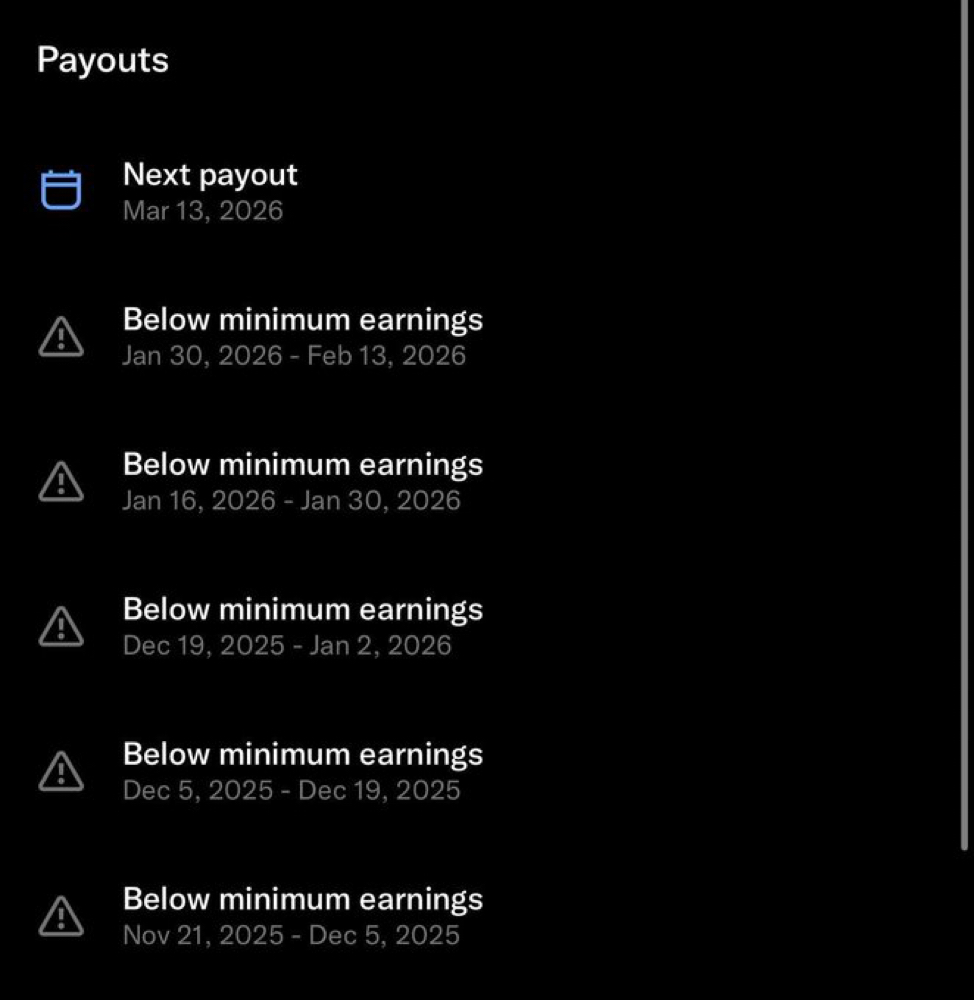

Psychological Traps and Decision Making in Financial Markets

102

Achieving financial success is not solely about market knowledge and analytical skills. The psychology of investors and their decision-making processes play a significant role in financial performance. Here are some strategies to be aware of potential traps and avoid them: