Bitcoin, Ethereum, and Solana Price Predictions: BTC, ETH & SOL Price On Verge Of Major Breakout

Cryptocurrency analyst Josh of Crypto World recently discussed the potential for significant breakouts in both Bitcoin and Ethereum. With Bitcoin hovering near crucial levels, Josh opened up about the importance of the impending breakout.

Cryptocurrency analyst Josh of Crypto World recently discussed the potential for significant breakouts in both Bitcoin and Ethereum. With Bitcoin hovering near crucial levels, Josh opened up about the importance of the impending breakout.

Bitcoin’s price, currently around $52,000, is on the verge of confirming a major breakout above the golden pocket range of $48,000 to $50,000. Confirmation would require a weekly candle close above $50,000, signaling further bullish momentum. Josh spoke about the significance of this breakout, indicating a possible move towards an all-time high in the coming months. At the time of writing, Bitcoin is up by more than one percent and is trading at $52,158.

Josh also noted the continued inflows into Bitcoin ETFs, suggesting ongoing bullish pressure, particularly during weekdays when stock markets are open. However, Josh warned against expecting uninterrupted bullish momentum, especially over the weekend, due to reduced ETF trading activity and potential sideways consolidation. He pointed out the upcoming holiday on Monday, which could further influence market dynamics upon the stock market’s reopening on Tuesday.

Ethereum Price Analysis

In Ethereum’s case, Josh explained a similar potential breakout scenario above the golden pocket range of $2,530 to $2,670, with a weekly candle close above $2,700 as confirmation. Given that Ethereum is already trading near the $2,900 level, he said that this breakout, if realized, could establish new support levels and pave the way for further upside momentum toward $3,400 to $3,500. At the time of writing, Ethereum is trading at $2900 levels, up by more than 3 percent.

Also Read: Top Reasons Why Bitcoin Price Will Hit $100K in 2024 – Crypto Expert Lark Davis’s Bold Prediction

Solana Price Analysis

Additionally, Josh discussed Solana’s price action, noting a recent retest of the golden pocket range between $115 and $117. While highlighting a potential head and shoulders pattern forming, he advised caution. Solana is trading near the $113 level. Altcoins Bitcoin Ethereum Price Analysis

Altcoins Bitcoin Ethereum Price Analysis

Bitcoin’s NVT Ratio Signals Overheated Sentiment! Here’s Why BTC Price Needs A Retest

Bitcoin price continues to maintain its bullish momentum, remaining above the $52K threshold as investor confidence is triggered by bullish on-chain ETF reports. Despite this, the surge in purchasing demand for BTC raises alarms about a potential decline ahead, influenced by an overheated market sentiment as highlighted by various on-chain metrics. Such a scenario could necessitate a retest of Bitcoin’s immediate support levels to stabilize the current momentum.

Bitcoin price continues to maintain its bullish momentum, remaining above the $52K threshold as investor confidence is triggered by bullish on-chain ETF reports. Despite this, the surge in purchasing demand for BTC raises alarms about a potential decline ahead, influenced by an overheated market sentiment as highlighted by various on-chain metrics. Such a scenario could necessitate a retest of Bitcoin’s immediate support levels to stabilize the current momentum.

Bitcoin’s NVT Ratio Skyrockets

According to the latest report by CoinShares, crypto funds from asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares saw inflows totaling $2.45 billion globally in the last week.

This surge was largely driven by the launch of new U.S. spot Bitcoin exchange-traded funds, bringing the total inflows into digital asset investment products for the year to $5.2 billion.

With the recent uptick in prices, the assets under management (AUM) at these crypto investment firms have reached $67 billion, marking the highest level since December 2021 during the climax of the previous bull market, as pointed out by James Butterfill, the Head of Research at CoinShares.As a result, the BTC price is experiencing positive momentum, consistently staying above the $52K mark. Yet, multiple on-chain metrics are now signaling an overheated sentiment for the BTC price, suggesting a potential need for a price correction. Among these indicators, the NVT ratio (Network Value to Transactions) has notably increased, currently standing at 133.2. This indicates that while Bitcoin’s network value has surged with the price hike, the volume of transactions has not seen a comparable increase, pointing towards a possible overvaluation.

Furthermore, the Netflow metric has recently experienced a significant rise, moving into the positive territory. This indicates that inflows are exceeding outflows for Bitcoin, leading to an increase in exchange reserves. Such a trend could bring a price correction for BTC. However, such retests might strengthen the buying momentum.

What’s Next For BTC Price?

Bitcoin is facing resistance at the $52,000 mark, with attempts by sellers to push the price below $50,000. However, buyers continue to defend a decline strongly. As of writing, BTC price trades at $52,122, surging over 0.7% from yesterday’s rate. A potential challenge to the rally’s sustainability is the Relative Strength Index (RSI) heading toward the midline, hinting at a correction in the short term.

For a bearish shift to be confirmed, sellers need to push the price below the 20-day exponential moving average ($51,880), potentially leading to a downturn towards the $50K level. To enhance the chances of climbing to $55,000, buyers must breach the $52,800 resistance.

