Uptrend and Downtrend in Trading

Image Source: FreeImages

Are you familiar with the dynamic nature of trading trends? The ebb and flow of the financial markets can be exhilarating, but it's essential to understand how to navigate the ups and downs for success. In this article, we delve into the world of trading and explore the concept of uptrends and downtrends.

Understanding Uptrend and Downtrend in Trading

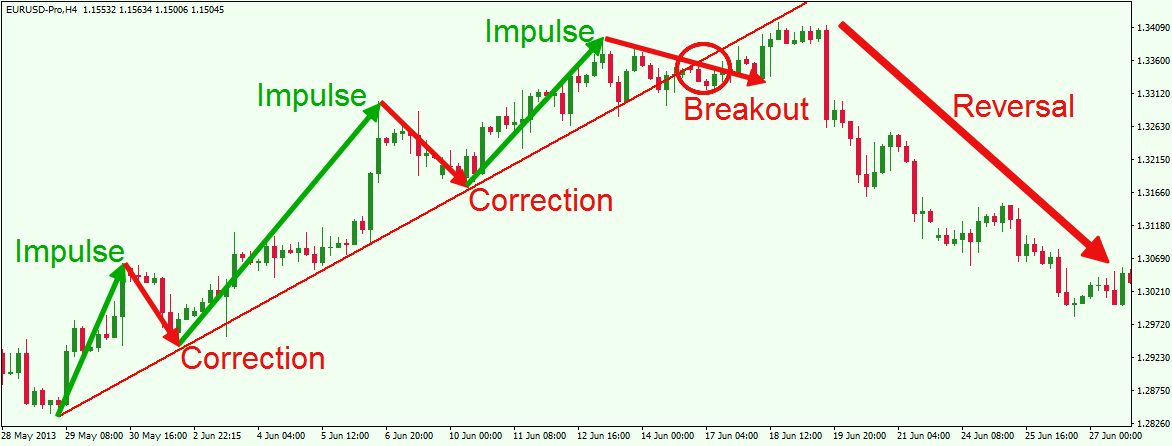

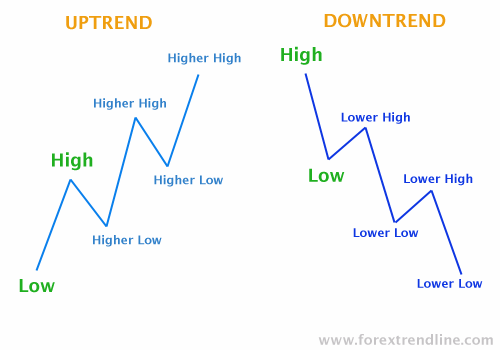

Uptrends and downtrends are key elements in technical analysis, a method used by traders to predict future price movements. An uptrend occurs when the price of an asset consistently moves higher, forming a series of higher highs and higher lows. Conversely, a downtrend emerges when the price steadily declines, creating lower highs and lower lows. These trends can provide valuable insights into the market sentiment and help traders devise effective strategies.

Characteristics of an Uptrend

In an uptrend, the price of an asset experiences a sustained increase over a period of time. This upward movement is characterized by a series of higher highs and higher lows. Each peak in the price is higher than the previous one, indicating a bullish sentiment in the market. Traders often look for these patterns to identify potential buying opportunities.

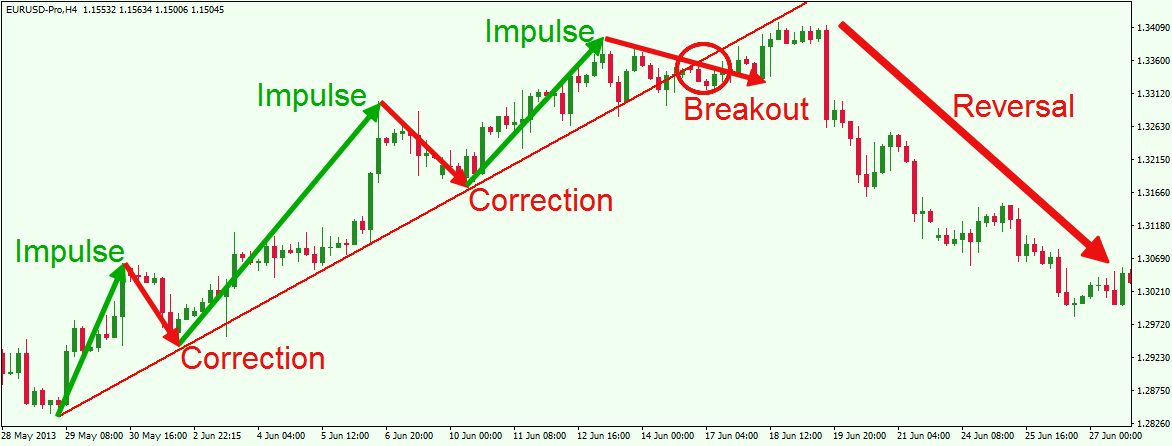

There are several key characteristics of an uptrend. Firstly, the price consistently moves in an upward direction, indicating a positive trend. Secondly, the pullbacks or corrections within the uptrend are generally smaller in magnitude compared to the overall upward movement. Lastly, trading volumes tend to be higher during uptrends, reflecting increased market participation and demand for the asset.

