Bitcoin

Bitcoin (abbreviation: BTC[a] or XBT;[b] sign: ₿) is the first decentralized cryptocurrency. Nodes in the peer-to-peer bitcoin network verify transactions through cryptography and record them in a public distributed ledger, called a blockchain, without central oversight.

Bitcoin Logo of Bitcoin

Logo of Bitcoin

Denominations

Plural

Bitcoins

Symbol

₿

(Unicode: U+20BF ₿ BITCOIN SIGN)[1]

Code

BTC,[a] XBT[b]

Precision

10−8

Subunits

1⁄1000

Millibitcoin

1⁄1000000

Microbitcoin

1⁄100000000

Satoshi[c][2]

Development

Original author(s)

Satoshi Nakamoto

White paper

"Bitcoin: A Peer-to-Peer Electronic Cash System"

Implementation(s)

Bitcoin Core

Initial release

0.1.0 / 9 January 2009 (15 years ago)

Latest release

25.1 / 19 October 2023 (3 months ago)[3]

Code repository

github.com/bitcoin/bitcoin

Development status

Active

Written in

C++

Source model

Free and open-source software

License

MIT License

Ledger

Ledger start

3 January 2009 (15 years ago)

Timestamping scheme

Proof-of-work (partial hash inversion)

Hash function

SHA-256 (two rounds)

Issuance schedule

Decentralized (block reward)

Initially ₿50 per block, halved every 210,000 blocks

Block reward

₿6.25 (as of 2023)

Block time

10 minutes

Circulating supply

₿19,591,231 (as of 6 January 2024)

Supply limit

₿21,000,000[d]

Valuation

Exchange rate

Floating

Demographics

Official user(s)

El Salvador[4]

This article contains special characters. Without proper rendering support, you may see question marks, boxes, or other symbols.

Consensus between nodes is achieved using a computationally intensive system based on proof-of-work called mining. Bitcoin mining requires increasing quantities of electricity[5] and was responsible for 0.2% of world greenhouse gas emissions as of 2022.[6][7]

Based on a free market ideology, bitcoin was invented in 2008 by Satoshi Nakamoto, an unknown person.[8] Use of bitcoin as a currency began in 2009,[9] with the release of its open-source implementation.[10]: ch. 1 In 2021, El Salvador adopted it as legal tender.[4] Bitcoin is currently used more as a store of value and less as a medium of exchange or unit of account. It is mostly seen as an investment and has been described by many scholars as an economic bubble.[11] As bitcoin is pseudonymous, its use by criminals has attracted the attention of regulators, leading to its ban by several countries as of 2021.[12]

Background

Before bitcoin, several digital cash technologies were released, starting with David Chaum's ecash in the 1980s.[13] The idea that solutions to computational puzzles could have some value was first proposed by cryptographers Cynthia Dwork and Moni Naor in 1992.[13] The concept was independently rediscovered by Adam Back who developed Hashcash, a proof-of-work scheme for spam control in 1997.[13] The first proposals for distributed digital scarcity-based cryptocurrencies came from cypherpunks Wei Dai (b-money) and Nick Szabo (bit gold) in 1998.[14] In 2004, Hal Finney developed the first currency based on reusable proof-of-work.[15] These various attempts were not successful:[13] Chaum's concept required centralized control and no banks wanted to sign on, Hashcash had no protection against double-spending, while b-money and bit gold were not resistant to Sybil attacks.[13]

value of bitcoin dropped,[32] and Baidu no longer accepted bitcoins for certain services.[33] Buying real-world goods with any virtual currency had been illegal in China since at least 2009.[34]

2015–2019

Research produced by the University of Cambridge estimated that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.[35] In August 2017, the SegWit software upgrade was activated. Segwit was intended to support the Lightning Network as well as improve scalability.[36] SegWit opponents, who supported larger blocks as a scalability solution, forked to create Bitcoin Cash, one of many forks of bitcoin.[37]

In December 2017, the first futures on bitcoin was introduced by the CME.[38]

In February 2018, price crashed after China imposed a complete ban on Bitcoin trading.[39] The percentage of bitcoin trading in the Chinese renminbi fell from over 90% in September 2017 to less than 1% in June 2018.[40] During the same year, Bitcoin prices were negatively affected by several hacks or thefts from cryptocurrency exchanges.[41]

2020–present

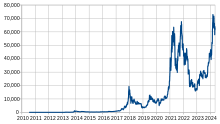

Bitcoin price in US dollars

Bitcoin price in US dollars

In 2020, some major companies and institutions started to acquire bitcoin: MicroStrategy invested $250 million in bitcoin as a treasury reserve asset,[42] Square, Inc., $50 million,[43] and MassMutual, $100 million.[44] In November 2020, PayPal added support for bitcoin in the US.[45]

