AUTOMATED TRADING (EA) VS MANUAL TRADINGWHICH IS BETTER – AND WHEN SHOULD YOU USE EACH?

In recent years, traders have clearly split into two groups:

those who trade with Expert Advisors (EAs) and those who trade manually.

Many argue about which method is “better.”

But the truth from a professional trading perspective is simple:

❝ There is no perfect method — only the right method for the right market conditions and the right account structure ❞

This article provides a deep, realistic, and non-hyped comparison to help you:

- Understand the true nature of EA vs manual trading

- Know when to use an EA and when to trade manually

- Learn how to allocate capital properly to avoid destructive risk

1️⃣ EA TRADING – THE POWER OF DISCIPLINE

🔹 What Is an EA?

An Expert Advisor is a fully programmed trading system that executes trades based on predefined rules:

- Entry conditions

- Risk & money management

- Take profit, stop loss, DCA, hedge logic (if implemented)

An EA has no emotions — no fear, no greed, no hesitation.

✅ Key Advantages of EA Trading

- Trades 24/5 without fatigue

- Executes rules with absolute discipline

- Ideal for scalping, DCA, grid systems

- Easy to backtest, optimize, and analyze statistically

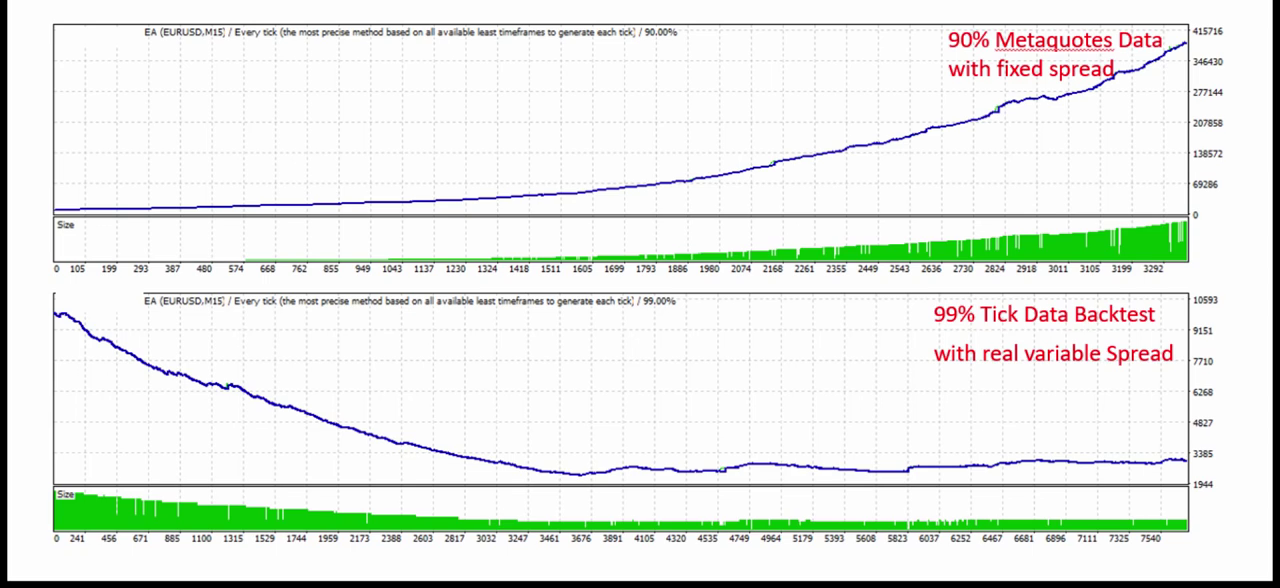

⚠️ Real-World Limitations (Often Ignored)

- EAs do not understand market context

- Vulnerable when market behavior changes

- DCA/grid strategies can be dangerous without strict risk control

- Dependent on VPS quality, spread, and slippage

👉 EAs are not for traders chasing fast profits

👉 EAs are for traders who value consistency and risk control

2️⃣ MANUAL TRADING – THE POWER OF MARKET UNDERSTANDING

🔹 What Is Manual Trading?

Manual trading relies on:

- Market structure analysis

- Trend recognition

- Context-based decision making

- Trader experience and discretion

✅ Advantages of Manual Trading

- Excellent adaptability to news and volatility

- Effective during trend shifts and breakouts

- Flexible position management

- Ideal for intraday, swing, and position trading

⚠️ Major Weakness

- Emotions are the biggest enemy

- FOMO and revenge trading risks

- Cannot trade consistently for long hours

- Performance depends entirely on the trader’s mindset

👉 Manual trading requires strong discipline and experience

👉 But when mastered, it is extremely powerful

3️⃣ WHEN SHOULD YOU USE AN EA — AND WHEN SHOULD YOU TRADE MANUALLY?