On the other hand, to plunge the upward momentum, bears must pull the price below the moving averages, potentially triggering a fall to the breakout point of $48,300. While bulls are likely to defend this level aggressively, a breach could see the price dropping to $47,000 and possibly further to $44,800.

Bitcoin Cryptocurrency Price Analysis

Top 5 Factors That Could Drive the Bitcoin Price to New ATH in 6 Months

Story Highlights

Story Highlights

- Bitcoin's price has surged 30% in 3 weeks, and analysts predict it could reach a new all-time high within 6 months.

- 5 factors that could drive the price up include the Bitcoin halving, new Bitcoin ETFs, etc.

- There are also risks, such as the possibility of these events being priced in, geopolitical conflicts, or unexpected selling pressure.

In an impressive start to the month, Bitcoin has surged by $50,000, smashing through the $1 trillion market cap and boasting a remarkable 30% increase in just three weeks. The big question now is when Bitcoin will hit an all-time high, especially with the 2021 peak of $69,000 now just 32% away.

Here are five key factors that could drive Bitcoin to new highs before summer.

Bitcoin to hit All-Time High of $69K, If?

Analytics firm IntoTheBlock’s report suggests an 85% chance of Bitcoin hitting a fresh all-time high within the next six months. According to their head of research, Lucas Outumuro, this forecast is based on five key catalysts that could drive Bitcoin higher in the coming months.

The Halving Buzz

First on the list is the eagerly awaited Bitcoin halving event in April. Miners seem ready for the event, and Outumuro believes Bitcoin’s all-time high might come just a month after the halving, reducing selling pressure as BTC’s issuance inflation rate drops significantly.

ETFs: A New Player in the Game

The second catalyst is the influx of funds from recently approved Bitcoin exchange-traded funds (ETFs). These ETFs have already attracted around $4 billion in new investments within a month of launch. With supply issuance decreasing post-halving, this significant influx of funds has the potential to boost Bitcoin demand.

Federal Reserve’s Influence

The anticipation of interest rate cuts by the Federal Reserve, possibly starting in March, is the third factor. Traders are factoring in these rate cuts, which could lead to increased liquidity in financial markets. This liquidity boost could benefit assets like Bitcoin and stocks, contributing to a potential surge.

Election Dynamics

Factor number four is the upcoming US presidential election. Expectations are high that the Federal Reserve might take steps to support the economy ahead of the event, potentially influencing market dynamics.

Corporate Bitcoin Adoption

The fifth factor is a global trend of companies accumulating Bitcoin in the coming months, accompanied by spot ETFs making Bitcoin more accessible. This shift, particularly in Asia and South America, is expected to expand nationally, boosted by the legitimacy brought by ETFs in the US.

In addition, the prospect of institutional treasuries allocating to Bitcoin presents a bullish narrative, adding to the optimism for price appreciation.

Risks on the Horizon

While the outlook is promising, several risks loom. The possibility of catalysts being priced in, geopolitical conflicts, or unexpected selling pressure could dampen Bitcoin’s ascent. A failure of anticipated events, like the Federal Reserve refraining from easing conditions, could trigger a significant market correction.

In this exciting Bitcoin journey, investors are navigating through a dynamic landscape, eagerly watching for the next turn in this volatile digital frontier.