In February 2021, Bitcoin's market capitalization reached $1 trillion for the first time.[46] In November 2021, the Taproot soft-fork upgrade was activated, adding support for Schnorr signatures, improved functionality of smart contracts and Lightning Network.[47] Before, Bitcoin only used a custom elliptic curve with the ECDSA algorithm to produce signatures.[48]: 101 In September 2021, Bitcoin became legal tender in El Salvador, alongside the US dollar.[4] In October 2021, the first bitcoin futures ETF, called BITO, from ProShares was approved by the SEC and listed on the Chicago Mercantile Exchange.[49]

In May and June 2022, the bitcoin price fell following the collapses of TerraUSD, a stablecoin,[50] and the Celsius Network, a cryptocurrency loan company.[51][52]

In 2023, ordinals, non-fungible tokens (NFTs) on Bitcoin, went live.[53] In January 2024, the first 11 US spot bitcoin exchange-traded funds (ETFs) began trading, offering direct exposure to bitcoin for the first time on American stock exchanges.[54][55]

Screenshot of Bitcoin Core

A paper wallet with the address as a QR code while the private key is hidden

A hardware wallet which processes bitcoin transactions without exposing private keys

Bitcoin wallets were the first cryptocurrency wallets, enabling users to store the information necessary to transact bitcoins.[86][10]: ch. 1, glossary The first wallet program, simply named Bitcoin, and sometimes referred to as the Satoshi client, was released in 2009 by Nakamoto as open-source software.[9] Bitcoin Core is among the best known clients. Forks of Bitcoin Core exist such as Bitcoin Unlimited.[87] Wallets can be full clients, with a full copy of the blockchain to check the validity of mined blocks,[10]: ch. 1 or lightweight clients, just to send and receive transactions without a local copy of the entire blockchain.[88] Third-party internet services called online wallets store users' credentials on their servers, making them susceptible of hacks.[89] "Cold storage" protects bitcoins from such hacks by keeping private keys offline, either through specialized hardware wallets or paper printouts.[90][10]: ch. 4

Scalability and decentralization challenges

Nakamoto limited the block size to one megabyte.[91] The limited block size and frequency can lead to delayed processing of transactions, increased fees and a Bitcoin scalability problem.[92] The Lightning Network, second-layer routing network, is a potential scaling solution.[10]: ch. 8

Research shows a trend towards centralization in bitcoin as miners join pools for stable income.[26]: 215, 219–222 [93]: 3 If a single miner or pool controls more than 50% of the hashing power, it would allow them to censor transactions and double-spend coins.[62] In 2014, mining pool Ghash.io reached 51% mining power, causing safety concerns, but later voluntarily capped its power at 39.99% for the benefit of the whole network.[94] A few entities also dominate other parts of the ecosystem such as the client software, online wallets, and simplified payment verification (SPV) clients.[62]

Bitcoin's theoretical roots and ideology

See also: Crypto-anarchism

External videos The Declaration Of Bitcoin's Independence, BraveTheWorld, 4:38

The Declaration Of Bitcoin's Independence, BraveTheWorld, 4:38

According to the European Central Bank, the decentralization of money offered by bitcoin has its theoretical roots in the Austrian school of economics, especially with Friedrich von Hayek's book The Denationalization of Money, in which he advocates a complete free market in the production, distribution and management of money to end the monopoly of central banks.[95]: 22 Sociologist Nigel Dodd, citing the crypto-anarchist Declaration of Bitcoin's Independence, argues that the essence of the bitcoin ideology is to remove money from social, as well as governmental, control.[96] The Economist describes bitcoin as "a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks".[97] These philosophical ideas initially attracted libertarians and anarchists.[98] Economist Paul Krugman argues that cryptocurrencies like bitcoin are only used by bank skeptics and criminals.[99]

Recognition as a currency and legal status

Legal status of bitcoin

Legal status of bitcoin

Legal tender (bitcoin is officially recognized as a medium of exchange)

Permissive (legal to use bitcoin, with minimal or no restrictions)

Restricted (some legal restrictions on the usage of bitcoin)

Contentious (interpretation of old laws, but bitcoin is not directly prohibited)

Prohibited (full or partial prohibition on the use of bitcoin)

No data (no information available)

vte

Money serves three purposes: a store of value, a medium of exchange, and a unit of account.[100] According to The Economist in 2014, bitcoin functions best as a medium of exchange.[100] In 2015, The Economist noted that bitcoins had three qualities useful in a currency: they are "hard to earn, limited in supply and easy to verify".[101] However, a 2018 assessment by The Economist stated that cryptocurrencies met none of these three criteria.[97] Per some researchers, as of 2015, bitcoin functions more as a payment system than as a currency.[26] In 2014, economist Robert J. Shiller wrote that bitcoin has potential as a unit of account for measuring the relative value of goods, as with Chile's Unidad de Fomento, but that "Bitcoin in its present form ... doesn't really solve any sensible economic problem".[102] François R. Velde, Senior Economist at the Chicago Fed, described bitcoin as "an elegant solution to the problem of creating a digital currency".[103] David Andolfatto, Vice President at the Federal Reserve Bank of St. Louis, stated that bitcoin is a threat to the establishment, which he argues is a good thing for the Federal Reserve System and other central banks, because it prompts these institutions to operate sound policies.[104]

