7 Hidden Gem Altcoins To Invest Right Now

Explore a diverse range of lesser-known altcoins that could potentially offer exciting investment opportunities in the ever-evolving cryptocurrency market. These hidden gems, often overshadowed by major cryptocurrencies like Bitcoin and Ethereum, possess unique features and promising fundamentals that make them intriguing investment prospects. From innovative blockchain technologies to revolutionary use cases, these altcoins have the potential to disrupt various industries and gain significant value in the future.

By investing in these hidden gem altcoins now, you could position yourself at the forefront of a burgeoning crypto landscape, potentially reaping substantial rewards as these projects mature and gain traction. However, it’s important to conduct thorough research and due diligence before investing, as the crypto market is notoriously volatile and unpredictable. With careful consideration and a strategic approach, these hidden gem altcoins could prove to be lucrative additions to your investment portfolio.

What Are Altcoins?

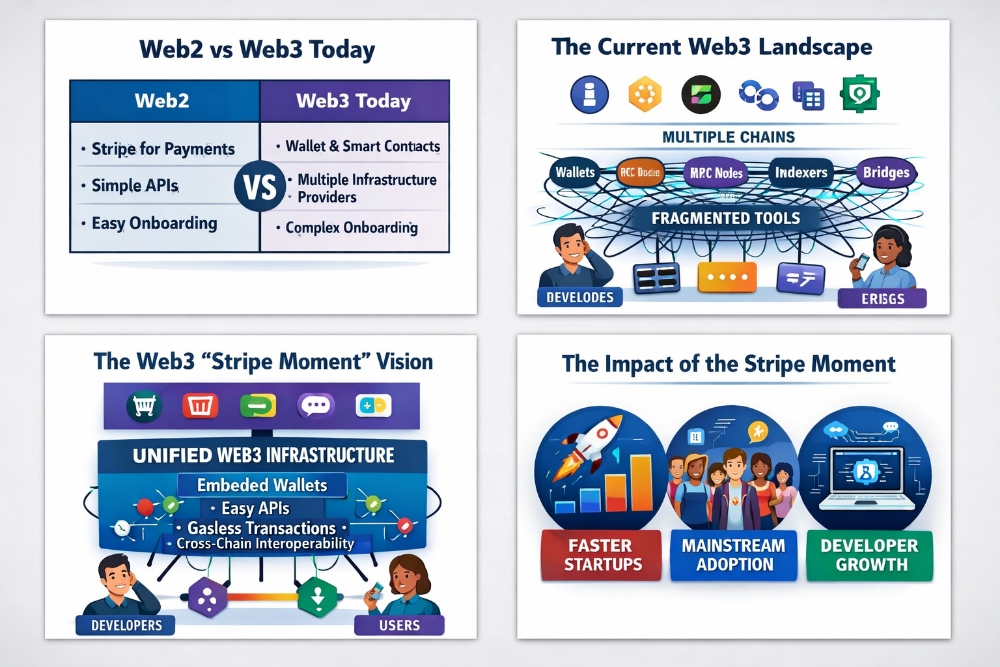

Altcoins, or alternative coins, refer to any cryptocurrency other than Bitcoin. They were created as alternatives to Bitcoin, often seeking to improve upon its limitations or offer different features. Altcoins can vary widely in terms of their technology, purpose, and popularity. Some altcoins, like Ethereum, have become major players in the cryptocurrency space, offering smart contract functionality and enabling the development of decentralized applications (dApps).

Other altcoins may focus on privacy, scalability, or niche use cases. Altcoins are typically traded on cryptocurrency exchanges and can be bought, sold, or traded like any other digital asset. While Bitcoin remains the dominant cryptocurrency by market capitalization, altcoins play an important role in the broader crypto ecosystem, offering investors and users a diverse range of options beyond the original cryptocurrency.

Factors to Consider Before Investing in Altcoins

Before investing in altcoins, it’s important to consider several factors to make informed decisions and manage risks effectively. Here are key factors to consider:

Project Fundamentals: Evaluate the project’s whitepaper, team, and roadmap. Look for a strong use case, experienced team members, and a clear development plan.

Market Potential: Assess the market demand for the altcoin’s use case. Consider factors such as competition, target audience, and potential for adoption.

