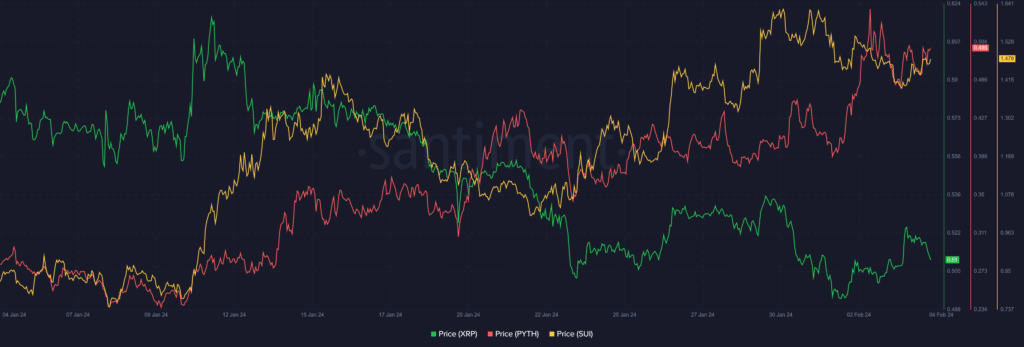

Each asset made noticeable contributions to the global crypto market cap, which remained above the $1.6 trillion mark over the past week despite the sustained market uncertainties, rising 1.86% to $1.64 trillion. XRP, PYTH and SUI prices – Feb. 4 | Source: Santiment

XRP, PYTH and SUI prices – Feb. 4 | Source: Santiment

XRP struggles at $0.51

XRP has not given investors much reason to be optimistic recently, and this week added to these growing concerns.

The crypto asset began the week touting a 2.11% rise on Jan. 29. However, XRP gave up all these gains, with a 4.57% collapse on Jan. 30. This decline coincided with developments around the Ripple vs. U.S. Securities and Exchange Commission (SEC) case. The agency recently made a demand for financial documents from Ripple.

The decline spilled into the last day of January, leading to a breach below the $0.51, $0.50 and $0.49 support levels. XRP eventually dropped to a three-month low of $0.4855 on Jan. 31. Despite recovering the $0.49 and $0.50 territories, XRP ended the day bearish, closing January with an 18% crash.

The bearish pressure persisted amid a massive 198% surge in whale transactions involving XRP, as reported by crypto.news. Whale transactions spiked considerably to a yearly high of 1,827 on Jan. 30, with large investors compounding the existing selling pressure.

The bearish trend was further exacerbated by reports of a hacking incident affecting Ripple’s co-founder and executive chairman Chris Larsen. The Ripple chairman confirmed the hack, which led to losing $112.5 million worth of XRP.

XRP collapsed 5% on the heels of the event.

The asset has continued to struggle at the crucial $0.51 territory. XRP has defended this level zealously, looking to leverage it for an upsurge once the market recovers fully. XRP has recorded three consecutive green days in February, helping it to recover above $0.51.

You might also like: API3 token up 70% following Bitget listing

PYTH looks to reclaim ATH

While XRP faced struggles this week, PYTH Network’s native token recorded occasional price spikes that contributed to its bullish end to the week. The token began the week amid a price slump below the $0.39 price threshold, changing hands at $0.3799 on Jan. 29.

PYTH witnessed a bullish structure that saw it breach multiple resistance levels, culminating in a surge to a yearly peak of $0.4457 on Jan. 30. The last time the asset traded above the $0.44 territory was in early December.

However, Pyth Network’s uptrend faced resistance at $0.4457, resulting in a steep correction. This correction eventually pushed the cryptocurrency below the recently breached psychological thresholds, as it collapsed to a low of $0.3890 on Feb. 1.

PYTH found its floor amid the retracement, setting the stage for a recovery campaign. Binance listed the asset on Feb. 2, compounding the recovery.

Upon the Binance listing, PYTH rallied 38% from the $0.3890 low to a high of $0.5392, slightly below the all-time high of $0.5487 attained last November.

An attempt to retest the all-time high was met with fierce resistance from the bears, triggering a mild correction. Despite this correction, PYTH fiercely defended the $0.50 level, trading for $0.5011 at the reporting time. The asset gained 32% this week.

Sui clinches 8-month high

Sui saw an impressive run last week despite recording more red days than green ones. The token kicked off the week with a massive rally of 17.19% on Jan. 29, closing the day above the pivotal $1.5 price threshold.

