Gateway to Staking: Sui

Sui at a glance

Sui is a groundbreaking, decentralized Proof-of-Stake L1 blockchain that introduces scalability and unmatched low-latency for simpler use cases (i.e. payment transactions or asset transfers). Instead of relying on consensus for every transaction, Sui enables simple transactions (i.e. coin transfers or NFT minting) to bypass global consensus and be processed through parallel execution.

As a result, Sui is uniquely poised to revolutionize the space with unprecedented scalability and near instant transaction finality. Add to this a friendly and streamlined UI/UX, and you get a first-rate user experience. Sui also offers a top-tier developer experience as a highly composable and expressive blockchain. Written in Rust, the protocol uses an adaptation of Diem’s Move language — Sui Move — to support its smart contracts.

Move emerged in 2018 as part of the then-Libra project, as a response to two key issues the team identified in smart contract languages: asset representation and ownership. Sui Move differs from the core Move in several key ways, revolving primarily around its programmable objects (Sui’s basic unit of data storage), how they’re stored, represented, annotated, etc. This object-centric model is what enables many of Sui’s key technological innovations.

This article will first break down Sui’s unique tokenomics, and then take you through a step-by-step staking guide.

Those who wish to get staking right away, skip ahead to our staking guide down below!

Understanding Sui’s Tokenomics

For those who stayed with us, let’s have a look at what characterizes Sui’s distinct economic model.

There are three main players in Sui’s economy:

- Users that submit transactions, create, alter and transfer assets (i.e. objects)

- SUI token holders that can stake their SUI to participate in PoS and governance

- Validators that process and verify transactions to secure the blockchain (that’s us!)

