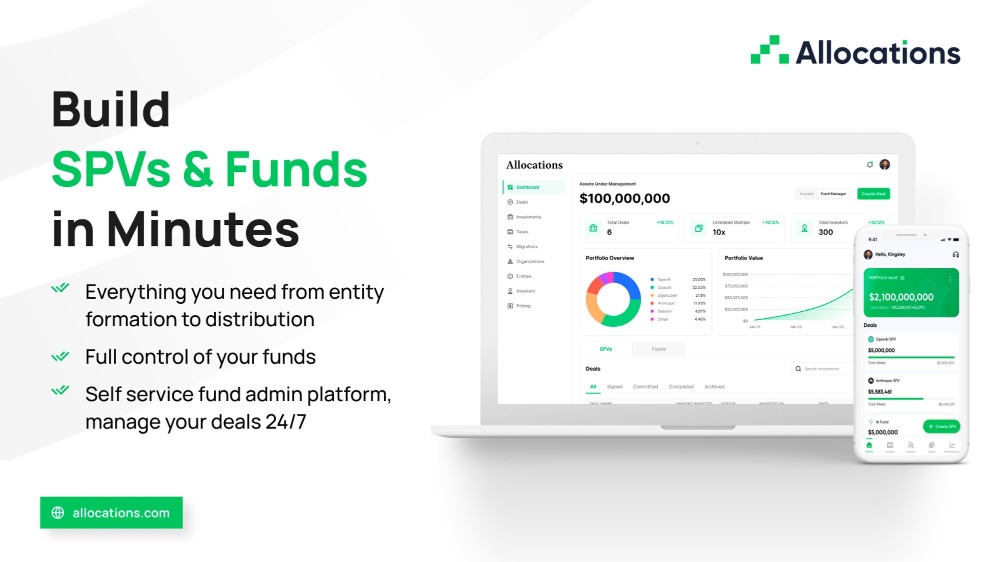

Why Allocations is the Best SPV Platform for Modern Investors

Allocations has quickly become the best SPV platform for fund managers, angel investors, and venture capitalists looking to simplify fund operations. With Allocations software, users can easily manage SPV investments, automate hedge fund administration, and track portfolio performance in real time.

1. Streamlined SPV Formation

Creating a Delaware SPV or private equity SPV has never been simpler. Allocations automates document preparation, compliance checks, and capital call management — saving time and reducing legal overhead.

Explore more: https://www.allocations.com/startup-spv

2. Full Compliance and Transparency

Allocations ensures complete SPV compliance with federal and state laws, handling Form D filings and investor reporting. The special purpose vehicle structure is fully integrated with 409a valuation tools and DPI private equity metrics for accuracy.

Learn more: https://www.allocations.com/fees

3. Integrated Fund Management Tools

From MOIC (Multiple on Invested Capital) tracking to capital call automation, the Allocations SPV system provides a unified platform for managing private funds and SPV for startups.

Meet the team behind the innovation: https://www.allocations.com/team

4. Crypto and Tokenized SPVs

Allocations extends to crypto SPVs, giving investors access to digital assets under the same compliant framework.

Read more: https://www.allocations.com/crypto-spv

5. Customization for Every Fund Type

Each fund can be tailored using Allocations custom SPV setup, providing flexibility for different deal structures and asset classes.

Get started: https://www.allocations.com/custom-spv