Cryptocurrency Strategy & Market Potential in 2026

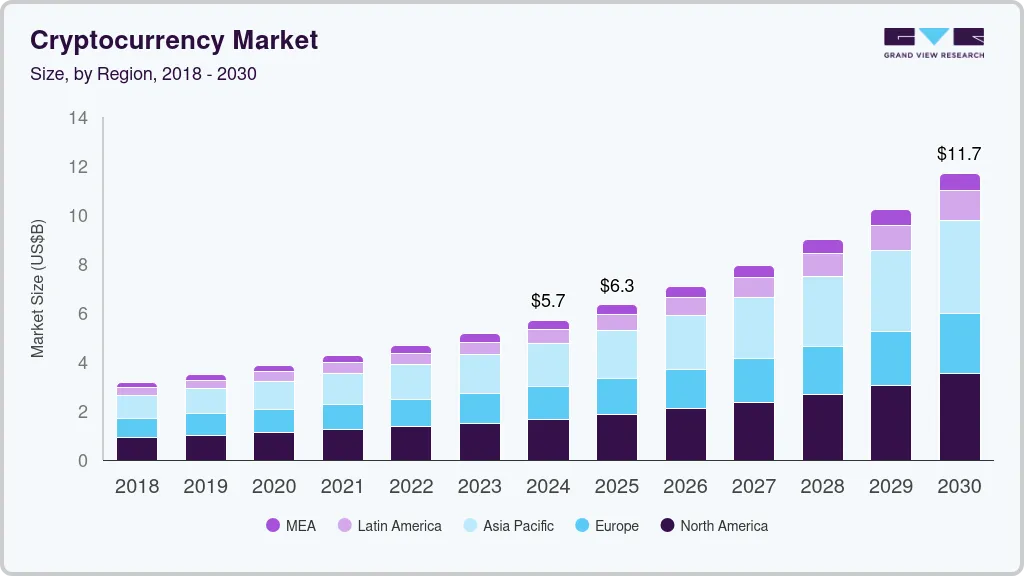

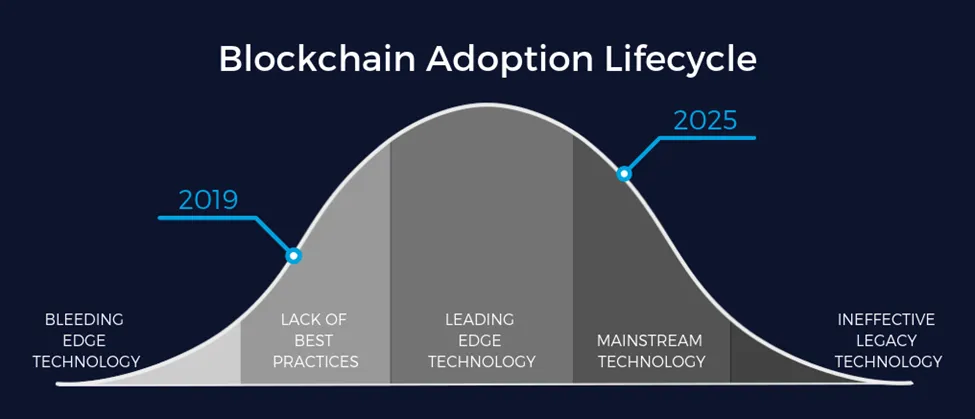

After several intense boom-and-bust cycles, the cryptocurrency market is entering a more mature phase. The year 2026 is widely expected to be a key milestone—when crypto moves beyond pure speculation and becomes an integral part of the global financial and technology ecosystem.

Below is a strategic outlook on the opportunities and potential of crypto in 2026.

1. The Big Picture: Crypto After the Market Cleanse

Recent years have filtered out many weak and unsustainable projects. By 2026, the market is likely to show:

- Fewer low-quality projects, more focus on real-world value

- Stronger participation from institutional capital

- Continued volatility—but with clearer structure and market logic

This environment favors investors with long-term strategies rather than short-term hype chasers.