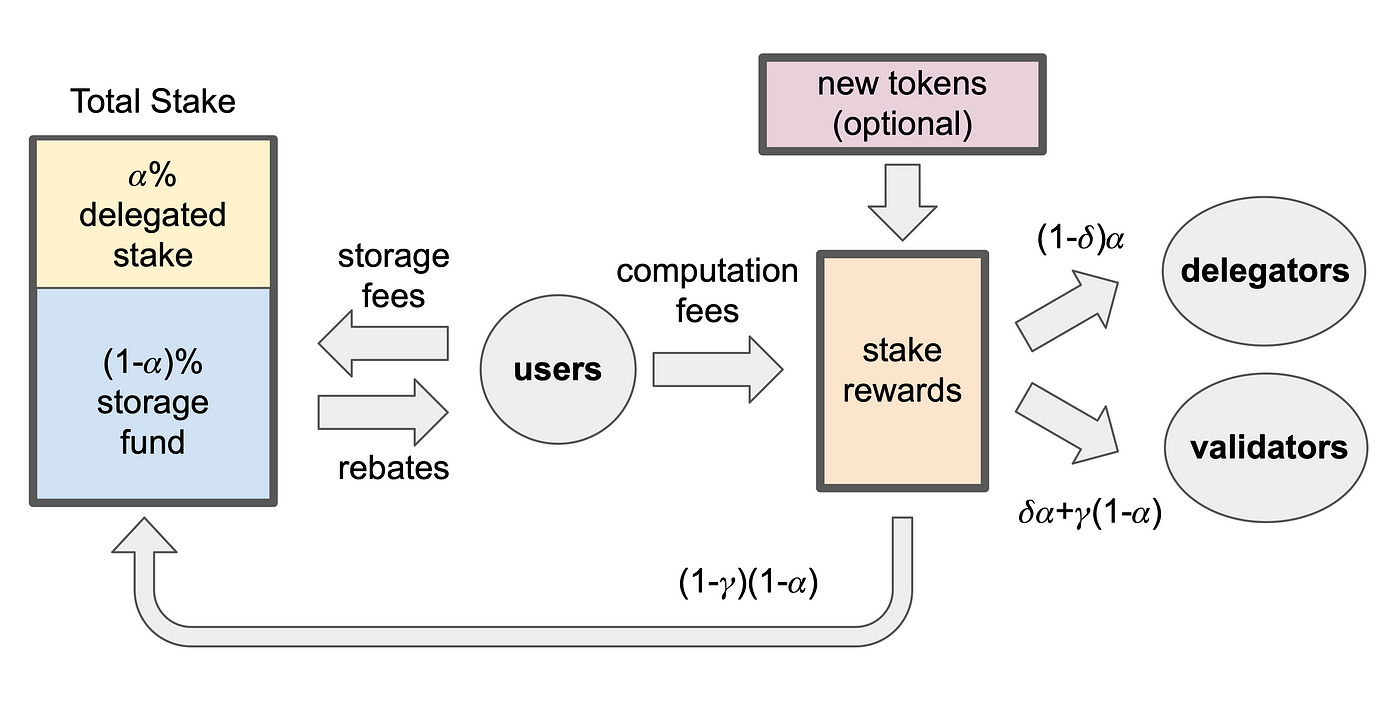

These participants all play a key role in the ecosystem, which is itself composed of five core elements that work together: the SUI token, Gas Fees, Storage Fund, Delegated Proof-of-Stake Mechanism, and On-Chain Governance! Most of our readers will have come across DPoS and governance already, so we’ll decipher the first three– all of which are central to Sui’s economy.

SUI Token

With a total supply capped at 10,000,000,000 (10B), the native asset is primarily used:

- To stake and participate in PoS

- To pay gas fees

- As a store of value across the Sui ecosystem

- As a governance token for on-chain voting

50% is managed for now by the Sui Foundation as a Community Reserve (for research & development, grants, etc.), while the rest is mostly divided between early contributors, investors, and supporters of the protocol.

Gas Fees

Sui promises stable and predictable transaction fees, thanks to an elegant Gas Pricing Mechanism that prioritizes both users and validators. Gas fees are composed of 1) the cost of computation and 2) the long-term cost of storage (see storage fund). But how are those two costs computed?

- The Computation Price for a given transaction is made up of the Reference Price, set by the validators at the start of each epoch via a survey, and a Tip*. The Reference Price is the minimum price at which validators agree to process transactions.

- The Storage Price on the other hand is set via governance and rarely undergoes change! This covers the cost of storage and is gathered in the storage fund, which we’ll get to next.

*Users cannot tip at the moment, but will be able to in due time!

In case you were wondering, this is calculated as such for transaction y:

GasFees[y] = ComputationUnits[y] x ComputationPrice[y] + StorageUnits[y] x StoragePrice

Storage Fund

On-chain data storage can get expensive, and there’s no way to predict how much storage needs will grow with time. To avoid slamming future validators with unreasonably high processing costs/ future users with inordinately high fees, Sui introduces a storage fund to redistribute fees.

This factors into validators’ stake rewards, though they never receive these fees directly from the fund (ensuring its survival)! And when users delete previously stored on-chain data — reducing the amount of storage needed — they can receive a rebate (partial refund of the storage fees initially paid).

You can get an idea of how these components work together in the visual below! Source: Sui Docs

Source: Sui Docs

Ready to get staking? A few things to keep in mind:

- Rewards: computation fees and staking subsidies; distributed at each epoch end (each epoch is 24 hours)

- Activation period: pending until activation at next epoch

- Unbonding period: none!

- Slashing penalties: Sui validators evaluate each others’ performance via a system known as the Tallying Rule– if your validator gets a 0 for poor performance (by 2/3 validators’ voting power), you won’t receive staking rewards

