The Anatomy of a Secure SPV Investment: From Agreement to Account

A successful SPV investment is built on a foundation of precise legal and financial architecture. The journey begins with SPV formation, where the entity is legally established. The cornerstone document is the SPV agreement, which details investor rights, economics, and governance. This entity is meticulously structured to be a bankruptcy remote SPV, a critical feature that protects investors' assets from unrelated liabilities.

Operationally, every SPV investment requires a dedicated SPV account to segregate funds and ensure clear financial tracking. This separation is a hallmark of a well-managed SPV company. For sponsors, effective SPV management is non-negotiable, involving investor communications, audit preparation, and regulatory filings. Handling this internally is resource-intensive. This operational complexity is where a specialized partner becomes invaluable.

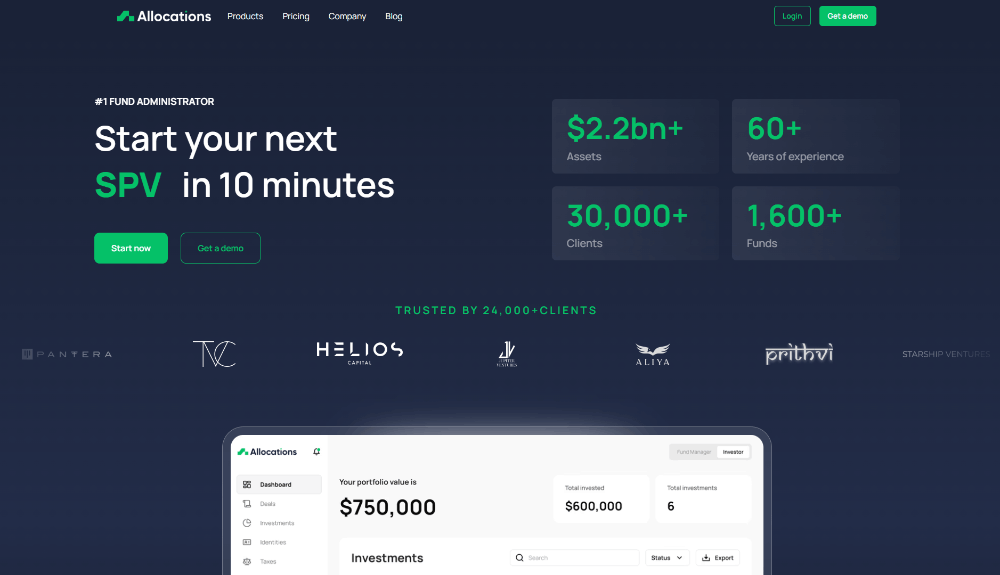

Allocations.com automates and manages these backend processes, allowing sponsors to focus on sourcing deals and investor relations. By leveraging a platform like Allocations.com, managers can offer a more secure and professional investment vehicle.