Bitcoin Price Analysis

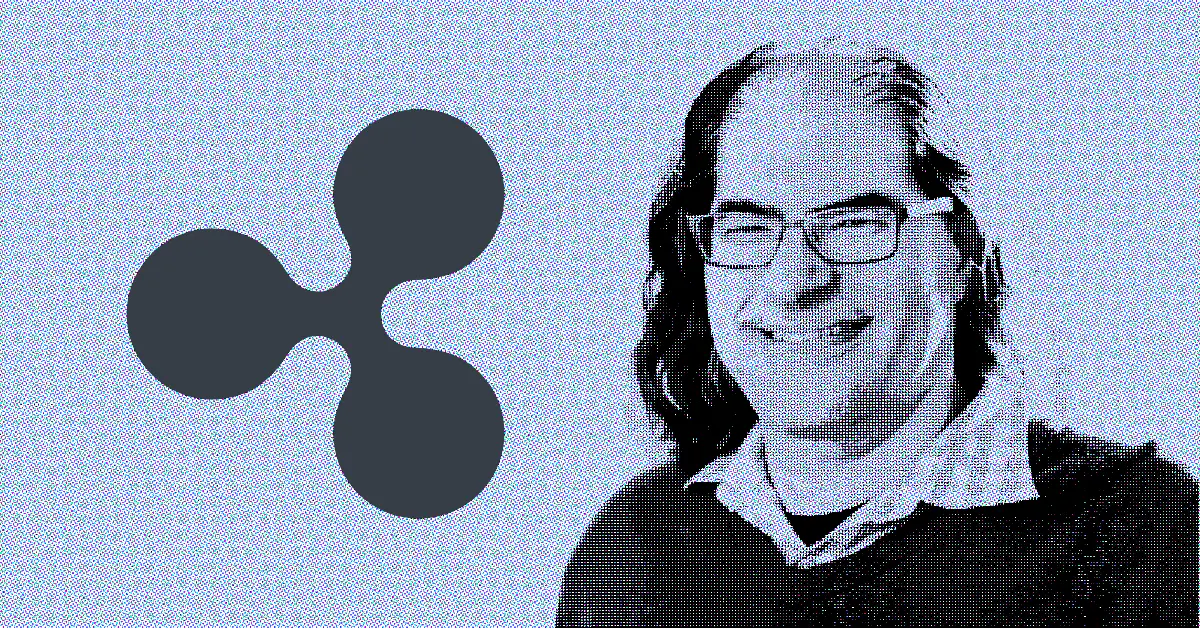

Ripple CTO’s Secret Plan to Burn 40.7 Billion XRP, Shocked Crypto Community

To tackle rising worries in the XRP community, Ripple’s Chief Technology Officer, David Schwartz, has shared vital details about the potential burning of a substantial chunk of the 40.7 billion XRP currently held in escrow.

Ripple’s Blackholing Strategy

Addressing criticism regarding the periodic release of XRP from escrow accounts, Schwartz recently took to Twitter to reveal Ripple’s distinctive approach. He termed it as the “blackholing” of associated accounts—a groundbreaking strategy that enables Ripple to prevent the released XRP from entering circulation by rendering the linked accounts inaccessible.

If you define "burn the escrow" to mean "ensure that no XRP from the escrow can ever get into circulation", then Ripple could do that unilaterally by blackholing the account the escrow cancels into.

— David "JoelKatz" Schwartz (@JoelKatz) February 19, 2024

Schwartz’s clarification comes at a crucial juncture as dissatisfaction grows within the XRP community over Ripple’s perceived influence on the cryptocurrency. The periodic release of XRP from escrow accounts, notably on the first day of each month, has fueled frustration among XRP enthusiasts.

A Messy Time

Against the backdrop of recent controversies in the broader cryptocurrency market, discussions about burning XRP escrows have gained significant traction.

Allegations of price manipulation through programmatic sales have heightened concerns among XRP enthusiasts, who view Ripple’s actions as actively influencing market dynamics and potentially devaluing the cryptocurrency.

A Complex Strategy and Ecosystem

However, Schwartz’s detailed explanation goes beyond addressing the burning of XRP escrows. It provides insights into Ripple’s overarching strategy for managing its substantial XRP reserves. This newfound transparency aims to deepen the community’s understanding of Ripple’s role in shaping the XRP market and alleviate concerns within the community.

Contrary to the apparent simplicity of Ripple’s control over releasing XRP, Schwartz’s revelations shed light on the intricate dynamics within the XRPL ecosystem. This news helps the community understand the complexities that influence Ripple’s decisions regarding XRP and clarifies the reasons behind the company’s actions in the cryptocurrency realm.

Mysterious $160 Million Ethereum Purchase Sparks Speculation: Is Justin Sun Behind It?

Crypto industry experts highly suspect an address that recently acquired $160 million in ETH to be potentially linked to Justin Sun, founder of the TRON network. What does the analytics say? Is the buy a huge indicator of a bullish drive for Ethereum? Let us dig in further to get all of the details!

Large transactions on the run

Lookonchain, an online chain investigator, has released its detailed scrutiny of the said huge transactions. According to their data, the purchase of 54,721 ETH was made through leading cryptocurrency exchange Binance and various decentralized exchanges (DEXs).

The wallet is identified with the partial address “TWGHNc” and has been scrutinized for its large-scale transactions. The same wallet had a withdrawal of 500 million USDT in Tether from HTX (Huobi) on Sunday.

Lookonchain also said that the same wallet also deposited 50 million USDT into Binance. Further comparisons of transaction patterns have linked the TWGHNc wallet to another address, “0x7a95,” noting parallel activities between the two.

On February 7, TWGHNc deposited $5.4 million to HTX which was followed by a similar amount in ETH withdrawal by 0x7a95 from HTX the next day. Additionally, a 50 million USDT deposit to Binance on Feb. 1 by TWGHNc correlated with a following withdrawal of 9,959 ETH from Binance by 0x7a95 on Feb. 12.

Is it likely that Justin Sun is the one making these transactions?

All the previous activity drives analysts and observers to one conclusion and that is Sun is the one that would have the potential capability to withdraw such a large amount from HTX keeping in mind his huge influence on the crypto market. There is too much of a coincidence between the transactions mentioned above bringing us to a guess based on onchain data.

What’s in it for the Ethereum market??

If Tron’s Justin Sun is accurately identified to be the one behind these transactions, it would signal a bullish interest in Ethereum from him. History has witnessed a surge in market rates through the influence of highly influential people in the industry and Sun is no less. ETH holders are on their way to getting delightful news with a soon-to-be witnessed bull market for Ethereum.

Ethereum