Technology and Innovation: Examine the technology behind the altcoin. Look for unique features, scalability, security, and potential for future upgrades.

Community and Development Activity: Check the community engagement and development activity. Active communities and regular updates can indicate a healthy project.

Market Liquidity: Consider the liquidity of the altcoin. Higher liquidity can make it easier to buy and sell the coin without significant price slippage.

Regulatory Environment: Understand the regulatory environment for the altcoin. Compliance with regulations can affect the long-term viability of the project.

Risk Management: Diversify your investment portfolio to manage risk. Avoid investing more than you can afford to lose in any single altcoin.

Security: Ensure that the altcoin’s wallet and exchange platforms are secure. Use best practices for securing your investments, such as hardware wallets and two-factor authentication.

Timing and Market Conditions: Consider the current market conditions and the timing of your investment. Look for entry points that offer a good risk-reward ratio.

Exit Strategy: Have an exit strategy in place. Determine your profit-taking and stop-loss levels to manage your investments effectively.

By considering these factors, you can make more informed decisions when investing in altcoins.

Why Invest in Hidden Gem Altcoins?

Investing in hidden gem altcoins can be appealing for several reasons:

Early Adoption Potential: Hidden gem altcoins are often at an early stage of development, offering the potential for significant growth if the project succeeds.

Undervalued Assets: Hidden gem altcoins may be undervalued relative to their potential, providing an opportunity for investors to buy low before prices rise.

Diversification: Investing in hidden gem altcoins can diversify your portfolio beyond well-known cryptocurrencies like Bitcoin and Ethereum, potentially reducing risk.

Innovation: Hidden gem altcoins often introduce innovative technology or use cases that have the potential to disrupt industries and gain widespread adoption.

Community and Development: Some hidden gem altcoins have strong communities and active development teams, which can indicate a project’s long-term viability.

High Returns: Investing in hidden gem altcoins carries higher risk but also the potential for higher returns compared to more established cryptocurrencies.

Personal Interest: Investing in hidden gem altcoins can be exciting for those interested in exploring new projects and technologies in the crypto space.

While investing in hidden gem altcoins can be rewarding, it’s important to conduct thorough research and due diligence to mitigate risks. Hidden gem altcoins are often more volatile and susceptible to market manipulation, so careful consideration is essential.

7 Hidden Gem Altcoins to Consider

1. SKALE Network (SKL)

SKALE Network (SKL) is a blockchain network aiming to address the scalability issues faced by the Ethereum network. Here’s a breakdown of the SKALE Network:

What it is:

An Ethereum-native, modular blockchain network designed to be scalable.

Enables building an unlimited number of independent blockchains (SKALE chains) with fast transaction speeds and near-zero gas fees for users.

SKALE chains can be customized for specific decentralized applications (dApps).

How it works:

SKALE utilizes a leaderless consensus mechanism and relies on a network of validators to secure transactions.

SKL is the utility token that powers the network. Users can stake SKL to participate in validation or delegate their tokens to validators.

Developers can use SKL to deploy and rent SKALE chains for their dApps.

Benefits:

Aims to overcome Ethereum’s scalability limitations by providing a faster and more cost-effective platform for dApps.

Offers customization options for developers to build dApps with specific requirements.

Focuses on maintaining decentralization while achieving scalability.

Current status:

The price of SKL is $0.095997 USD with a circulating supply of 5.34 billion tokens.

You can find SKL listed on various cryptocurrency exchanges like Binance and Coinbase.

2. Realio Network (RIO)

Realio Network aims to bridge the gap between traditional finance and decentralized finance (DeFi) by allowing users to invest in, trade, and leverage real-world assets like real estate and private equity through DeFi.

Purpose:

Eliminate barriers to investing in real-world assets using DeFi.

Provide access to exclusive real estate and other alternative investments through a tokenized system.

How it works:

Realio Network likely tokenizes real-world assets, creating digital representations that can be traded on DeFi platforms.

RIO is the utility token that fuels the network, potentially used for:

Governance: Participating in network decisions.

Fees: Paying for transactions on the network.

Staking: Earning rewards for locking up RIO tokens.

Benefits:

Increased accessibility to real-world assets for a wider range of investors.

