Hedge Fund Administration Made Simple with Allocations

Modern hedge fund administration demands speed, transparency, and accuracy. Allocations delivers all three through advanced automation and an intuitive SPV platform designed for fund managers, investors, and institutions.

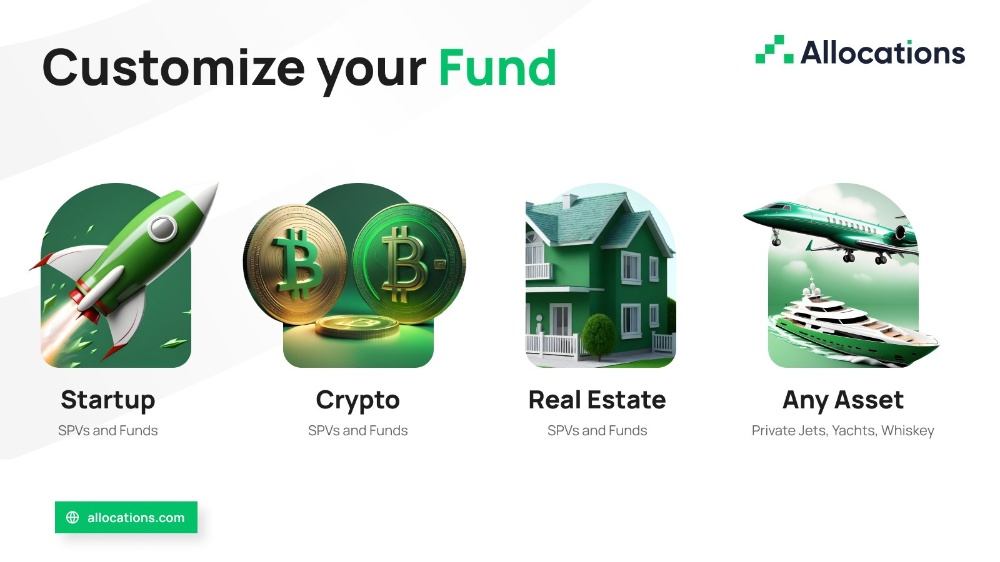

Simplifying Fund Operations

Allocations offers a complete solution for hedge fund administration, from capital calls to investor onboarding and performance tracking. Its Allocations software eliminates manual data entry while providing real-time reporting and portfolio visibility.

For startups and emerging fund managers, Allocations SPV enables quick and compliant fund creation via Startup SPV setup.

Compliance and Transparency

Allocations ensures smooth SPV compliance, handling filings and investor documentation automatically. Whether forming a Delaware SPV or managing a private equity SPV, you stay aligned with the latest regulatory requirements.

Learn more about fees and features at Allocations Fees.

Measuring Fund Performance

Allocations helps managers track MOIC (Multiple on Invested Capital) and DPI (Distributions to Paid-In Capital) in one place. These metrics give clear insights into fund performance and investor returns.

For complex fund structures or digital assets, Allocations also supports Crypto SPVs with seamless blockchain integration.

The Allocations Advantage

Backed by an experienced Allocations Team, the platform combines technology and expertise for scalable growth. From SPV for startups to hedge fund solutions, Allocations is the best fund management software for modern private markets.

Learn how to customize your setup through Allocations Custom SPVs.