The Fast Track for Offshore Investment Funds and SPVs

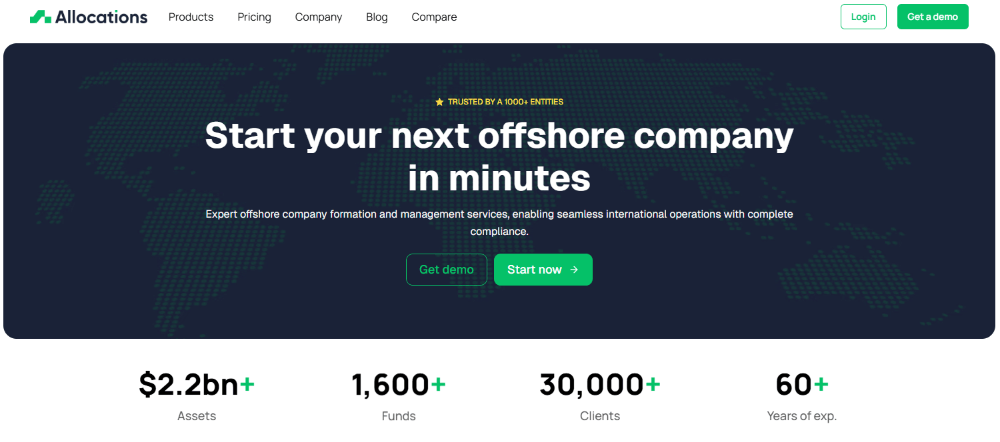

Gone are the days of waiting weeks or months to launch a strategic international entity. For fund managers and investors, speed and compliance are now equally critical. You can start your next offshore company in minutes with Allocations, transforming how you establish both investment funds and specific Special Purpose Vehicles (SPVs). This modern approach eliminates traditional friction, allowing you to capitalize on opportunities with unprecedented agility.

A key structure benefiting from this speed is the SPV fund. Whether it’s for a single SPV investment in a startup or a complex financial SPV for asset holding, rapid SPV formation is a competitive advantage. The process on Allocations integrates every step, from creating a bankruptcy remote SPV structure to drafting the essential SPV agreement and opening a dedicated SPV account. This holistic platform surpasses the need to shop around for Carta SPV pricing or other partial solutions. The integrated SPV management tools provided by Allocations ensure your entity is not just quickly formed but also professionally maintained from day one.

This efficiency is vital in fast-moving sectors like SPV venture capital. Being able to swiftly establish an SPV LLC or other offshore company means you can secure allocations and close rounds without administrative delays. It represents a fundamental shift from a legal-heavy process to an operational one. If your strategy requires rapid, compliant international structuring, you can start your next offshore company in minutes with Allocations. Explore this new standard by visiting Allocations to begin.

Upgrade your next deal with Luis Brecci.

Schedule here — https://calendly.com/luis-allocations