Potential for more fractional ownership and liquidity in traditionally illiquid assets like real estate.

Leverage DeFi features for potentially more efficient transactions and management.

Current status:

The price of RIO is around $1.68 USD with a circulating supply of approximately 6.57 million tokens.

RIO has experienced a price decline in the last 24 hours and the past week.

You can find RIO listed on cryptocurrency exchanges like OKX, Binance, and CoinMarketCap.

Information about the circulating supply can vary between sources.

DeFi and cryptocurrency are inherently volatile.

Realio Network is a relatively new project, and its long-term success depends on various factors.

3. Qubic (QUBIC)

Qubic has two meanings: a game and a cryptocurrency platform. Based on your previous questions about cryptocurrencies, let’s assume you’re interested in QUBIC the cryptocurrency platform.

What it is:

A layer-1 blockchain protocol designed for efficiency and scalability in the cryptocurrency space.

Aims to address limitations of traditional blockchains like high transaction fees and slow processing times.

Key features:

Unique consensus mechanism: Utilizes a quorum-based computer (QBC) system instead of proof-of-work (PoW) mining. This aims to be more energy-efficient and potentially contribute to real-world AI services.

Smart contract capabilities: Supports smart contracts written in C++, allowing for faster execution compared to virtual machine-based platforms.

Focus on AI integration: Aims to leverage AI for tasks like optimizing network efficiency and potentially training AI models through mining processes.

Benefits (potential):

Faster transaction processing times and lower fees compared to traditional blockchains.

More efficient use of computing power through the QBC system.

Potential for integration with real-world AI applications.

Current status:

Qubic (QUBIC) is a relatively new cryptocurrency with a current price of around $0.000006 USD.

Its market capitalization is relatively low, ranking around #156 according to Livecoinwatch.

You can find QUBIC listed on some cryptocurrency exchanges like Livecoinwatch.

The cryptocurrency market is inherently volatile, and QUBIC is a new project with uncertain future success.

More mainstream adoption is needed for Qubic to reach its full potential.

4. Myria (MYRIA)

Myria is a blockchain gaming ecosystem powered by its own Ethereum L2 scaling solution. It aims to address the scalability issues faced by traditional blockchains, enabling the development of high-quality, play-to-earn games with fast transaction speeds and low fees.

Key Features of Myria:

Ethereum L2 scaling solution: Myria’s scaling solution is designed to handle a large volume of transactions without compromising on security or decentralization. This makes it suitable for developing massively multiplayer online games (MMOs) and other high-throughput applications.

Focus on play-to-earn: Myria is built with play-to-earn gaming in mind, providing a platform for developers to create games that reward players for their time and contributions.

Developer-friendly: Myria offers a suite of tools and resources to make it easy for developers to build and deploy games on its platform.

Community-driven: Myria is committed to building a strong community of gamers and developers, and its governance model is designed to give them a voice in the future of the platform.

Current Status and Ecosystem:

Myria is still in its early stages of development, but it has already partnered with several game studios to bring their games to the platform.

The MYRIA token is the native cryptocurrency of the Myria ecosystem and is used for various purposes, including paying transaction fees, staking, and governance.

Myria has a growing community of users and developers who are excited about the potential of the platform.

Potential Benefits of Myria:

Improved gaming experience: Myria’s scaling solution can potentially provide a smoother and more enjoyable gaming experience for players.

New opportunities for play-to-earn: Myria’s focus on play-to-earn could create new opportunities for gamers to earn rewards while playing their favorite games.

Innovation in blockchain gaming: Myria could help to drive innovation in blockchain gaming by providing a platform for developers to create new and exciting games.

Important Considerations:

Early-stage project: Myria is still in its early stages of development, and there are some risks associated with investing in early-stage projects.

Competitive landscape: The blockchain gaming space is highly competitive, and many other platforms are vying for the same users and developers.

Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and there is some uncertainty about how this could impact Myria in the future.

Overall, Myria is a promising project with the potential to revolutionize the blockchain gaming industry. However, it is important to do your own research and understand the risks involved before investing in any cryptocurrency project.

