As the weekend approaches, the crypto economy experienced a downturn, declining 4.38% in the past 24

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

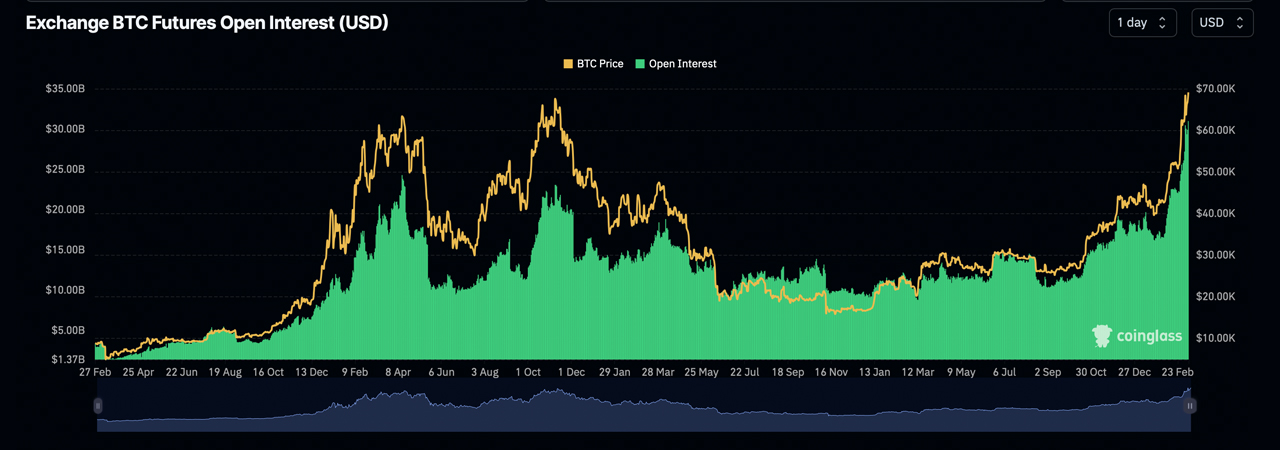

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront. Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets.

Soaring Open Interest in BTC Futures Signals Growing Derivatives Market

Friday, March 8, 2024, marked a notable day when BTC soared to a new peak price of $70,184 per coin at 10:30 a.m. Eastern Time. Although the price later declined, the bounce back was quicker compared to the substantial volatility bitcoin witnessed on March 5. The latest crypto rally has triggered a noticeable increase in open interest for crypto futures, particularly in bitcoin. Data indicates a total of $32.30 billion in open interest recorded in the last day, with CME Group at the forefront.

Bitcoin futures open interest according to coinglass.com figures on March 8, 2024.

CME Group leads with $10.07 billion in volume, followed by Binance with approximately $7.21 billion. Bybit and Okx have reported $4.88 billion and $3.18 billion in open interest, respectively, over the last 24 hours. The leading three markets have also experienced increases in open interest in the same timeframe. Currently, bitcoin’s 24-hour open interest represents 48.2% of the $67 billion total across all crypto economy futures.

For example, on Friday, ETH futures markets saw $13.24 billion in open interest, and SOL futures reached about $2.50 billion. There have also been significant liquidations of long and short positions over the past week. In the last 24 hours, as BTC approached the $70K mark, the entire crypto economy saw $311.76 million in liquidations. Of this, $152.71 million were long positions, and $159.02 million were short, with $96.89 million of this total stemming from BTC short positions, which were eliminated over the past day.