This uptrend spilled into the next day, with Sui surging to an eight-month high of $1.65. The last time Sui saw this price was in May 2023.

An attempt to breach the price territory resulted in a retracement. Amid this retracement, the asset eventually closed on Jan. 30 with a mild 1.12% drop.

Sui recorded another intraday decline on Jan. 31, dropping by 1.69% to close the day at $1.5187. The asset aimed to recover these losses at the start of February, but the bears mounted formidable resistance at the $1.5679 level. Despite the setback, Sui closed Feb. 1 with a 0.47% rise.

Sui continued to record declines, relinquishing the $1.5 and $1.4 psychological support. However, a recent recovery has seen it reclaim $1.4, currently pushing to breach above $1.5. Despite recording four losing days this week, Sui increased by 11.8%.

Read more: SEC charges American Bitcoin Academy founder in $1.2m crypto fraud scheme

READ MORE ABOUT

cryptocurrency

pyth network

ripple

sui

Rekt Capital bullish on Solana as XRP validators support new upgrade, whales interested in KangaMoon

February 4, 2024 at 1:00 pm

SPONSORED PARTNER CONTENT

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Rekt Capital is bullish on Solana (SOL). Additionally, XRPL has made changes to allow the disbursement of XRP rewards. On the other hand, KangaMoon (KANG), a meme coin project, is attracting whales.

Solana to $115?

Rekt Capital is bullish on Solana, expecting the coin to reach $115 in the days ahead.

SOL is on a sharp uptrend, recently adding 33%.

You might also like: Bitcoin billionaire Arthur Hayes urges a return to investing in Solana

So far, SOL is up by 30.9%, 2.6%, and 329.7% on the weekly, monthly, and yearly timeframes.

XRPL to support AMM?

XRPL validators support integrating an automated market maker (AMM).

This change will allow XRP owners to earn passive income from their assets.

In addition, Ripple version 2.0.1 has been released to fix previous problems.

XRP remains in a broader range between $0.5061 and $0.5387 but mostly in a bearish trend.

Whales exploring KangaMoon

KangaMoon, a project combining meme coins and NFTs, is attracting whales.

The platform wants to create a community of meme coin fans.

You might also like: Cardano takes on Ethereum, analysts bullish on KangaMoon

Unlike other meme coins, KANG offers discounts, rewards, and access to special NFTs.

Moreover, its smart contracts have been audited by SOLIDProof.

In the ongoing presale, KANG is available for $0.005. Even so, experts say the token will rally after launch.

Final thoughts

Solana, XRP, and KangaMoon are trending. Whales appear interested in KangaMoon because of its unique approach of combining the meme coin trend with utility.

Read more: Cardano and Tron bullish, Kangamoon bringing utility to meme coins

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Cardano upgrades and Render releases Q4 2023 report as 15k users sign up for Pullix presale

February 4, 2024 at 12:00 pm

SPONSORED PARTNER CONTENT

PARTNER CONTENT

Collect the article

share

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The crypto market is gearing up for a potential bull run. Cardano (ADA) is releasing a new version of its ClientLab, while Render (RNDR) recently shared its Q4 2023 performance index. Pullix (PLX) is gaining popularity, with 15k users already signed up in the ongoing presale.

15k users sign up in the ongoing Pullix presale

Pullix has raised nearly $5 million in the ongoing presale, with over 15,000 users signed up.

The platform aims to solve problems related to liquidity and security breaches using its hybrid approach.

It is a non-custodial exchange, which means investors can secure their funds by themselves, ensuring improved trust and eliminating third-party intervention.

Read more: Pullix will be more deflationary than Ethereum and BNB

Presale participants will get a 10% bonus. There is also an ongoing Meme contest where the platform will give a grand prize of $250, with the second and third runners-up getting $100 and $50, respectively.

CoinGecko has already listed PLX.

Cardano launches new ClientLab version

Cardano has released a new version of ClientLab, called v0.5.1, which supports Conway Era.

This version has been integrated with the QuickTX Governance API, allowing users to register DRep, create proposals, delegate, and vote using their accounts.

You might also like: Cardano whales make surprise $120m move; is ADA price at risk?

With the platform’s development focused on improving user-friendliness, the Cardano ecosystem may see more community engagement.

Render releases Q4 2023 report

Render’s Q4 2023 report shows that the platform grew to 3,026,317 from 2,345,476 recorded in the previous quarter.

