Historic Milestone: SEC Approves Bitcoin Spot ETF, Paving the Way for Mainstream Adoption

Introduction:

In a groundbreaking move that could reshape the landscape of cryptocurrency investing, the U.S. Securities and Exchange Commission (SEC) has finally given its approval for a Bitcoin spot exchange-traded fund (ETF). This long-awaited decision marks a significant milestone for the crypto industry, providing a bridge between traditional finance and the rapidly evolving world of digital assets.

The Approval:

After years of speculation, anticipation, and multiple rejections, the SEC's green light for a Bitcoin spot ETF is a momentous occasion for both seasoned crypto enthusiasts and traditional investors alike. The approval signifies a growing recognition of the legitimacy and maturity of the cryptocurrency market.

What is a Bitcoin Spot ETF?

A Bitcoin spot ETF is an investment vehicle that allows investors to gain exposure to the price movements of Bitcoin without actually owning the digital asset. Unlike futures-based ETFs, a spot ETF holds the physical asset, in this case, Bitcoin itself. This distinction is crucial as it eliminates some of the risks associated with futures contracts and offers a more direct and transparent investment option for market participants.

Key Benefits:

- Mainstream Accessibility: The SEC's approval opens the door for mainstream investors who may have been hesitant to enter the cryptocurrency space due to regulatory uncertainties. With a spot ETF, investors can now access Bitcoin through their traditional brokerage accounts, making it more convenient and familiar.

- Reduced Counterparty Risk: Spot ETFs are structured to hold the underlying asset, mitigating counterparty risk associated with futures-based products. This structure enhances transparency and security for investors, aligning with the principles of decentralization that underpin cryptocurrencies.

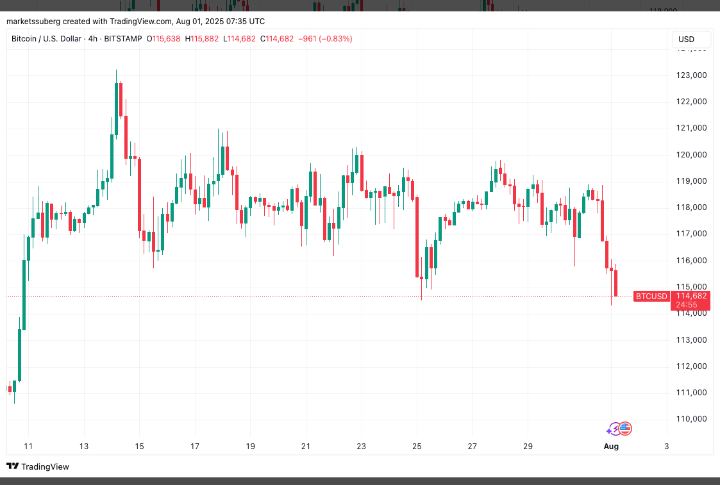

- Market Liquidity and Price Discovery: The introduction of a Bitcoin spot ETF is expected to contribute to increased liquidity and improved price discovery in the cryptocurrency market. With institutional investors gaining easier access, the market may experience more stability and reduced volatility over time.

- Institutional Adoption: Institutional investors, who have been cautiously exploring the crypto space, now have a regulated and mainstream way to allocate funds to Bitcoin. This approval may signal a shift in the perception of cryptocurrencies as a legitimate asset class for institutional portfolios.

Challenges and Risks:

While the approval of a Bitcoin spot ETF is a significant step forward, it is not without challenges and risks. Regulatory scrutiny, market volatility, and evolving industry dynamics remain factors to watch closely. Investors should be aware of the inherent risks associated with cryptocurrency investments and exercise due diligence.

Conclusion:

The SEC's approval of a Bitcoin spot ETF is a pivotal moment in the journey towards the mainstream adoption of cryptocurrencies. This regulatory milestone not only provides a more accessible entry point for investors but also validates the maturation of the crypto market. As the landscape continues to evolve, market participants, regulators, and investors alike will be closely monitoring the impact of this historic decision on the broader financial ecosystem. The future of finance is undoubtedly being shaped by the convergence of traditional and digital assets, and the approval of a Bitcoin spot ETF is a clear indicator of this transformative journey.