Weekly Crypto and Web3 Safety Digest — CW52 2025

5-Minute Intelligence Brief — Biggest Real-World Threats This Week

This CW52 digest condenses the highest-impact real-world crypto and Web3 losses into a fast, readable snapshot.

This is not theory, hype, or “what might happen.”

Before you skim: regardless of your experience level, it’s worth at least browsing this digest.

Many CW52 losses came from edge cases, UI defaults, and “safe-feeling” habits that even careful users didn’t realize were risky until it was too late.

You don’t need to read every line — but scanning the patterns may surface a trap you didn’t know applied to you.

It’s what did happen — to real users — and the exact moments where one different decision would have stopped the loss.

If you’re new to crypto, this shows the traps that are working right now.

If you’re experienced, it shows how careful users still lose funds through defaults, permissions, and misplaced trust.

If you’re security-aware, it separates high-signal threat patterns from noise and sensationalism.

CW52’s through-line is blunt:

Most losses were not caused by advanced exploits.

They happened because users moved faster than they verified.

Quick Intelligence Overview — CW52 at a Glance

CW52 continues a pattern that’s now structural:

Attackers aren’t breaking blockchains.

They’re shaping interfaces, permissions, and narratives.

At the same time, quiet operational failures (backups, recovery, email security) continue to cause permanent damage — even without an attacker.

CW52 Incident Mix (by frequency)

· Scams — ~74%

Fake platforms, pay-to-withdraw traps, phishing, impersonation, romance and task scams, address poisoning

· Hacks / Technical Compromise — ~15%

Malware, malicious extensions, session hijacking, key leaks

· User Errors — ~11%

Backup failures, recovery mistakes, approval misunderstandings, address copy-paste errors

Why this matters:

Most CW52 losses were preventable with basic verification steps at the UI or workflow level.

Many victims didn’t “not know better” — they believed they already did.

The Four Threat Zones That Defined CW52

1. Wallet-Drainers, Permission Abuse & Silent “Hacks”

Intensity: High 🔥

CW52 again shows why “wallet hack” is often the wrong mental model.

In many cases, funds moved exactly as authorized — because the authorization itself was the exploit.

What we saw this week

· ~$50M lost through address poisoning after an exchange withdrawal

Representative case: https://x.com/web3_antivirus/status/2002043421368693140

· Six-figure losses via old unlimited approvals abused days or weeks later

Representative case: https://www.reddit.com/r/Scams/comments/1prwouo/help_needed_300k_usdt_autotransferred_from_my/

· WalletConnect phishing clones + blind signing turning approvals into trust exercises

Representative case: https://www.reddit.com/r/ledgerwallet/comments/1ps52ny/284_lost_to_a_phishing_clone_ledger_walletconnect/

Press enter or click to view image in full size Screenshot of a fake MetaMask wallet update prompt on a phishing website, designed to trick users into connecting their wallet and approving malicious actions.

Screenshot of a fake MetaMask wallet update prompt on a phishing website, designed to trick users into connecting their wallet and approving malicious actions.

· Long-tail exposure from compromised browser extensions and leaked vault data

Representative case: https://x.com/PeckShieldAlert/status/2004357360371023948

Representative case: https://thehackernews.com/2025/12/lastpass-2022-breach-led-to-years-long.html

🚨 The $50M reality check (this matters)

In the largest case, the victim did take precautions:

· A small test transfer was sent first

· The test transfer went to the correct address

Minutes later, the attacker poisoned the transaction history.

The final transfer copied a lookalike address from “recent recipients” — and $50M was gone.

Nothing was hacked.

The transfer was valid.

🔑 Key takeaway

A successful test transfer does not protect you if the final send relies on:

· “recent recipients”

· truncated address display

· visual familiarity instead of full verification

🤔 Ask yourself

If you sent a test transfer, then copied the address from history for the real send —

would your current address-checking habit have stopped this loss?

What would have stopped most CW52 wallet drains

· Verifying the full destination address, not just first/last characters

· Using address books / allowlists for large transfers

· Reviewing and revoking approvals routinely (revoke.cash)

· Disabling blind signing unless strictly necessary

2. Fake Platforms, Romance Scams & Task-Based Deposit Schemes

Intensity: Extremely High 🔥

This remains CW52’s highest-volume and highest-loss category.