5. Neoxa (NEX)

Neoxa is a blockchain network focused on the gaming industry, particularly the play-to-earn (P2E) model. Here’s a breakdown of Neoxa:

What it is:

A Proof-of-Work (PoW) Layer 1 blockchain designed for the gaming industry.

Aims to provide a platform for gamers to earn rewards (NEOX tokens) while playing their favorite games.

Offers features like smart contracts and a marketplace for in-game assets.

Key Features:

Play-to-earn: Neoxa integrates P2E mechanics, allowing gamers to earn NEOX tokens through gameplay.

Smart Nodes: Users can run Smart Nodes to contribute to the network’s security and earn rewards.

Coin Burning: Neoxa implements a coin-burning mechanism during marketplace purchases, reducing the total supply of NEOX tokens and potentially increasing its value over time.

Watch-to-Earn (potential): Some sources mention the possibility of a watch-to-earn feature, but its current status is unclear.

Benefits (potential):

Gamers can potentially earn rewards while playing games they enjoy.

Smart Nodes offer an opportunity for passive income generation for network participants.

Coin burning could contribute to token value appreciation in the long run.

Current Status:

Neoxa is a relatively new project with a circulating supply of around 4.03 billion NEOX tokens.

Price: Around $0.007 USD

Market Capitalization: Lower compared to established cryptocurrencies.

The price of NEOX can be found on cryptocurrency tracking websites.

Neoxa has a gaming portal and a marketplace in development according to their website.

Important points to consider:

The cryptocurrency market is volatile, and the success of P2E models is still evolving.

Neoxa is a new project, and its long-term viability depends on factors like adoption and development progress.

Conduct your research before making any investment decisions.

6. Shrapnel (SHRPN)

Shrapnel (SHRPN) is the native token of the Shrapnel game ecosystem, built on the Avalanche blockchain.

Shrapnel is a first-person extraction shooter game where players compete to collect valuable meteorite resources and escape the map alive.

SHRPN tokens are used for various purposes within the Shrapnel ecosystem:

Rewards during early access competitions

Publishing in-game content

Purchasing user-created weapon skins and content

Participating in community votes

Current Status (as of April 16, 2024):

The price of SHRPN is around $0.26 USD with a circulating supply of approximately 240,900,741 tokens (according to CoinMarketCap).

SHRPN’s market capitalization is relatively low compared to more established cryptocurrencies.

You can find SHRPN listed on cryptocurrency exchanges like Bybit, LBank, Bitget, BingX, and Bitrue.

Important points to consider:

Shrapnel is a relatively new project, and the long-term success of the game and its token heavily depends on factors like player adoption and development progress.

The cryptocurrency market is inherently volatile, and the value of SHRPN can fluctuate significantly.

Conduct your own research before making any investment decisions related to Shrapnel (SHRPN).

7. MicroVisionChain (SPACE)

What it is:

A Level 1 blockchain project utilizing a UTXO-based public blockchain powered by Proof-of-Work (PoW) consensus mechanism.

Aim to achieve high performance and scalability to cater to large Web3 applications.

Key Features:

High Throughput: Designed to handle a large volume of transactions efficiently.

Scalability: Aims to overcome limitations faced by traditional blockchains for mass adoption.

Smart Contracts: Supports smart contract functionality, enabling the development of decentralized applications (dApps) on the MicroVisionChain network.

DID Integration: Integrates Decentralized Identifiers (DIDs) potentially offering greater security and privacy for users.

SPACE Token: SPACE is the native token that fuels the network. It’s used for staking, transaction fees, and potentially governance within the MicroVisionChain ecosystem.

Project Description:

MicroVisionChain (SPACE) is a public blockchain platform based on the UTXO model and Proof-of-Work (PoW) consensus mechanism.

It aims to address scalability issues faced by traditional blockchains, focusing on high concurrency and efficiency for large Web3 applications.

The native token, SPACE, fuels the network and is used for staking, transaction fees, and potentially governance.

Market Performance:

Price: $16.86 USD (CoinMarketCap)

Circulating Supply: Approximately 2.85 million SPACE (CoinMarketCap — unverified data)

Market Capitalization: Relatively low compared to established cryptocurrencies (information may vary depending on the source)

Trading Volume: Data availability may vary depending on the exchange you use. Check CoinMarketCap or other reliable sources.