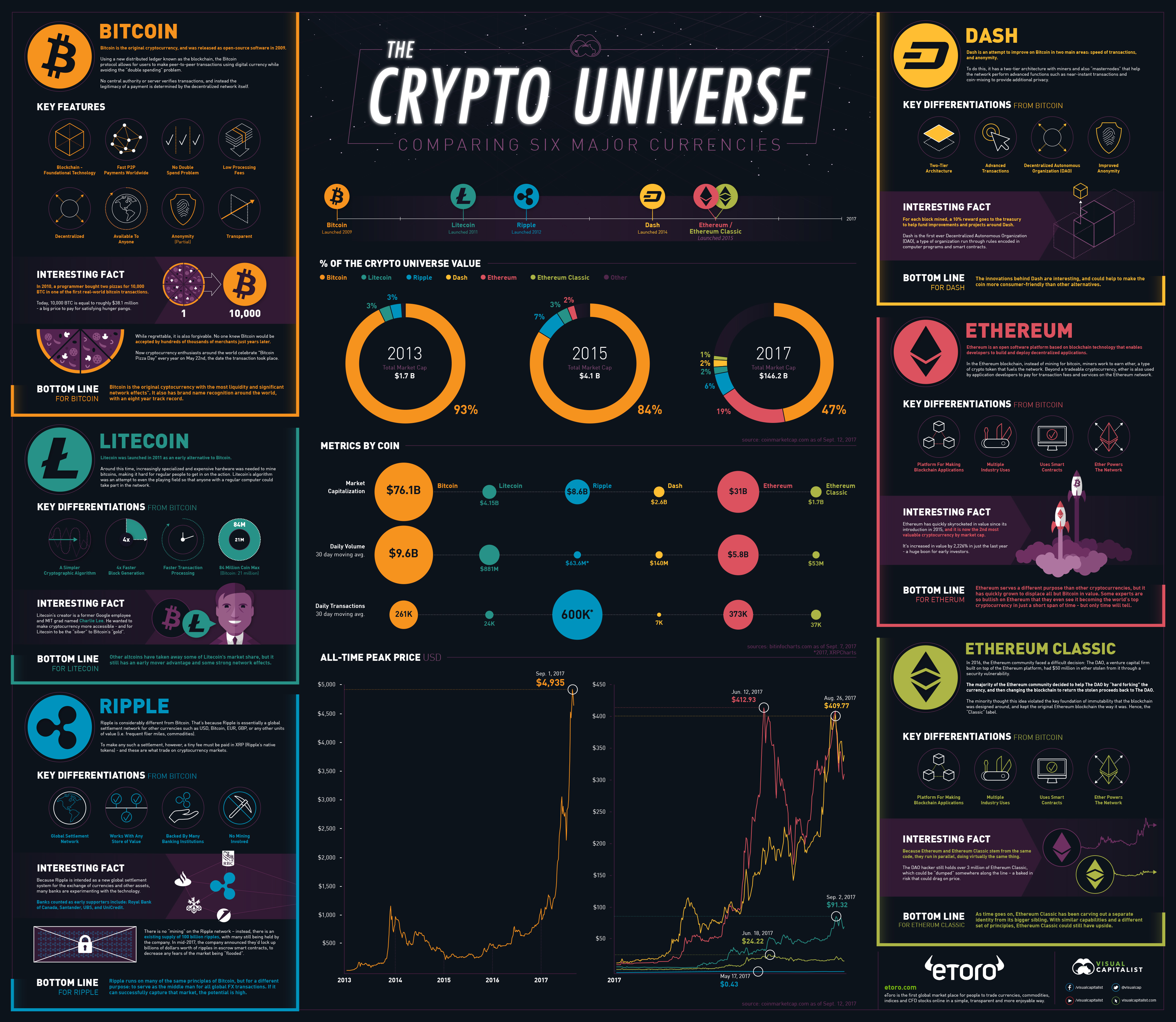

2. High-Potential Crypto Sectors in 2026

🔹 Blockchain Infrastructure & Layers

🔹 Blockchain Infrastructure & Layers

- Scalability, lower fees, and higher transaction speed remain core demands

- Projects that improve performance and security are likely to attract capital

🔹 AI × Blockchain

- The convergence of artificial intelligence and blockchain opens new possibilities:

- Decentralized data processing

- More transparent and privacy-focused AI systems

- This could become a leading trend in the next market cycle

🔹 Real World Assets (RWA)

- Tokenization of real assets such as real estate, commodities, and bonds

- Bridges blockchain technology with the traditional economy

- Strong appeal to institutional investors

🔹 Next-Generation DeFi

- Greater emphasis on security and sustainable liquidity

- Less “artificial yield,” more practical financial use cases

3. Smart Crypto Investment Strategies for 2026

📌 Strategy 1: Cycle-Based Investing

📌 Strategy 1: Cycle-Based Investing

- Allocate capital gradually using DCA

- Avoid FOMO during periods of market euphoria

📌 Strategy 2: Focus on Projects with Real Users & Revenue

- Real adoption matters more than attractive whitepapers

- Clear and sustainable business models are essential

📌 Strategy 3: Risk Management Is Survival

- Avoid excessive leverage in highly volatile conditions

- Always define exit plans and protect capital

4. Risks That Should Not Be Ignored

Despite strong potential, crypto in 2026 still carries notable risks:

- Rapid changes in regulations and policies

- Possibility of deep market corrections

- Extreme volatility driven by crowd psychology

👉 Crypto is not for undisciplined investors.

5. Conclusion

2026 may not be about “getting rich overnight,” but it could be a golden period for those who understand the market, stay patient, and follow a clear strategy.

Crypto is evolving from a trend into core financial and technological infrastructure. The winners won’t be the earliest entrants—but those who stay long enough and move in the right direction.

This article is for educational purposes only and does not constitute financial advice. Always conduct your own research and manage risk carefully before making any investment decisions.