Why You’re Losing Trades — And How Technical Analysis Can Fix It

In the world of trading, charts tell a story. But without a solid grasp of technical analysis, it’s easy to misread that story — or miss it altogether. Whether you’re new to trading or looking to sharpen your edge, understanding these five principles will help you make smarter, more strategic decisions.

In the world of trading, charts tell a story. But without a solid grasp of technical analysis, it’s easy to misread that story — or miss it altogether. Whether you’re new to trading or looking to sharpen your edge, understanding these five principles will help you make smarter, more strategic decisions.

1. Start With Top-Down Analysis: Follow the Bigger Picture

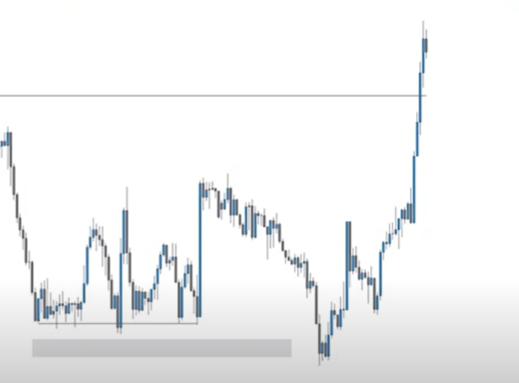

Before zooming into 5-minute candlesticks, start with the larger time frame (daily, 4H, or 1H). This is where the overall trend becomes clear.

- Trend-Following Setup: If the trend is bullish, look for price retracements that consolidate and reverse back up from demand zones. Enter when large momentum candles confirm the continuation.

- Reversal Setup: Want to go against the trend? Wait for confirmation. Look for a Break of Structure (BoS) — a previous swing high or low getting taken out. A liquidity grab (where equal highs/lows are swept) strengthens the reversal case.

👉 Pro Tip: A shift in momentum confirmed by large, full-bodied candles (with minimal wicks) often signals a high-probability entry.

2. Supply and Demand Zones Are King (Not Just Support & Resistance)

Many traders confuse supply and demand zones with traditional support/resistance lines. Here’s the distinction:

- Support/Resistance: Horizontal price levels where price reacted in the past.

- Supply/Demand: Zones where aggressive institutional orders were placed, often leading to strong impulses.

To trade effectively:

- Mark the demand zone before a bullish impulse or the supply zone before a bearish impulse.

- Use these zones to anticipate where price may react next.

These zones offer context: Are we retracing into a demand zone for a bounce? Or has price entered a supply zone, suggesting a potential drop?

3. Momentum Candles Tell the Real Story

Not all candles are created equal. Momentum candles — those with large bodies and small wicks — tell you a lot about who’s in control.

- Bullish momentum: Big green candles breaking through prior resistance, often seen during a continuation of trend.

- Bearish momentum: Long red candles with conviction, signaling strength in a downtrend or a reversal.

Look for these candles as confirmation signals — especially after entering a supply or demand zone, to guide your decision on whether to long or short the market.

4. Watch for Liquidity Grabs Before Reversals

The market often takes out equal highs or lows to trap traders before reversing. This is known as a liquidity sweep.

The market often takes out equal highs or lows to trap traders before reversing. This is known as a liquidity sweep.

For example:

- Price forms an apparent suspport level with equal lows→ retail traders place buy orders, with stop losses below this support level.

- Price breaks below the lows (taking out stop losses) → then pumps hard.

- The zone before this bullish impulse becomes a demand zone.

This move often precedes major reversals and is a favorite tactic of smart money.

5. Combine Structure, Zone, and Candle Clarity

Your highest-probability setups come when all elements align:

- Market structure shows a clear trend or reversal (BoS).

- Price enters a refined supply or demand zone.

- A momentum candle confirms the direction.

This trifecta is your confluence — and the difference between random trades and intentional strategy.

🎯 Final Thoughts

Technical analysis isn’t about predicting the future — it’s about stacking probabilities in your favor. By mastering the interplay between structure, zones, and momentum, you’ll begin to see the market not as chaos, but as a repeating rhythm of opportunity.

And remember: zones over lines, structure over noise, clarity over clutter.

★Free apps to earn money without any capital!★

★Free apps to earn money without any capital!★

🎁 Honeygain A passive income app to earn money off your unused internet bandwidth. Get $3 for free, no investment required.

🎁 Grass An innovative web-based platform that rewards you for sharing your unused network resources.

🎁 IPRoyal Pawns A passive income app to earn money off your unused internet bandwidth.

🎁 EarnApp A passive income app to earn money off your unused internet bandwidth.

🎁 Peer2Profit A passive income app to earn money off your unused internet bandwidth.

🎁 JumpTask Earn free crypto when you complete microtasks!

🎁 CryptoTab Earn free Bitcoin while surfing the internet!

🎁 Bitcoin Faucet Sites: FreeBitco.in, Cointiply

🎁 StormX: Earn crypto as you shop online!

★Cryptocurrency Investment/ Trading Platforms★

🎁 Nexo Atrusted platform that lets you earn, borrow, and trade effortlessly with your digital assets. Get a $25 bonus with a $100 deposit.

🎁 Binance The world’s largest cryptocurrency exchange!

🎁 Bitget A leading cryptocurrency exchange offering free advanced trading bots and copy trading.

🎁 Kucoin An expansive cryptocurrency exchange, with interesting offerings like staking, free trading bots and bitcoin cloud mining services.

🎁 HTX A cryptocurrency exchange with diverse offerings, free airdrops and trading bots.

🎁 Crypto.com A cryptocurrency exchange based in Singapore. Get $25 in CRO on staking for a Ruby card.

🎁 TradingView An invaluable charting platform for various markets. Get up to $30 discount off a paid plan here!

🎁 Bake

★Cryptocurrency Trading Bots★

🎁 3Commas A cryptocurrency bot trading platform.

🎁 GT App An advanced spot and futures trading bot with Copy Trading functionality. 3-day trial period available with demo account.

🎁 Pionex A free multifunctional arbitrage trading bot that automates the process of buying low and selling high, 24/7.

🎁 Wundertrading An automated cryptocurrency trading bot offering a 7 day trial period with full functionality.

🎁 One Click Crypto An AI bot powered by neural networks that manage your cryptocurrency portfolio on autopilot.

★For Malaysian investors★

🎁 Moomoo Get a free Apple share!

🎁 Luno Get a RM75 bonus in BTC with a RM250 purchase of BTC!

🎁 Stashaway Get free investing for 6 months!

🎁 Wahed code ‘KENLIE1’ RM10 signup bonus!

🎁 Capbay P2P code ‘8879c6’ RM100 signup bonus!

🎁 Versa Get a RM10 bonus with a RM100 deposit!

🎁 KDI Get a RM10 bonus with a RM250 deposit!

🎁 Klook Get a RM15 signup bonus!

Connect with me Medium | Read.cash | Publish0x | BulbApp | YouTube | X