Market Sentiment:

Limited information is available about market sentiment specifically for MicroVisionChain.

You can potentially find discussions and analysis on social media platforms or cryptocurrency forums, but be cautious about unsubstantiated claims.

Competition:

The blockchain space is highly competitive, with numerous established projects like Ethereum, Avalanche, and Solana focusing on scalability and smart contract functionality.

How to Invest in Hidden Gem Altcoins

Investing in hidden gem altcoins requires careful research and a strategic approach. Here’s a step-by-step guide to help you get started:

Research and Due Diligence: Identify potential hidden gem altcoins by researching projects with strong fundamentals, innovative technology, and a clear use case. Look for projects with a solid team, active community, and a well-defined roadmap.

Evaluate Risk-Reward Ratio: Assess the risk-reward ratio of each potential investment. Consider factors such as market demand, competition, technology, and regulatory environment to determine the growth potential.

Choose a Secure Exchange: Select a reputable cryptocurrency exchange that supports the altcoins you’re interested in. Ensure the exchange has a strong security track record and offers the altcoins you want to invest in.

Set Up a Wallet: Use a secure wallet to store your altcoins. Hardware wallets are considered the most secure option, but you can also use software wallets or exchange wallets (although they are less secure).

Start Small: Begin by investing a small amount in your chosen altcoins to test the waters. As you gain confidence and familiarity with the market, you can consider increasing your investment.

Monitor Your Investments: Keep track of the performance of your altcoin investments and stay updated on news and developments related to the projects you’ve invested in.

Diversify Your Portfolio: To manage risk, consider diversifying your investment portfolio across different altcoins and other asset classes.

Stay Informed: Stay informed about the cryptocurrency market and industry trends. Join communities, follow influencers, and read news sources to stay updated.

Have an Exit Strategy: Define your exit strategy before investing. Determine your profit-taking and stop-loss levels to protect your investment and manage risk.

Investing in hidden gem altcoins can be rewarding, but it’s important to approach it with caution and diligence. Conduct thorough research, diversify your portfolio, and stay informed to make informed investment decisions.

Future of Altcoin Investing

The future of altcoin investing holds both promise and challenges. As the cryptocurrency market continues to mature, altcoins are likely to play an increasingly important role alongside Bitcoin. Altcoins offer unique value propositions, such as improved scalability, privacy features, and smart contract capabilities, which could drive their adoption and value in the long term.

However, investing in altcoins also comes with risks, including regulatory uncertainties, technological vulnerabilities, and market volatility. To navigate these challenges, investors should conduct thorough research, diversify their portfolios, and stay informed about market trends and developments.

Additionally, as the regulatory landscape evolves, altcoin projects that comply with regulations and demonstrate strong fundamentals are more likely to succeed. Overall, while altcoin investing offers opportunities for growth and innovation, it requires a cautious and informed approach to mitigate risks and capitalize on the potential of these alternative cryptocurrencies.

Conclusion

In conclusion, identifying and investing in hidden gem altcoins can be a rewarding but challenging endeavor. These lesser-known cryptocurrencies offer the potential for significant returns, but they also come with increased risks due to their volatility and lack of widespread adoption. To mitigate these risks, it’s crucial to thoroughly research each altcoin, understand its technology, team, and community, and assess its long-term potential. Diversifying your investment across a portfolio of these hidden gems can also help spread risk and maximize potential returns.

Additionally, staying informed about market trends, regulatory developments, and technological advancements can help you make informed decisions and navigate the dynamic crypto landscape. While investing in hidden gem altcoins can be speculative, with the right approach and thorough analysis, it can also present unique opportunities for growth and diversification in your investment portfolio.

![𝐐𝐮𝐢𝐜𝐤 𝐚𝐥𝐩𝐡𝐚: [𝑝𝑜𝑡𝑒𝑛𝑡𝑖𝑎𝑙 𝑠𝑡𝑖𝑚𝑚𝑦 𝑎𝑡 𝑇𝐺𝐸] – 𝐉𝐔𝐒𝐓 𝐃𝐎 𝐈𝐓 𝐍𝐎𝐖!!!!](https://cdn.bulbapp.io/frontend/images/30a2649d-ce6e-4d5d-8666-7a0e754fc4e6/1)