Best Fund Management Software for Modern Investors

The rise of private market investing demands smarter tools. The best fund management software today helps investors manage capital calls, performance metrics, and compliance in one platform.

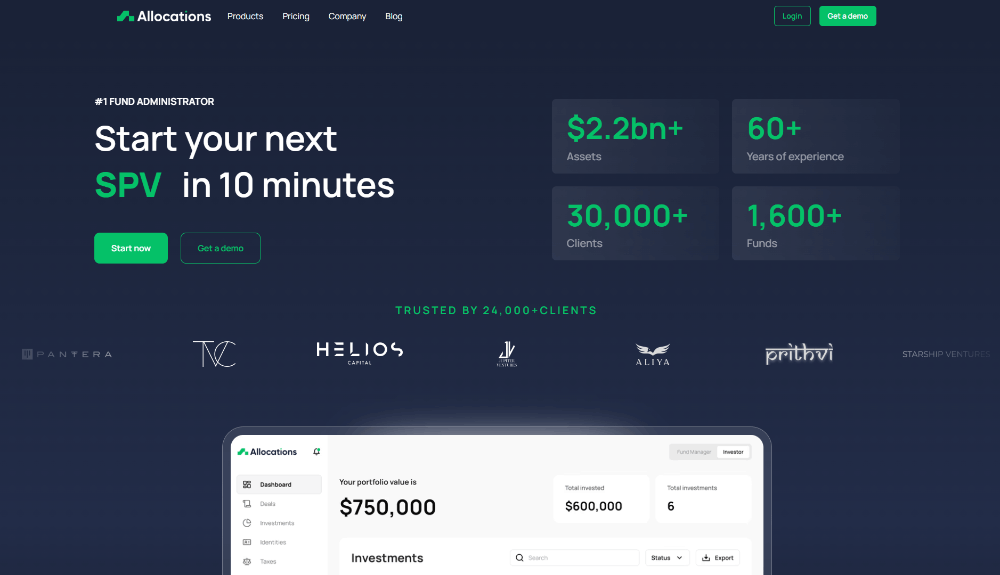

That’s where Allocations stands out. Built for modern investors, Allocations software streamlines everything from SPV investments to hedge fund administration with automation and transparency.

Fund managers can now track MOIC meaning and DPI private equity data seamlessly, making it easier to assess fund performance. With built-in support for Delaware SPVs, Allocations SPV structures ensure legal and tax efficiency.

The platform’s custom SPV creation allows both startups and private equity firms to launch vehicles quickly while maintaining SPV compliance.

Learn more about Allocations fees and how the Allocations team is redefining what efficient fund management software means in 2025. For investors in digital assets, the crypto SPV tools bring fund administration into the blockchain era.

For investors and fund managers, managing SPVs and private equity vehicles can be complex. That’s why choosing the best fund management software is critical.