Its social media metrics are also increasing, with 122k X followers, 4k on Instagram, 3.4k Medium, and 1.7k reads.

This improvement highlights the rise in engagement and interest in the content being pushed out by Render.

RNDR prices rose by 20% in the past week.

Read more: Binance and SEC at odds; Pullix may flip Uniswap in trading volume

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

READ MORE ABOUT

sponsored

Does your digital asset exchange abide by the rules? | Opinion

By Selva Ozelli

By Selva Ozelli

February 4, 2024 at 11:24 am Edited by Max Yakubowski

Edited by Max Yakubowski

OPINION

Collect the article

share

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The United States Securities Exchange Commission’s (SEC) eleven Bitcoin ETF approvals, which took over a decade of efforts by fund managers to accomplish, have institutionalized Bitcoin, allowing digital assets to seep into investors’ portfolios in the US forever. With the two largest digital asset exchanges—Coinbase and Binance—still battling in court with the SEC, digital asset investors should beware that to protect investors, federal agencies SEC, Commodity Futures Trading Commission (CFTC), Financial Crimes Enforcement Network (FinCEN), Internal Revenue Service (IRS) and Office of Foreign Assets Control (OFAC) during 2023 ramped up legal enforcement efforts against world’s largest digital asset exchanges reaching a wide range of misconduct, that occurred in both US and foreign jurisdictions.

You might also like: In 2023, the US government tried to kill crypto | Opinion

After all, the United States leads in traffic to digital asset exchanges, followed by India, Indonesia, and Turkey, according to the latest Coincub’s report.

Crypto exchanges traffic report 2023 | Source: Coincub

Erhan Kahraman, editor at Cointelegraph, explained the reasons for Turkish investors’ increased activity on digital asset exchanges—which are not yet regulated within the country— to me: “The Coincub’s ‘Crypto exchanges traffic report 2023’ aligns with the overall narrative of cryptocurrencies as a hedge against inflation. In Turkey, crypto exchanges such as Binance, Btc Turk, and Paribu are adding fuel to the flames, ranked number one, two, and three, respectively, genuinely having a presence. Their advertisements are on billboards on highways. They have TV commercials. They have brand partnerships with major sports teams. That aggressive marketing feeds the Turkish population’s never-ending quest for get-rich-quick schemes due to the lack of a reliable economic structure.” As Erhan continues:

“Turkey has endured skyrocketing inflation rates, especially since the tail end of the COVID-19 pandemic. Inflation numbers went from 20%, which is already high, to the north of 60% in 2023. Bitcoin was around 400,000 Turkish liras at the start of 2023, and it closed the year at around 1.2 million Turkish liras.”

Binance is the number one digital asset exchange in Turkey and the world, with over 1 billion visits. Coinbase ranks second in the world but number one in the US, with 549 million visits, attracting over 50% of the US traffic share, according to the report.

Crypto exchanges traffic report 2023 | Source: Coincub

Nevertheless, both the US and the world’s largest digital asset exchanges—Coinbase and Binance—are embroiled in lawsuits with the SEC for not abiding by a multitude of federal securities laws. The federal securities laws have two primary objectives: (1) to require that investors receive financial and other significant information concerning securities being offered for public sale and (2) to prohibit deceit, misrepresentations, and other fraud in the sale of securities. As the SEC Chair Gary Gensler explained about the litigation with Coinbase, which serves as a custodian for most of the BTC ETFs:

“To the extent that crypto assets are offered and sold in the form of an investment contract, and to the extent that entities intermediate transactions in crypto asset securities, the federal securities laws apply.”

In the US, digital assets—particularly after the 2022 bear market—have been the focus of much attention by both federal and state governments. At the federal level, most of the focus has been at the administrative and agency level, including the SEC, the CFTC, and the Department of the Treasury through the IRS, FinCEN, and OFAC. While there has been significant enforcement by these agencies to protect investors, little formal rulemaking has occurred.

A look at 2023 federal enforcement actions against digital asset exchanges

The 2023 federal enforcement action reports issued by the SEC, CFTC, FinCEN, IRS, and OFAC indicate that very few digital asset exchanges are actually abiding by applicable laws despite handling the world’s highest digital asset activity.

The Securities Exchange Commission: The SEC cryptocurrency report details 46 enforcement actions against various digital-asset market participants—26 (57%) alleged fraud, 28 (61%) alleged an unregistered securities offering violation, and 17 (37%) alleged both.