A note on wallets

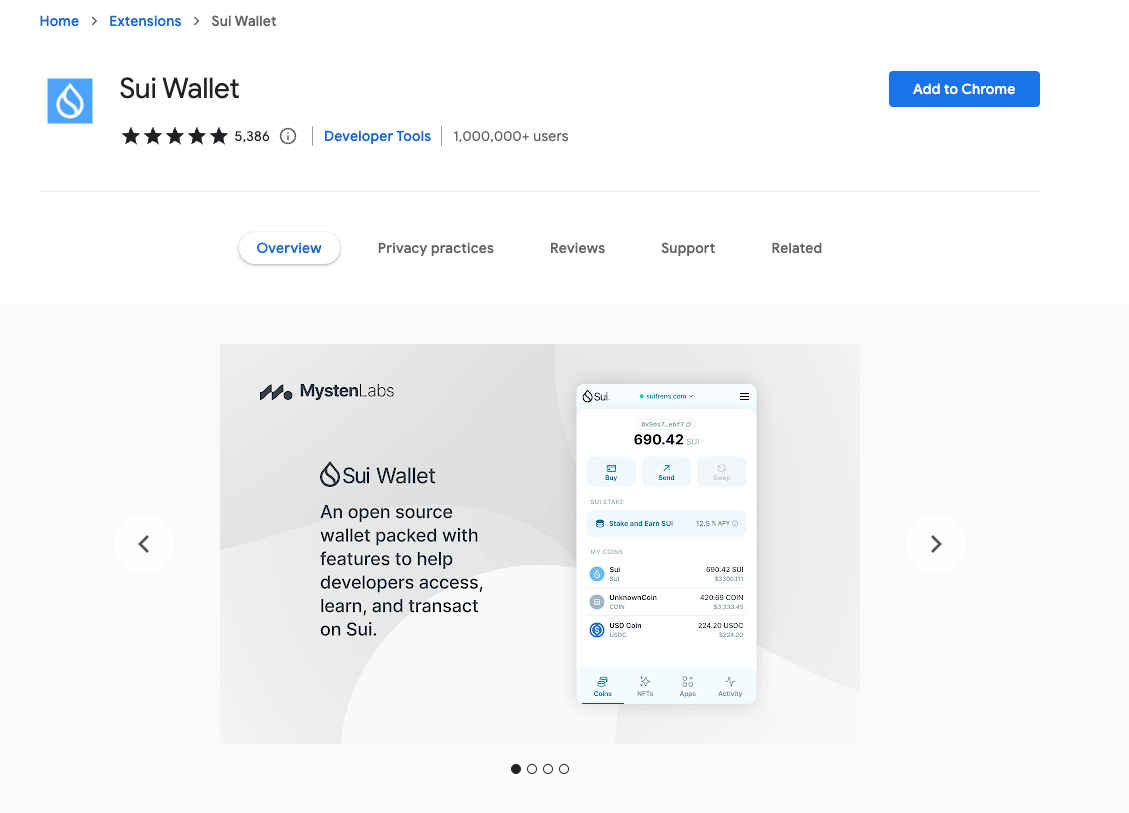

You can use several different wallets to stake SUI, including Sui Wallet and Suiet Wallet. DSRV’s own WELLDONE Wallet will soon support SUI staking, so stay tuned for an updated section on how to stake with WELLDONE!

For the purpose of this guide, we’ll use Sui Wallet. If you haven’t already, you can easily add Sui Wallet via the chrome web store.

Let’s get started!

Step-by-step guide

- Head over to the chrome web store on your browser of choice (we’re using Chrome) and click Add to Chrome.