The legal status of bitcoin varies substantially from one jurisdiction to another. Because of its decentralized nature and its global presence, regulating bitcoin is difficult. However, the use of bitcoin can be criminalized, and shutting down exchanges and the peer-to-peer economy in a given country would constitute a de facto ban.[105] The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, and law enforcement.[106] Nobel-prize winning economist Joseph Stiglitz says that bitcoin's anonymity encourages money laundering and other crimes.[107] This is the main justification behind bitcoin bans.[12] As of November 2021, nine countries applied an absolute ban (Algeria, Bangladesh, China, Egypt, Iraq, Morocco, Nepal, Qatar, and Tunisia) while another 42 countries had an implicit ban.[108][needs update] Bitcoin is only legal tender in El Salvador.[4]

Use for payments

Café in Delft accepting Bitcoin

Café in Delft accepting Bitcoin

As of 2018, Bitcoin is rarely used in transactions with merchants,[109] but it is popular to purchase illegal goods online.[110][111] Prices are not usually quoted in bitcoin and trades involve conversions into fiat currencies.[26] Commonly cited reasons for not using Bitcoin include high costs, the inability to process chargebacks, high price volatility, long transaction times, transaction fees (especially for small purchases).[109][112] Bloomberg reported that bitcoin was being used for large-item purchases on the site Overstock.com and for cross-border payments to freelancers.[113] As of 2015, there was little sign of bitcoin use in international remittances despite high fees charged by banks and Western Union who compete in this market.[26][114]

In September 2021, the Bitcoin Law made bitcoin legal tender in El Salvador, alongside the US dollar.[4] The adoption has been criticized both internationally and within El Salvador.[4][115] In particular, in 2022, the International Monetary Fund (IMF) urged El Salvador to reverse its decision.[116] As of 2022, the use of Bitcoin in El Salvador remains low: 80% of businesses refused to accept it despite being legally required to.[117] In April 2022, the Central African Republic (CAR) adopted Bitcoin as legal tender alongside the CFA franc,[118] but repealed the reform one year later.[119]

Bitcoin is also used by some governments. For instance, the Iranian government initially opposed cryptocurrencies, but later saw them as an opportunity to circumvent sanctions.[120] Since 2020, Iran has required local bitcoin miners to sell bitcoin to the Central Bank of Iran, allowing the central bank to use it for imports.[121] Some constituent states also accept tax payments in bitcoin, including Colorado (US)[122] and Zug (Switzerland).[123]

Use for investment and status as an economic bubble

Further information: Cryptocurrency bubble

As of 2018, the overwhelming majority of bitcoin transactions took place on cryptocurrency exchanges.[109] Since 2014, regulated bitcoin funds also allow exposure to the asset or to futures as an investment.[124][125] Individuals and companies such as the Winklevoss twins[126] and Elon Musk's companies SpaceX and Tesla have massively invested in Bitcoin.[127][128] Bitcoin wealth is highly concentrated, with 0.01% holding 27% of in-circulation currency, as of 2021.[129] As of September 2023, El Salvador had $76.5 million worth of bitcoin in its international reserves.[130]

In 2018, research published in the Journal of Monetary Economics concluded that price manipulation occurred during the Mt. Gox bitcoin theft and that the market remained vulnerable to manipulation.[131] Research published in The Journal of Finance also suggested that trading associated with increases in the amount of the Tether cryptocurrency and associated trading at the Bitfinex exchange accounted for about half of the price increase in bitcoin in late 2017.[132][133]

Bitcoin, along with other cryptocurrencies, has been described as an economic bubble by several economists, including Nobel Prize in Economics laureates, such as Joseph Stiglitz,[134] James Heckman,[11] and Paul Krugman.[99] Another recipient of the prize, Robert Shiller, argues that bitcoin is rather a fad that may become an asset class. He describes its price growth as an "epidemic", driven by contagious narratives.[135]

According to research published in the International Review of Financial Analysis in 2018, Bitcoin as an asset is highly volatile and does not behave like any other conventional asset.[136] According to one 2022 analysis published in The Journal of Alternative Investments, bitcoin was less volatile than oil, silver, US Treasuries, and 190 stocks in the S&P 500 during and after the 2020 stock market crash.[137] The term "hodl" was created in December 2013 for holding Bitcoin rather than selling it during periods of volatility.[138][139]

Economists, investors, and the central bank of Estonia have described bitcoin as a potential Ponzi scheme.[140][141][142] Legal scholar Eric Posner disagrees as "a real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion."[143] A 2014 World Bank report also concluded that bitcoin was not a deliberate Ponzi scheme.[144]