A Deep Dive into Fundamental Analysis

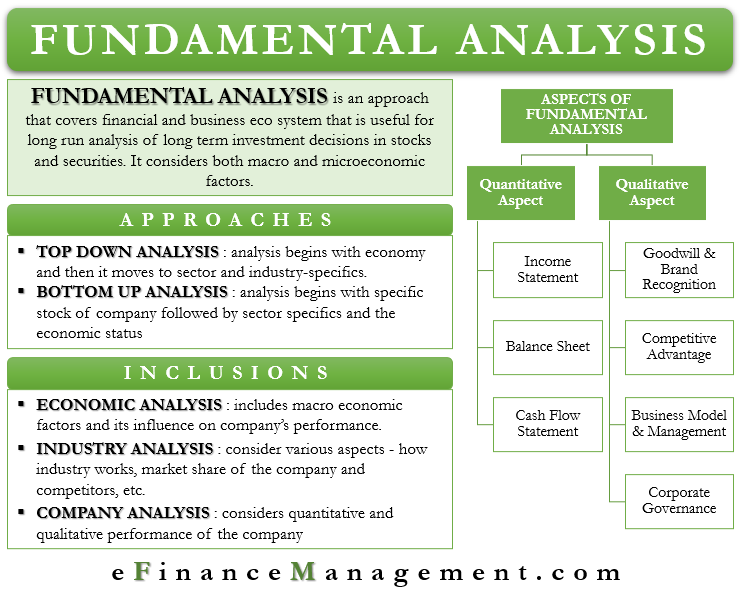

In the ever-churning ocean of the financial markets, navigating towards profitable investments takes more than just a lucky dip. Enter fundamental analysis (FA), a meticulous detective work aimed at uncovering the intrinsic value of an investment, be it a stock, bond, or even an entire company. By dissecting various financial and economic factors, FA equips investors with an informed perspective on which assets hold true potential.

Deciphering the Intrinsic Value: The Core of FA

Fund. Analysis

Fund. Analysis

At its heart, FA revolves around estimating the intrinsic value of an investment. This intrinsic value, distinct from the volatile market price, represents the true worth of the underlying asset based on its long-term fundamentals. By assessing these fundamentals, investors can identify discrepancies between intrinsic value and market price, paving the way for potentially lucrative decisions.

The Investigator's Toolkit: Components of FA

Components

Components

FA equips investors with a diverse toolkit, each element providing a crucial piece of the puzzle:

1. Financial Statements:

These pronouncements, issued by companies regularly, offer a detailed picture of their financial health. Investors closely scrutinize income statements, balance sheets, and cash flow statements to uncover profitability, solvency, and efficiency. Key metrics like earnings per share (EPS), price-to-earnings ratio (P/E), and debt-to-equity ratio reveal valuable insights into the company's financial performance.

Financial Statements:max_bytes(150000):strip_icc()/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)

2. Competitive Landscape:

Analyze

Analyze

Analyzing a company's position within its industry is vital. Assessing market share, competitor analysis, and industry trends helps gauge the company's competitive advantage and future growth prospects.

3. Macroeconomic Factors:

The bigger economic picture plays a crucial role. Investors consider factors like interest rates, inflation, GDP growth, and economic cycles to understand how external forces might impact the company's operations and profitability.

Macroeconomy:max_bytes(150000):strip_icc()/macroeconomic-factor.asp-FINAL-57c3f1a12ba5426fbd2882906a7e3008.png)

4. Qualitative Analysis:

Beyond the numbers, FA delves into intangible aspects like management quality, brand reputation, corporate governance, and technological innovation. Evaluating these soft factors can provide invaluable insights into the company's long-term direction and risk profile.

Qual. Analysis:max_bytes(150000):strip_icc()/qualitativeanalysis.asp-final-1175e446167f4b70af10d5f7a3938bd1.png)

Putting it All Together: The FA Roadmap

While there's no one-size-fits-all approach, conducting FA typically involves:

1. Defining Investment Objectives:

your risk tolerance, time horizon, and desired returns clarifies which financial instruments and industries to prioritize.

2. Selecting Companies:

Narrow down your options based on your objectives and initial research. Industry reports, news articles, and financial databases can be valuable resources.

3. Deep Dive into Company Research:

Analyze the aforementioned components of FA using financial statements, industry reports, news articles, and investor presentations.

4. Valuation & Comparison:

Based on your analysis, estimate the intrinsic value of the company and compare it to the current market price. This comparison informs your investment decision – whether to buy, sell, or hold.

5. Continuous Monitoring:

FA is an ongoing process. Stay updated on company news, industry trends, and economic developments to refine your initial valuation and adjust your position if necessary.

The Power and Pitfalls of FA

FA provides a robust framework for informed investment decisions, but it's crucial to acknowledge its limitations:

Future Uncertainty:

- Predicting the future is inherently challenging. Economic and market conditions can shift unexpectedly, impacting valuations.

Subjectivity & Judgment:

- Interpreting data and qualitative factors involves inherent subjectivity, leading to varying opinions among investors.

Time & Effort:

- Thorough FA requires dedicated time and effort, potentially deterring some investors.

Conclusion: FA - A Guide, Not a Guarantee

Fundamental analysis empowers investors with a comprehensive understanding of the companies and assets they consider. It fosters informed decision-making, potentially leading to long-term investment success. However, it's not a crystal ball; unexpected events and inherent uncertainties can still disrupt even the most meticulous analysis. Remember, FA is a guide, not a guarantee, but its rigorous approach equips you with the tools to navigate the turbulent waters of financial markets with a greater sense of confidence and control.

So, take up the mantle of the financial detective, delve into the depths of FA, and uncover the true potential of your investments!