The branding shifts — exchanges, arbitrage bots, “AI trading,” jobs, mentors — but the mechanics are identical:

Staged profits → blocked withdrawals → escalating deposit demands

What we saw this week

· Fake trading platforms freezing withdrawals behind “VIP,” “tax,” or “verification” fees

Representative case: https://www.reddit.com/r/CryptoScams/comments/1psck5l/is_my_friend_being_scammed/

· Romance-driven funnels routing victims into controlled dashboards

Representative case: https://www.reddit.com/r/CryptoScams/comments/1psmmm5/new_crypto_scam_quantum_apex_capital_the_wealth/

· Task/job scams escalating deposits via fake balances and “negative clears”

Representative case: https://www.reddit.com/r/Scams/comments/1pu2ybq/us_scammed_by_zappippccom_task_scam_lost_money/

The retrospective lesson (this keeps repeating)

In multiple CW52 cases, victims successfully withdrew small amounts first.

That success was used as proof.

When larger balances appeared, withdrawals were suddenly blocked — not by a bug, but by design — and each new payment was framed as “the last step.”

The platform didn’t malfunction.

It progressed.

The invariant rule still holds

If you must pay to withdraw, the balance is fiction.

🤔 Ask yourself

If a platform let you withdraw once — then demanded a fee when the balance got bigger

What would have stopped most CW52 platform scams

· Checking domain age + independent reputation before depositing

· Verifying whether any activity exists on-chain (who.is)

· Stopping immediately at the first pay-to-withdraw demand

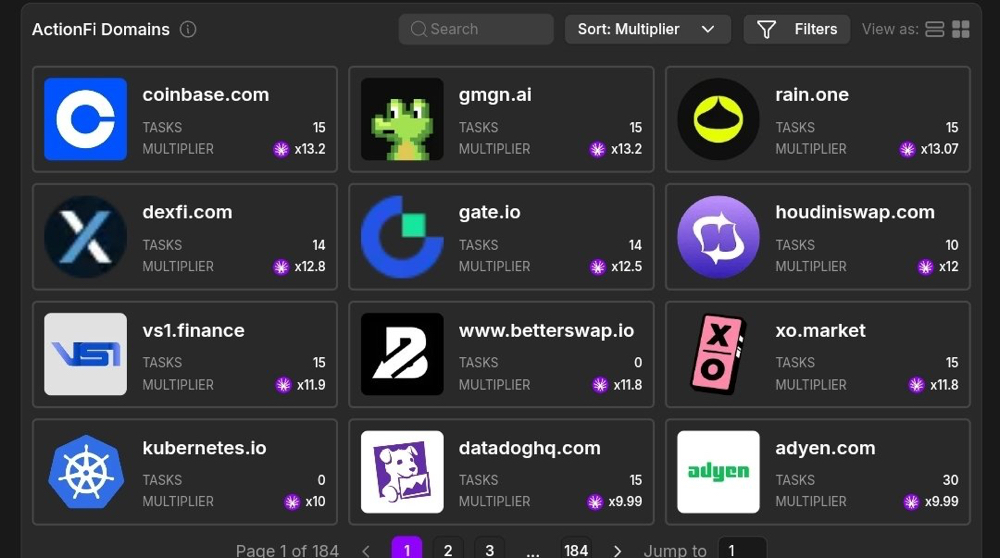

3. Impersonation, Phishing & “Support” Abuse

Intensity: Very High 🔥

CW52 impersonation wasn’t technically clever — it was operationally disciplined.

Attackers succeeded by moving victims off official channels and into guided flows designed to capture seeds, OTPs, or transfers.

What we saw this week

· Physical Ledger and Trezor letters with QR codes

Representative case:

https://www.reddit.com/r/ledgerwallet/comments/1psnwzk/my_family_fell_victim_to_a_ledger_scam_in_the/

Press enter or click to view image in full size Fake hardware wallet security letter with QR code used in phishing scams to steal recovery phrases by impersonating Ledger or Trezor support.

Fake hardware wallet security letter with QR code used in phishing scams to steal recovery phrases by impersonating Ledger or Trezor support.

· Phone calls impersonating Coinbase, Binance, PayPal

Representative case:

https://www.reddit.com/r/Scams/comments/1psmwfo/uk_stupidly_fell_for_paypal_scam/

· SMS and email “security alerts” routing to clone sites

Representative case:

https://www.reddit.com/r/ledgerwallet/comments/1ps52ny/284_lost_to_a_phishing_clone_ledger_walletconnect/

Press enter or click to view image in full size Example of SMS phishing impersonating a crypto exchange, showing fake verification codes, lookalike domains, and urgent security alerts used to route victims to clone sites and steal credentials.

Example of SMS phishing impersonating a crypto exchange, showing fake verification codes, lookalike domains, and urgent security alerts used to route victims to clone sites and steal credentials.

· Recovery scams extracting fees after the first loss

Representative case:

https://www.reddit.com/r/CryptoScams/comments/1pml3v6/recovery_scam/

The retrospective lesson

In several CW52 cases, victims didn’t click random links or panic blindly.