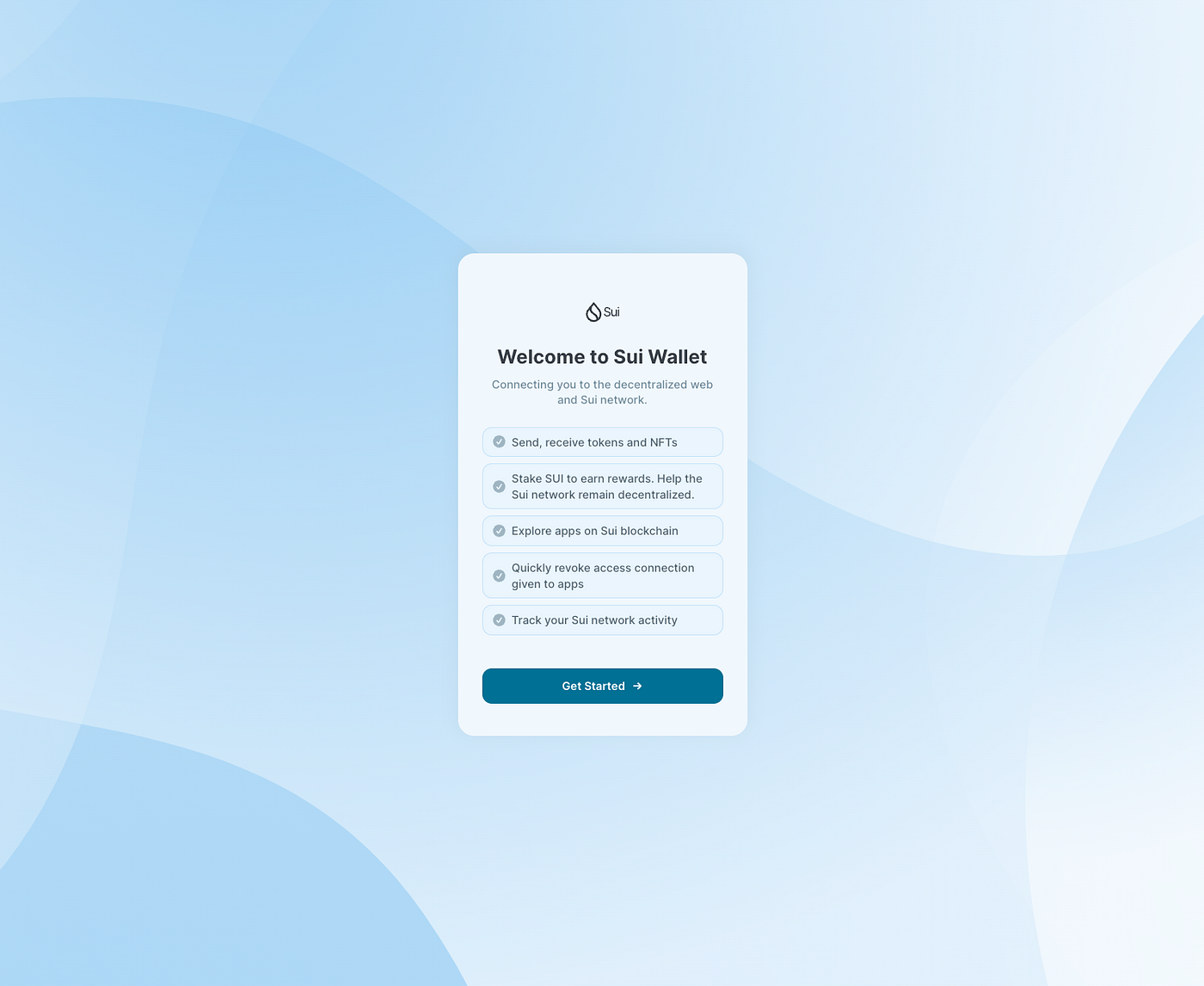

2. Once the installation is complete, you’ll land on this page. Click Get Started and if you don’t have a wallet yet, select + Create a New Wallet.

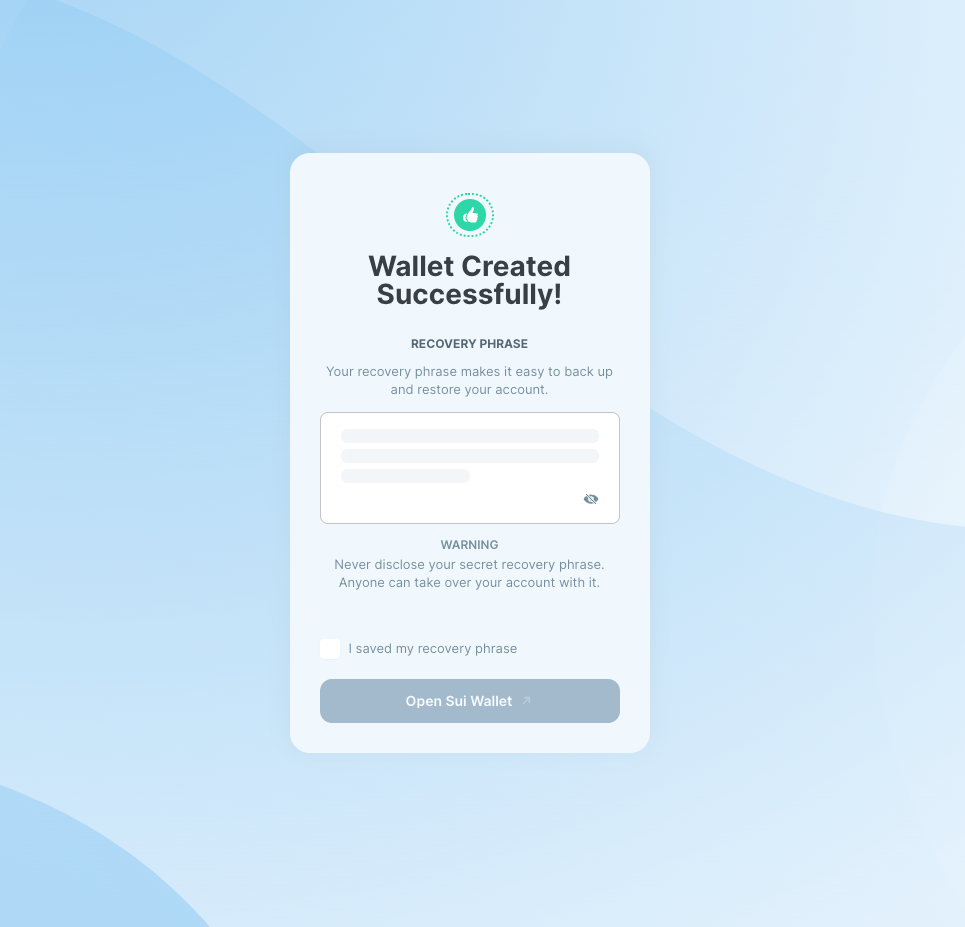

2. Once the installation is complete, you’ll land on this page. Click Get Started and if you don’t have a wallet yet, select + Create a New Wallet. 3. You’ll be prompted to create a password for your new wallet (make sure it’s a solid one!), and then you’ll receive your recovery phrase.

