📈 Liquidity In Cryptocurrency Trading: Why Does The Price Seek Your Stop?

Have you ever experienced the price hitting your stop loss, liquidating your trade... and then the market moves exactly the way you predicted? If the answer is yes, don't worry: you're not alone. This happens to thousands of traders around the world, every day. And it's no coincidence. The reality is that 80% of traders lose money in the markets, while only 20% achieve consistent results. The question is: why?

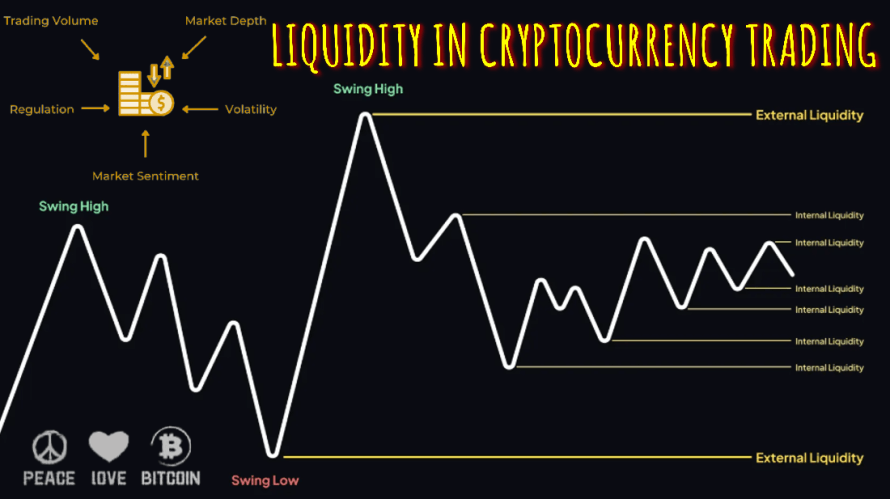

The answer can be summed up in one word: liquidity. The market doesn't move randomly or on a whim; the price has a clear and constant objective: to seek liquidity. This invisible force acts like a magnet, drawing the price to certain areas, where real money, buy and sell orders, stop losses from millions of retail traders, and liquidations from overleveraged traders are concentrated. And until you understand this concept, you'll fall prey to a repetitive cycle: entering the market with hope and leaving it as part of the losing statistic.

In simple terms, liquidity is the money available in the market. It's all those orders waiting to be executed, allowing someone to buy while someone else sells. Without liquidity, trading wouldn't be possible.

Imagine this: a trader wants to buy 10 Bitcoin at the current price of $112,035. His order needs a counterparty; that is, someone willing to sell him those 10 Bitcoin. If there isn't enough supply at that level, his purchase will "eat up" the sell orders placed higher up, causing the price to rise until it reaches the necessary volume.

That's why it's said that liquidity is the fuel of price. If there's little market depth, a single large order can dramatically move the price. On the other hand, in areas with a lot of accumulated liquidity, the big players—institutions, funds, and whales—find the perfect terrain to execute their trades without causing uncontrolled movements.

Here's the key that differentiates professional traders from novices: Price always goes where the liquidity is. And where does that liquidity accumulate?

- In the stop losses of thousands of retail traders.

- In the limit orders waiting on the order book.

- In the liquidations of leveraged positions (especially those in crypto futures).

If you placed your stop loss below an obvious low, believe me: you're not alone. Thousands of traders did it in the same place. And that means there's a "liquidity pool" that's irresistible to the market. The big players need you to execute your stop because that forced sale becomes their purchase. They need your defeat to enter with an advantage. You stop being a trader and become liquidity.

When a retail trader goes long, they usually place their stop just below the last support level. Their reasoning is logical, but naive: "If the price breaks this level, it invalidates my idea". What they don't know is that thousands of traders thought the same. That accumulation of stops forms a magnet. And high-frequency algorithms, whales, and large funds know this. They need liquidity to enter strongly. Where do they find it? In your stop.

The same thing happens on the other side: when you go short, your stops are usually above a clear resistance. Again, a liquidity pool is formed that the price will sooner or later seek out. Coincidence? No, pure strategy.

The good news is that today you don't need to guess where those levels are. There are tools that allow you to identify liquidity in real time and better understand why the price moves the way it does. Some of the best-known are:

- Coinglass (https://www.coinglass.com) – Free, intuitive, and widely used in crypto. It allows you to view liquidity pools and liquidation zones.

- Trading Different (https://tradingdifferent.com) – One of the most comprehensive and professional platforms (paid). With advanced heat maps, integration with TradingView, and filters to view leverage levels.

- TensorCharts (https://www.tensorcharts.com) – Ideal for observing pending orders in the order book and how they accumulate at psychological levels (round numbers).

These platforms work like flashlights in the dark: they reveal where the money is hidden. And believe me, MONEY LEAVES TRACES.

Many people still don't fully understand that trading is a zero-sum game: what one wins, another loses. And most of the time, the losers are the retail traders who operate without understanding the dynamics of liquidity. The big players have no interest in going against you personally. They simply look for where the largest volume of orders is so they can execute theirs. You, unwittingly, offer them the perfect counterpart with your stop. Therefore, the difference between being on the losing side or the winning side is not having a "holy grail" of indicators, but learning to identify where the market is going to seek liquidity and positioning yourself intelligently.

The financial market is neither fair nor benevolent: it is a hunting ground where the weak are fed by the strong. It is not a space designed to fulfill your dreams, but to redistribute money from the impatient to the patient, from the naive to the informed. If you want to stop being part of the 80% of traders who lose, you need to understand that the price doesn't seek your stop because of bad luck: it seeks it because that's where the liquidity that moves the market is. The next time you enter a trade, ask yourself:

- Am I placing my stop where everyone else is?

- Am I entering the market just before it's about to wipe out a liquidity pool?

- Am I acting as a trader or as bait for the big players?

Only when you stop being liquidity and learn to read it, will you begin to play the real game of trading. The market is unforgiving, but it rewards those who know how to listen to what it's really after: money, YOUR MONEY, liquidity.

OTHER LINKS 👍:

🔎 Discover Cryptocurrency Trading with AI. 🤖 Robot Trader (➕💲5️⃣ FREE). 💡 LET TECHNOLOGY WORK FOR YOU 😎

- 🤖 Bot GPTrading: https://app.gptrading.ai/invite/01JZJT6KQNTM3KZVMRQYA7NPGX

- 📈 Zaffex Broker: https://broker.zaffex.com/auth/register?referrerUserId=01JZJSMDFAW5ECTRZH852EYR0J

- ✍️ Tutorials: https://www.youtube.com/@TeamReferralFamily

💳 Get the BANCUS Cryptocurrency Debit Card 🥳 NO KYC VERIFICATION REQUIRED. Participating in their REFERRAL PROGRAM allows you to accumulate sufficient funds to purchase it WITHOUT INVESTMENT.

- 🔗 https://go.bancus.io/?ref=CD89QYCG

- 💰 Referral Reward Levels 👉

Card Purchase:1º-$7.50, 2º-$11.25, 3º-$7.50;Of the Top-Up Amount:1º-0.285%, 2º-0.43%, 3º-0.285% - 👉 Plastic Card: ATM: $200 daily, Merchant: $2,500 monthly, Reload: $2,500 maximum | Metal Card: ATM: $600 daily, Merchant: $2,500 daily, Reload: $50,000 maximum.

"If you don't find a way to earn money while you sleep, you'll work until you die" - Warren Buffett