They believed they were already inside a verified support flow.

The failure wasn’t ignorance — it was accepting first contact as authority.

Hard override rule

If “support” reaches out to you first,

you are already inside the attacker’s flow.

🤔 Ask yourself

If a message looked official and referenced your wallet or account correctly,

would you verify independently — or continue the conversation?

What would have stopped most CW52 impersonation losses

· Re-entering only through bookmarked official apps/sites

· Never sharing seed phrases, private keys, or OTPs

· Treating unsolicited QR codes as hostile by default

4. Account Takeovers, Backups & Recovery Failures

Intensity: Medium, but persistent 🔥

Not all CW52 losses involved active scammers.

Some were permanent failures caused by operational fragility — discovered only when recovery was needed.

What we saw this week

· Exchange drains after email compromise blocked alerts

Representative case:

https://www.reddit.com/r/CoinBase/comments/1ps9sda/yet_another_victim_of_scam/

· Wallets lost after phone upgrades revealed missing backups

Representative case:

https://www.reddit.com/r/CoinBase/comments/1ptelv8/need_a_solution/

· Funds “missing” after restore due to derivation path mismatch

Representative case:

https://www.reddit.com/r/Bitcoin/comments/1psjupj/help_recovering_a_wallet_i_have_12_words/

· Second-hand hardware wallets reused without generating new seeds

Representative case:

https://www.reddit.com/r/ledgerwallet/comments/1pu0jku/solana_stolen/

The quiet but brutal truth

“No attacker involved” does not mean “low impact.”

These losses weren’t dramatic — they were irreversible.

The retrospective lesson

In CW52, recovery failed not because users acted recklessly,

but because recovery was assumed, not proven.

Backups that were never tested didn’t exist.

🤔 Ask yourself

If you had to restore a wallet today — on a fresh device —

could you do it without guessing?

What would have stopped most CW52 operational losses

· Verifying recovery before you need it

· Hardening email with phishing-resistant 2FA

· Documenting wallet type, derivation path, and setup metadata

· Never using hardware wallets without full initialization hygiene

CW52 in One Sentence

Attackers didn’t need zero-days this week — they won by shaping what users thought was happening, and by relying on urgency, defaults, and routine clicks.

What CW52 Tests in Practice

Ask yourself honestly:

· Do you treat approvals and permits as real spend authority, not UI friction?

· Would you recognize pay-to-withdraw as a hard stop, not a hurdle?

· If “support” contacted you today, would you close everything and re-enter via a path you choose?

· When sending crypto or blockchain based assets, do you verify the full address, or trust “recent”?

· If you had to restore a wallet or prove access tomorrow, could you — without guessing?

CW52 shows that losses don’t come from ignorance alone.

They come from overconfidence, automation, and skipped checks.

Closing Perspective

CW52 reinforces a blunt but actionable reality:

Most losses were not caused by protocol failure.

They were caused by skipped verification at predictable moments.

Across scams, hacks, and user mistakes, the same failures recur:

- trusting interfaces instead of verifying reality

- reacting to urgency instead of slowing down

- copying instead of confirming

- assuming backups and security are “probably fine”

The strongest defenses in Web3 are still small, boring habits.

Attackers didn’t need to be clever.

They only needed victims to move faster than they verified.

Read the full CW52 intelligence report (all incidents, sources, and breakdowns):

https://cryptosafetyfirst.com/weekly-crypto-and-web3-safety-digest-cw52-2025/

Disclaimer

This 5-minute Crypto and Web3 Safety Digest is based on curated open-source intelligence (OSINT), including public posts, news reports, and user disclosures. Details may be incomplete or change over time.

This content is not financial, investment, legal, or tax advice.

Do not make trading, custody, or reporting decisions based solely on this summary. Always verify information independently and consult qualified professionals where appropriate.

References to platforms, tools, or services do not imply endorsement. Scam domains or URLs are included only for awareness.

If you believe you are currently being scammed or your account is compromised, do not send more funds. Preserve evidence and contact official support or relevant authorities using verified channels.

Methodology & AI Disclosure

This report combines manual research, source verification, and editorial judgment using publicly available reports, community disclosures, and reputable media sources.

AI-assisted tools are used selectively to:

· structure and normalize incident data

· summarize technical or verbose sources

· support visual concepts and illustrations

All content is reviewed, edited, and validated by humans before publication. AI is used to streamline repetitive tasks and improve clarity — not to replace analysis or editorial decision-making.

Some visuals may be AI-generated illustrations intended to help readers recognize common scam patterns and attack flows. They are illustrative, not literal representations of specific platforms or interfaces.