Factors that Contribute to an Uptrend

Several factors contribute to the formation of an uptrend in the financial markets. Economic factors such as positive GDP growth, low unemployment rates, and strong corporate earnings can create a bullish sentiment among investors. Additionally, market sentiment and investor psychology play a significant role in driving uptrends. Positive news, investor optimism, and favorable market conditions can all contribute to the continuation of an uptrend.

It's important to note that external factors such as geopolitical events, economic indicators, and market news can impact the strength and duration of an uptrend. Traders should stay informed and monitor these factors to make informed trading decisions.

Identifying Signals of an Uptrend

Identifying signals of an uptrend is crucial for traders looking to capitalize on potential buying opportunities. Technical analysis tools such as trendlines, moving averages, and chart patterns can help identify and confirm the presence of an uptrend. Trendlines are drawn by connecting the higher lows in an uptrend, providing a visual representation of the upward movement.

Moving averages, on the other hand, smooth out price fluctuations and provide a clearer view of the overall trend. Traders often use the 50-day and 200-day moving averages to identify and confirm uptrends. Additionally, chart patterns such as higher highs and higher lows, ascending triangles, and bullish flag patterns can also signal the presence of an uptrend.

Strategies for Trading in an Uptrend

Trading in an uptrend requires a systematic approach and the use of appropriate strategies. One common strategy is trend following, where traders buy assets that are in an uptrend and hold onto them until the trend reverses. This strategy aims to capitalize on the upward momentum and maximize profits.

Another strategy is breakout trading, where traders look for price breakouts above resistance levels to enter trades. This strategy assumes that the uptrend will continue after the breakout, providing an opportunity for profit. Additionally, traders can use trailing stop-loss orders to protect their profits and exit trades if the trend reverses.

It's important to manage risk effectively when trading in an uptrend. Setting stop-loss orders, diversifying your portfolio, and using proper position sizing techniques can help mitigate potential losses.

Characteristics of a Downtrend

In a downtrend, the price of an asset experiences a sustained decrease over a period of time. This downward movement is characterized by a series of lower highs and lower lows. Each peak in the price is lower than the previous one, indicating a bearish sentiment in the market. Traders often look for these patterns to identify potential selling opportunities.

There are several key characteristics of a downtrend. Firstly, the price consistently moves in a downward direction, indicating a negative trend. Secondly, the bounces or corrections within the downtrend are generally smaller in magnitude compared to the overall downward movement. Lastly, trading volumes tend to be higher during downtrends, reflecting increased market participation and selling pressure.

Factors that Contribute to a Downtrend

Several factors contribute to the formation of a downtrend in the financial markets. Economic factors such as negative GDP growth, high unemployment rates, and weak corporate earnings can create a bearish sentiment among investors. Additionally, market sentiment and investor psychology play a significant role in driving downtrends. Negative news, investor pessimism, and unfavorable market conditions can all contribute to the continuation of a downtrend.

Similar to uptrends, external factors such as geopolitical events, economic indicators, and market news can impact the strength and duration of a downtrend. Traders should stay informed and monitor these factors to make informed trading decisions.

Identifying Signals of a Downtrend

Identifying signals of a downtrend is crucial for traders looking to capitalize on potential selling opportunities. Technical analysis tools such as trendlines, moving averages, and chart patterns can help identify and confirm the presence of a downtrend. Trendlines are drawn by connecting the lower highs in a downtrend, providing a visual representation of the downward movement.

Moving averages can also be used to identify and confirm downtrends. Traders often use the 50-day and 200-day moving averages to assess the overall trend. Additionally, chart patterns such as lower highs and lower lows, descending triangles, and bearish flag patterns can also signal the presence of a downtrend.

Strategies for Trading in a Downtrend

Trading in a downtrend requires a systematic approach and the use of appropriate strategies. One common strategy is trend following, where traders sell assets that are in a downtrend and hold onto them until the trend reverses. This strategy aims to capitalize on the downward momentum and maximize profits.

Another strategy is breakout trading, where traders look for price breakouts below support levels to enter trades. This strategy assumes that the downtrend will continue after the breakout, providing an opportunity for profit. Additionally, traders can use trailing stop-loss orders to protect their profits and exit trades if the trend reverses.

Risk management is crucial when trading in a downtrend. Setting stop-loss orders, diversifying your portfolio, and using proper position sizing techniques can help mitigate potential losses.

Conclusion: The Importance of Recognizing and Adapting to Market Trends

In conclusion, understanding and identifying uptrends and downtrends is crucial for traders of all levels. By recognizing these patterns, traders can identify potential entry and exit points, manage risk, and make informed trading decisions. Whether you're a seasoned trader or just starting out, recognizing and adapting to market trends is essential for success in the ever-changing landscape of trading.

Remember, trading trends are dynamic and can change quickly. Staying informed, keeping an eye on market indicators, and continuously updating your strategies will help you navigate the ups and downs of trading. Embrace the power of uptrends and downtrends, and use them to your advantage in the pursuit of financial success.

So, are you ready to dive into the fascinating world of trading trends? Start exploring today and unlock the potential of uptrends and downtrends in your trading journey. Happy trading!