The highest-profile digital asset exchange cases were the following: the SEC’s action against the former FTX CEO (who was charged with defrauding equity investors in FTX), Binance, Coinbase, and Kraken.

The Commodity Futures Trading Commission: The CFTC digital assert report details a record-setting number of 47 actions involving conduct related to digital asset commodities cases and precedent-setting court decisions in complex litigations, cementing its reputation as a premier enforcement agency in the digital asset space.

The highest-profile digital asset exchange case was the CFTC’s action against Binance. Sergiu Hamza, CEO of Coincub, explained Binance’s global regulatory problems to me: “In 2019, Binance said they would block US customers and launched a separate US exchange, called Binance.US. Binance still faces a lawsuit from the SEC for 13 federal securities law violations. However, it was the second biggest exchange in the US last year, still driving almost 34.5 million visitors from the US, and Binance.US was the seventh biggest, with only 17.8 million visits.” As Sergiu continues:

“Four years and four billion US dollars in fines later, Binance is still looking for trouble, not only in North America. Binance does not list any of its MSB licenses in the US and Canada, and the exchange announced it would leave Canada, but it didn’t and got 14 million visits. Of the top 10 crypto countries during 2023, Binance got banned in India and the Philippines but still had 75M and 2.5M visits, respectively.

“According to a 500-page report in Brazil, Binance and its leaders are accused of fraudulent management, offering or trading securities without prior authorization, and operating a financial institution without consent. Yet, last year, 18 million Brazilians visited the exchange. Binance announced it would exit Russia in September, yet Russia is their fifth biggest market by traffic. Binance was denied a license from the Netherlands but got 11.2 million visits in traffic.

“In the rest of the world, Binance established its headquarters in Malta and is suspected of evading taxes and faking accounts in Malta and Ireland by EU regulators. Yet, the company got 365,000 and 3.5 million visits in each country, respectively. Binance did monthly transactions worth $90 billion in the banned Chinese market, where the company got 4.4 million visits last year. Binance side the Belgium ban in June by redirecting users to Poland with 6 million visits. In September, Taiwan banned unregistered foreign crypto exchanges, including Binance, yet got 8.7 million visits from 2.2 million unique visitors last year. SEC Nigeria banned the global crypto exchange Binance in July, yet it got 9.2 million visits last year. In 2021, Malaysia and South Africa’s financial regulators warned against Binance, saying the exchange is not authorized to operate in the respective countries, and took enforcement actions against Binance; the exchange still got 9.5 million visitors last year from Malaysia and 4 million visits from South Africa.”

Crypto exchanges traffic report 2023 | Source: Coincub

You might also like: Binance founder and CEO plead guilty to federal charges | Opinion

The Financial Crimes Enforcement Network: The FinCEN placed restrictions on Bitzlato Limited, a digital asset exchange, for facilitating illicit transactions linked to Russian money laundering. FinCEN also imposed a $3.4 billion penalty on Binance, which represented FinCEN’s most significant penalty to date.

The Internal Revenue Service: The IRS criminal investigation unit (IRS-CI) witnessed a notable increase in cases related to digital tax evasion, according to Jim Lee, Chief, IRS-CI, with approximately half of the active digital-asset investigations involving tax matters ranging from failure to report income from capital gains or mining activities to deliberate non-disclosure of cryptocurrency holdings. The IRS-CI’s top 10 high-profile cases for 2023 included four involving digital assets.

During the cyber challenge of the Joint Chiefs of Global Tax Enforcement (known as the J5), committed to combatting transnational tax-related crime, well over 50 leads on potential tax crimes and money laundering involving cryptocurrency were created using data mining and AI. “These ‘Challenges’ have been incredibly fruitful for the J5 over the years, giving us sophisticated cases with large dollar amounts that affect multiple jurisdictions,” said Jim Lee, Chief, IRS-CI. He continued:

“But the results should not be a surprise to anyone. When you put really smart people together from different backgrounds, give them the data and tools they need, and create an environment where partnerships are the priority, amazing results happen every time.”

The Office of Foreign Assets Control: The OFAC issued 17 enforcement actions, with three involving digital asset exchanges totaling over $1.5 billion in civil penalties, nearly four times the level of OFAC’s civil penalties in 2022. OFAC’s $970 million settlement with Binance marked the most significant penalty in its history.