3. You’ll be prompted to create a password for your new wallet (make sure it’s a solid one!), and then you’ll receive your recovery phrase.

Also known as a mnemonic phrase or seed, this 12-word key is incredibly important and must be stored carefully. If anyone gets hold of your mnemonic phrase, they have access to your assets. If you lose it, you can’t recover it either.

Some tips:

- Don’t ever share your mnemonic with anyone.

- Store it in more than one place, and ideally offline.

Once this is done, click Open Sui Wallet to access your wallet.

Once this is done, click Open Sui Wallet to access your wallet.

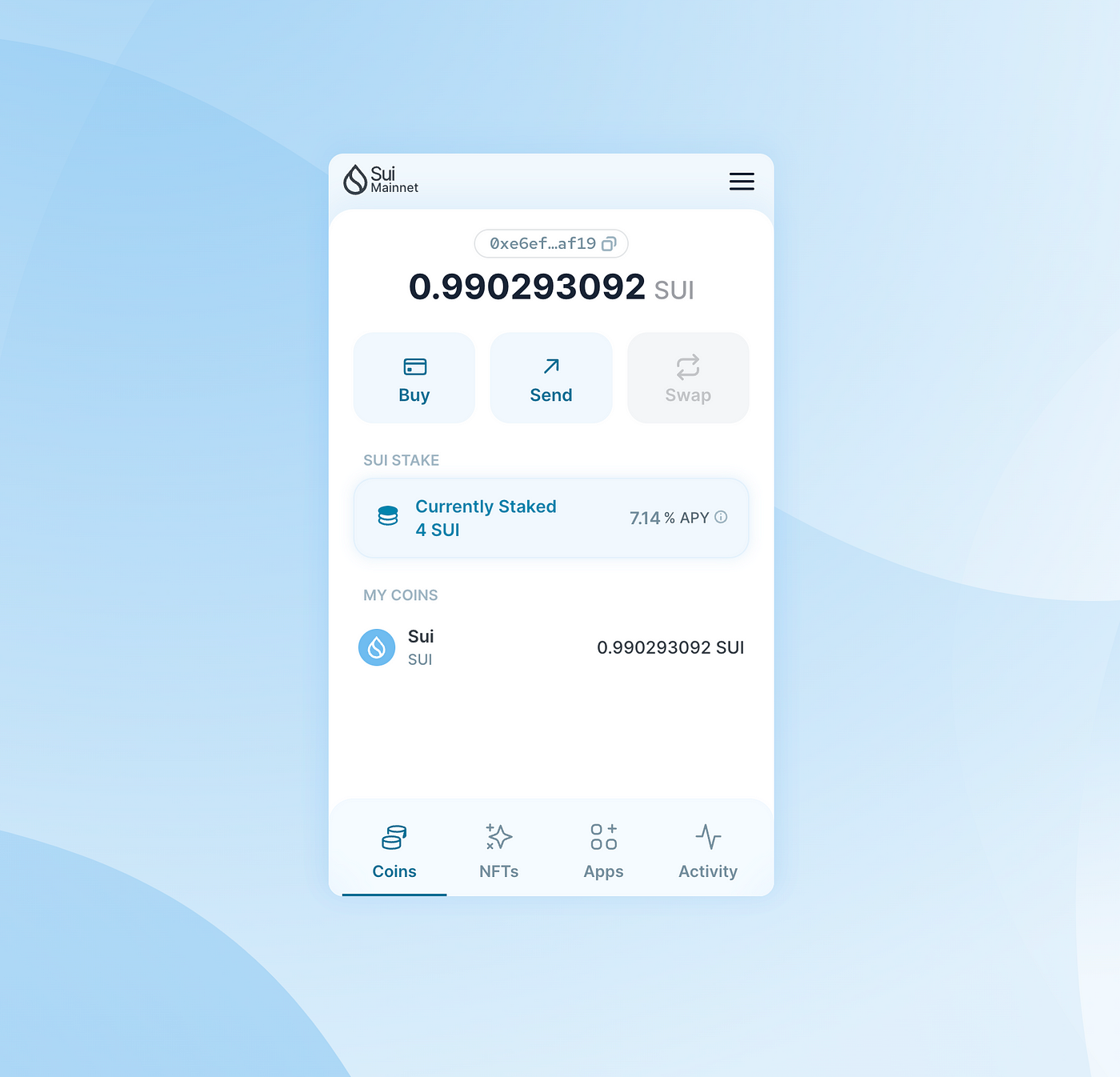

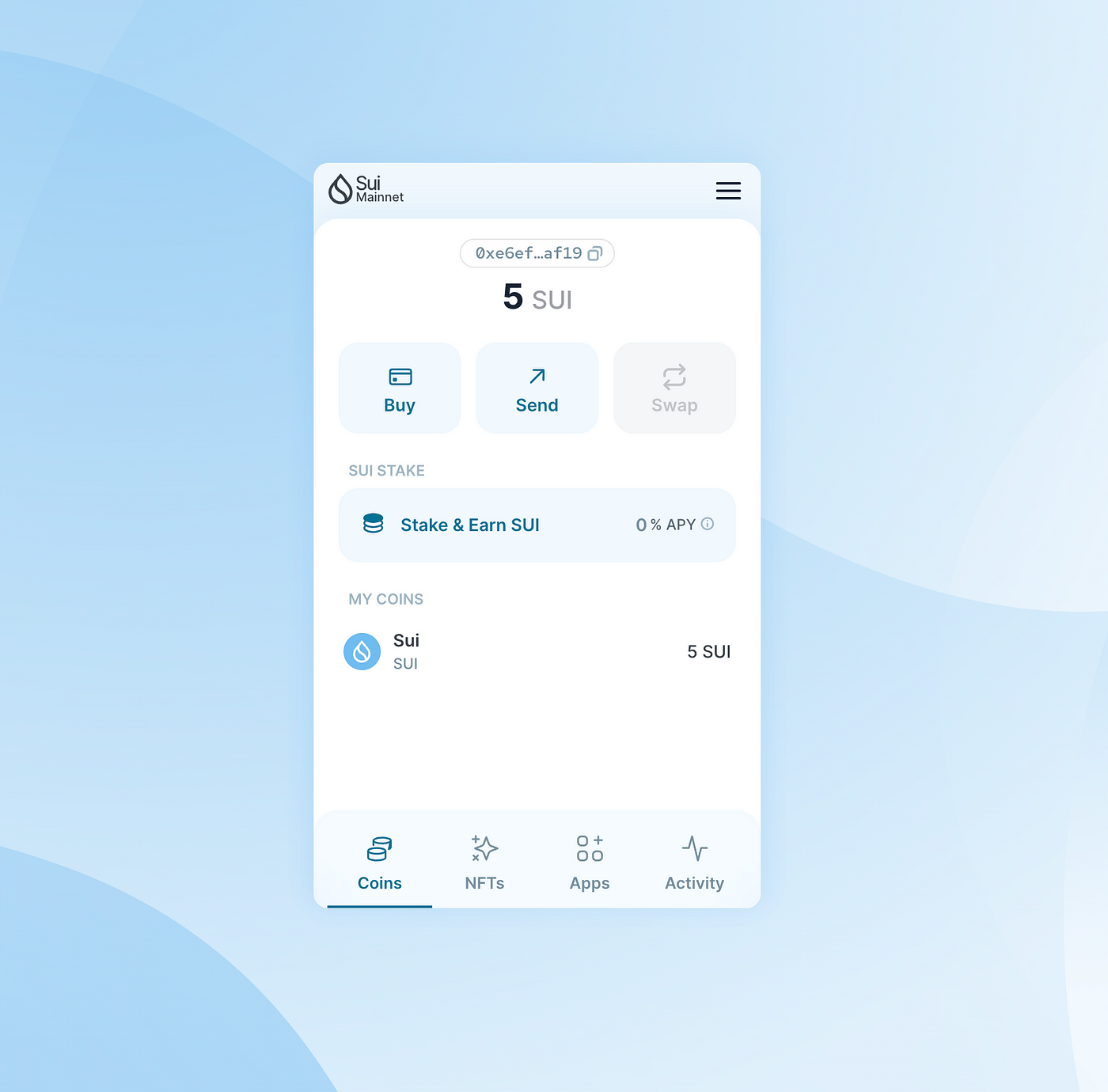

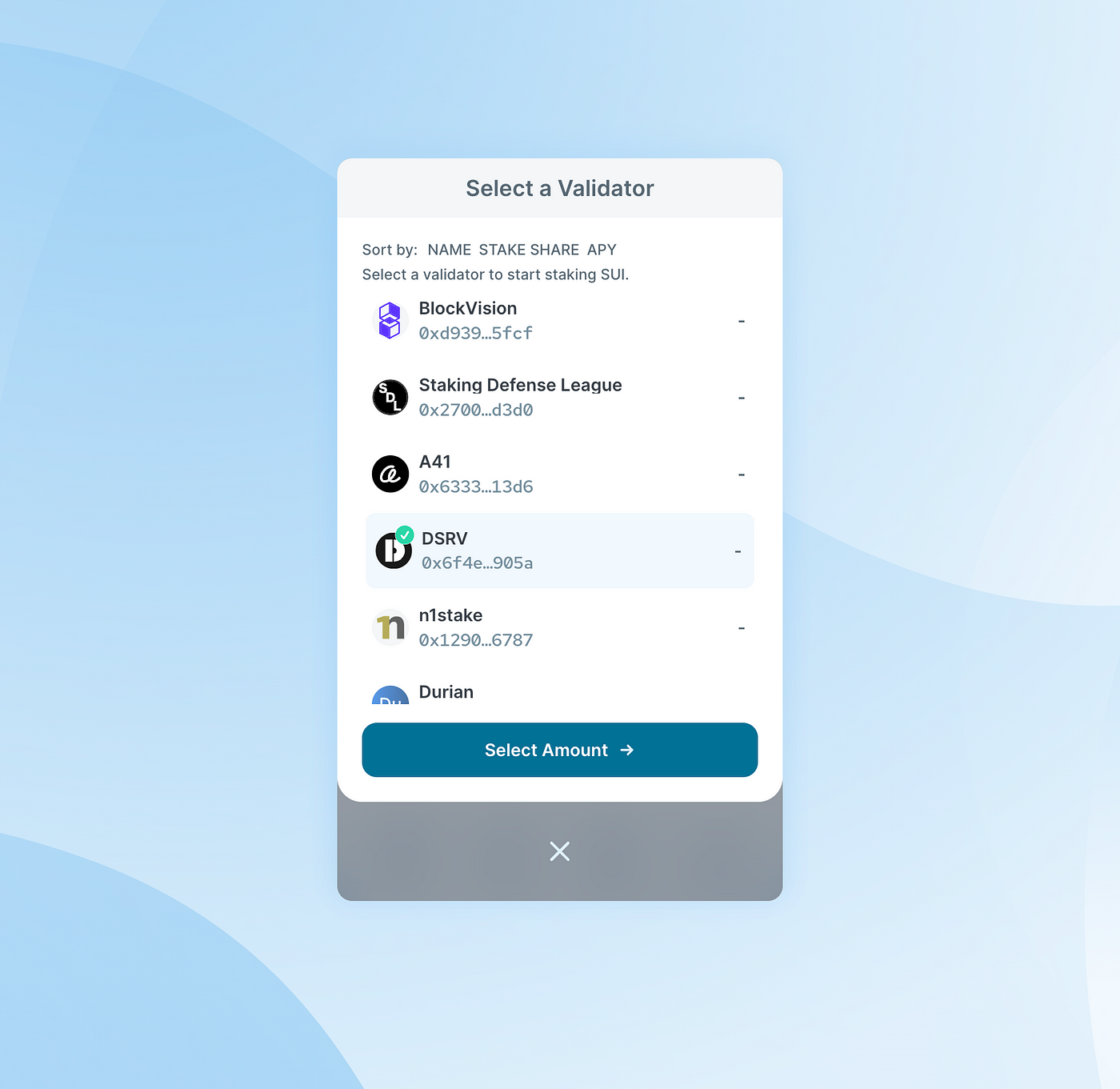

4. Say hi to your new wallet! Your address is the string of characters beginning with 0x at the top. You’ll need this to fund your account, or receive funds from someone else. Once you have some SUI (the minimum you can stake is 1 SUI, keep in mind you need a little more for gas fees), you’re ready to stake. 5. Click Stake & Earn SUI, and then select the validator of your choice. Scroll down to find DSRV!