🔸 USE AN EA WHEN:

✔ Market is range-bound / sideways

✔ Scalping, DCA, or grid strategies

✔ Lower timeframes: M1 – M5 – M15

✔ No high-impact news

✔ You cannot monitor the market constantly

👉 EAs work especially well in Forex & Gold during Asian sessions and early London

🔸 TRADE MANUALLY WHEN:

✔ High-impact news events (CPI, NFP, FOMC)

✔ Strong breakouts or trend reversals

✔ Higher timeframes: H1 – H4 – D1

✔ You need to read market structure and sentiment

👉 Gold & Forex during New York session favor manual trading

4️⃣ SMART ACCOUNT ALLOCATION – THE SURVIVAL FACTOR

❌ COMMON MISTAKES

- Running EA and manual trades in one account

- Manual trading to “recover” EA losses

- Increasing EA lot size after manual losses

👉 This behavior often leads to rapid account destruction

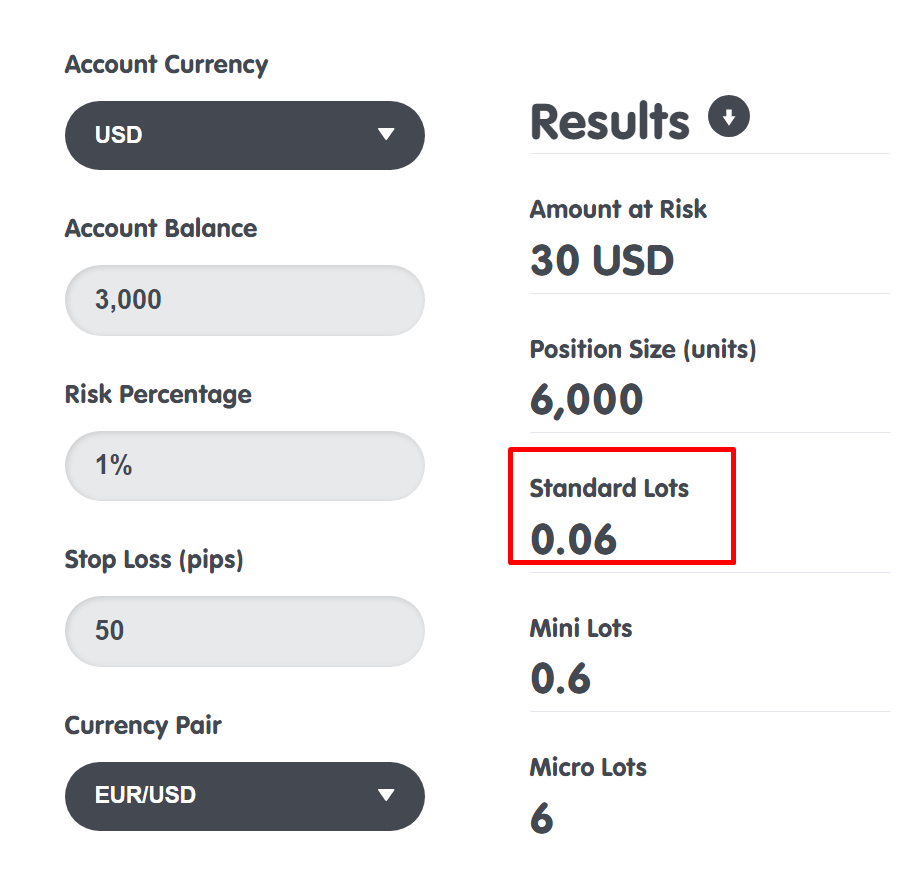

✅ RECOMMENDED CAPITAL STRUCTURE

Account 1 – EA Trading

- 40–60% of total capital

- Stable logic (controlled DCA, average TP)

- No manual interference

Account 2 – Manual Trading

- 20–40% of total capital

- Trend, news, swing trades

- Clear stop loss, minimum RR 1:2

Account 3 – Testing / Research

- 5–10% of total capital

- New EA or strategy testing

5️⃣ FINAL THOUGHTS – PROFESSIONAL TRADERS DON’T CHOOSE JUST ONE

❝ Beginners choose between EA or manual

Professionals know when to use each ❞

- EA = a disciplined profit engine

- Manual trading = a flexible tactical weapon

- Risk management = the foundation of survival

👉 Stop asking “Which is better?”

👉 Start asking “What does the market require right now?”