Demystifying the SPV in Venture Capital

The world of startup investing has been transformed by a powerful tool: the SPV in venture capital. An SPV, or Special Purpose Vehicle, is a legal entity created for a single, specific investment. In the VC context, it allows a lead investor to pool money from backers to invest in a promising startup, functioning as a single-purpose spv fund.

This structure is crucial for managing a targeted spv investment. By using an spv llc, the venture creates a bankruptcy remote spv, isolating the investment's risk from the personal assets of the investors and the sponsor's other activities. The rules of this syndicate are meticulously laid out in an spv agreement.

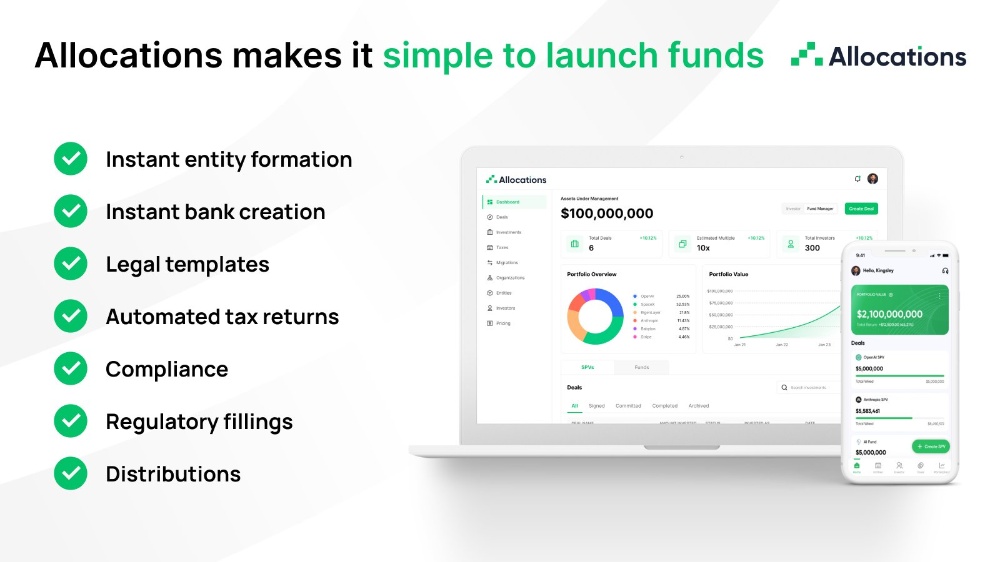

Managing these structures efficiently is where modern platforms excel. While many are familiar with a carta spv, innovative solutions like Allocations are streamlining the entire process. From spv formation to operating a dedicated spv account, proper spv management is key to a successful syndicate. For any sponsor running an spv business in tech, leveraging a platform like Allocations reduces administrative friction and ensures compliance.

Whether for a moonshot like a spacex spv or the next software unicorn, the spv venture capital model democratizes access. It empowers experienced angels to lead deals and allows investors to write smaller checks into specific opportunities they believe in, all facilitated by robust operational backends like Allocations.