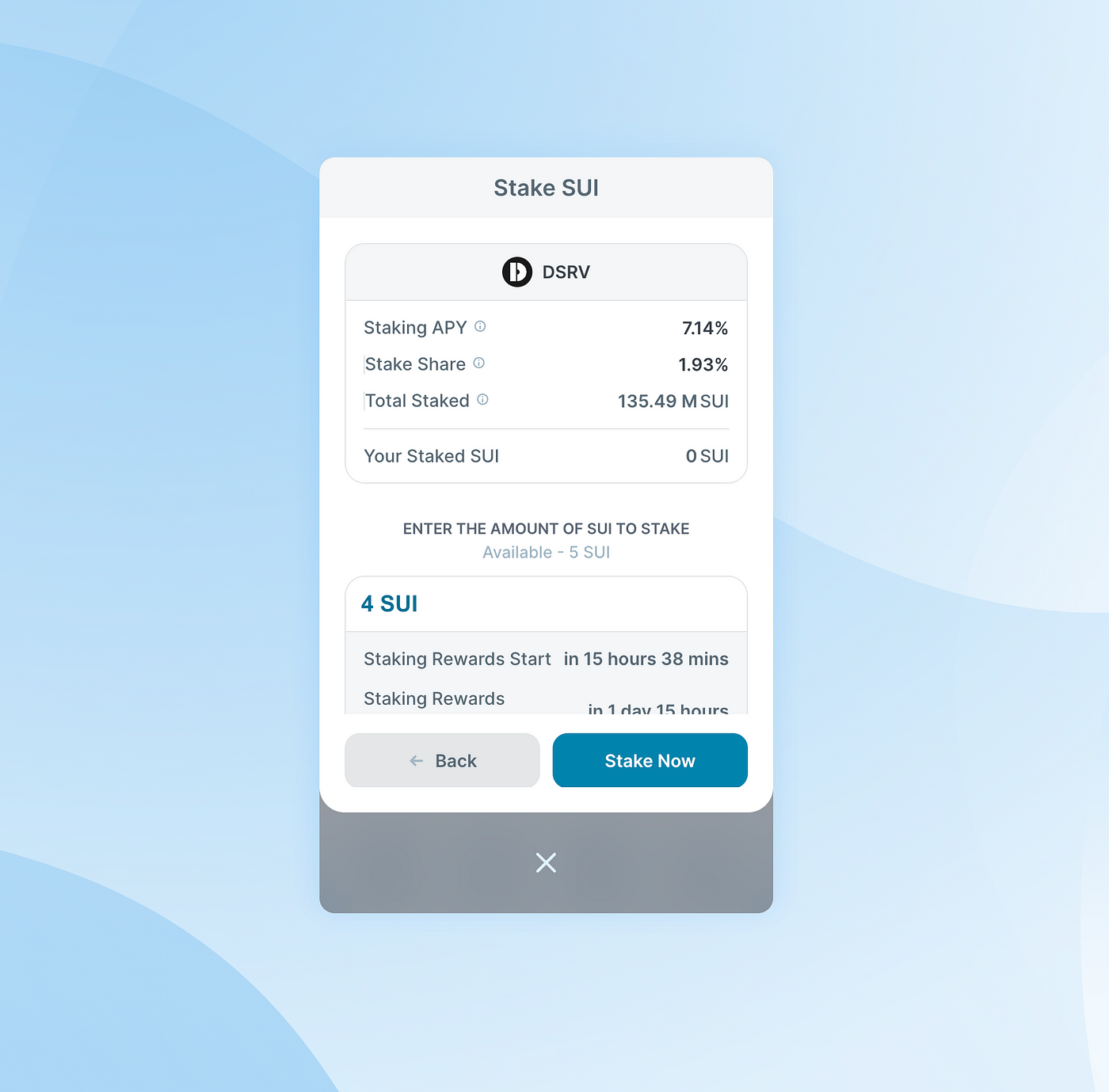

5. Click Stake & Earn SUI, and then select the validator of your choice. Scroll down to find DSRV! 6. Enter the amount of SUI you wish to stake (minimum 1 SUI), and click Stake Now. You can also take a look at the APY, as well as when you can expect Staking Rewards to start rolling in.

6. Enter the amount of SUI you wish to stake (minimum 1 SUI), and click Stake Now. You can also take a look at the APY, as well as when you can expect Staking Rewards to start rolling in. 7. And there you go! Congratulations, you’ve successfully staked your SUI! If you click on Currently Staked, you can see details regarding both your staked and earned SUI.

7. And there you go! Congratulations, you’ve successfully staked your SUI! If you click on Currently Staked, you can see details regarding both your staked and earned SUI.